Economy

EU: German economic confidence rises in June. Germany's economic confidence improved in June but remained negative as the economy faces uncertainties posed by the war in Ukraine and the tightening of monetary policy. The ZEW Indicator of Economic Sentiment climbed to a four-month high of minus 28.0pts in June from -34.3 in May. The reading was forecast to rise to -27.5. The current situation index also improved in May, by 8.9pts to minus 27.6pts. The expected score was -31.0. Financial market experts are less pessimistic about the economy. (RTT)

EU: Germany inflation hits new record high as estimated . Germany consumer price inflation accelerated to a new record high in May, as initially estimated, driven by higher energy prices. Consumer price inflation rose to 7.9% in May from 7.4% in April. The rate came in line with the flash estimate published on May 30. A higher inflation was last reported in 1973/74, when mineral oil prices sharply increased as a consequence of the first oil crisis. The increase in energy prices had a substantial impact on the inflation rate. Delivery bottlenecks due to interruptions in supply chains also contributed to the record high inflation. The EU measure of inflation (HICP), advanced 8.7% annually, faster than April's 7.8% increase. On a monthly basis, the HICP gained 1.1% versus a 0.7% rise in April. Both annual and monthly rates were confirmed. (RTT)

UK: UK unemployment rate rises. The UK unemployment rate rose slightly in the three months to April. The jobless rate rose slightly to 3.8% in the three months to April from 3.7% in the three months to March. The rate was forecast to fall to 3.6%. At the same time, the employment rate came in at 75.6%, which was still below pre-coronavirus pandemic levels. (RTT)

Japan: BoJ undertakes additional bond purchases to defend yield cap. The Bank of Japan conducted additional bond purchases on June 15 as the policy tightening stance by major central banks put pressure on the 0.25% yield cap on Japanese government bonds. The yen weakened to a 24-year low against the US dollar on Monday. The BoJ has been under renewed pressure to bring yields down, but such interventions weaken the currency. Allowing the 10- year JGB yields to rise would probably give the yen a boost, at least in the short term. The BoJ is widely expected to stick to its ultra loose monetary policy stance. (RTT)

India: Wholesale price inflation at record high. India's wholesale price inflation accelerated at a faster-than-expected pace in May to reach a new record high amid surging costs for fuel and power. The wholesale price index climbed 15.88% YoY in May, faster than the 15.08% rise in April. Economists had expected inflation to rise marginally to 15.10%. Wholesale price inflation has now remained at a double-digit figure for the fourteenth successive month in May, and the latest one was the highest since the series started in 2013. The upward trend in inflation was mainly due to a 40.62% spike in fuel and power prices. Prices for primary articles surged 19.71% and those of manufactured products gained 10.11%. (RTT)

South Korea: Jobless rate stays low in sign of economic resilience. South Korea’s unemployment rate remained low, suggesting the labor market is holding up in the face of accelerating inflation and rising interest rates. The jobless rate edged up to 2.8% in May from 2.7% in the prior month. Inflation is a growing headwind for South Korea and has prompted the Bank of Korea to remain open to the idea of a “big-step” rate hike. The central bank has already raised its benchmark five times since last summer and is concerned that rising consumer prices may spur increased wage demands and fuel a wage-price spiral in the economy. Finance Minister Choo Kyung-ho has said the government is unlikely to pursue another extra budget unless the virus situation worsens seriously again. (Bloomberg)

Hong Kong: Industrial production falls in Q1. Hong Kong's industrial production declined for the first time in five quarters in the three months ended March. The index of industrial production for manufacturing industries as a whole decreased 1.2% yearly in the Q1, in contrast to a 5.8% rise in the Q4. Moreover, this was the first decrease since the Q1 of 2021. On a quarterly basis, industrial production fell a seasonally adjusted 1.0% in the Q1. Meanwhile, producer prices rose 2.3% in the March quarter compared to last year, following a 1.2% increase in the December quarter. Data also showed that production for sewerage, waste management and remediation activities climbed 0.5% annually in the first quarter, well below the 5.1% gain in the previous quarter. (RTT)

New Zealand: Q1 current account deficit NZD8.5bn. New Zealand posted a seasonally adjusted current account deficit of NZD8.5bn in the first quarter of 2022, Following the NZD6.6bn shortfall in the three months prior. The current account deficit for the year ended March 2022 widened to NZD23.3bn (6.5% of GDP) from the NZD8.2bn deficit for the March 2021 year (2.5% of GDP). The seasonally adjusted goods deficit widened to NZD2.9bn, while the seasonally adjusted services deficit widened to NZD3.0bn. The primary income deficit widened to NZD2.3bn and the financial account recorded a net inflow of NZD4.5bn. (RTT)

Markets

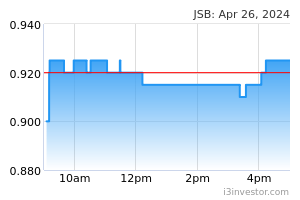

Jentayu Sustainables: To raise up to RM47.07m for pre development expenditures . Jentayu Sustainables has proposed a private placement to raise as much as RM47.07m, mainly to finance the group's pre-development expenditures. Jentayu Sustainables said the exercise entails the issuance of up to 142.63m new shares, representing not more than 30% of the total number of issued shares, and it is intended to be placed to third party investors to be identified at a later date. (The Edge)

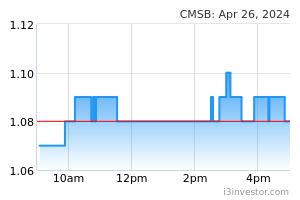

CMS: Selling stakes in units for RM531m . Cahya Mata Sarawak (CMS), via its wholly-owned subsidiary Samalaju Industries SB, has entered into a conditional share sale agreement (SSA) with OM Materials (S) Pte Ltd. The SSA is for the proposed disposals of CMS’ entire 25% equity interests in OM Materials (Sarawak) SB (OM Sarawak) and OM Materials (Samalaju) SB (OM Samalaju) for a total cash consideration of USD120m (RM530.65m). However, the net disposal consideration amounted to USD109.23m (RM483.03m) after a full and final settlement and full discharge of all shareholders’ loans, including interest, extended by CMS to OM Sarawak and OM Samalaju. (StarBiz)

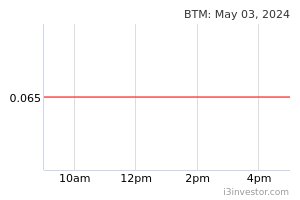

BTM: Gets extension for RE project . BTM Resources has obtained an approval from the Sustainable Energy Development Authority (Seda) for a time extension of a renewable energy (RE) power generation project. The approval was received via its wholly-owned subsidiary, BTM Biomass Products SB. Seda has granted an extension of time for the group to build and operate a RE power plant with a capacity to supply 10MW of electricity per hour to Tenaga Nasional Bhd (TNB). The group has also receive an extension for the initial operation date of the plant from Jan 23, 2022 to June 23, 2023. (StarBiz)

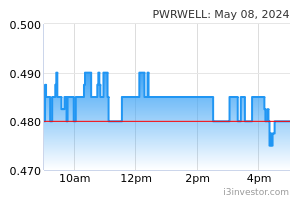

Powerwell: Bags second contract worth RM94.12m from Tialoc Malaysia this year. Powerwell Holdings has bagged a supply contract worth RM94.12m for a new building project in Kulim Hi-Tech Park, Kedah. Powerwell said its wholly-owned subsidiary Powerwell International SB had accepted a letter of award dated June 10 from Tialoc Malaysia SB for the supply, installation, testing and commissioning of low voltage panels. (The Edge)

Dynaciate: Proposes to buy Pahang industrial land from KPower for RM12m . Dynaciate Group has proposed to acquire a piece of freehold industrial land measuring 23,550 sq m in Bentong, Pahang from KPower for RM12m, cash. Dynaciate said its wholly-owned subsidiary Magnitude Resources SB had entered into a sale and purchase agreement with KPower’s wholly-owned subsidiary Powernet Industries SB for the proposed acquisition. The acquisition includes a double-storey office building, single-storey factory, double-storey warehouse and a single-storey warehouse. (The Edge)

IPO: YXPM IPO shares oversubscribed . YX Precious Metals Bhd’s (YXPM) public portion of its IPO has been oversubscribed by 26.36 times. The company, a subsidiary of the Main Market listed Tomei Consolidated, has received 8,105 applications for 509.16m shares with a value of RM142.57m from the public. In a statement, the group said that for the bumiputra portion, 3,923 applications for 173.55m shares were received, representing an oversubscription of 17.65 times. (StarBiz)

Market Update

The FBM KLCI might open flat today after US government debt was under pressure on Tuesday as markets bet that the Federal Reserve would raise interest rates by 0.75 percentage points at the conclusion of its two-day policy-setting meeting on Wednesday. The yield on the two-year Treasury note, which moves with interest rate expectations, rose as much as 0.1 percentage points to a 15- year high of 3.45%, reflecting a fall in the debt instrument’s price. The benchmark 10-year Treasury yield, which moves with growth and inflation expectations, rose by as much as 0.14 percentage points to an 11-year high of 3.5%. The $23tn US Treasury market is the world’s largest financial market and the bedrock of investment and loan pricing decisions. Until Friday, futures markets were betting that the Fed would raise interest rates by 0.5 percentage points in June and July — as indicated by chair Jay Powell at the US central bank’s most recent meeting — to combat inflation that has been running at 40-year highs. In equities, the S&P 500 share index fell 0.4%. The benchmark US gauge had closed nearly 4% lower on Monday, taking it down more than 20% from its all-time peak in January — a scenario typically referred to as a bear market. The technology-heavy Nasdaq Composite edged 0.2% higher in choppy trading, remaining more than 30% lower for the year, after tighter monetary policy drained liquidity from markets and hit speculative growth stocks.

Back home, the FBM KLCI snapped its eight-day losing streak to end in positive territory on Tuesday, rising by 1.12% as bargain hunting activities emerged following the heavy sell-down recently. At closing, the barometer index rose 16.45 points to 1,481.28 from Monday's close of 1,464.83. The regional markets finished mixed with the Shanghai Composite gained 1.02%, while Japan's Nikkei 225 was off 1.32%. Shares in Hong Kong were unchanged with the Hang Seng at 21,067.99.

Source: PublicInvest Research - 15 Jun 2022