Economy

US: Private sector job growth falls well short of estimates in August. Private sector employment in the US increased by much less than expected in the month of Aug. Private sector employment rose by 132,000 jobs in Aug after jumping by 268,000 jobs in July. Economists had expected employment to surge by 288,000 jobs. The relatively modest increase in employment in Aug reflected notable job growth in the leisure and hospitality sector, which added 96,000 jobs. (RTT)

EU: German unemployment increases in August. Germany's unemployment increased in Aug due to the registration of Ukrainian refugees. The number of people out of work increased 28,000, as expected, after rising 45,000 in the previous month. In turn, the jobless rate rose slightly to 5.5% in Aug from 5.4% in July. The rate came in line with expectations. Despite the economic and political uncertainties, the labour market is robust. (RTT)

EU: Eurozone inflation hits fresh record high. Eurozone inflation hit a new record in Aug, reflecting the intensifying cost of living crisis, and added further pressure on the ECB to tighten policy more aggressively as soon as next week. Inflation rose to 9.1% in Aug from 8.9% in July. Core inflation that excludes energy, food, alcohol and tobacco, advanced to 4.3% in Aug from 4.0% in July, while the rate was expected to remain steady at 4.0%. (RTT)

India: Economy logs double-digit growth. India's economy logged a double-digit growth in the quarter ended June. GDP advanced 13.5% in three months to June but slower than the 15.2% expected growth. In the same period last year, GDP had expanded 20.1%. The Reserve Bank of India had forecast the economy to expand at 7.2% in 2022-23. Data showed that the gross value added climbed 12.7% in the June quarter. (RTT)

China: Manufacturing PMI improves to 49.4. The manufacturing sector in China continued to contract in Aug, albeit at a slower pace with a manufacturing PMI score of 49.4. That beat expectations for a reading of 49.2 and it's up from 49.0 in July - although it remains beneath the boom-or-bust line of 50 that separates expansion from contraction. The bureau also said its non-manufacturing PMI slipped to 52.6 in Aug from 53.8 in July, while the composite index fell to 51.7 from 52.5. (RTT)

Japan: Industrial production rises 1.0%. Industrial output in Japan was up a seasonally adjusted 1.0% on month in July. That exceeded expectations for a decline of 0.5% following the upwardly revised 9.2% increase in June (originally 8.9%). On a yearly basis, industrial production sank 1.8% - roughly in line with expectations after slipping 2.8% in the previous month. (RTT)

Markets

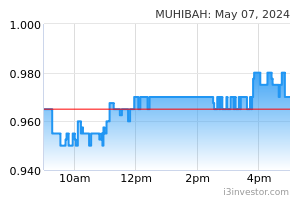

Muhibbah Engineering: Consortium bags RM240m job from Petronas unit. A consortium led by Muhibbah Engineering (M) has won a RM240m contract to undertake a job related to the Integrated Bekok Oil project located offshore Terengganu. The contract was awarded by Petroliam Nasional (Petronas)’s subsidiary Petronas Carigali SB, said Muhibbah. The construction and engineering group did not reveal the names of the other members of the consortium nor its participating interest. The contract is expected to be completed within 18 months and will contribute positively to its earnings and net assets for the current and future financial years, the group said. (The Edge)

UMW: Sells industrial land for RM305m. UMW Holdings has inked a sale and purchase agreement (SPA) with LONGi (Kuching) SB for the sale of 140 acres industrial land worth RM304.92m. The land is located in the vicinity of the 861-acre UMW High Value Manufacturing Park (UMW HVM) in Serendah, Selangor. UMW said: “The strategically located and green-rated UMW HVM Park is both a managed and gated as well as guarded high-value manufacturing park equipped with infrastructure and services for manufacturing excellence.” According to the conglomerate, UMW HVM offers a secured and integrated Industry 4.0 infrastructure and technologies. (StarBiz)

THHE: To be delisted from bourse on Sept 5 after Bursa rejects time extension appeal. TH Heavy Engineering Bhd (THHE) will be delisted from the Main Market of Bursa Malaysia effective Sept 5. The delisting comes after Bursa Malaysia dismissed THHE’s further appeal for an extension of time to submit its regularisation plan to the relevant authorities for approval pursuant to paragraph 8.04 of Bursa Securities Main Market Listing Requirements, according to the oil-and-gas-turned-shipbuilding company’s filing with Bursa Malaysia. (The Edge)

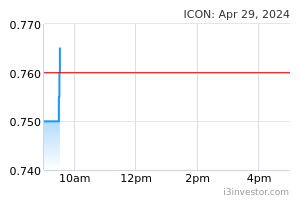

Icon Offshore: To sell jack-up rig at double the purchase price. Icon Offshore is set to offload a jack-up rig to Saudi Arabia-based ADES Arabia Holding for RM381.65m, which is more than double the price paid by the company to buy it 22 months ago. Icon Offshore said its wholly owned subsidiary Icon Caren (L) Inc has entered into an agreement with ADES for the disposal of jack-up rig Perisai Pacific 101. The company noted that the disposal consideration of RM381.65m is double the RM177m it spent to purchase the jack-up rig from Perisai Petroleum Teknologi in Oct 2020. Of the RM381.65m proceeds, Icon Offshore said it has ring fenced RM159.2m for the redemption and discharge of the existing mortgage over the rig, earmarked another RM208.61m for general corporate purposes and working capital requirements, and set aside the remaining RM13.84m for the estimated expenses of the disposal. (The Edge)

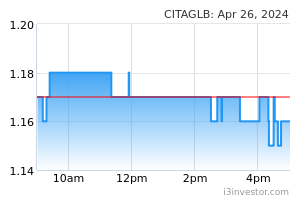

Citaglobal: Wins RM373.5m Perlis Inland Port EPC contract. Citaglobal has bagged an engineering, procurement and construction (EPC) contract to provide design, construction and equipping work in relation to Phase 1 of the Perlis Inland Port (PIP) with a contract sum of RM373.5m — 85% higher than Citaglobal's current market value of RM202m. Citaglobal said its wholly owned subsidiary Citaglobal Land SB (CG Land) has entered into EPC agreement with Inland Port Perlis SB (IPPSB). IPPSB is the master developer for the PIP development on 500.28-acre land. (The Edge)

Market Update

Overnight, US and European stocks slid for a fourth consecutive day on Wednesday, ending the month on a low after aggressive messaging from the Federal Reserve brought an abrupt end to the early summer rally. The broad S&P 500 index fell 0.8%, and has now dropped almost 6% since Fed chair Jay Powell’s hawkish speech at the Jackson Hole Economic Symposium last Friday. Stock markets had rebounded strongly in July and extended their gains in the first half of August, helped by hedge funds unwinding bearish trades that had benefited from market declines in the first half of the year. However, Powell’s insistence that the US central bank would “keep at it until the job is done” and focus on taming inflation even in the face of stuttering economic growth renewed investor concerns about the effect of higher interest rates. The S&P 500 fell 4.2% in August. The tech-heavy Nasdaq Composite fell 0.6% on Wednesday, bringing its loss since Powell’s speech to almost 7%. Rebalancing of portfolios can contribute to volatility on the last day of trading each month, and the Nasdaq swung between small gains and losses on Wednesday afternoon. European shares also closed lower, with the regional Stoxx 600 gauge down 1.1% after worse-than-expected eurozone inflation data for August. Figures published earlier in the session showed consumer price growth hit a record 9.1% this month, higher than economists’ expectations of 9%. In the region, major benchmarks were mixed. The Shanghai Composite Index fell 0.8% and Hong Kong’s Hang Seng Index closed flat. China’s official gauge of factory activity remained in contraction in August, although it came in a little higher than economists had forecast.

Source: PublicInvest Research - 1 Sept 2022