Economy

US: Fed’s Bowman says more interest rate hikes needed to tame inflation. The Federal Reserve will need to continue to raise interest rates in order to get them to a level high enough to bring inflation back down to the central bank's target rate, Fed Governor Michelle Bowman said. "I expect we'll continue to increase the federal funds rate because we have to bring inflation back down to our 2% goal and in order to do that we need to bring demand and supply into better balance”. (Reuters)

US: To sell more strategic oil despite Biden’s push to halt sales. The Biden administration plans to sell more crude oil from the Strategic Petroleum Reserve, fulfilling budget directives mandated years ago that it had sought to stop as oil prices have stabilized. The congressionally mandated sale will amount to 26m barrels of crude, according to people familiar with the matter. The sale is in accordance with a budget mandate enacted in 2015 for the current fiscal year. The Energy Department has sought to stop some of the sales required by 2015 legislation. (Bloomberg)

EU: Eurozone set to escape recession, inflation outlook downgraded. Following the favourable development in energy prices and the diversification of supply sources, the euro area is set to avoid a recession and gradually pick up pace next year, as inflation likely peaked and has loosened its grip on economic activity, the European Commission said in its interim forecast. In the Winter Interim Forecast, the commission raised its economic growth outlook for the currency bloc to 0.9% from 0.3%. At the same time, the economy is expected to advance 1.5% in 2024, unchanged from the Autumn forecast. (RTT)

EU: France leans on retailers to help consumers cope with food prices. France’s finance minister urged food retailers to do more to help consumers cope with high prices, as the government leans on them to agree to sell an anti-inflation basket of everyday essential goods at knockdown prices. The government wants big retail chains such as Carrefour, Casino and the family-owned grocery dynasties Auchan and E. Leclerc, to sell a basket of about 50 everyday items at purchasing price from next month. (Reuters)

India: Inflation surges to 6.52%, crosses RBI's target range. India's consumer price inflation accelerated for the first time in four months in Jan and cut across the Reserve Bank's target corridor amid rising prices for fuel and clothing among others, according to data released by the statistics ministry. The consumer price index, or CPI, climbed 6.52% YoY in Jan, faster than the 5.72% gain in Dec. Economists had forecast 5.90% inflation. The acceleration in Jan came after inflation remained within the Reserve Bank's tolerance band of 2 to 6% in the previous months. Last week, the Monetary Policy Committee of the Reserve Bank of India decided to raise the policy repo rate by 25 bps to 6.50% at its February meeting. (RTT)

Australia: Consumer confidence plunges on RBA tightening signal. Australia’s consumer confidence tumbled as mounting cost of living pressures and little prospect of a pause in interest-rate increases squeezed household finances. Consumer sentiment slid 6.9% to 78.5, signalling pessimists heavily outweigh optimists with a dividing line of 100, a Westpac Banking Corp. survey showed. Senior Economist Matthew Hassan pointed to stronger-than expected inflation together with a “resumption” of tightening for the gloomy outcome. The Reserve Bank has raised rates by 3.25 percentage points since May to the current 3.35%, the highest level since late 2012. (Bloomberg)

Singapore: GDP Grows 0.1% On Quarter, +2.1% On Year In Q4. Singapore's GDP expanded a seasonally adjusted 0.1% on quarter in the fourth quarter of 2022, the Ministry of Trade and Industry said. That missed expectations for an increase of 0.3% following the 0.8% gain in the third quarter. On a yearly basis, GDP was up 2.1%, again shy of expectations for 2.3% following the upwardly revised 4.0% increase in the three months prior 2.2%. For all of 2022, GDP expanded 3.6%, slowing from 8.9% in 2021. Upon the release of the data, the MTI maintained its growth forecast for 2023 at 0.5 to 2.5%. (RTT)

New Zealand: Services growth At 3-month high. Slowdown in New Zealand's service sector growth rebounded at the start of the year to the highest level in three months, as sales and stocks continued to increase at stronger rates along with a renewed rise in employment, survey figures from Business NZ showed. The performance of the services index, or PSI, rose to 54.5 in Jan from 52.0 in Dec A reading above 50 indicates an expansion in the sector. Further, the latest reading was above the long-term average of 53.6. (RTT)

Markets

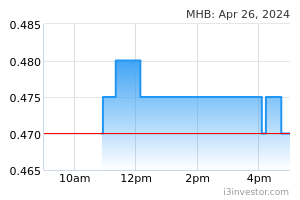

MHB: Clinches RM1.4bn EPCI contract from Carigali-PTTEPI . Malaysia Marine and Heavy Engineering Holdings Bhd’s unit has obtained a contract worth about RM1.4bn to undertake the engineering, procurement, construction and installation of five wellhead platforms in the Malaysia-Thailand Joint Development Area. The unit, Malaysia Marine and Heavy Engineering SB (MMHE), received the award from Carigali-PTTEPI Operating Company SB (CPOC). CPOC is the operator of PC JDA Ltd, a unit of Petronas Carigali SB and PTTEP International Ltd (PTTEPI). (The Edge)

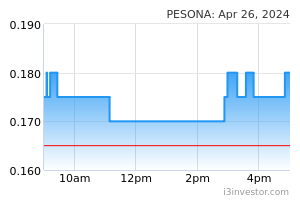

Pesona Metro: Bags RM948m construction job in Cheras . Pesona Metro Holdings has bagged a RM948.1m contract to build a residential development project in Cheras. Under the turnkey construction agreement signed with property developer Danau Lumayan SB, the project is split into two phases. The first phase involves a 43-storey building housing 922 units of Residensi Wilayah, while the second is to house another 2,516 units in two additional 52-storey buildings. Residensi Wilayah, previously known as Rumawip, is the government’s affordable home scheme to aid lower- to middle-income groups to become first-time homebuyers. (The Edge)

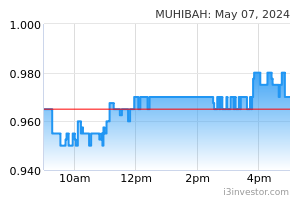

Muhibbah Engineering: Wins RM172.6m construction job . Muhibbah Engineering (M) (MEB) has won a construction job in Penang worth RM172.6m from Penang Development Corp. MEB said the job will entail the development of a nine-storey office building and factory; a six-storey parking building with a TNB sub station (and its mechanical requirements); as well as a normal waste depot, office waste depot and recycling room. “The contract is scheduled to commence on Feb 13, 2023 and is expected to be completed within 14 months from the commencement date.” (StarBiz)

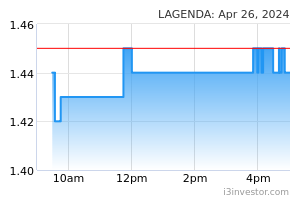

Lagenda Properties: Buys Johor land for RM4bn township project . Lagenda Properties via its 70%-owned indirect subsidiary Lagenda Mersing SB, has purchased a piece of land worth RM398.2m in Kulai, Johor. The company said it acquired the 1,075.48-acre land from the wholly-owned subsidiary of Permodalan Nasional Bhd, Seriemas Development SB. The company said it intends to use its newly acquired asset to develop a large-scale affordable township that encompasses 12,000 residential units and a mix of commercial development. The project has an estimated gross development value of RM4bn. (StarBiz)

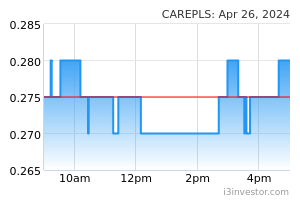

Careplus: Disposes of its 50% stake in glove firm for RM37.5m . Careplus Group is disposing of its 50% stake in Careplus (M) SB amid the challenging outlook in the glove market due to lower demand and increased competition. Careplus is selling the stake for RM37.5m to Ansell Services (Asia) SB. (The Edge)

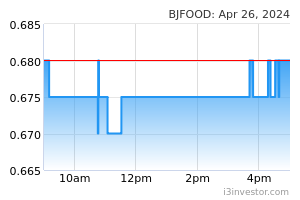

Berjaya Food: Increased operating costs dent Berjaya Food’s 2Q net profit, but group pays higher dividend. Berjaya Food Bhd’s net profit dropped 8.72% to RM35.5m for the second quarter ended Dec 31, 2022 (2QFY2023) from RM38.9m a year before, mainly due to margin compression as a result of higher operating costs. Quarterly revenue, however, increased 8.27% to RM295.3m from RM272.8m in 2QFY2022, due to the opening of additional Starbucks cafes. It declared a second interim dividend of two sen per share — compared with 0.2 sen paid a year ago — to be paid on March 22. (The Edge)

Market Update

The FBM KLCI might open higher today as US stocks rose on Monday as investors bet that forthcoming economic data would ease the pressure on the Federal Reserve to continue lifting interest rates. Wall Street’s blue-chip S&P 500 index finished 1.1% higher, with all sectors except energy making gains. The tech-heavy Nasdaq Composite added 1.5%. US equities last week recorded their biggest five-day decline in two months. US stocks have declined and government bonds yields have jumped since data in early February showed the economy added more than 500,000 jobs in the first month of the year, roughly triple the number that had been forecast. The numbers suggested the US economy was stronger than expected, and traders bet the Fed would be forced to raise rates further to combat inflation. In Europe, the region-wide Stoxx 600 rose 0.9% with the FTSE 100 in London closing 0.8% higher at a record high.

Back home, the FBM KLCI erased earlier losses to finish marginally higher as bargain hunting emerged during late trading, amid the mixed performance by regional peers. At the closing bell, the benchmark FBM KLCI went up 0.58 of-a-point to end at an intraday high of 1,475.17 compared with last Friday's close of 1,474.59. In the region, Hong Kong’s Hang Seng index fell 0.1%, Japan’s Topix declined 0.5% and South Korea’s Kospi dropped 0.7%. China’s CSI 300 added 0.9%.

Source: PublicInvest Research - 14 Feb 2023