Economy

US: Fed faces difficult call to avoid overdoing rates shock. The Fed’s effort to shock the economy back to lower inflation is in its early days, making it tough for the US central bank to avoid overdoing it with higher-than-needed interest rates, a top economic adviser in the Obama White House said after a fresh review of Fed policy since World War Two. The Fed has raised its target policy rate by more than 4ppts in the last year, and we are just now entering the window where the effects might start to be noticed. Fed officials have acknowledged how tricky it will be to judge how high to raise rates and how long to keep them elevated, and have scaled back the pace of the increases in borrowing costs to try to avoid a mistake. Minutes of the most recent Fed policy meeting in Dec showed central bankers struggling with the risks, while economists see a high probability that the rate increases will lead to a US recession in the coming year. (Reuters)

US: CPI will help determine size of next Fed rate hike. US inflation data in the coming week are expected to stay consistent with a gradual step-down in cost pressures, and will help determine the size of the Fed’s next interest-rate increase. The CPI excluding food and energy, known as core CPI and seen as a better underlying indicator than the headline measure, is projected to have risen 0.3% in Dec. While slightly more than Nov, the monthly advance would be in line with the average for the quarter, and well below the 0.5% average seen from Jan through Sept amid the highest inflation in a generation. Figures will be some of the last such readings policy makers will see before their 31 Jan - 1 Feb meeting and rate decision, the first with a new rotation of voting members. (Bloomberg)

US: Services Index unexpectedly indicates contraction in Dec. Activity in the US service sector unexpectedly contracted for the first time in over two years in the month of Dec, according to a report released by the Institute for Supply Management on Jan 6. The ISM said its services PMI tumbled to 49.6 in Dec from 56.5 in Nov, with a reading below 50 indicating a contraction. Economists had expected the index to edge down to 55.0. With the much bigger than expected decrease, the index indicated a contraction for the first time since May 2020, when it hit 45.2. The sharp drop by the headline index came as the new orders index plunged to 45.2 in Dec from 56.0 in Nov, which also indicated the first contraction since May 2020. (RTT)

US: Factory orders tumble much more than expected in Nov. A report released by the Commerce Department showed a much steeper than expected drop in new orders for US manufactured goods in the month of Nov. Factory orders tumbled by 1.8% in Nov after climbing by a downwardly revised 0.4% in Oct. Economists had expected factory orders to slump by 0.9% compared to the 1.0% jump originally reported for the previous month. The sharp pullback in factory orders came as new orders for durable goods plunged by 2.1%, led by a 6.3% nosedive in orders for transportation equipment. Orders for non-durable goods also dove by 1.4%. (Reuters)

US: Employment jumps by 233,00 jobs in Dec, slightly more than expected. Employment in the US increased by slightly more than expected in the month of Dec. The report said non-farm payroll employment jumped by 223,000 jobs in Dec after surging by a revised 256,000 jobs in Nov. Economists had expected employment to shoot up by 200,000 jobs compared to the addition of 263,000 jobs originally reported for the previous month. The stronger than expected job growth reflected notable job gains in the leisure and hospitality, healthcare, construction, and social assistance sectors. The report also said the unemployment rate edged down to 3.5% in Dec from a revised 3.6% in Nov. (RTT)

EU: Inflation slows on lower energy prices. Euro area CPI slowed to a four-month low in Dec on easing energy price growth, but an unexpected acceleration in core inflation pushes the case for the ECB to continue with its hawkish stance. Other economic data suggested that recession is likely to be shallower than estimated previously. At the end of 2022, economic confidence strengthened to a four-month high on widespread improvements across trade, services, industry, and construction and among consumers. Official data also showed a rebound in retail sales in Nov, underpinned by an upturn in non-food product turnover. (RTT)

Japan: Real wages fall most in over 8 years on inflationary pressures. Japan's total real wages fell at the fastest pace in over eight years in Dec amid soaring inflation. Real wages declined 3.8% YoY in Dec, after a 2.9% drop a month earlier. This was the eighth successive monthly fall. The plunge in real wages at the end of the year was attributed to the rising inflation facing the economy. The latest data showed that Japan's CPI rose to above a 40-year high in Dec. The inflation was above the BoJ’s target range of 2.0%, and the policymakers are currently in a challenging position since they expect wage growth to boost demand and price growth. Data also showed that total earnings increased 0.5% YoY in Nov following a revised 1.4% rise in Oct. Further, the latest increase in total cash earnings was the slowest since the current sequence of growth began in Jan. Contractual gross earnings also grew 1.8% annually in Nov, while special cash earnings fell sharply by 19.2%. (RTT)

Taiwan: Inflation rises to 2.71%. Taiwan's CPI accelerated more than-expected in Dec, largely driven by higher food prices, especially eggs. Consumer prices rose 2.71% YoY in Dec, faster than the 2.35% increase in Nov. Economists had forecast inflation to rise to 2.50%. The price index for eggs grew 19.92% annually in Dec, and that for vegetables rose 11.98%. Prices for fish and seafood increased 6.25%, while the cost of communication equipment declined 8.30%. (RTT)

Philippines: Industrial production growth slows; jobless rate falls. The Philippines' industrial production index increased at a softer pace in Nov and the unemployment rate declined. The unemployment rate declined to the lowest rate since April 2005 and employment increased slightly. The production index value for manufacturing increased 12.7% yearly in Nov, after a revised 13.0% growth in Oct. Manufacture of machinery and equipment for electrical contributed the highest growth among industry divisions, by 67.9% yearly in Nov, while the production of electrical equipment declined the most, down 53.6% along with the renaming five industries. (RTT)

Markets

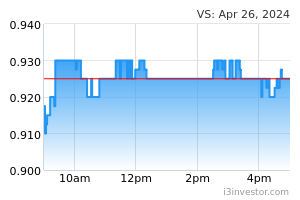

VS Industry (Outperform, TP: RM1.23): Aims to grow business by deploying RM80m capex this year. VS Industry (VSI) is committed to remaining steadfast and focused on growing its business by deploying RM80m for capex. 2022 was a demanding year for the company as it was fraught with many challenges ranging from the effects of a prolonged pandemic to global macroeconomic issues. Nevertheless, VSI have navigated these taxing business operating conditions and delivered a commendable performance. (BTimes)

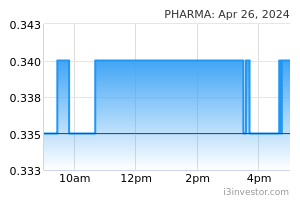

Pharmaniaga: Expands distribution capacity in northern Peninsular Malaysia. Pharmaniaga has officially opened its new distribution centre in Penang. This new centre is targeted to increase the group’s distribution capacity coverage, buffer the stock readiness, as well as cater to the increasing demand from Peninsular Malaysia’s northern region clientele, especially among health ministry facilities in Perlis, Kedah, Penang and Perak. (The Edge)

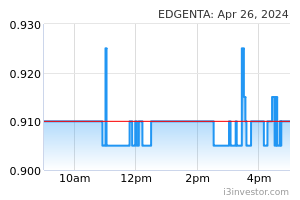

UEM Edgenta: Serves winding-up petition to AZRB’s unit. Ahmad Zaki Resources (AZRB)’s unit was served with a winding-up petition by UEM Edgenta for failing to settle an outstanding amount of RM11.05m in regards to the Klang Valley Mass Rapid Transit's Putrajaya Line (MRT2) project. AZRB does expect any financial and operational impact arising from the filing of the petition. AZRB also said that the total cost of investment in its unit AZSB is RM165.3m. (The Edge)

CSH Alliance: Obtains manufacturing licence to assemble electric vans. CSH Alliance has obtained the manufacturing licence for the assembly of commercial electric vans, primarily the BYD T3 compact van. The group is applying for an approved permit from MITI, as well as other approvals from relevant authorities, to bring in the complete-built-up (CBU) units of BYD T3 into Malaysia for distribution purposes before the setup of the local assembly plant in Tanjung Malim, Perak. (The Edge)

Yong Tai: Unit to acquire land in Melaka worth RM41.6m. Yong Tai has entered into a sale and purchase agreement with Admiral City SB to acquire a piece of leasehold land in Melaka for RM41.69m. Admiral City is the registered proprietor of the leasehold land, known as Plot 1A, measuring approximately 57,171 sq m in Melaka Tengah, with leasehold tenure expiring on June 12, 2116. (The Edge)

Binasat Communications: Bags satellite facilities installation contract in Kelantan, Pahang. Binasat Communications has won contracts to set up a total of 275 satellite facilities in Kelantan and Pahang. The contracts paved the way for expanding its services to other local state councils and businesses. It is eyeing double-digit top-line growth from this business division. (BTimes)

IPO: Wellspire Holdings public portion oversubscribed by 11.24 times. The 36m public issue shares made available for application by the Malaysian public has been oversubscribed. A total of 7,727 applications for 440.7m public issue shares with a value of RM101.4m were received from the Malaysian public, which represents an overall oversubscription rate of 11.24 times. For the Bumiputera portion, a total of 3,628 applications for 126.9m public issue shares were received, which represents an oversubscription rate of 6.05 times. (BTimes)

Market Update

US benchmarks surged notably higher last Friday after the December jobs report signaled that inflation may be easing. Nonfarm payrolls came in slightly higher than expectations, though wages increased at a slower pace than expected. Data on the day also showed a contraction in the services sector, adding to hopes that the US Federal Reserve’s (FED) rate hikes may be achieving its goals. The Dow Jones Industrial Average and S&P 500 gained 2.1% and 2.3% as the Nasdaq Composite popped up 2.6%. European bourses also ended the day higher as investors here digested the US jobs report. Inflation in the Eurozone dropped for a second consecutive month in December meanwhile. Despite further signs that inflation is easing, market observers believe it is still too early to celebrate and do not expect a pivot from the region’s central bank anytime soon. Germany’s DAX and France’s CAC 40 rose 1.2% and 1.5% while UK’s FTSE 100 gained 0.9%. Major Asian markets were mixed earlier in the day as the FED signaled more rate hikes ahead in its latest meeting minutes, though likely to rebound today following the strong performance on Wall Street last Friday. The Hang Seng and Straits Times indices slipped 0.3% and 0.5% respectively. The Shanghai Composite Index inched 0.1% higher however. Japan’s Nikkei 225 rose 0.6%.

Source: PublicInvest Research - 9 Jan 2023