Economy

US: Home sales post 12th straight monthly drop; house price inflation slows . US existing home sales dropped to the lowest level in more than 12 years in Jan, but the pace of decline slowed, raising cautious optimism that the housing market slump could be close to reaching a bottom. The report from the National Association of Realtors also showed the smallest increase in annual house prices since 2012, which should help to improve affordability. It will, however, be a while before the housing market turns the corner. Mortgage rates have resumed their upward trend after robust retail sales and labor market data as well as strong monthly inflation readings raised the prospect of the Fed maintaining its interest rate hiking campaign through summer. (Reuters)

EU: German economic sentiment improves for fifth month: ZEW. Germany's economic confidence rose for the fifth month in a row and at a faster than expected pace in Feb, results of the ZEW survey showed, adding strength to the view that the biggest euro area economy may indeed avoid a recession. The ZEW Indicator of Economic Sentiment climbed to 28.1 points from 16.9 in Jan, the Mannheim-based think tank said. Economists had expected a score of 22.0. The reading improved sharply for a second straight month. Latest improvement was driven by a fourth successive increase in the assessment of the German economic situation. The corresponding index gained 13.5 points to reach minus 45.1. Economists had forecast a score of -50.5. Despite the sustained improvement, the reading remained deep in the negative territory. (RTT)

UK: Private sector returns to growth on improving demand . The UK private sector expanded for the first time since July 2022, and at the fastest pace in eight months in Feb, amid the improving customer demand and business confidence as inflation and supply shortage concerns cooled, results of the closely watched purchasing managers' survey by S&P Global revealed. The S&P Global/Chartered Institute of Procurement & Supply flash composite output index climbed to 53.0 in Feb from 48.5 in Jan. (RTT)

UK: Manufacturing output falls; selling price inflation expectations slow: CBI. The UK manufacturing output declined in Feb at the fastest pace since Sept 2020 and selling price expectations slowed to the lowest since early 2021, survey data showed. A net balance of -16 % of manufacturers said output volumes declined in three months to Feb compared to -1 % in three months to Jan, the Industrial Trends Survey from the Confederation of British Industry revealed. This was the weakest balance since Sept 2020. Nonetheless, manufactures expect output to rise moderately in three months to May, with the balance rising to +7 %. (RTT)

Japan: Private sector logs steady growth in Feb . Japan's private sector activity registered a steady growth in Feb as the sharp deterioration in manufacturing activity was offset by the robust improvement in the service sector, a closely watched survey showed. The flash au Jibun Bank composite output index remained unchanged at 50.7 in Feb, data published by S&P Global revealed. A score above 50.0 indicates expansion in the sector. The flash manufacturing Purchasing Managers' Index declined to 47.4 from 48.9 in the previous month. (RTT)

South Korea: Consumer confidence weakens . South Korea's consumer sentiment deteriorated in Feb as households' expectations on the future living standards and earnings weakened, survey data showed, as the Bank of Korea prepares to hold its latest rate-setting session later this week. The consumer confidence index dropped to 90.2 from 90.7 in Jan, survey results from the Bank of Korea showed. In Dec, the reading was 90.2. (RTT)

Australia: RBA board discussed 50 bps & 25 bps rate hikes, minutes show . Reserve Bank of Australia policymakers discussed only two options for its interest rate decision in Feb, either a quarter point or a half percentage point hike, completely abandoning the option of leaving rates unchanged as there was a risk that inflation could persist at an uncomfortably high level, minutes of the session held on Feb 7, revealed. Arguments favoring a 50bps increase stemmed from the concern that prices and wages data are exceeding expectations and there is a risk that high inflation would be persistent. Those who sought a 25 basis point increase recognized the need to bring demand and supply in the economy more into balance, but expect inflation to have peaked and headline inflation to remain below earlier expectations. (RTT)

Markets

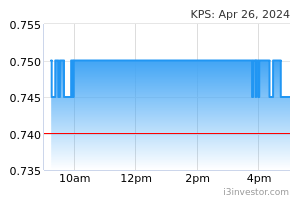

KPS (Neutral, TP: RM0.80): KPS unit is water meter supplier for Air Selangor till end-2024. Kumpulan Perangsang Selangor (KPS) will be supplying and delivering water meters to Pengurusan Air Selangor SB with a contract sum of about RM12.9m. (The Edge) Comments: KPS has a 51% stake in Aqua Flo SB, which has secured a contract to supply and deliver of water meters for the period of 2 years commencing from 1 Jan 2023 to 31 Dec 2024 for RM12.9m. We expect this contract to contribute an average of +0.4% to KPS’ bottomline, for FY23 and FY24. We are neutral on this development given the marginal impact to the Group’s earnings.

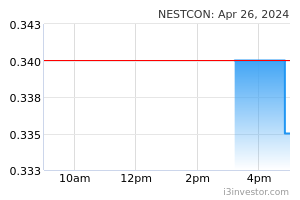

Nestcon: Bags RM154m job in Kuala Lumpur. Construction and renewable energy service provider Nestcon Bhd has bagged a RM154m contract from privately-held property development firm Solaris Ceria SB to build office suites and serviced apartments in Jalan Duta Kiara, Mont Kiara. Nestcon had accepted a Letter of Award (LOA) from Solaris Ceria for the main building works of one block of 52-storey office suites and serviced apartments. The overall completion for the contract works is 36 months and is expected to be completed by Feb 28, 2026. (The Edge)

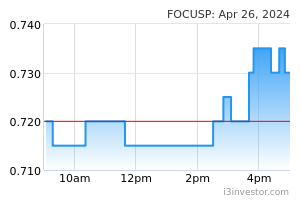

Focus Point: Plans two-for-five bonus issue; achieves record earnings in FY2022. Focus Point Holdings has proposed to undertake a bonus issue of up to 132m shares on the basis of two bonus shares for every five existing shares held on the entitlement date to be fixed later. Based on the five-day volume weighted average price up to and including the latest practicable date (Feb 20) of RM1.27, the theoretical ex-bonus price will be 90.74 sen. (The Edge)

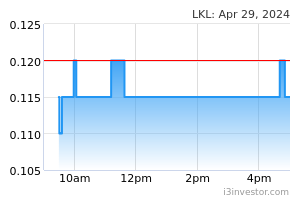

LKL: Buys EPF Damansara Fairway building for RM24m for business expansion. LKL International has proposed to acquire a piece of leasehold land attached with the Employees Provident Fund (EPF) Damansara Fairway building in Selangor for RM24m cash. LKL has entered into a sale and purchase agreement with the EPF board on Feb 21. The property comprises a piece of land measuring approximately 2,301 square metres, together with a 12- storey commercial office block and a five-storey car park. (The Edge)

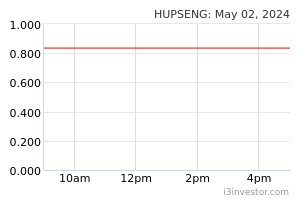

Hup Seng: Purchases new production line for RM11.71m. Hup Seng Industries has proposed to acquire a new production line from GEA Imaforni S.p.A for RM11.71m. Hup Seng is making the purchase to manage risks arising from ageing machinery and equipment. The introduction of high-tech European ovens as gradual replacements for existing ageing ovens is to improve efficiency and productivity by reducing wastage and improving energy savings. (StarBiz)

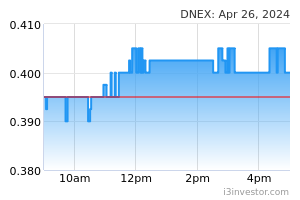

DNeX: Explores partnership with Mimos. Dagang Nexchange (DNeX) has inked an agreement with Mimos to explore opportunities to leverage government strategic projects and initiatives towards technological and digital development. DNeX said the proposed collaboration would include the development of enhanced digital technology capabilities, software development, networking, system integration, consultation services, cloud computing, and the Fourth Industrial Revolution (IR 4.0) (The Edge)

Market Update

The FBM KLCI could open lower today after US stocks recorded their worst day in two months on Tuesday, as investors were unnerved by economic data suggesting interest rates have further to rise after months of increases by the Federal Reserve. The blue chip S&P 500 index ended down 2%, with declines in every sector. The tech-heavy Nasdaq Composite slid 2.5%. Both indices had their steepest daily losses since December 15. Markets have wobbled in recent days as investors gird for further interest rate rises from the Fed to combat inflation in the US economy. Yields on benchmark Treasury bonds reached three-month highs on Tuesday. In Europe, the benchmark Stoxx 600 closed down 0.2% and Germany’s Dax shed 0.5% after the S&P surveys for the eurozone also indicated private sector activity in the bloc was better than expected.

Back home, Bursa Malaysia ended marginally higher on Tuesday, as investors stayed on the sidelines, ahead of the retabling of Budget 2023 on Friday. At the closing bell, the benchmark FBM KLCI had inched up 0.55 of a point or 0.04% to end at 1,474.01, compared with Monday's close at 1,473.46.

In the region, the Hang Seng index fell 1.7%, while China’s CSI 300 gained 0.3% after rising 2.45 % on Monday, its best one-day performance since late November. The index has risen 6.6 % this year.

Source: PublicInvest Research - 22 Feb 2023