Economy

US: Trade deficit widens as exports fall and imports rise. Reflecting a decrease in the value of exports and an increase in the value of imports, US trade deficit widened in the month of Oct. The trade deficit widened to USD78.2bn in Oct from a revised USD74.1bn in Sept. Economists had expected the trade deficit to increase to USD79.1bn from the USD73.3bn originally reported for the previous month. The wider trade deficit came as the value of exports slid by 0.7% to USD256.6bn, while the value of imports climbed by 0.6% to USD334.8bn. The drop in the value of exports reflected notable decreases in exports of industrial supplies and materials and pharmaceuticals, which more than offset a jump in exports of soybeans. (RTT)

US: Biden celebrates US manufacturing comeback at giant semiconductor project. President Joe Biden declared the comeback of US manufacturing at the site of a mammoth expansion to a Taiwanese-owned semiconductor plant aimed at breaking risky US dependency on foreign-based producers for the vital component. The project by TSMC, the world's biggest maker of leading-edge chips, would go a long way to meeting the US goal of ending reliance on foreign-located factories -- particularly in Taiwan, which is under constant threat of being absorbed or even invaded by China. TSMC, or Taiwan Semiconductor Manufacturing Company, announced it is building a second Phoenix plant by 2026, ballooning its investment in Arizona from USD12bn to USD40bn, with a target of producing some 600,000 microchips a year. About 10,000 high-tech jobs will be created once both plants are working. (Bloomberg)

EU: German construction shrinks most in 21 months on weak housing activity. Germany's construction sector deteriorated at the steepest pace in nearly two years in Nov, primarily due to a sharp fall in housing activity. The construction Purchasing Managers' Index dropped to 41.5 in Nov from 43.8 in Oct. Any reading below 50.0 indicates contraction. Among the three broad categories, the residential property segment logged a sharp decline in activity, which was the fastest fall since Feb 2012. The fall in civil engineering activity was the most pronounced for 21 months. Meanwhile, the commercial sector registered the slowest decline in 8 months. Easing demand for construction activity in Nov was mainly attributed to high prices, rising interest rates, and hesitancy among customers. (RTT)

UK: Construction growth slows amid weak demand, recession worries. The UK construction sector expanded for the 3 rd consecutive month in Nov, but there was a renewed slowdown in growth amid subdued demand and reduced risk appetite among clients, while rising interest rates and worries over the economic outlook hurt confidence, adding to signs that the economy is in recession. At 50.4, the construction PMI was down from 53.2 in Oct, signaling the weakest performance since Aug. However, a reading above 50.0 indicates expansion. Within the 3 segments of construction, only commercial work reported an increase in business activity. Meanwhile, civil engineering activity declined for the 5 th consecutive month as there was a lack of new work to replace completed project. (RTT)

Japan: Household spending rises for second month. The average household spending in Japan rose for the second straight month in Oct amid a reduction in Corona virus cases. Household spending rose 1.1% MoM in Oct, following a 1.8% gain in Sept. On a yearly basis, household spending growth eased to 1.2% in Oct from 2.3% in the previous month. Spending has been growing since June. The expected increase was 1.0%. The average monthly income per household stood at JPY568,282, down 0.9% from a year ago. (RTT)

Taiwan: Inflation at 9-month low. Taiwan's consumer price inflation eased more-than-expected in Nov to the lowest level in 9 months. Consumer prices rose 2.35% YoY in Nov, slower than the 2.74% increase in Oct. Economists had forecast inflation to drop to 2.50%. Further, this was the slowest rate of inflation since Feb, when prices had risen 2.33%. The price index for eggs grew 24.81% annually in Nov, and that for fish and seafood rose 6.23%. Prices for food away from home increased 5.81%, while the cost of communication equipment declined 7.26%. (RTT)

Australia: Central bank hikes rate to 3.10%. The policy board of the Reserve Bank of Australia, governed by Philip Lowe, decided to lift the cash rate target by 25bps to 3.10%, the highest since late 2012. The interest rate on exchange settlement balances was also raised by 25bps to 3.00%. The current policy tightening has taken the cash rate target to 3.10% from 0.10%, indicating a total 300bps increase April 2022. (RTT)

Philippines: Inflation highest in 14 years, more rate hikes likely. The Philippines' inflation accelerated to the highest level since Nov 2008, mainly due to an increase in food prices due to poor climate, but remained within the forecast range of the central bank that is widely expected to deliver another rate hike in its policy session next week. The consumer price inflation rose to 8.0% in Nov from 7.7% in Oct. (RTT)

Markets

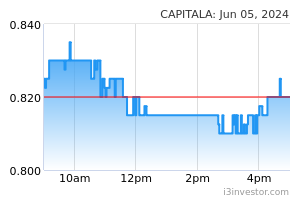

Capital A (Neutral, TP: RM0.69): Proposal is not a merger, but disposal of assets to AirAsia X, clarifies Capital A . Capital A has issued a clarification that the proposed plan announced recently is not a merger of AirAsia and AirAsia X but a potential disposal of Capital A’s aviation assets to AirAsia X. The group said the exercise is aimed at forming a separate publicly-quoted aviation group, comprising six airlines — four short-haul Asean airlines and two medium-haul airlines, namely AirAsia, Thai AirAsia, AirAsia Indonesia, AirAsia Philippines, AirAsia X and Thai AirAsia X. (The Edge)

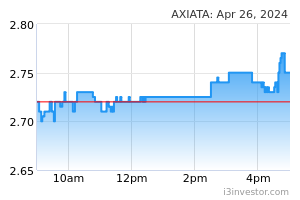

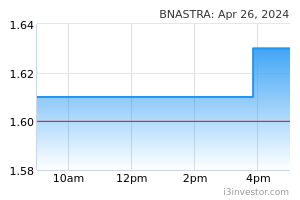

Axiata (Neutral, TP: RM3.60): Announces special dividend from proceeds of Celcom-Digi merger . Axiata Group has announced a special tax-exempt dividend of four sen per share, following the completion of the Celcom-Digi merger on Nov 30. The company has received a cash consideration of RM2.5bn from Digi.Com Bhd and RM300m from Digi’s parent company Telenor Asia Pte Ltd, as part of the transaction. (The Edge)

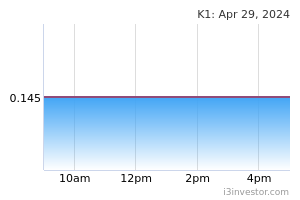

K-One: Made exclusive distributor of Diversey products in Malaysia . K-One Technology has been appointed the exclusive distributor of Diversey (M) SB's healthcare and hygiene-care products in Malaysia. In a statement, K-One said the products include disinfectants, detergents, wipes, clean patches and UV light disinfection among other things. Diversey is a subsidiary of Diversey Holdings Ltd, a US multinational listed on the Nasdaq that provides eading hygiene, infection prevention and cleaning solutions. (StarBiz)

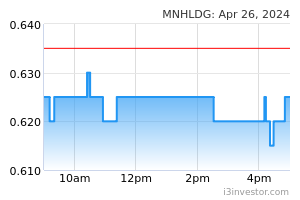

MN Holdings: Clinches substation parts replacement job from TNB . MN Holdings had secured a RM43.5m contract from Tenaga Nasional Bhd (TNB) to replace parts of a substation in Penang. Its wholly-owned subsidiary MN Power Transmission SB, and joint venture (JV) partner Zafas SB has been appointed by TNB as the main contractors of the gas-insulated substation in situ replacement project, and the contract entails the completion in 790 days from the commencement date (Dec 5). The JV company — owned 90% by MN Power and 10% by Zafas — will undertake the dismantling, replacement and commissioning of primary and secondary equipment, and power cables of the gas-insulated substation in Bayan Baru. (The Edge)

Comintel: Upper limit price frozen at 69 sen as shares surge upon lifting of trading suspension . The upper limit price of Comintel Corp’s shares has been frozen at 69 sen by Bursa Malaysia, after the stock hit limit up for two consecutive trading days. (The Edge)

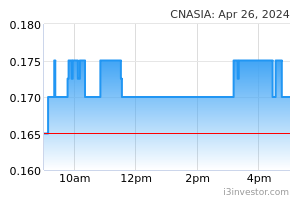

CN Asia: Sells more shares in Zen Tech, trimming stake to 1.05%. CN Asia Corp has trimmed its stake in Zen Tech International (formerly known as INIX Technologies Holdings) to 1.05%, from 6.69% previously. This came about after the company disposed of 19.0m Zen Tech shares on Dec 2 and another 26.6m shares on Dec 5. (The Edge)

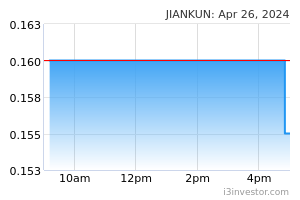

Jiankun: Hit with RM13m demand notice from JV partner for residential project . Jiankun International Bhd’s unit has been slapped with a notice of demand from Fivestar Development (Puchong) SB for RM13m linked to a joint venture agreement for the development of a residential property in Petaling, Selangor. (The Edge)

Market Update

The FBM KLCI might open lower today after US stocks slid and the price of Brent crude touched its lowest level since January after a round of strong economic data revived concerns that the Federal Reserve will rapidly lift borrowing costs to tame inflation. The benchmark S&P 500 closed 1.4% lower while the tech-heavy Nasdaq Composite lost 2% on Tuesday, extending heavy declines from the previous session. Facebook-owner Meta was among the biggest fallers, sliding 6.8%. Other Big Tech companies also slipped, with Google-owner Alphabet and Apple both down 2.5%, and Amazon 3% lower. Brent crude, the international oil benchmark, fell below USD80, down 4% to USD79.35, as traders took hotter than expected US services data on Monday as a signal the Fed would continue to raise rates to fight inflation. A report from the Institute for Supply Management showed that its index, which tracks economic activity in the US services sector, expanded for the 30th month in a row in November. Meanwhile, Europe’s Stoxx 600 fell 0.6%, with London’s FTSE 100 off by the same margin.

Back home, Bursa Malaysia ended mixed on Tuesday on the back of a lacklustre market, in line with the weakness in most key regional markets. The weak regional sentiment followed cues from the downbeat Wall Street performance overnight, amid renewed fears of a bigger interest rate hike by the US Federal Reserve in its monetary policy meeting next week. At the closing bell, the benchmark FBM KLCI was almost flat at 1,471.55, down by 0.01 of a point from Monday's closing at 1,471.56, after opening 2.57 points easier at 1,468.99. Hong Kong’s Hang Seng index shed 0.4%, while China’s CSI index of Shanghai- and Shenzhen-listed stocks gained 0.5%.

Source: PublicInvest Research - 7 Dec 2022