Economy

US: Manufacturing index indicates continued contraction in Jan. Activity in the US manufacturing sector contracted for the third consecutive month in Jan. The manufacturing PMI dipped to 47.4 in Jan from 48.4 in Dec, with a reading below 50 indicating a contraction. Economists had expected the index to edge down to 48.0. "The US manufacturing sector again contracted, with the Manufacturing PMI at its lowest level since the coronavirus pandemic recovery began. With Business Survey Committee panelists reporting softening new order rates over the previous nine months, the Jan composite index reading reflects companies slowing outputs to better match demand in the first half of 2023 and prepare for growth in the second half of the year. The decrease by the headline index came as the new orders index fell to 42.5 in Jan from 45.1 in Dec, while the production index slipped to 48.0 from 48.6. (RTT)

US: Fed raises interest rates by another quarter point, signals further rate hikes. The Federal Reserve announced its widely anticipated decision to raise interest rates by another quarter point. After a two-day meeting, the Fed said it has decided to raise the target range for the federal funds rate by 25bps to 4.50 to 4.75%. The latest interest rate hike comes after the central bank raised rates by 75bps in Nov and by 50bps in Dec. The Fed also said it anticipates ongoing increases in interest rates will be appropriate in order to attain a stance of monetary policy that is sufficiently restrictive to return inflation to 2% over time. In determining the extent of future increases in the target range, the Committee will take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments. (RTT)

EU: Eurozone inflation slows, manufacturing logs mild contraction. Euro area inflation eased to an eight-month low in Jan on slower growth in energy prices, and the unemployment rate remained unchanged at a lower level. Elsewhere, a private survey said the factory downturn in the currency bloc slowed suggesting that the worst of the slump has passed, the region narrowly escaped a shrinkage at the end of 2022. Inflation slowed more than-expected to an 8.5% in Jan from 9.2% in Dec. Prices were expected to climb 9.0%. This was the lowest rate since May 2022. Core inflation that excludes prices of energy, food, alcohol and tobacco, was 5.2% in Jan, unchanged from Dec, but slightly above economists' forecast of 5.1%. Despite the slowdown in overall inflation, high core inflation will be enough for the ECB to hike the rate by another 50bps tomorrow. (RTT)

China: Manufacturing sector shrinks moderately. China's manufacturing sector shrank at a slower pace in Jan as the downturns in output and new orders softened. The Caixin manufacturing PMI rose to 49.2 from 49.0 in Dec. However, the score has remained below the neutral 50.0 for the sixth consecutive month suggesting contraction. Moreover, the reading was below economists' forecast of 49.5. The manufacturing sector expanded for the first time in four months in Jan. The corresponding index climbed to 50.1 from 47.0 in Dec. The non-manufacturing PMI advanced sharply to 54.4 from 41.6 a month ago. The relative improvement was partially due to the softer decrease in production, S&P said. Output dropped at a marginal pace as firms reported reduced pressure on operations after the easing of containment measures. (RTT)

Japan: Manufacturing PMI holds steady in Jan. The manufacturing sector in Japan continued to contract in Jan, and at a steady pace with a manufacturing PMI score of 48.9. That's unchanged from the Dec reading and remains beneath the boom or-bust line of 50. The main positive influences on the headline PMI came from slower cutbacks to production and a smaller decline in new orders. Jan data pointed to only a modest reduction in output levels across the Japanese manufacturing sector, with the speed of decline the slowest since Oct 2022. Survey respondents noted that production schedules were curtailed due to weaker customer demand and more subdued underlying business conditions, especially across the electronics supply chain. (RTT)

Taiwan: Industrial production falls 7.93%, retail sales growth at 4-month high. Taiwan's industrial production declined for the fourth straight month in Dec, largely led by a sharp contraction in manufacturing output. Separate data showed that retail sales growth accelerated markedly at the end of the year. Industrial production decreased 7.93% YoY in Dec, after a revised 5.5% fall in Nov. Manufacturing output declined the most by 8.40% annually in Dec, followed by electricity and gas supply with a 2.13% drop. The mining and quarrying production fell at a slower pace of 0.80% in Dec, while the output of the water sector increased by 3.99%. (RTT)

Indonesia: Inflation slows to 5.28%, lowest in 5 months. Indonesia's inflation rate eased to the lowest in five months in Jan after accelerating in the previous month, and remained above the Bank Indonesia's target. Separate data showed that tourist arrivals to the country continued its triple-digit growth in Dec. The consumer price index, or CPI, rose 5.28% YoY in Jan after a 5.51% increase in Dec. Economists had expected the annual inflation rate to ease to 5.40%. The latest inflation was the lowest since Aug, when prices rose 4.69%. (RTT)

Markets

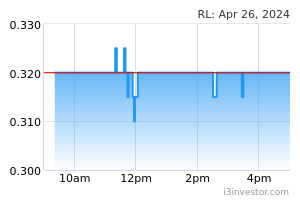

Reservoir Link (Underperform, TP: RM0.31): To acquire 90% stake in Indonesian mini hydro plant project . Reservoir Link Energy’s unit has entered into a term sheet (TS) to acquire a 90% stake in Indonesia’s PT Eco Power Engineering (EPE) for USD3m (RM12.8m) in cash. EPE was incorporated in Indonesia on Feb 20, 2013 as a limited liability company as a special purpose vehicle (SPV) to enter into a power purchase agreement (PPA) with PLN for a 9.6MW Mini Hydro Project at Sungai Lawe Mamas, Wilayah Sungai Alas-Singkil, Acheh, Indonesia, according to Reservoir Link's bourse filing. (The Edge)

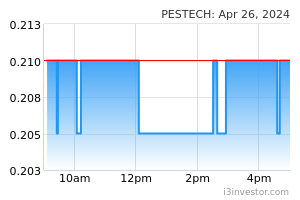

Pestech: Confirms two top execs charged for allegedly abetting in misappropriation of a subsidiary's funds . Pestech International has confirmed that two of its top executives have been charged for allegedly abetting the misappropriation of RM10.6m related to its wholly-owned subsidiary, PESTECH Technology SB. Pestech said both executive chairman Lim Ah Hock and managing director-cum-group chief executive officer Lim Pay Chuan were charged at Shah Alam Sessions Court last Friday (Jan 27). (The Edge)

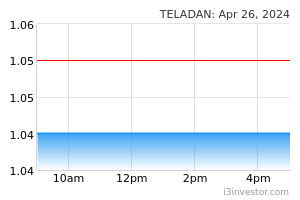

Teladan Setia: In RM48.5m land purchase . Teladan Setia Group has proposed the RM48.5m acquisition of a leasehold plot of land in the Central Melaka District with a land size of 7.54 acres. The Melaka-based property developer said it plans to satisfy the acquisition through a combination of bank borrowings and internally generated funds and plans to complete it by the fourth quarter of 2023. (StarBiz)

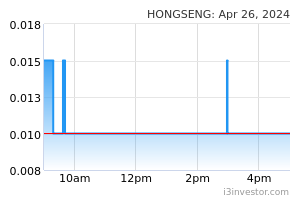

Hong Seng: Acquires 51% stake in Innov8tif for RM30.8m . Hong Seng Consolidated has entered into a shares sales agreement with Innov8tif Consortium SB to acquire 717,570 shares in Innov8tif Holdings SB for RM30.85m. Hong Seng said the acquisition would pave the way for the company to venture into the digital industry. It said that upon completion of the exercise, Innov8tif Holdings would become a 51%-owned subsidiary of Hong Seng. (Bernama)

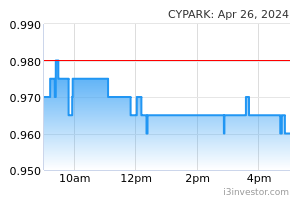

Cypark: Unaware of reason for UMA, except Jakel’s emergence as largest shareholder . Cypark Resources said it is not aware of any explanation for the unusual trading volume of its shares recently, except for the completion of its private placement and the emergence of Jakel Group’s investment arm as its new substantial shareholder, which may have boosted investor confidence. (The Edge)

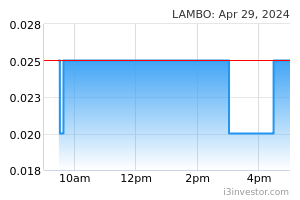

Lambo Group: External auditor expresses disclaimer of opinion . Lambo Group’s external auditor has expressed a disclaimer of opinion in the group’s financial statement due to lack of audit evidence on financials relating to its subsidiary Fujian Accsoft Technology Development Co Ltd. CAS Malaysia PLT expressed the disclaimer of opinion in Lambo’s financial statement for the 16-month period ended Sept 30, 2022. (The Edge)

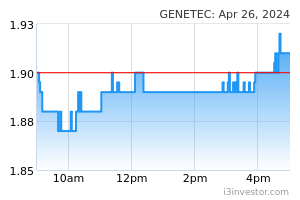

Genetec: Fixes private placement exercise at RM2.61 per share to raise RM178m . Genetec Technology has fixed the issue price of its private placement exercise at RM2.61 per share to raise RM178m. The issue price represents a discount of 2.69% to the volume weighted-average of the shares for the five market days up to and including Jan 30 of RM2.6821 per share. The funds will be mainly used for its business expansion. (The Edge)

Market Update

The FBM KLCI might open with a positive bias today as US stocks closed at their highest level since last summer and government bonds swung higher on Wednesday after the Federal Reserve announced a further slowdown in the pace of interest rate rises. The US central bank lifted its benchmark interest rate 0.25 percentage points to a range of 4.5% to 4.75%. The widely expected move in the federal funds rate was less than previous increases of 0.5 or 0.75 percentage points undertaken at recent meetings. The Fed’s smaller rate increase after its first monetary policy meeting of the year reflects growing confidence that inflation is on a downward trajectory after several months of encouraging data. Wall Street’s benchmark S&P 500 index, which had slipped earlier in the day, rebounded after Fed chair Jay Powell spoke to reporters and closed 1.1% higher for the day. The tech-heavy Nasdaq Composite jumped 2%.

Across the Atlantic, the regional Stoxx Europe 600 traded flat after Eurozone inflation fell more than expected to 8.5% in January, down from 9.2% in December. Core inflation, which omits relatively volatile food and energy prices, remained at 5.2%, with investors having expected a decline to 5.1 %. London’s FTSE 100 slipped 0.1%. In the region, Hong Kong’s Hang Seng index added 1%, China’s CSI 300 rose 0.9% and South Korea’s Kospi gained 1.2%. Japan’s Nikkei was flat.

Source: PublicInvest Research - 2 Feb 2023