Economy

US: Weekly jobless claims hit five-month low, economic picture darkening. The number of Americans filing new claims for unemployment benefits fell to a five-month low last week as the labour market remains resilient despite rising headwinds from the Federal Reserve's stiff interest rate increases and slowing demand. The weekly unemployment claims report from the Labour Department, the most timely data on the economy's health, also showed jobless rolls shrinking to their lowest level in just over two months in mid-Sept. That raises the risk that the unemployment rate will drop this month, keeping the Fed on its aggressive monetary policy tightening path. (Reuters)

US: GDP declines 0.6% in Q2, unrevised from previous estimate. The Commerce Department released its third estimate of US economy activity in the second quarter, showing the decrease in gross domestic product was unrevised from the previous estimate. The report said real GDP fell by 0.6% in the second quarter, unchanged from the drop reported last month and in line with economist estimates. The dip in GDP in the second quarter follows a 1.6% slump in the first quarter, with the two consecutive decreases signalling the US economy is in a technical recession. (Reuters)

US: Mester - Fed will watch growth concerns after clear progress on inflation. Fed officials at some point will begin balancing concerns about growth against their inflation goals, but not until inflation is clearly heading back towards its 2% target, Cleveland Fed President Loretta Mester said. "At this point price stability is still job one. We have to get that out of the way," before worrying about the impact on economic growth, Mester said in comments at an inflation conference at the Cleveland Fed. (Reuters)

US: Fed's Bullard doesn't see UK situation affecting US economy. The US economy is mostly insulated from turmoil in UK markets, St. Louis Federal Reserve President James Bullard said, a day after the BOE resumed its bond-buying in an emergency move to protect pension funds from partial collapse. “We certainly saw some movement in US asset prices in response to this, but I do think this is about UK policy,” Bullard said during a conference call with reporters. (Reuters)

EU: Eurozone economic confidence near 2-year low. Eurozone economic confidence weakened to the lowest level in nearly two years in Sept as all surveyed business sectors reported marked declines, signalling a recession in the currency bloc, survey results from European Commission showed. (RTT)

EU: German inflation sets new record high of 10%. Germany's consumer price inflation accelerated at a faster-than-expected pace to a new record high in Sept amid higher energy prices, preliminary figures from Destatis showed. Consumer prices registered a double-digit growth of 10.0% YoY in Sept, faster than the 7.9% rise in Aug. That was also above the 9.4% rise expected by economists. The latest upturn in inflation was largely driven by a 43.9% surge in energy prices. Food prices also rose at an above-average rate of 18.7%. (RTT)

UK: Truss sticks with tax cuts as she breaks silence after market rout. British Prime Minister Liz Truss said she would stick to her controversial plan to reignite economic growth, breaking her silence after nearly a week of financial market chaos triggered by the government's push for huge tax cuts. A day after the Bank of England resumed its bond-buying in an emergency move to protect pension funds from partial collapse, Truss blamed the upheaval on the Russian invasion of Ukraine, which has caused inflation to spike around the world. (Reuters)

UK: Car production rises for fourth straight month - SMMT. UK car production increased for the fourth straight month in Aug but volumes still remained below the pre-pandemic levels, the Society of Motor Manufacturers and Traders or SMMT said. Car output logged a strong annual growth of 34.0% in Aug to 49,901 units. Nonetheless, the volume remained 45.9% below the pre-pandemic levels. The latest increase follows a very weak performance in Aug 2021 when production stoppages and extended summer shutdowns caused by the global chip shortage saw volumes plummet to historic lows. (RTT)

Japan: Jobless rates ease to 2.5% in Aug. The unemployment rate in Japan came in at a seasonally adjusted 2.5% in Aug, the Ministry on Internal Affairs and Communication said. That was in line with forecasts and down from 2.6% in July. The jobs-to applicant ratio was 1.32, surpassing expectations for 1.30 and up from 1.29 in the previous month. The participation rate was 62.9% - matching forecasts and unchanged from the previous month. (RTT)

South Korea: Aug factory output shrinks more than expected, retail sales jump. South Korea’s factory production shrank for a second month in Aug, missing expectations, while retail sales jumped, government data showed. The country’s industrial output fell 1.8% on a seasonally-adjusted monthly basis, by a faster pace than 1.3% in July and 0.5% tipped in a Reuters poll. It rose 1.0% compared with the same month a year earlier, also missing a 1.3% rise seen in the survey and marking the slowest pace since Sept 2021. (Reuters)

Singapore: PPI inflation eases further. Singapore's producer price inflation eased for the second straight month in Aug to the lowest level in nearly a year, data from the Department of Statistics showed. The manufacturing producer price index climbed 14.7% YoY in Aug, slower than the 16.4% surge in July. Further, this was the slowest rate of increase since Sept last year, when prices had risen 14.4%. The oil-index grew 50.9% annually in Aug and the non oil index registered an increase of 9.3%. (RTT)

Markets

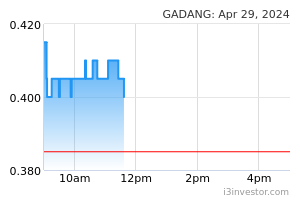

Gadang: Secures RM188m contract from Public Works Department . Gadang Holdings has secured a contract from the Public Works Department worth RM188.80m. The contract is for a project known as Institut Perubatan Forensik Negara (IPFN), Hospital Kuala Lumpur. "The contract shall commence upon site possession on Dec 12, 2022 and shall be completed on Oct 6, 2026,” it told Bursa Malaysia. It said the contract is expected to contribute positively to the earnings of Gadang for the duration of the contract. (Bernama)

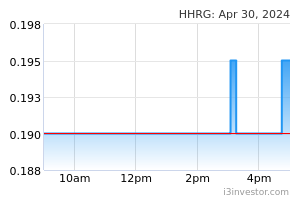

Heng Huat: Major shareholders make mandatory takeover offer at 37.7 sen per share after shareholding consolidation . Heng Huat Resources received a notice of mandatory takeover offer from two substantial shareholders — its MD Datuk H'ng Choon Seng and Goh Boon Leong — at 37.7 sen a share and 29.7 sen per warrant. The conditional mandatory takeover was triggered after the duo entered into a JV to “formalise corporation in the management of Heng Huat and its subsidiaries”, Heng Huat in the filing with Bursa Malaysia. (The Edge)

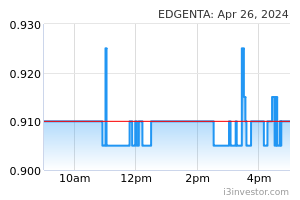

UEM Edgenta: Buys 60% stake in Saudi facilities management services firm . UEM Edgenta is investing RM13.5m for a 60% equity interest in a facilities management services business in Riyadh, Saudi Arabia. The group said its wholly owned unit, Edgenta Arabia Ltd, is buying the stake in MEEM for Facilities Management Company (MEEM) from Mohammed Ibrahim Al Subeaei and His Sons Investment Company (MASIC). MASIC, whose activities include asset management, direct investments and real estate investments, will continue to own the remaining 40% stake in MEEM. (The Edge)

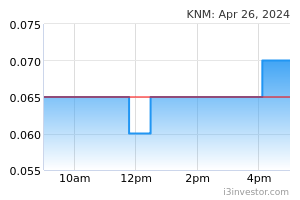

KNM: Bags RM26m job from PetGas in Terengganu . KNM Group has bagged an engineering, procurement, construction and commissioning (EPCC) contract worth RM25.69m from Petronas Gas (PetGas). The job involves "packed bed modification for special scheme inspection" at PetGas' Santong gas processing plant in Dungun, Terengganu. KNM said the contract awarded to its wholly owned subsidiary KNM Process Systems SB is for two years. It added that the contract is expected to contribute positively to its earnings for the financial year ending June 30, 2023 (FY23) to FY25. (The Edge)

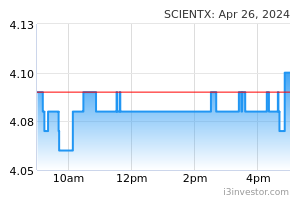

Scientex: Hits record revenue of RM1.11bn in 4Q . Scientex said it will take a more aggressive approach to open up new markets with the progressive expansion of its production plants. "We continue to bring new packaging innovations and develop value added and customised products, as well as sustainable and fully recyclable solutions."The recent acquisition of Taisei Lamick Malaysia provides an immediate foothold in the fast-growing film business for liquid and paste packaging, as well as enhances our diversified offering especially in the Food and Beverage sector in Malaysia and regionally," said CEO Lim Peng Jin. (StarBiz)

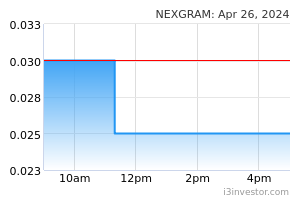

Nexgram: To acquire Langkawi resort from Croske for RM90m via subsidiary’s RCPS issuance . Nexgram Holdings is acquiring Wings By Croske Resort Langkawi for RM90m, to be paid via issuance of preference shares by its subsidiary Medic Asset Group SB (MAG). MAG will acquire the 218-room resort from its 80% shareholder Croske Hotels SB and Flyboys Club SB, which owns the remaining stake, via the issuance of 1m redeemable convertible preference shares (RCPS) at RM90 apiece, Nexgram said. (The Edge)

Market Update

The FBM KLCI might open lower today after global stocks and government bonds tumbled as the boost wore off from the Bank of England’s intervention on Wednesday to support UK government debt markets. Wall Street’s benchmark S&P 500 dropped as much as 3%, touching its lowest level since November 2020, before recovering to close 2.1% lower on Thursday. The Nasdaq Composite, which is dominated by tech groups that are regarded by investors as particularly sensitive to higher interest rates, tumbled 2.8%. Investors have become increasingly concerned about the impact of high rates and the prospects for global economic growth since the US Federal Reserve and a host of other central banks raised rates last week. Data on Thursday showed the number of Americans filing for unemployment benefits over the past week hit its lowest since April. That weighed on Wall Street from the opening bell, as a tight labour market carries risks of inflation becoming entrenched. Europe’s regional Stoxx 600 fell 1.7% on Thursday after ending Wednesday up 0.3%. London’s FTSE 100 lost 1.8%.

Back home, Bursa Malaysia reversed earlier gains to close in negative territory on Thursday, with the benchmark index falling below the 1,400-psychological mark due to a lack of buying support. At the closing bell, the FBM KLCI slipped 4.39 points or 0.31% to settle at 1,397.5, after opening 5.5 points higher at 1,407.39. In the region, Japan’s Nikkei 225 Index widened 0.95% to 26,422.05 while Hong Kong’s Hang Seng Index declined 0.49% to 17,165.87.

Source: PublicInvest Research - 30 Sept 2022