Amid a downturn in the global semiconductor industry last year, the industry is now in frenzy over ChatGPT, which could potentially revolutionize semiconductor manufacturing as the sprawling influence of artificial intelligence (AI) reshapes industries from logistics, education and healthcare to automotive and manufacturing. We believe Malaysian technology sector could see robust job orders going forward as more investments will be poured into AI-related products. We remain Overweight on the technology sector, with our top picks Inari Amertron and D&O Green Technologies.

- Winners of AI boom. Recently, ChatGPT (Chat Generative Pre-trained Transformer), an artificial intelligence (AI) chatbot has been dominating global headlines, while also sparking a tense clash between Google and Microsoft, two of the world’s largest tech companies. ChatGPT is developed by San Francisco-based startup, OpenAI, which was co founded in 2015 by Elon Musk and Sam Altman and is backed by Microsoft. Generative artificial intelligence is a technology that uses machine learning to create new content, based on simple instruction. ChatGPT is one example of text-to-text Generative AI.There are also text-to-image, text or image-to-video, text-to-music and numerous other projects. It is starting to look like 2023 may be the year when AI goes mainstream.

Companies like ABB, NVIDIA and Dynatrace are already developing AI applications to make industries like healthcare, education and manufacturing more efficient and responsive. Further, AI requires large amounts of data to be processed and high-performance hardware to train models. Digital data is currently growing at +60% per annum, fueling massive demand for cloud computing. On the other hand, the generation of grammatically correct, human-like written text by AI applications can be used to make social engineering attacks such as phishing or business email, compromising scams harder to detect and remove. As a result, corporate cybersecurity budgets will continue to rise. Gartner expects information security spending to reach USD187bn as companies raise their outlay, including on AI-augmented security tools, to fend off new cyberattack tactics. In-short, growth in expenditure on AI, cloud and cybersecurity are expected to post strong earnings growth for the leading companies in these sectors.

- Re-routing to Southeast Asia. According to Nikkei Asia, the major US chip equipment suppliers are shifting operations from China to Southeast Asia in a sign that US export controls enacted last October are accelerating the decoupling of tech supply chains between the world’s two largest economies. Applied Materials, Lam Research and KLS, which collectively own about 35% of the global market share for chip production equipment, have been increasing their production capacity in Southeast Asia or relocating their workforce from China to Singapore and Malaysia since October. We believe the relocation of major semiconductor players to Malaysia will see more global semiconductor companies following their footsteps. The shift not only helps increase job orders for local players, it also helps widen the scope of the semiconductor value chain in Malaysia, which has a strong foundation in back-end assembly and testing services as well as a large pool of automation equipment suppliers in assembly & packaging, and test & vision inspection. We think there will be more potential developments especially in the front-end wafer fabrication and fabless deign fields, which can help widen Malaysia’s semiconductor value chain.

- Correction in consumer semiconductor components to weigh on global foundries. For 4Q 2022, Trendforce believes that the majority of the global top 10 foundries will post either smaller growth or a drop in revenue, attributed to the i) weakness in global economy, ii) China’s policy on containing Covid-19 outbreak and iii) high inflation continuing to impact consumer confidence. In view of the slower-than-expected demand in the consumer electronics market, Trendforce thinks a turnaround will unlikely happen in the short-term. With the slump continuing, foundry orders for chips used in consumer electronics are expected to undergo larger downward corrections going forward. This in turn, will affect foundries’ wafer shipments and capacity utilization rates.

- Another stellar performance for EV sales in 2022. Despite seeing sluggish global passenger car sales in 2022, down 0.5% YoY and 15% below pre-2020 levels, electronic vehicle (EV) sales bucked the trend and continued to see strong performance as a total of 10.5m new BEV (battery) and PHEVs (plug-in hybrid) were delivered (refer to Figure 4 and Figure 5), a staggering increase of 55% compared to 2021. China’s NEV sales defied all headwinds the country faced and increased by another 82% YoY. BYD more than tripled sales to 1.85m units, making it the number one in the global sales ranking if their 944,500 PHEV sales are included. Counting BEVs, Tesla still leads by a wide margin with 1.31m units in 2022. Rapid EV adoption in weak auto markets has boosted EV market share further with BEVs (9.5%) and PHEVs (3.5%) standing for 13% of global passenger vehicle sales in 2022 compared to 8.3% in 2021. China is the largest EV market, making up 59% of global EV sales with 6.7m units or 64% of global volume made in China.

For 2023, TrendForce expects EV sales of 14.3m, a growth of 36% YoY with BEVs reaching 8m units and PHEVs 2.6m units. By end-2023, it expects nearly 40m EVs in operation globally.

- TSMC projects lower capex for 2023. The world’s largest contract chipmaker expects its capital expenditure (capex) in 2023 would decline to USD32-USD36bn from USD36.3bn in 2022 as it expects softer demand from Apple Inc that is grappling with weakening purchasing power brought by i) decades-high inflation, ii) rising interest rates and iii) economic downturn. Still, it forecasts growth would return in the second half of this year. Overall, it expects the slower demand is a cyclical issue and would be a slight growth year for the company. Meanwhile, the company expects the auto chip shortage to be “relaxed quickly”. Going forward, it believes its business would continue to benefit from a “mega trend” of demand for high-performance computing chips for 5G networks and data centres, as well as increased use of chips in gadgets and vehicles.

- Smartphone shipments plunge to a low not seen since 2013. According to IDC, a total of 1.21bn smartphones were shipped in 2022, the lowest since 2013 due to significantly dampened consumer demand, inflation and economic uncertainties. Meanwhile, IDC said that the tough close to the year puts the 2.8% recovery expected for 2023 in serious jeopardy with downward risk to the forecast. Samsung remained the top smartphone leader with 21.6% market share while Apple came second as it saw its market share rise from 17.3% to 18.8%. China’s smart phone makers, Xiaomi, OPPO and Vivo remained in the top 5 despite seeing a decline in their market shares due to the US chip sanctions.

- Memory chip prices continue slumping. Memory chip prices, which saw a steep decline over the past year, are expected to keep falling in the first half of 2023, putting more pressure on an industry that has already pulled back investments and hiring. TrendForce expects the average prices for the two main types of memory chips (NAND and DRAM) used in consumer gadgets to experience a double-digit decline this quarter. DRAM memory enables devices to multi-task while NAND flash memory provides storage capacity on devices. That comes after prices dropped by more than 20% in the last three months of 2022 from the previous quarter. DRAM prices are expected to continue dropping through the 2H of this year and production cuts on a massive scale would be needed to shore them up. Prices of NAND flash, however, could start to rebound starting in the 2H as steeper price falls in recent months had prompted vendors to pursue more aggressive supply cutbacks for 2023. Several major companies, namely, Samsung, SK Hynix and Intel have announced poor figures during the recent quarterly results.

- Lead times for chips normalizing. The lead times are beginning to stabilize and even declining in some. As of early 2023, lead times for most standard semiconductors average 26 to 52 weeks, improving throughout the 2H of 2022. US-based electronics manufacturing service provider, Jabil expects the average lead times for most non-automotive chips to drop to below 35 weeks though it is still far behind the average pre-pandemic lead times. Automotive-grade and high-end semiconductors like microcontrollers and chipsets remained heavily constrained. Most of these high-end components are in allocation, with average lead times averaging 52 to 78 weeks (refer to Figure 8)

- Expecting a mixed bag of earnings in 4Q. Unlike in the past, we think this coming 4Q results would be a tough final quarter for the automated test equipment and outsourced semiconductor and assembly and test companies with strong exposure to the consumer electronics as global smartphone shipments fell by 11.4% in 2022, the lowest since 2013. Meanwhile, the weak sentiment also caused a pull-back in capex spending by the electronic manufacturing services and foundries, resulting in lower job orders available. We notice several technology companies have started diversifying their customer portfolio or venturing into new product development to reduce their earnings risks.

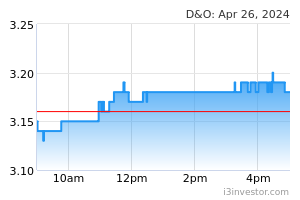

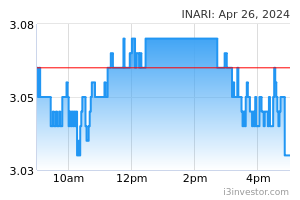

- Top picks. Inari (Outperform, TP: RM3.74) is primed to ride on the stronger 5G adoption globally and to benefit from US smartphone super cycle in the next release. Meanwhile, D&O (Outperform, TP: RM5.16) is expected to see strong multi-year growth on the back of increasing market share in the global automotive LED market given the increasing adoption of smart LEDs especially for ambient lighting and spillover orders from one of the global leading automotive LED makers, which has been scaling down its operations.

Source: PublicInvest Research - 14 Feb 2023