Economy

Global: Economy is heading into a decade of low growth, economist says. The global economy likely faces a decade of sluggish growth, according to Daniel Lacalle, author and chief economist at Tressis Gestion. Economies around the world have been grappling with a multitude of shocks — from Russia’s invasion of Ukraine to China’s persistent zero-Covid measures — that have sent inflation soaring and weakened activity. The IMF now projects that global GDP growth will slow from 6% in 2021 to 3.2% in 2022 and 2.7% in 2023. The Fund characterized this as “the weakest growth profile since 2001 except for the global financial crisis and the acute phase of the Covid-19 pandemic.” Meanwhile, global inflation is forecast to rise from 4.7% in 2021 to 8.8% this year before declining to 6.5% in 2023 and to 4.1% by 2024, remaining above the target levels for many major central banks. (CNBC)

US: Pending home sales unexpectedly show another steep drop in Nov. A report released by the National Association of Realtors unexpectedly showed a continued slump in US pending home sales in the month of Nov. NAR said its pending home sales index tumbled by 4.0% to 73.9 in Nov after plunging by 4.7% to a revised 77.0 in Oct. The extended nosedive came as a surprise to economists, who had expected pending home sales to increase by 0.6%. Pending home sales slid for the sixth consecutive month and are now down by 37.8% compared to the same month a year ago. A pending home sale is one in which a contract was signed but not yet closed. Normally, it takes four to six weeks to close a contracted sale. "Pending home sales recorded the second-lowest monthly reading in 20 years as interest rates, which climbed at one of the fastest paces on record this year, drastically cut into the number of contract signings to buy a home," said NAR Chief Economist Lawrence Yun. (RTT)

Japan: BoJ discussed wage hikes, continuing monetary easing. BoJ policymakers said the bank should continue its monetary easing to achieve the price stability target in a stable manner. A policymaker said the economy is in a critical phase for achieving the price stability target of 2% in a sustainable and stable manner, the Summary of Opinions at the Monetary Policy Meeting held on Dec 19 and 20 showed. Therefore, continuing with monetary easing is necessary. Another member said the economy is set to expand at a pace above its potential growth due to the stronger momentum in wage hikes and investment. The course of wage revisions for spring 2023 and the trend in various investments warrant close monitoring. The functioning of bond markets deteriorated and if this situation persists, it could have a negative impact on financial conditions, the summary said. (RTT)

Japan: Industrial production slips 0.1% in Nov. Industrial output in Japan fell a seasonally adjusted 1.0% on month in November, the Ministry of Economy, Trade and Industry said. That beat expectations for a decline of 0.3% following the 3.2% drop in Oct. On a yearly basis, industrial production sank 1.3% - missing expectations for a gain of 1.0% following the 3.0% increase in the previous month. Upon the release of the data, the METI downgraded its assessment of industrial production, saying that it has weakened. Industries that contributed to the decline included business-oriented machinery, production machinery and organic chemicals - offset by increases among other chemicals, plastic products and electrical machinery. (RTT)

South Korea: Business confidence falls in Dec. Business sentiment in South Korea weakened in Dec, the latest survey from the Bank of Korea showed. The Business Survey Index on business conditions in the manufacturing sector fell to 71 in Dec from 74.0 in Nov. At the same time, the outlook weakened further, with the index falling to 68.0 for Jan from 69.0. In the non-manufacturing sector, the BSI on business conditions for December remained unchanged at 76, and the outlook for the following month fell by 5 points to 72. The Economic Sentiment Index, which combines the BSI and the Consumer Survey Index, for Dec was 91.7, up 0.3 points from Nov. The survey was conducted among 3,255 companies between December 13 and 20. (RTT)

Hong Kong: Nov home prices ease to more than five-year low. Hong Kong private home prices dropped 3.3% in Nov to the lowest since Aug 2017, official data showed, as its housing market — one of the most unaffordable in the world — is set to post the first annual drop since 2008. Prices in the Asian financial hub were weighed down by a weak economic outlook and rising mortgage costs, following a serious Covid outbreak at the beginning of the year. Nov's fall in home prices came after a revised 2.7% drop in Oct. Home prices in Hong Kong have fallen 13.8% in the first 110 months of the year. Transaction volume for the year is expected to fall to a decade low but it could have a small bounce next year after authorities lift travelling restrictions with mainland China, property agents said. (Reuters)

Markets

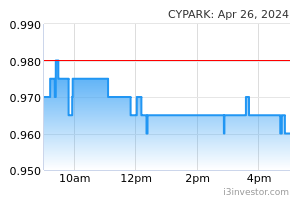

Cypark (Outperform, TP: RM0.85): Sets private placement price at 38 sen per share to raise RM68m. Cypark Resources has fixed the issue price of its private placement exercise at 38 sen per share to raise about RM68m, which is lower than what it had planned earlier. The issue price represents a discount of almost 8% to the volume-weighted average price of the units for the five market days up to and including Dec 27 of 41.27 sen apiece. (The Edge)

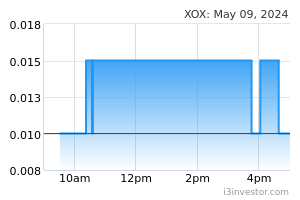

XOX: Proposes to reduce issued share capital of RM65m. XOX Technology has proposed to undertake a capital reduction exercise by cancelling a portion of its issued share capital unrepresented by assets of RM65m. The corresponding credit of RM65m from the exercise will be used to set-off against the company’s accumulated losses, while the remaining balance will be credited to its retained earnings. (StarBiz)

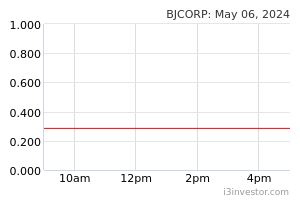

Berjaya Corp: Buys RM408.8m Yokohama land for development of Four Seasons project. A unit of Berjaya Corp (BCorp) is acquiring six parcels of freehold land collectively measuring about 20,977.2sqm in Yokohama, Japan, for JPY12.7bn (RM408.8m) cash. BCorp is contemplating the development of a Four Seasons Yokohama Harbour Edge project. (The Edge)

Tiong Nam: Enters JV agreement with JLand to develop high tech logistics park. Tiong Nam Logistics Holdings has entered into a JV agreement with Johor Corp to develop a high-tech logistics industrial park on a 300-acre land at Sedenak Technology Valley, Johor. (The Edge)

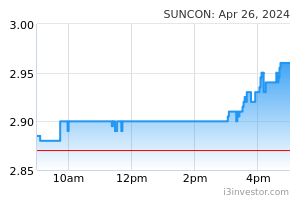

SunCon: Led consortium in negotiation to build Toyo Ventures' Vietnam power plant for USD2.2bn. Toyo Ventures' units have entered into an interim agreement with a consortium led by Sunway Construction Group (SunCon) to negotiate details for the consortium to undertake a USD2.2bn (RM9.7bn) job for the development of a 2,120 MW coal-fired power plant in Vietnam. (The Edge)

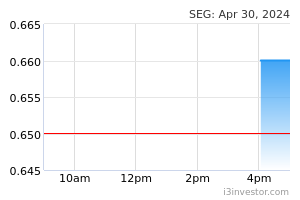

SEGi: Announces two sen dividend, purchase of two K-12 education companies from MD Hii. SEG International (SEGi), which operates the SEGi Group of Colleges, is planning to pay a second interim dividend of two sen per share for its FY22, and to buy two companies involved in the K-12 education business for RM700k in an all-cash deal to expand its business. (The Edge)

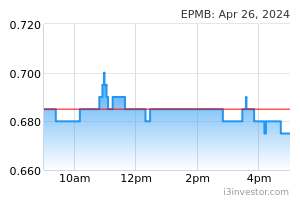

EP Manufacturing: Signs deal to distribute Chinese EV Lingbox in Malaysia, Indonesia. EP Manufacturing has entered into an exclusive distributor agreement with Hubei Dongfeng Power Auto Trade and Xiamen Tsingyan Hylong Motor Technology to assemble and sell Lingbox EVs in Malaysia and Indonesia. (The Edge)

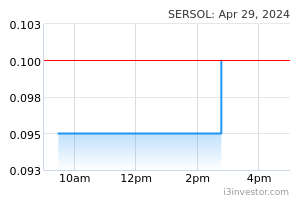

Sersol: Sees a good ride with Thai's Takuni. Sersol has signed a JV agreement with Thailand energy giant Takuni Group to manufacture, assemble and distribute electric two-wheelers motorbikes and scooters across Malaysia, Indonesia and Thailand. (StarBiz)

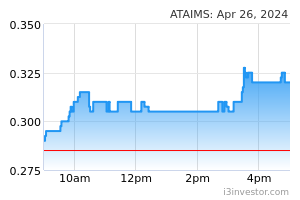

ATA IMS: Flags impairment risk, capacity cut on Dyson contract termination. ATA IMS is looking to undertake an impairment exercise and slash its operating capacity, following the termination of contracts by Dyson. (The Edge)

Market Update

The FBM KLCI might open lower today as US stocks fell on Wednesday, all but erasing hopes of a festive rally to end a dire year for equities, though Hong Kong-listed shares climbed as China eased its zero-Covid restrictions. Wall Street’s benchmark S&P 500 fell 1.2%, while the tech-heavy Nasdaq Composite fell 1.4%. The National Health Commission in China on Monday said it would drop quarantine requirements for inbound travellers from January 8, having earlier this month scrapped the requirement for positive Covid-19 cases to quarantine at centralised facilities. The decision has bolstered stocks in Hong Kong this week, but fears about a renewed spread of the virus have hampered US equities. The US on Monday said that it would require air passengers from China to present negative Covid-19 tests to enter the country, as cases have surged in China. Officials estimate that roughly 250mn people, or 18% of the population, were infected with Covid in the first 20 days of December. European markets finished mixed with the FTSE 100 gained 0.32%, while the CAC 40 led the DAX lower. They fell 0.61% and 0.50% respectively.

Back home, Bursa Malaysia jumped to a two-month high on Wednesday as last-minute buying in mainly telecommunications and financial heavyweights helped the barometer index to recoup earlier losses. Selective buying was also seen in several other sectors with the plantation and industrial products and services indices swinging back to green. At the closing bell, the benchmark FBM KLCI ended at its intra-day high of 1,480.11, up 5.42 points from Tuesday's closing of 1,474.69. Elsewhere, Hong Kong’s Hang Seng index added 1.6%, with all sectors apart from real estate in positive territory. The index is set to finish the year 14% lower but has risen by a third since the end of October as Beijing has loosened pandemic restrictions that have constrained China’s economic growth since early 2020.

Source: PublicInvest Research - 29 Dec 2022