Economy

US: Consumer prices increase in Jan, trend slowing. US consumer prices accelerated in Jan, but the annual increase was the smallest since late 2021, pointing to a continued slowdown in inflation and likely keeping the Federal Reserve on a moderate interest rate hiking path. The consumer price index increased 0.5% last month after gaining 0.1% in Dec, the Labor Department said. Monthly inflation was boosted in part by rising gasoline prices, which increased 3.6% in Jan, according to data from the US Energy Information Administration. Economists polled by Reuters had forecast the CPI climbing 0.5%. (Reuters)

US: Fed officials float even higher rates after brisk inflation data. Federal Reserve officials stressed the need for further interest-rate increases to help tame inflation, but expressed differing views about how close they are to stopping after new data showed signs of persistent price pressures. Several officials said that interest rates may need to move to a higher level than anticipated to ensure inflation continues to ease. Richmond Fed President Thomas Barkin, speaking in a Bloomberg TV interview, said that “if inflation persists at levels well above our target, maybe we’ll have to do more.” (Bloomberg)

US: Small business sentiment improves in Jan, NFIB. US small business confidence improved in Jan as worries about inflation eased, but labour shortages remained a major concern for many owners, according to a survey. The National Federation of Independent Business (NFIB) said its Small Business Optimism Index rose 0.5 point to 90.3 last month, also lifted by an improvement in the share of owners who expected better business conditions over the next six months. (Reuters)

EU: Eurozone bond yields lurch higher after US inflation data. Eurozone bond yields rose in whippy trade after US inflation data showed consumer price pressures eased for some goods and services, but accelerated for others. Headline inflation rose faster than expected in Jan, but at its slowest rate since late 2021, highlighting that the overall trend is heading lower, but price pressures are not easing quite as quickly as some had hoped. Treasury prices initially rallied, pushing yields lower on the day, before reversing course, prompting a similar reaction in euro zone debt. (Reuters)

EU: Eurozone economy manages to expand in 4Q. Euro area managed to grow at the end of the year, as initially estimated, raising hopes that the region could avert a technical recession, official data revealed. The currency bloc logged a quarterly expansion of 0.1% in the fourth quarter, which was unchanged from the previous estimate released on Jan 31, the statistical office Eurostat said. The pace of growth slowed from 0.9% in the second quarter and 0.3% in the third quarter. The breakdown of GDP is currently unavailable. (RTT)

EU: French unemployment rate falls in 4Q. France's unemployment rate dropped in the fourth quarter to the lowest since early 2008, the statistical office INSEE reported. The ILO unemployment decreased 45,000 from the previous quarter to 2.2m. The ILO jobless rate was 7.2% of the labour force, down from 7.3% in the third quarter. "It is its lowest level since the Q1 2008, except for the sharp fall in Q2 2020 during the first lockdown," the INSEE said. The unemployment rate among people aged between 15 and 24 decreased to 16.9% from 17.9% in the third quarter. (RTT)

Japan: Industrial production rises 0.3%. Japan's industrial production expanded for the second straight month in Dec, revised from a slight fall reported initially, final data from the Ministry of Economy, Trade and Industry said. Industrial production climbed a seasonally adjusted 0.3% MoM in Dec, revised from a 0.1% fall estimated initially on Jan 30. This was followed by a 0.2% recovery in Nov. The inventory ratio showed a positive growth of 1.5% over the month, while shipments dropped 0.9%. A monthly fall of 0.4% was observed in inventories at the end of 2022. (RTT)

India: Wholesale price inflation at 2-year low on easing food, energy prices. India's wholesale price inflation softened further at the start of the year to the lowest level in twenty-four months amid continued slowdown in prices for food articles, fuel and power, provisional data from the Ministry of Commerce and Industry revealed. The wholesale price index, or WPI, climbed 4.73% YoY in Jan, slower than the 4.95 rise in Dec. Economists had expected inflation to ease to 5.60%. Further, the rate of inflation remained below the 5.0% mark for the second straight time in Jan. (RTT)

Australia: Consumer sentiment weakens sharply, Westpac. Australia's consumer sentiment declined sharply in Feb to near historic lows seen last year due to the cost of living pressures and interest rate hikes, survey results from Westpac showed. The Westpac-Melbourne Institute consumer sentiment index fell 6.9% to 78.5 in Feb from 84.3 in Jan. There were notable deterioration in views on family finances, the near-term outlook for the economy and whether now is a good time to buy a major household item. The 'family finances vs a year ago' sub-index dropped percent to just 62.1, which was the weakest reading since the depths of the early- 1990s recession. (RTT)

Markets

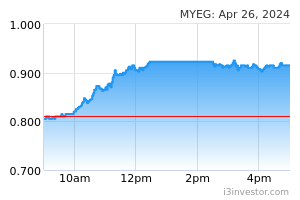

MYEG: Controlling shareholder Asia Internet buys 8.8% stake in Cuscapi. Asia Internet Holdings, the largest single shareholder in MyEG Services, bought some 83.25m shares, or 8.81% stake, in point-of-sale system provider Cuscapi. Asia Internet bought the block of shares via the direct business transaction on 10 Feb, according to the company’s filing to Bursa Malaysia. It is not known from whom Asia Internet bought the shares. (The Edge)

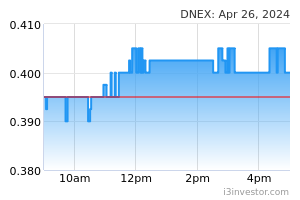

DneX: Largest shareholder sells stake to exit Theta Edge. DneX’s largest shareholder Arcadia Acres SB has ceased to be a substantial shareholder in Theta Edge. Arcadia disposed of its entire 16.53% stake in Theta Edge, comprising 19.5m shares, on 14 Feb, according to a bourse filing. The disposal consideration for the shares was not disclosed. Based on Theta Edge’s closing price of 70 sen on Tues, the 19.5m shares would be worth RM13.65m. (The Edge)

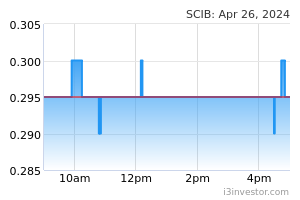

SCIB: Terminates RM56m EPCC contract in Indonesia. Sarawak Consolidated Industries (SCIB) has terminated a proposed engineering, procurement, construction and commissioning (EPCC) project worth RM55.59m, involving earthworks for the Prabumulih Muara Enim tolled road in Sumatera, Indonesia. The civil engineering specialist’s wholly owned unit SCIB International (Labuan) Ltd (SCIBILL) issued a notice of termination to PT Cipta Multi Sarana (PTCMS) on 13 Feb, amid a lack of progress in the project arising from Covid-19 pandemic uncertainties and initiatives to review and update SCIB’s order books. (The Edge)

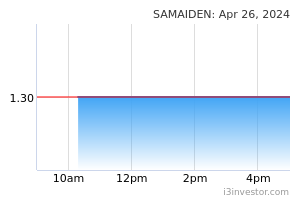

Samaiden: Subsidiary hit with two notices of arbitration for RM12.21m. Samaiden Group’s wholly owned subsidiary Samaiden SB (SSB) has received two notices of arbitration from Ditrolic concerning claims for two work packages worth a combined RM12.21m. In a filing to Bursa Malaysia, the Ace Market-listed company said SSB had been appointed as a subcontractor for the work packages, which were part of a 100 megawatt alternating current large scale solar photovoltaic plant project in Kerian, Perak. (BusinessToday)

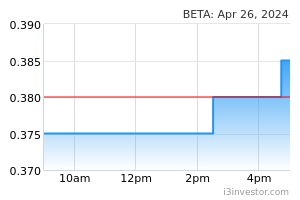

Betamek: Secures RM123.5mil contract to supply various electronics parts for new Perodua model. EMS provider Betamek has secured a RM123.5m contract to supply various electronics parts for a new Perodua model. On 13 Feb, the company's wholly-owned subsidiary Betamek Electronics (M) SB (BESB) received a letter of appointment from Perusahaan Otomobil Kedua SB (Perodua). Betamek managing director Mirzan Mahathir said the company is optimistic that the demand for its vehicle audio visual (AV) products and accessories will continue to grow given that its major customer Perodua continues to see rising demand for its vehicles. (New Straits Times)

Jerasia Capital: Bursa Malaysia publicly reprimands Jerasia, fines eight directors RM600,000. Bursa Malaysia Securities has publicly reprimanded Jerasia Capital and eight of its directors for breaches of the Main Market listing requirements. In addition, the eight directors were imposed total fines of RM600,000. In a statement, Bursa Securities said Jerasia was publicly reprimanded for defaults in payments by Jerasia’s wholly-owned subsidiaries Jerasia Fashion SB (JFSB), Jerasia Apparel SB (JASB) and Canteran Apparel SB (CASB). (The Edge)

Market Update

The FBM KLCI might open flat today after US stock markets steadied on Tuesday despite disappointing inflation data that raised the prospect of more aggressive interest rate rises than investors had previously expected. Wall Street’s benchmark S&P 500 index dropped as much as 1% in early trading but ended the day flat, holding on to the gains made in strong trading on Monday. The tech-heavy Nasdaq Composite rose 0.6% after falling as much as 1.1% in the morning. The early falls followed the publication of data showing that US consumer prices rose 6.4% year on year in January — a slight slowdown from the previous month but higher than economists had expected. Annual core inflation, which strips out volatile food and energy prices, was also slightly above expectations at 5.6%, down from 5.7% in December. Prices rose 0.4% month on month. The high numbers renewed concerns that stubbornly high inflation would push the Federal Reserve to raise rates higher than the market expected, as chair Jay Powell warned last week. Europe’s region-wide Stoxx 600 closed 0.2% higher. London’s FTSE added less than 0.1%.

Back home, the FBM KLCI ended higher in tandem with the positive performance of regional bourses as investors look to the January US consumer price index (CPI) for clues to the interest-rate path. At the closing bell, the benchmark FBM KLCI went up 8.8 points to 1,483.97 compared with Monday's close of 1,475.17. In the region, Hong Kong’s Hang Seng index fell 0.2% and China’s CSI 300 was steady.

Source: PublicInvest Research - 15 Feb 2023