Economy

Global: Fed and BOE prepare 75 bps salvos on inflation. The Fed and the BOE may both unleash 75 bps interest-rate hikes in the coming days in a show of aggression toward inflation, even in the face of mounting recession risks. The transatlantic double act illustrates the trade-off confronting central banks as evidence of an impending global economic contraction becomes harder to ignore, even as inflation lingers. For the Fed, the fourth such out-sized move on Wed will bring it to a crossroads. (Bloomberg)

US: Key inflation gauge for the Fed rose 0.5% in Sept, in line with expectations. The core personal consumption expenditures price index increased 0.5% from the previous month and accelerated 5.1% over the past 12 months. Including food and energy, PCE inflation rose 0.3% for the month and 6.2% on a yearly basis, the same as in Aug. The report comes as the Fed is prepared to enact its sixth interest rate increase of the year at its policy meeting next week. (CNBC)

US: Pending home sales plunge much more than expected in Sept. The National Association of Realtors released a report on Friday showing pending home sales in the US plunged by much more than expected in the month of Sept. NAR said its pending home sales index tumbled by 10.2% to 79.5 in Sept after falling by 1.9% to a revised 88.5 in Aug. Economists had expected pending home sales to slump by 5.0% compared to the 2.0% drop originally reported for the previous month. (RTT)

EU: Inflation sets new record high. Germany's consumer price inflation accelerated faster than expected in Oct to set a new record, as the biggest euro area economy heads into a recession, adding more pressure on the ECB policymakers who have signaled more interest rate hikes ahead. The consumer price index rose 10.4% following a 10.0% increase in Sept, preliminary data from the statistical office Destati. (RTT)

EU: Latvian GDP contracts in Q3. Latvia's economy contracted in 3Q, after expanding in the previous five quarters. GDP fell a non adjusted 0.6% YoY in the Sept quarter, reversing a 2.9% rise in the June quarter. On a seasonally and calendar-adjusted basis, GDP also contracted 0.4% in the 3Q, following a 2.7% expansion in the previous quarter. On a quarterly basis, the seasonally and calendar adjusted GDP decreased 1.7% in the Sept quarter, after a stagnation in the previous quarter. (RTT)

EU: Ireland retail sales fall in Sept. Ireland's retail sales decreased in Sept, after rising for the first time in four months in Aug. The volume of retail sales dropped 3.1% MoM in Sept, reversing a 2.9% fall in Aug. Food, beverages, and tobacco sales dropped the most in Sept, by 7.2%. Sales of books, newspapers, and stationary slid 5.3%. (RTT)

Japan: BoJ leaves ultra-loose policy unchanged, maintains dovish stance. The BoJ kept its massive monetary policy stimulus unchanged on Friday defying the global tightening stance, and maintained its guidance on the interest rate despite the weakening yen. The policy board, governed by Haruhiko Kuroda, unanimously decided to maintain a negative interest rate of -0.1% on current accounts that financial institutions maintain at the central bank. The board repeated its guidance on rates that short and long-term policy interest rates will remain at their present or lower levels. (RTT)

Markets

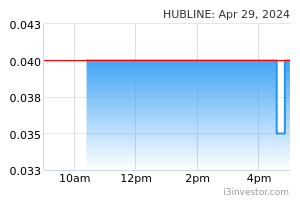

HUBLine: Unit clinches RM22m contract to provide helicopter services in Sabah during GE15. HUBLine will be responsible for providing helicopters as well as aviation operational supplies and equipment, flight operational planning and preparation. The company will also be in charge of implementing flight schedules and operations, and planning and implementation of emergency response for a period of 6 months. (The Edge)

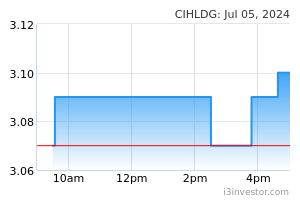

CI Holdings: Unit to buy industrial land with factory in Pasir Gudang. CI Holdings is acquiring a 6.6-acre industrial land together with a two-storey factory and office building in Pasir Gudang, Johor for RM33.8m. Palmtop Vegeoil Products SB, a 60%-owned indirect subsidiary of CI Holdings, is also buying storage tanks, machinery and other fittings for RM3.3m. The purchase of the land and the other assets is necessary for the expected growth in business and in-house production in the coming years. (The Edge)

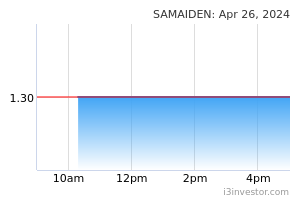

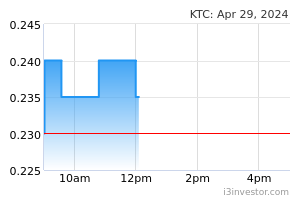

Samaiden, Kim Teck Cheong: Eyes move to Main Market. ACE Market-listed Samaiden Group and Kim Teck Cheong has set their sights on a transfer to the Main Market of Bursa Malaysia. In a filing on Oct 28, the companies believe the move to the Main Market will enhance its credibility, reputation and accord it greater recognition and acceptance among investors. The proposals are expected to be completed by 1H 2023. (The Edge)

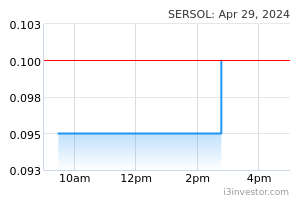

Sersol: Partners Thai firm to sell organic food products in Malaysia. The company has entered into a heads of agreement (HOA) with N&P to jointly invest and set up a new joint venture (JV) company to distribute N&P's products in Malaysia. The HOA is effective for 3 months. (The Edge)

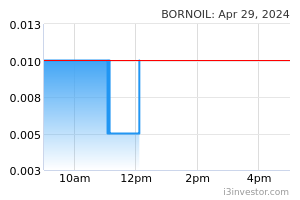

Borneo Oil: Proposes 30% private placement to raise its stake in cement maker. Borneo Oil plans to issue 2.8bn new shares to partly fund an exercise to increase the group’s shareholding in a clinker, cement and related products manufacturer, Makin Teguh SB. The company currently owns a 29.3% stake in Makin Teguh and it intends to buy another 30.7% shareholdings from one Global 2332 Ltd for RM100m cash. (The Edge)

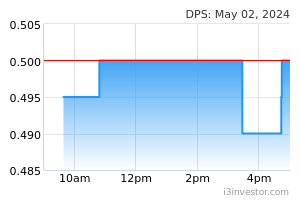

DPS Resources: Plans RM39m rights issue to repay advances, for working capital. DPS Resources has proposed to undertake a renounceable rights issue with free warrants to raise between RM28.1m and RM38.7m to fully repay advances amounting to RM10m from its executive chairman to the group, which had been fully utilised to partially fund the acquisitions of land in 2021, as well as for working capital. It is also planning a share consolidation exercise by consolidating every five existing shares in the company into one share. (The Edge)

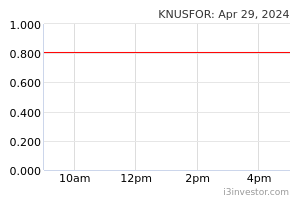

Knusford: To sell commercial land for RM14.6m. Knusford is disposing of a commercial land in Ulu Langat, Selangor to electric, building and general contractors LKC Ventures SB for RM14.6m cash. The land was acquired in Sep 1996, at RM2.4m. The disposal will allow the group to immediately unlock the value and monetise the cost incurred on the land, while also simultaneously enhancing the group’s cash flow. (The Edge)

Market Update

The FBM KLCI might open higher today after US stocks finished higher for the second consecutive week despite a series of earnings that caused investors to shed shares of some of the world’s biggest tech companies. The benchmark S&P 500 index closed 2.5% higher on Friday, taking its weekly gain to 4%. The tech-heavy Nasdaq Composite rallied 2.9%, for a weekly advance of 2.2%. Both indices had back-to-back weekly gains for the first time since August. Stocks finished up on Friday helped by Apple. Shares in the iPhone maker had their biggest one-day gain in more than two years, closing up 7.6%, after it reported $90.1bn in revenues for the September quarter, an 8% increase year-on-year. Elsewhere in equity markets, Europe’s Stoxx 600 closed 0.1% higher.

Back home, Bursa Malaysia’s key index staged a pullback on Friday for the second day running, after having breached the 1,450 level on Wednesday, as profit-taking set in across the broader market. Lacklustre trading on the local bourse also mirrored the weak regional market performance, as investors digested interest rates announcements by the European Central Bank (ECB) and Bank of Japan (BOJ) for clues ahead of the US Federal Open Market Committee and Bank Negara Malaysia (BNM) meetings this week. At the closing bell, the FBM KLCI had slipped 6.78 points to 1,447.31, compared with Thursday's close at 1,454.09. Chinese stocks fell sharply, resuming a descent that began after President Xi Jinping tightened his grip on power at the Communist party congress last weekend. Hong Kong’s Hang Seng index lost 3.7%.

Source: PublicInvest Research - 31 Oct 2022