Economy

US: Cargo imports to cool in second half as inflation, rates bite. US ports will see less retail cargo entering the country in the second half of the year as economic growth slows amid back-to back interest-rate increases and persistent inflation. After record setting volumes registered in the spring, retail shipments arriving at the nation’s largest ports from July to December will likely total 12.8m 20-foot equivalent units, 1.5% less than a year earlier. Still, 2022 is expected to be the busiest year for imports due to the strong demand in the first half. The US is projected to handle 26.3m units of retail imports this year, 2% more than 2021, which was a record. Retail sales are still growing, but the economy is slowing down and that is reflected in cargo imports. (Bloomberg)

US: Ending Covid jobless benefit aided us employment. Ending emergency unemployment benefits had a significant impact on boosting US employment. The federal government provided enhanced unemployment benefits during the pandemic -- which propelled a loss of some 22m jobs -- increasing eligibility to many individuals who would not otherwise be covered, boosting the amounts paid and extending their duration. By spring 2021, some business owners complained the generous benefits were contributing to difficulties filling job vacancies running near all-time highs. Many benefit recipients saw a more than one-for-one replacement rate on lost earnings, whereas, before the pandemic, unemployment insurance benefits typically replaced less than half of lost earnings. (Bloomberg)

EU: Sentix investor confidence rises less than expected. Eurozone investor confidence improved in August but less than expected suggesting that the economy is undergoing a downturn. The investor confidence index rose to -25.2 in August from -26.4 in July. Despite the increase, a recession in the currency bloc is still very likely. Both the situation index and the expectations indicator continue to paint a gloomy picture of the economic environment. It is not surprising that neither weak consumer confidence, nor the inflation front, nor energy prices are providing any lasting positive impulses, the think tank said. Further, consumer confidence in particular is set to be the greatest economic burden. Consumers face higher energy costs. Companies too experience increased input cost, which they are forced to pass on to consumers. (RTT)

China: PBOC takes an incremental approach in easing cycle. The People's Bank of China (PBOC) remains biased toward easing. It has kept its policy levers steady in recent months through July. Strong credit expansion in the second quarter gave it some space to assess the recovery. The economy needs support from monetary policy. A brief rebound in activity after Shanghai reopened was cut short by fresh outbreaks and deepening turmoil in the property sector. The government’s zero tolerance on Covid-19 continues to depress consumption and disrupt business. A slowdown in global growth threatens to weaken exports. Inflation is relatively low. The window is open for the PBOC to cut rates and banks’ reserve requirements in 3Q. (Bloomberg)

Japan: Has JPY132.4bn current account shortfall in June. Japan posted a current account deficit of JPY132.4bn in June. That beat expectations for a shortfall of JPY703.8bn yen following the JPY128.4bn surplus in May. Imports were up 49.2% on year to JPY9.6trn, while exports advanced an annual 20.4% to JPY8.6trn yen for a trade deficit of JPY1.1trn. The capital account showed a surplus of JPY135.8bn, while the financial account saw a deficit of JPY588.9bn. (RTT)

Japan: Overall bank lending jumps 1.8% on year in July. Overall bank lending in Japan was up 1.8% on year in July - coming in at JPY588.2trn. That follows the downwardly revised 1.2% increase in June (originally 1.3%). Excluding trusts, bank lending was up 2.1% on year to JPY511.9trn, while lending from trusts was roughly flat at JPY76.3trn. Lending from foreign banks jumped 2.9% on year to JPY3.4trn after slipping 1.3% in June. (RTT)

Taiwan: Export growth slows less than forecast. Taiwan's export growth eased at a slower-than-expected pace in July, while imports rose at a faster pace. Exports climbed 14.2% YoY in July, following a 15.2% gain in the previous month. Economists had forecast the growth to slow to 11.6%. Exports of mineral products logged the sharpest growth of 123.4% annually in July. This was followed by a 16.9% increase in machinery shipments. On the other hand, annual growth in imports accelerated slightly to 19.4% in July from 19.2% in June. In contrast, the growth was expected to moderate to 15.85%. The trade surplus for July was USD5.03bn versus USD4.64bn in June. The expected surplus was USD4.49bn. (RTT)

Markets

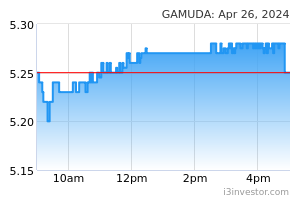

Gamuda (Outperform, TP: RM3.94): SSPAs of four expressway concession companies executed. Gamuda announced that the shares sales purchase agreements (SSPAs) of four expressway concession companies were successfully executed with Amanat Lebuhraya Rakyat (ALR). (StarBiz)

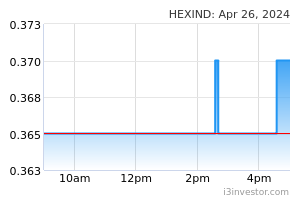

Hextar Industries: To acquire entire stake in HFL for RM480m to expand fertiliser business. Hextar Industries Bhd (HIB) had entered into a conditional SSA with Hextar Holdings SB (HHSB) for the proposed acquisition of the entire equity interest in Hextar Fertilizers Ltd (HFL) for RM480m. The proposed acquisition will enable HIB to immediately increase its existing production capacity from 75,000 tonnes per annum to an aggregate of 679,000 tonnes per annum and will also allow the HIB Group to tap into HFL Group’s extensive distribution network throughout Malaysia to expand its distribution base. (StarBiz)

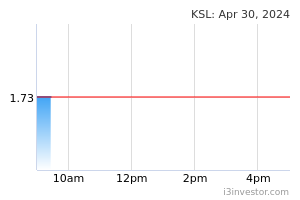

KSL: Buys 84 acres of land in JB from Tropicana for RM110m. KSL said it is buying 84 acres of land in Johor Bahru from Tropicana Corp Bhd for RM109.89m. The land in Pulai will be used for landed property development. The acquisition is expected to be completed in the 2Q of 2023. (The Edge)

Stella: Clinches RM33.88m water distribution contract in Johor. Stella has accepted a RM33.88m contract to improve the water distribution system in Johor from Pengurusan Aset Air Bhd. The group said the contract is for a period of 18 months and the date of completion shall be on March 18, 2024. The contract is expected to contribute positively to the earnings of Stella group. (The Edge)

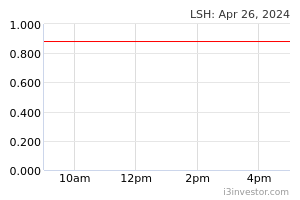

LSH Capital: Diversifies into construction business. Lim Seong Hai Capital Bhd (LSH Capital) has proposed to diversified its existing principal activities and its subsidiaries to include construction business and the provision related business and solutions as part of a collaboration framework. (The Edge)

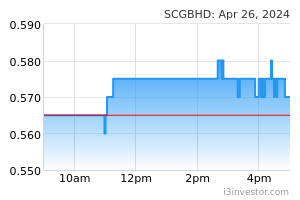

Southern Cable: Proposes one-for-two bonus issue of warrants. Southern Cable Group proposes to undertake bonus issue of warrants on the basis of one warrant for every two shares, hoping to raise as much as RM117.68m for working capital. The amount expected to be raised from the five-year warrants is based on an indicative exercise price of 29.42 sen, which represents a discount of about 20% to 36.78 sen per share, the group’s five-day VWAP up to and including July 20. (The Edge)

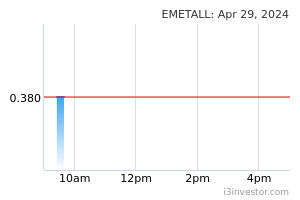

Eonmetall: Sells stake in Lienteh amid challenging glove business environment. Eonmetall Group plans to dispose of its 51% stake in glove company Lienteh Technology for RM35.7m, amid the tough business environment in the glove industry. The disposal plan was made after demand for gloves and price pressure caused some of Lienteh's customers to cancel current purchase contracts or negotiate new ones, as well as reduce orders. (The Edge)

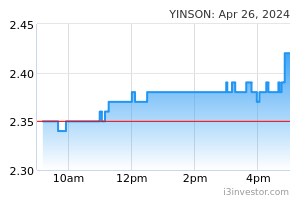

Yinson: Unit inks MOU to provide chargEV access to GoCar. Yinson’s unit is exploring collaboration to provide electric vehicle (EV) charging infrastructure access to vehicle-sharing platform operator GoCar Mobility SB. (The Edge)

Market Update

The FBM KLCI might open with negative bias today after Wall Street stocks moved slightly lower on Monday, adding to small losses in the previous session when a hot US jobs report stoked expectations of a more aggressive interest rate rise campaign by the Federal Reserve. The blue-chip S&P 500 and the tech-heavy Nasdaq Composite both fell 0.1%, reversing gains in early dealings. Europe’s Stoxx 600 closed 0.7%higher. US government debt rose in price, with the yield on the 10-year Treasury note falling 0.09 percentage points to 2.74%. The policy-sensitive two year yield fell 0.04 percentage points to 3.21%. Those moves came after a labour report for the world’s largest economy on Friday showed the unemployment rate returning to a half-century low as employers added 528,000 jobs in July — more than double the 250,000 anticipated by economists.

Back home, Bursa Malaysia closed marginally lower on Monday amid mixed regional peers as sentiment was mostly weighed by the negative cues from global markets. At the closing bell, the FBM KLCI fell 5.52 points to 1,496.03 from 1,501.55 on Friday, with almost two thirds of the 30 index-linked companies ending in negative territory.

In the region, major benchmarks were mixed. The Shanghai Composite Index added 0.3%, while Hong Kong’s Hang Seng Index slid 0.8%. Japan’s Nikkei 225 added 0.3%.

Source: PublicInvest Research - 9 Aug 2022