Economy

Global: World Bank warns of rising global recession risk amid simultaneous rate hikes . As central banks across the world simultaneously hike interest rates in response to inflation, the world may be edging toward a global recession in 2023, the World Bank warned. Central banks around the world have been raising interest rates this year with a degree of synchronicity not seen over the past five decades - a trend that is likely to continue well into next year, the World Bank said in a new study, reported Xinhua. (Bernama)

US: Consumer inflation expectations fall in Sept; sentiment rises . US consumers' near-term inflation expectations fell to a one year low in Sept and the outlook over the next five years also improved, easing fears that the Fed could raise interest rates by a full percentage point. The University of Michigan's survey followed in the wake of data this week showing a surprise increase in consumer prices in Aug, which raised concerns that high inflation was becoming entrenched. (Reuters)

US: Retail sales growth sluggish in Aug as consumers fight to keep up with inflation . Retail sales numbers were better than expected in Aug as price increases across a multitude of sectors offset a considerable drop in gas station receipts, the Census Bureau reported. Advance retail sales for the month increased 0.3% from July, better than the Dow Jones estimate for no change. (CNBC)

EU: Italy inflation rises to 37-year high as estimated . Italy consumer price inflation hit a 37-year high in Aug, as initially estimated, on surging energy prices, final data from Istat showed. Consumer price inflation rose to 8.4% in Aug, the strongest since Dec 1985, from 7.9% in July. The initial estimate was confirmed. However, the statistical office raised the annual increase in the harmonized index of consumer prices to 9.1% from 9.0%. (RTT)

UK: Retail sales decline worse than expected . UK retail sales declined more than expected in Aug as the cost of living crisis weighed on consumer spending, official data showed. The retail sales volume declined 1.6% MoM, in contrast to July's revised 0.4% increase, the Office for National Statistics reported. Economists had forecast a moderate 0.5% decline. (RTT)

China: Industrial output, retail sales growth tops expectations . China's industrial output grew more than expected in Aug as companies ramped up production following the relaxation of pandemic-related restrictions and the pent-up demand boosted retail sales, official data showed. Industrial production growth accelerated to 4.2% from 3.8% in July, the National Bureau of Statistics said. (RTT)

Singapore: Exports increase in Aug . Singapore's non-oil domestic exports increased at a faster pace in Aug amid a growth in shipments of non-electronic goods, data from Enterprise Singapore showed. Non-oil domestic exports increased 11.4% YoY in Aug, following a 7.0% rise in July. (RTT)

Markets

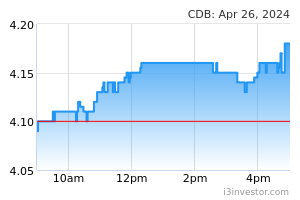

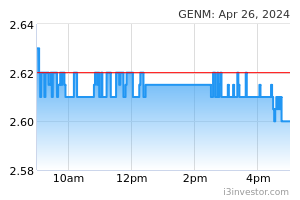

Genting Malaysia (Outperform, RM3.66): Submits bid for 10- year Macau gaming concession. Genting Malaysia (GenM) has submitted a bid for the award of a new 10-year gaming concession for the operation of casino games of fortune in Macau. (The Edge) Comments: We understand that Genting Malaysia is one of the seven bidders with six of them being the current concessionaires in Macau i.e. Wynn Macau, Galaxy, SJM, Melco, MGM and Sands China. Although the potential winning of a concession in Macau may be positive to the group in the long run as it helps to widen its geographical presence and diversify its casino operations, we believe it could also be a drain to its cashflow in the near term. Conservatively, earnings should also be affected during the early stage of operations. At this juncture, no change to our earnings forecasts and recommendation.

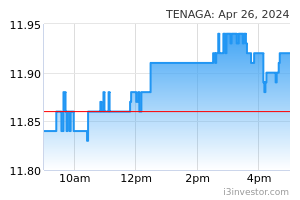

TNB (Outperform, TP: RM12.42): Collects RM1.9bn in ICPT payment from govt. Tenaga Nasional Bhd (TNB) said it has received a sum of RM1.9bn from the federal government for the imbalance cost pass-through (ICPT) mechanism. A back-of-the envelope calculation shows this will offset 19.4% of TNB's outstanding under-recovery of the ICPT totalling RM9.81bn as of end-June. (The Edge)

DiGi.Com (Neutral, TP: RM3.83), Axiata (Neutral, TP: RM3.60): Merger gets SC's nod. Axiata Group moved a step closer to merging the telecommunication operations of its subsidiary Celcom Axiata with Norwegian Telenor Group’s unit DiGi.Com, after the Securities Commission Malaysia (SC) approved the plan. The completion of the proposed transaction will now be subject to the approval of Bursa Malaysia and by both Axiata and DiGi.Com shareholders. (The Edge)

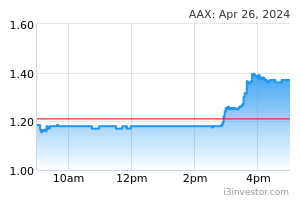

AirAsia (Neutral, TP: RM0.69): To enlarge Indonesian and Philippine ops, says Fernandes. AirAsia plans to enlarge its Indonesian and Philippine operations beyond their pre-pandemic levels by the first quarter of next year, riding on better tourism and connectivity prospects. (The Edge)

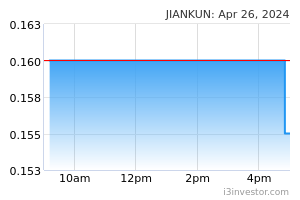

Jiankun: Wins RM90m property contract from Menara Rezeki. Jiankun International has been offered to be the main contractor for a RM90m Menara Rezeki SB's (MRSB) development with Koperasi Perumahan Sentul Pasar Kuala Lumpur (KPSPKL). The project is to develop a 29-floor modern apartment with 320 units along with seven shop units on the ground floor. (BTimes)

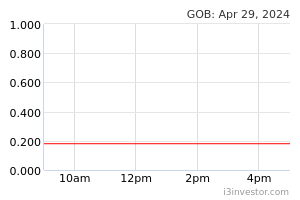

Global Oriental: To acquire three retail lot units in Pavilion Bukit Ceylon for RM30m. Global Oriental is acquiring three shop units in Bukit Ceylon, Kuala Lumpur for RM30m, as part of its development of a 39-storey premium service residence project. (The Edge)

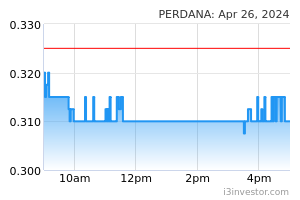

Perdana Petroleum: Secures work order contracts worth RM11.6m from Petronas Carigali. Perdana Petroleum said it has secured two work order awards worth RM11.6m from Petronas Carigali SB. The contracts involve the provision of anchor handling tug and supply vessels with crew and equipment to perform 24-hour services for assisting and servicing drilling rigs, offshore installation, derrick barges, towing and anchor jobs. (The Edge)

Market Update

The FBM KLCI might open with a cautious note today as Wall Street stocks recorded the biggest weekly drop in months after a profit warning from economic bellwether FedEx jolted investors who are already on edge over a looming interest rate rise by the US Federal Reserve at its upcoming meeting. The blue-chip S&P 500 index fell 0.7% on Friday, bringing weekly losses to 4.8%, the worst performance since mid-June. The tech-focused Nasdaq Composite fell 0.9% on the day for a 5.4% weekly drop, also its worst week since June. Stocks have been on the back foot since data published on Tuesday showed US consumer prices rose unexpectedly in August, in spite of a fall in petrol prices. European stock markets also reflected the rising investor jitters about the state of the global economy. The regional Stoxx 600 closed 1.6% lower while Germany’s Dax slipped 1.7%. In the region, Hong Kong’s Hang Seng index lost 0.9% and Japan’s Topix fell 0.6%.

Source: PublicInvest Research - 19 Sept 2022