Economy

US: Employment climbs by 315,000 jobs in Aug, roughly in line with estimates. Non-farm payroll employment rose by 315,000 jobs in Aug after surging by a revised 526,000 jobs in July. The increase in employment reflected notable job gains in the professional and business services, healthcare, and retail sectors. Meanwhile, unemployment rate edged up to 3.7% in Aug from 3.5% in July. Economists had expected the unemployment rate to remain unchanged. The unexpected uptick by the unemployment rate came as the labour force increased by 786,000 persons, more than outpacing the 442,000-person growth in the household measure of employment. (RTT)

US: Factory orders unexpectedly show sharp pullback in July. Factory orders slumped by 1.0% in July after surging by a revised 1.8% in June. The steep drop surprised economists, who had expected factory orders to edge up by 0.2% compared to the 2.0% jump originally reported for the previous month. The unexpected pullback in factory orders was partly due to a notable decrease in orders for non-durable goods, which tumbled by 1.9% in July after shooting up by 1.4% in June. The report also showed durable goods orders edged down by 0.1% in July after spiking by 2.3% in June. Last week, the Commerce Department said durable goods orders were virtually unchanged. (RTT)

EU: Eurozone producer price inflation at new record high. Producer prices surged 37.9% YoY in July, following a 36.0% rise in June, which was revised up from 35.8%. The upward trend in inflation was largely driven by a 97.2% jump in energy prices. Excluding energy, producer price inflation softened to 15.1% from 15.7%. Prices for intermediate goods registered a sharp growth of 21.6% annually in July and those for non-durable consumer goods gained 13.8%. There was an increase of 7.9% and 9.8% in producer prices of capital goods and durable consumer goods, respectively. (RTT)

China: Chengdu lockdown to hit mood, 1.7% of GDP. The lockdown of Chengdu, a transportation hub in southwest China with 20.9m residents, will deal another major blow to the economy when it’s already struggling from a barrage of shocks. The growth outlook for the 2H2022 was already looking challenging, in part due to lockdowns motivated by China’s Covid Zero stance. Economists see even bigger downside risks to 3Q growth forecast of 4.5%. Chengdu’s population makes it China’s fourth biggest city, after Chongqing (32.1m), Shanghai (24.9m) and Beijing (21.9m). The city’s RMB1.77trn in GDP in 2020 accounted for 1.74% of the national total, less than Shanghai’s 3.81% or Beijing’s 3.55%. (Bloomberg)

Singapore: Retail loans unscathed by rising borrowing cost. Credit losses from Singapore banks' retail portfolios, which consist of secured and unsecured retail loans, could be modest as borrowing costs rise. The banks' modelled probabilities of defaults on mortgages and unsecured retail loans have fallen due to their tight underwriting. Singapore banks may face very modest credit losses from mortgages of about SGD1-2bn if it enters into a recession. Yet, bank capital reserves may stay robust even in worst-case scenario, supporting their dollar Tier 2s' bond performance. Singapore's economy contracted in 2Q, falling 0.2% from 1Q. Momentum on a YoY basis picked up by 0.6 ppt to 4.4% in 2Q, driven by stronger household spending, investment, exports and government expenditures. (Bloomberg)

Australia: Retail sales data due. Australia will on Monday release July data for retail sales, highlighting a busy day for APAC economic activity. Sales are predicted to rise 1.3% on month, accelerating from 0.2% in June. Australia also will see Aug results for the construction, the services and composite indexes, the inflation gauge, job ads and Q2 numbers for business inventory and profit data. The construction index had a score of 45.3 in July, while the services PMI was at 50.9 and the composite was at 51.1. Inflation was seen at 1.2% in July, while job ads were down 1.1% on month. (RTT)

Indonesia: Raises fuel cost to ease subsidy burden on budget. Indonesia raised some fuel prices as the government balances the risk of inflationary pressures against a ballooning energy subsidy bill. The price of Pertalite, the most commonly used gasoline, will increase more than 30% to USD0.67 a litre. The changes are effective as of Aug 3. The subsidy cut is a shift in strategy for the government, which repeatedly said it would use its budget as an inflation “shock absorber.” That strategy has proven challenging as Jokowi has also pledged to return the deficit to within its legal limit of 3% of GDP by 2023 from an estimated 3.92% of GDP this year. (Bloomberg)

Markets

Telco (Neutral): DNB offers bigger stakes to the remaining four MNO. The government has invited the remaining four mobile network operators (MNOs) to increase their equity participation in Digital Nasional Bhd (DNB) for Malaysia's 5G roll-out, following the withdrawal of Maxis Bhd and U Mobile SB from the programme. (The Edge) Comments: Previously, six MNOs were offered to take an 11.67% stake each in DNB, while the government will hold a controlling stake of 30%. Last week, Maxis and U Mobile were reported to have turned down stakes in the national 5G company, prompting DNB to invite the remaining four MNOs to increase their equity participation by taking up the shares initially offered to Maxis and U Mobile. It added that Axiata and Digi, upon their merger completion, will only be allowed to hold a maximum of 25% stake in DNB. We believe Maxis and U Mobile’s non-participation in DNB equity holding should not affect their access to DNB’s 5G infrastructure network as it is governed by separate access agreement. Meanwhile, although the four MNOs could increase their stakes, they remain the non-controlling minority shareholders of DNB. No change to our Neutral stance on the telco sector.

Wah Seong (Outperform, TP: RM0.87): Bid to divest idle Singapore property falls through. Wah Seong Corp’s attempt to dispose of idle Singapore real estate for SGD13m (RM40.1m) lapsed as the buyer was not able to get approval from the relevant authorities in the island nation. The real estate consists of 13,734 sq m leasehold land with industrial workshop, warehouse and office built on it. The property has 28 years of leasehold tenure until end- 2037. (The Edge)

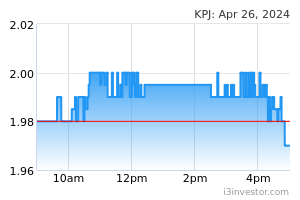

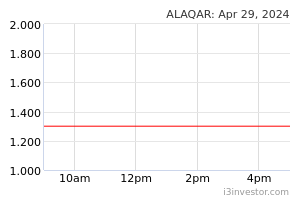

KPJ Healthcare (Neutral, TP: RM0.93), Al-'Aqar Healthcare REIT: Al-'Aqar Healthcare REIT buys three hospitals from KPJ Healthcare for RM192m. Al-'Aqar Healthcare REIT has acquired three hospitals from KPJ Healthcare for RM192m, to be paid in cash and new shares. The acquisitions are deemed to be related party transactions, as both entities have a common major shareholder in Johor Corp. Al-'Aqar Healthcare REIT is buying TMC Healthcare Centre Building in Taiping, Perak for RM14.3m in cash and KPJ Seremban Specialist Hospital Building for RM84.7m in cash. (The Edge)

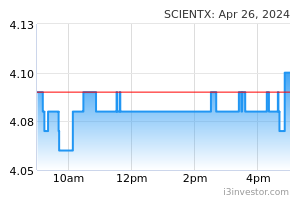

Scientex: Partners Japan-based Taisei Lamick to expand into liquid, paste packaging. Scientex is partnering with Taisei Lamick Co Ltd, to expand its market share in the region. It signed a share sale agreement (SSA) with Taisei Lamick to acquire 8,100 ordinary shares representing 80.2% in Taisei Lamick Malaysia SB (TLM) for RM63.8m cash. Scientex chief executive officer Lim Peng Jin said this partnership is a meaningful step for the company on multiple fronts. (BTimes)

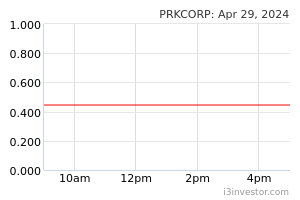

Perak Corp: Obtains further extension until Feb 10 to submit regularisation plan. Perak Corp has been granted a further extension of time up to Feb 10, 2023, to submit its regularisation plan to the regulatory authorities. Perak Corp was previously granted an extension of time to submit the regularisation plan to Aug 10. As an integral part of the regularisation plan to address its financial condition, Perak Corp inked a memorandum of understanding with its immediate holding corporation Perbadanan Kemajuan Negeri Perak. (The Edge)

Market Update

The FBM KLCI might open flat today after US stocks had another bruising week, with the tech-heavy Nasdaq Composite ending the day down 1.3% to mark a sixth consecutive daily decline in its longest losing streak in more than three years. The blue-chip S&P 500 index fell 1.1% on Friday, pushing it down 3.3% for the week. The S&P 500 and Nasdaq have declined for three weeks in a row. The moves came after US labour department data showed a slight uptick in the unemployment rate and a slower pace of jobs growth, to 315,000 in August from 526,000 the previous month. The details failed to assuage concerns that the Federal Reserve will continue to sharply raise interest rates as it combats inflation. Jobs data have been closely scrutinised in recent months for clues about how aggressively the Fed will tighten monetary policy, with evidence of a hotter labour market fuelling expectations of larger and faster interest rate rises. Conversely, indications of cooling jobs activity have helped to reduce projections of how far the Fed will opt to increase borrowing costs, as it strives to strike a balance between quelling rapid price growth and pushing the US economy even further into a protracted slowdown. Elsewhere, European shares extended their gains after the jobs data release, with the regional Stoxx 600 index adding 2% — putting the brakes on five straight days of declines.

Back home, Bursa Malaysia ended marginally lower after moving cautiously in a tight range ahead of the release of US jobs data later on Friday, and tracking the weakness in most regional peers. At the closing bell, the benchmark FBM KLCI shaved off 0.77 of a point to 1,491.18 from Thursday’s close of 1,491.95. In the region, Hong Kong’s Hang Seng fell 0.7%, and South Korea’s Kospi edged down 0.3%. China’s Shanghai Composite added almost 0.1%.

Source: PublicInvest Research - 5 Sept 2022