Economy

US: The housing market stares into the abyss. The FOMC’s updated forecasts were more consequential than the third straight 75bps hike at the Sep 20-21 meeting. They showed just how high the committee thinks rates will have to go to quash inflation, surprising markets. If the fed funds rate does reach the implied 4.75% upper bound in 2023, that likely means rates will peak near 5% at some point during the year. Mortgage rates surged past 6.2% over the past week — compared to about 3.6% in 2H2019 — while the median home price in Aug was about 40% higher than in the same month of 2019. The monthly payment on the median house is now USD2,700, compared to USD1,500 before the pandemic, an 80% jump. Home ownership increasingly is out of reach for many Americans. That means house prices may come down significantly sooner or later. Judging by how much price growth has outpaced income growth, the eventual adjustment could be ugly. A sharp drop in housing prices would likely crimp household spending via declining wealth effects. (Bloomberg)

EU: Lagarde says ECB will debate quantitative tightening once it has normalized rates . The European Central Bank will consider shrinking its balance sheet only once it has completed the “normalization” of interest rates. Raising borrowing costs is the most appropriate and effective tool for now to combat record-high euro area inflation. That suggests that only once rates have reached the so-called neutral level -- where they are neither stimulative nor restrictive -- will the Governing Council address what to do with the trillions of euros of debt the Eurosystem holds. Reducing the almost USD4.8 trn of bonds bought by the ECB during recent crises is expected to be discussed at officials’ non-policy meeting in Cyprus on Oct. 5. The ECB raised its deposit rate to 0.75% earlier this month and traders expect another such step in Oct. (Bloomberg)

China: Central bank adopts measures to safeguard yuan. China's central bank (PBoC) ramped up measures to safeguard the yuan from further depreciation on Sep 26 as the US dollar continued to strengthen on the Federal Reserve's tightening stance. The PBoC decided to raise the risk reserve requirement for banks' forward forex sales to 20% from 0, effective Sep 28. The PBoC had set the central parity rate of the RMB at 7.0298 per dollar on Sep 26, the weakest since mid-2020. The currency is allowed to move within the range of 2% above or below the central parity each trading day in the spot market. (RTT)

Japan: Manufacturing sector ebbs in Sep. The manufacturing sector in Japan continued to expand in Sep, albeit at a slower pace with a manufacturing PMI score of 51.0. That's down from 51.5 in Aug, although it remains above the boom-or-bust line of 50 that separates expansion from contraction. For the third straight month, both output and new orders were in contraction territory as high prices reportedly dented demand for Japanese goods. Output price inflation accelerated slightly in Sep and held close to June's survey peak. Manufacturing sector business confidence faltered, dropping to a five-month low. (RTT)

UK: House price inflation accelerates despite economic headwinds. Despite economic pressures, UK house price inflation accelerated in Sep driven by middle and high-end market sectors. Average asking prices increased 8.7% on a yearly basis in Sep, faster than the 8.2% rise in Aug. MoM, house prices gained 0.7%, in contrast to the 1.3% fall in Aug. The rise in new seller asking prices was in line with the ten-year Sep average increase of 0.6%. The stamp duty cut announced in the mini-budget is set to underpin demand from first-time buyers. Data showed that the number of homes coming to market increased 16% in Sep compared to this time last year, which is a return to 2019 levels. If Friday's budget announcement lead to a big jump in prospective buyers competing for the constrained number of properties for sale, then it could lead to some unseasonal price rises over the next few months. (RTT)

South Korea: Consumer confidence improves in Sep. Consumer confidence in South Korea strengthened in Sep with a consumer sentiment survey reading of 91.4 - up from 88.8 in Aug. Consumer sentiment for current living standards was two points higher than in Aug at 85, and that outlook was three points higher at 86. Consumer sentiment related to future household income was two points higher than in Aug at 96, while the outlook was one point lower at 109. Consumer sentiment concerning current domestic economic conditions was three points higher at 50, and the outlook was four points higher at 62. The expected inflation rate for the upcoming year was 4.2%. (RTT)

Hong Kong: Exports fall sharply in Aug. Hong Kong's exports and imports declined sharply in Aug. Exports plunged 14.3% YoY in Aug, faster than the 8.9% fall in July. This was the fourth successive monthly decline. Imports also decreased notably by 16.3% annually in Aug, after falling 9.9% in the previous month. The trade deficit narrowed to HKD13.264bn in Aug from HKD26.298bn in the corresponding month last year. In July, there was a shortfall of HKD27.554bn. Looking forward, Hong Kong's export performance will face immense pressure alongside the deteriorating external environment. Elevated inflation in major advanced economies and aggressive interest rate hikes by relevant central banks in response will continue to dampen global demand, and heightened geopolitical tensions and supply-chain disruptions also add uncertainties. (RTT)

Singapore: Industrial production grows unexpectedly. Singapore's industrial production increased unexpectedly in Aug. Industrial production rose 0.5% YoY in Aug, slower than the 0.8% gain in July. Meanwhile, economists had expected a 0.6% decline. Moreover, the latest rate of growth was the weakest since the current trend of increase began in Oct last year. Excluding biomedical manufacturing, industrial production decreased 1.2% yearly in Aug, reversing a 3.2% increase in the preceding month. On a monthly basis, industrial production recovered 2.0% in Aug, following a 2.1% drop in July. That was above the expected increase of 1.5%. (RTT)

Markets

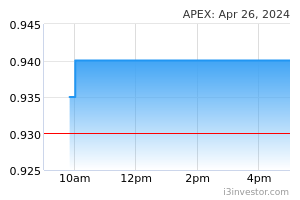

Apex Equity (Neutral, TP: RM1.06): Shareholders go to court to stop mandate for issuance of new shares . Two substantial shareholders of Apex Equity Holdings have filed a lawsuit to stop the tabling of a resolution for the approval of a mandate to allot and issue new shares. The resolution, if approved by shareholders at an extraordinary general meeting (EGM) scheduled for Sept 29, will provide the company a general mandate to allot and issue shares pursuant to Sections 75 and 76 of the Companies Act 2016. The two shareholders are Fun Sheung Development Ltd (15.8% stake), and Yenson Investments Ltd (5.2%).(The Edge)

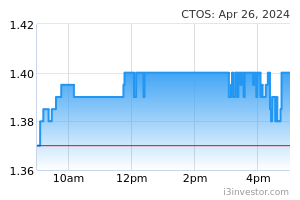

CTOS: Raises stake in RAM to 57.7% via purchase of MUFG Bank’s 2.1% stake . CTOS Digital further raised its equity interest in RAM Holdings to 57.68% after buying out MUFG Bank (Malaysia)’s 2.1% stake in the credit reporting firm for RM5.99m. The increase in CTOS’s stake in RAM “will allow both companies to leverage each company’s expertise in credit assessment, data and analytics to further extend their product offering and value proposition to their existing customer base”, CTOS said. The acquisition will be fully funded by bank financing, the group said. (The Edge)

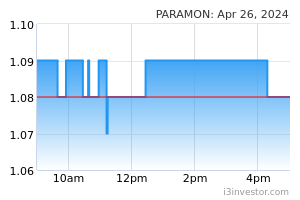

Paramount: Sells rest of stake in education biz for lower price tag of RM120m . Paramount Corp is disposing of its remaining stake in education units Paramount Education SB (PESB), Sri KDU Klang SB (SKK) and Sri KDU SB (SK) to XCL Education Malaysia SB for RM120m cash. The group has inked a conditional share sale and purchase agreement (SPA) with XCL, formerly known as Prestigion Education SB, which will mark Paramount’s exit from the education business. Paramount, whose core business is in property development, holds 30.3% in PESB, which is a 66%-shareholder of R.E.A.L. Education Group. Paramount also owns 20% each in SKK and SK, it said. (The Edge)

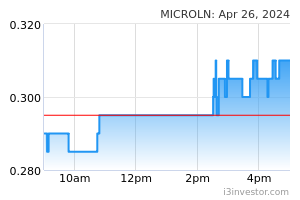

Microlink: Wins RM48.55m contract from Koperasi Co-opbank Pertama . Microlink Solutions has received and accepted a letter of offer from Koperasi Co-opbank Pertama Malaysia (CBP) for the upgrade of its existing MiBS core banking platform worth RM48.55m. Microlink said the contract was for five years with two years of implementation and three years of maintenance and support, commencing in Oct this year. (StarBiz)

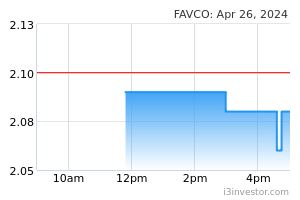

Favelle Favco: Subsidiaries receive contracts totalling RM130.8m . Favelle Favco through several subsidiaries has received the purchase order (PO) or letter of intent with a combined value of RM130.8m. Favelle Favco said the subsidiaries involved are Favelle Favco Cranes Pty Ltd, Favelle Favco Cranes (M) SB, Shanghai Favco Engineering Machinery Manufacturing Co Ltd and Favelle Favco Cranes (USA) Inc. It said the PO received are from Marr Contracting Pty Ltd, OREC Engineering Holdings Pty Ltd, Lindores Construction Logistics Pty Ltd, Favco Heavy Industry (Changshu) Co Ltd, McDermott Middle East Inc and Zachry Industrial Inc. (Bernama)

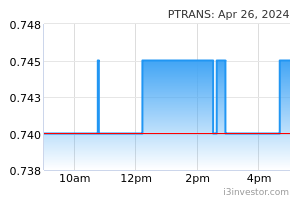

Perak Transit: Signs 20-year deal with TNB, GSPARX to source solar energy . Perak Transit has entered into 20-year agreements with TNB and GSPARX SB to install solar photovoltaic (PV) energy generating system with total installed capacity of 422 kWp at the designated site of its subsidiaries. Under the deal, GSPARX will install the solar PV energy generating systems at Perak Transit's Terminal Meru Raya in Ipoh, Kampar Putra Sentral in Kampar, and at three petrol stations. (The Edge)

Market Update

The FBM KLCI might open lower as Wall Street equities closed at the lowest level since December 2020, while US Treasury yields lurched higher after intense volatility in Britain’s gilt market and a lacklustre sale of new Treasuries shook investor sentiment. The blue-chip S&P 500 share index ended the day down 1%, after having lost 4.7% over the course of the previous week. The technology-heavy Nasdaq Composite fell 0.6% on Monday. Monday’s wobble in equities came as the yield on the 10-year US Treasury note, a benchmark for global borrowing costs, added 0.22 percentage points to 3.92% — the highest level since 2010. Bond yields rise when prices fall. The region-wide Stoxx Europe 600 share index swung between positive and negative territory during the day before finishing down 0.4%. The FTSE 100 finished flat.

Back home, Bursa Malaysia ended broadly lower on Monday, tracking regional peers amid the weak sentiment globally. At the closing bell, the benchmark FBM KLCI had slipped 11.94 points, or 0.84%, to 1,413.04 from last Friday’s close at 1,424.98. In the region, Japan's Nikkei 225 tumbled 2.66% to 26,431.55, Hong Kong's Hang Seng Index fell 0.44% to 17,855.14, and Singapore’s Straits Times Index lost 1.31% to 3,183.69.

Source: PublicInvest Research - 27 Sept 2022