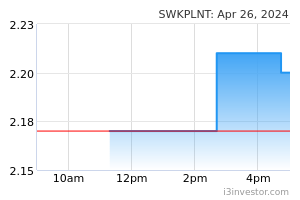

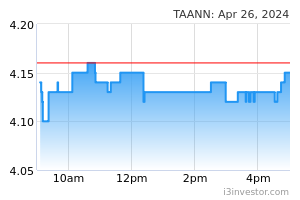

Malaysia’s palm oil stockpiles ended 2022 at 2.19m mt, the highest level since 2017 as both CPO production and CPO exports saw a slight pick-up. Meanwhile, it was a roller coaster ride for the CPO price performance as it jumped to as high as RM8,000/mt in March 2022 before sliding to the current level of RM4,100/mt. For the full-year, it averaged at a record level of RM5,126/mt, which was slightly higher than our CPO price assumption of RM5,000/mt. We also introduce our 2023 CPO price assumption of RM3,800/mt, down 25% YoY, on rising supply following the gradual return of foreign workers to the oil palm plantation. Maintain Neutral on the sector. Our top picks are Sarawak Plantation and Ta Ann.

- Palm oil stockpiles ended at 4-month low. Though palm oil stockpiles closed at 4-month low of 2.19m mt, it was higher by 36% compared to 2021’s 1.61m mt. Stock-to-usage ratio from 10.3% to 10.4%, attributed to a decline in both domestic consumption and exports.

- Exports grew by only 1%. For 2022, palm oil exports saw a small growth of 1% to 15.7m mt, despite seeing weaker exports to China (-4%), India (-19.3%), Pakistan (-15%) and US (-20%), offset by stronger demand from EU (+15%). India remained the top palm oil importer, accounting for 18%, followed by EU (11.9%) and China (11.4%).

- Production recovered by 1.9% despite workforce constraints. Despite the severe shortage of workers, Malaysia’s palm oil production managed to register a gain of 1.9% to 18.4m mt, contributed by Peninsular Malaysia (+3.2%) and East Malaysia (+0.3%)

- Seeing stronger global oilseed supply. Global oilseed is expected to increase by 7% YoY, led by bumper supply from Brazil and Argentina thanks to decent planting and favorable weather. Meanwhile, Malaysia’s palm oil production is forecast to rise to 19m mt this year, attributed to an increase in productivity especially in Peninsular Malaysia as worker shortage issue starts to ease.

- Projecting earnings slide in 2023. Based on our CPO price assumption of RM3,800/mt, we are seeing a decline of up to 43% in plantation earnings. First half of 2023 results are expected to be relatively weak given the 1) slow hiring process, 2) elevated production cost due to a sharp decline in palm kernel credit and 3) weaker CPO selling prices.

Source: PublicInvest Research - 11 Jan 2023