Economy

US : Chicago business barometer rebounds more than expected in Dec. Chicago-area business activity showed bigger than expected slowdown in Dec. Chicago business barometer climbed to 44.9 in Dec from 37.2 in Nov, although a reading below 50 still indicates a contraction. Economists had expected the index to rise to 41.2. The bigger than expected rebound came after the Chicago business barometer fell to its lowest reading since the 2008/09 global financial crisis, excluding the 2020 pandemic shock. The report showed the new orders index jumped to 44.1 in Dec from 30.7 in Nov, reflecting a number of last-minute and year-end blanket orders. The production index also rose to 39.2 in Dec from 35.9 in Nov, although material and staff shortages were cited as hampering production. (RTT)

EU: Eurozone factory slowdown softens as supply chain, inflation pressures ease. Downturn in the euro area manufacturing slowed in the final month of 2022 amid healing supply chains and softening inflationary pressures. The manufacturing PMI Index rose to a three-month high of 47.8 in Dec from 47.1 in Nov. The reading came in line with the flash estimate. Among sectors, consumer and intermediate goods manufacturing logged deterioration, while capital goods production showed a marginal growth. The PMI survey showed that output contracted for the seventh straight month in Dec, but the latest pace of fall was the weakest since June. New order inflows dropped in line with the trend in output. A slower fall in new export businesses helped to alleviate the decline in overall new orders. There was a sharp fall in backlogs of work in Dec. Manufacturers consequently cut back hiring, with the job creation rising at the slowest pace in nearly two years. (RTT)

UK: House price inflation weakens amid rising interest rates. UK house price inflation slowed markedly at the end of the year as the rising interest rates and high inflation started to dampen the affordability of home buyers. House prices were 2.8% higher than in Dec 2021. This was slower than Nov's 4.4% increase, but faster than economists' forecast of 2.3%. On a monthly basis, house prices dropped at a slower pace of 0.1% after a 1.4% decrease in Nov. This was the fourth consecutive fall, the worst run since 2008, leaving prices 2.5% lower than their August peak. The housing market is unlikely to regain much momentum in the near term as economic headwinds strengthen, with real earnings set to ease further and the labour market to weaken as the economy shrinks. On a quarterly basis, house prices decreased 1.8%. All regions registered a slowdown in annual price growth in the Dec quarter. (RTT)

China: Private sector sinks into deeper contraction amid Covid scare. China's manufacturing and services sectors weakened the most since early 2020 despite the abrupt abandonment of zero Covid policy in Dec amid public resistance, as the number of infections rise that prompted several countries to raise alerts and, bring back testing and protective measures. The official manufacturing PMI declined to 47.0 in Dec from 48.0 in the previous month. The production sub-index weakened by 3.2 ppts to 44.6 in Dec. Demand also waned towards the end of the year, with the new orders index easing to 43.9. The non-manufacturing PMI that combines services and construction, declined more sharply to 41.6 from 46.7 a month ago. Both the manufacturing and nonmanufacturing indices reached its weakest levels since early 2020. By contrast, the construction sector continued to expand in Dec. Consequently, the overall composite output index fell to 42.6 from 47.1 in the previous month. (RTT)

India: Manufacturing growth strongest in over 2 years. India's manufacturing sector ended 2022 on a strong note as activity expanded at the fastest rate in more than 2 years in Dec amid an acceleration of growth in output and demand. The manufacturing PMI rose to 57.8 in Dec from 55.7 in Nov. Further, this was the highest PMI score since Oct 2020. In Dec, sales growth strengthened due to a resilient demand, with the rate of growth reaching its quickest level since Feb 2021. At the same time, new export orders grew at the slowest pace in five months as companies struggled to secure new work from key export markets. Growth in output accelerated to a 13-month high in Dec, thanks to strong overall demand. By the end of the year, Indian goods producers had hired additional staff to deal with backlogs. Employment rose for the tenth successive month, but the rate of job creation was the slowest in three months. On the price front, input cost inflation was contained, but selling prices grew solidly and quickly. (RTT)

South Korea: Manufacturing downturn worsens on weak demand. South Korea's manufacturing activity registered a steeper downturn towards the end of 2022 as subdued demand drove output and new orders down. The factory PMI slid to 48.2 in Dec from 49.0 in Nov. Overall orders posted its sharpest fall in 2.5 years. Foreign orders decreased at the most pronounced pace since mid- 2020. As a result, firms cut back their production, thereby extending the current sequence of fall to eight months. Input buying declined for the fifth consecutive month in Dec. Likewise, firms reduced their holdings of finished goods. Backlogs of work dropped again as the lack of demand enabled firms to focus on working through outstanding orders. Workforce numbers decreased in Dec due to voluntary resignations. Average cost burdens increased in Dec due to rising raw material costs and weaker currency. Producers transferred increasing costs onto their clients. But the rate of output price inflation was the softest in the current sequence of 27 months of inflation. The survey showed that the outlook for output over the coming year was the weakest in the current 29-month sequence of optimism. (RTT)

Indonesia: Inflation climbs to 5.51%. I ndonesia's inflation increased unexpectedly in Dec and remained above Bank Indonesia's target as food prices continued to rise at stronger rates. The CPI rose 5.51% YoY in Dec, following a 5.42% increase in Nov. Economists had expected the annual inflation rate to rise to 5.39%. Headline inflation stayed above the Bank Indonesia's of 3 plus or minus 1% for the seventh month in a row. Core inflation, which excludes the volatile food and energy prices, rose to 3.36% in Dec from Nov's 3.30%. Economists had forecast 3.39%. Prices for food, beverages and tobacco grew 5.83% annually in Dec and those of housing, water, electricity and household fuels gained 3.78%. (RTT)

Markets

KLK (Neutral: TP: RM23.17): Sees challenging 2023 for cash flow on expansion to oleochemicals segment, capex for plantation ops. Kuala Lumpur Kepong (KLK) foresees challenges to its cash flow going into 2023 as its committed major oleochemicals expansion in Indonesia, Malaysia, China and Europe are currently on schedule. "A cash outflow of RM1.5bn will be required over the coming two years," said chairman R M Alias in the group's annual report for the year ended FY2022. "The plantation sector also has capital expenditure requirements to upgrade and renew some existing palm oil mills and infrastructure. However, our net debt at 40.7% is still able to cushion any impact from a shortfall in cash generation," he added. (The Edge)

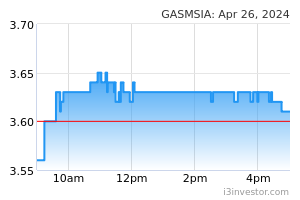

Gas Malaysia: Maintains base average tariff at RM1.573 per GJ per day. Gas Malaysia has announced that under the Incentive Based Regulation (IBR) framework, the current Base Average Tariff is maintained at the rate of RM1.573 per gigajoules (GJ) per day. The current Base Average Tariff is for users of Gas Malaysia Distribution SB’s (GMD) Natural Gas Distribution System between Jan 1, 2023 and Dec 31, 2025, said Gas Malaysia. Gas Malaysia said GMD is to affect the adjustment at the rate of 3.8 sen per GJ per day through a rebate to its Base Average Tariff in the next three years. "Therefore, GMD’s Distribution Tariff under the IBR framework for all types of utilisations is RM1.535 per GJ per day for the period from Jan 1, 2023 until Dec 31, 2023. (Bernama)

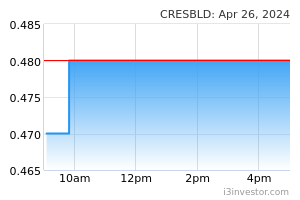

Crest Builder: Unit bags RM478.9m Desa Parkcity condo project . Crest Builder Holdings has secured a RM478.89mil contract from Perdana Parkcity SB for the completion of two blocks of condominiums with a cark park podium and retail units at Desa Parkcity in Kuala Lumpur. The group said the contract period is for 39 months from May 5, 2023 to August 4, 2026. "The Contract is expected to contribute positively to the earnings of the Group for the financial years ending 31 Dec 2023 and onwards," it said. (StarBiz)

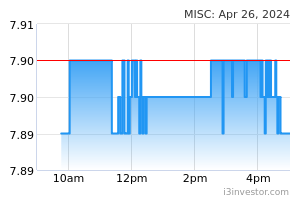

MISC: High Court dismisses MISC's application to set aside USD330m in arbitration award over Gumusut-Kakap semi-FPS project. The High Court has dismissed an application by MISC to set aside USD330.2m (RM1.45bn) representing parts of an arbitration award against its subsidiary involved in the Gumusut Kakap semi-floating production system (semi-FPS) project in 2014. The 2020 arbitration award, totalling USD352.4m excluding costs, was to be claimed by Sabah Shell Petroleum Co Ltd (SSPC) from MISC's subsidiary, Gumusut-Kakap Semi-Floating Production System (L) Ltd (GKL). (The Edge)

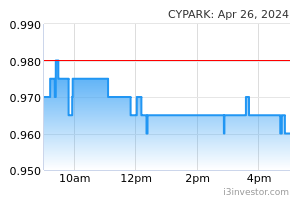

Cypark: 4Q net profit plunges 79%, dragged down by lower revenue . Cypark Resources net profit for the 4QFY22 plunged 79% to RM5.4m from RM25.7m a year earlier, dragged down by lower revenue. Earnings per share declined to 0.29 sen from 4.55 sen. Quarterly revenue dropped 44.4% to RM48.4m from RM87.0m on lower contributions from the renewable energy division and waste management and waste-to-energy (WTE) division. (The Edge)

Top Builders: Bursa reprimands Top Builders for late issuance of 2021 annual report. Bursa Malaysia Securities has publicly reprimanded Top Builders Capital for failing to issue its annual report for the 18-month period ended June 30, 2021 (FY2021) within the stipulated time. The construction engineering company only issued the report on Nov 22, 2021, a delay of 15 market days from the Oct 31, 2021 deadline. (The Edge)

Market Update

Overnight, European stocks kicked off 2023 on a high note as traders scooped up equities at a discount following steep falls across global markets last year. The regional Stoxx 600 rose 1% on Monday after the index fell 12.9% in 2022 in its worst year since 2018. France’s Cac 40 rallied 1.9% on Monday, Spain’s Ibex rose 1.7%, Italy’s FTSE Mib gained 1.9% and Germany’s Dax drifted 1.1% higher. Markets in London and New York were closed for public holidays. Global equities and bond markets shed more than $30tn in 2022, as central bank rates rises and the war in Ukraine triggered heavy losses. The MSCI All World share index lost 19.8% of its value, with many pandemic-era high flyers such as electric carmaker Tesla tumbling. Monday’s gains in Europe were broad, with most sectors of the Stoxx 600 rising on the day. Economically sensitive industries including real estate, energy and retail led the way higher. Healthcare and consumer staples, both defensive sectors, lagged behind. Meanwhile, widespread coronavirus outbreaks in China, which began lifting Covid-19 curbs late last year, have prompted fresh concerns about the world’s biggest emerging market.

Source: PublicInvest Research - 3 Jan 2023