Economy

US: Leading economic index increases in line with estimates in March. Despite headwinds from the war in Ukraine, reading on leading U.S. economic indicators increased in line with economist estimates in the month of March. The Conference Board said its leading economic index rose by 0.3% in March after climbing by an upwardly revised 0.6% in Feb. This broad-based improvement signals economic growth is likely to continue through 2022 despite volatile stock prices and weakening business and consumer expectations.

US: Jobless claims edge slightly lower to 184,000. The Labour Department released a report on April 21 showing a slight decrease in first-time claims for US unemployment benefits in the week ended April 16th. The report showed initial jobless claims edged down to 184,000, a decrease of 2,000 from the previous week's revised level of 186,000. Meanwhile, the less volatile four-week moving average rose to 177,250, an increase of 4,500 from the previous week's revised average of 172,750. The report also showed continuing claims, a reading on the number of people receiving on-going unemployment assistance, fell by 58,000 to 1.417m in the week ended April 9th, hitting the lowest level since Feb 1970. (RTT)

EU: Consumer confidence remains negative. Euro area consumer confidence unexpectedly improved in April, after falling sharply in the previous month, yet remained in the negative territory indicating pessimism. The flash consumer confidence index rose to -16.9 from -18.7 in March, which was the weakest since May 2020 shortly after the coronavirus pandemic began. The corresponding index for the EU climbed 2.0 points to -17.6. Both indicators remained well below their long-term averages. The survey data was collected from April 1 to 20. Eurozone consumption in recent weeks was likely underpinned by increased mobility due to removal of most of the restrictions linked to the pandemic and households releasing their pent-up demand. (RTT)

UK: Consumer morale plunges near all-time low in April. British consumer sentiment tumbled in April to its second-lowest reading since records began nearly 50 years ago, as the worsening cost-of living crisis hurt households’ confidence in the economy and their personal finances. Consumer confidence index fell to -38 from -31 in March, within a whisker of an all-time low hit in July 2008, in the midst of the global financial crisis. With consumer price inflation surging to a new 30-year high of 7% in March and likely to rise further. The survey underscored growing concern among some Bank of England officials about weakening demand in the economy, even though inflation is far above its 2% target. (Reuters)

Australia: Manufacturing PMI improves to 57.9 in April. The manufacturing sector in Australia continued to expand in April, and at a faster rate. The manufacturing PMI score of 57.9 was up from 57.7 in March, and it moves further above the boom-or-bust line of 50 that separates expansion from contraction. Manufacturing production expansion accelerated in April amid faster new orders growth. This was underpinned by better local and overseas demand with new export orders seeing growth for the first time in four months. As a result, employment levels and purchasing activity sustained in growth in April, contributing to higher stocks of purchases. Also, the services PMI improved to 56.6 in April from 55.6 in March, while the composite rose to 56.2 from 55.1. (RTT)

Hong Kong: Jobless rate accelerates in March. Hong Kong's unemployment and underemployment rate accelerated in March. The unemployment rate rose to a seasonally adjusted 5.0% in the three months to March from 4.5% during Dec-Feb period. The underemployment rate increased to 3.1% in the three months ended in March from 2.3% in the preceding period. The number of unemployed persons increased by around 26,900 to 188,500 in Jan-March. Over the same period, the number of underemployed persons also rose, around 27,800 to 117,000. Meanwhile, total employment decreased about 54,000 to 3.61 million in the three months to March. While the labour market will still be subject to pressure in the near term, with the easing local epidemic situation of late, together with the launch of a new round of consumption vouchers, the business of the consumption-related sectors should gradually improve and thus support employment in these sectors. (RTT)

Markets

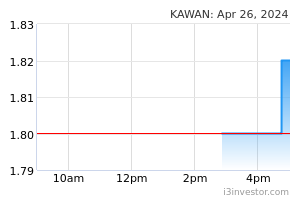

Kawan Food (Outperform, TP: RM2.60) Buys land in Selangor to build second manufacturing facility . Kawan Food is buying five parcels of land measuring 7.08 acres in Shah Alam, Selangor for a total of RM50.46m, as part of its expansion plans. Kawan Food said it intends to build a second manufacturing facility for its operations on the proposed site. (The Edge)

Comment: We are positive on this development as we think that Kawan’s plans to diversify into chilled and ambient food products complements its existing frozen food business. In addition, Kawan intends to expand the cold room facility to include warehouse and cold chain distribution mainly to cater for the local market, which could potentially reduce logistic cost given Shah Alam’s strategic location. Should the acquisition goes through, we estimate Kawan to be in a net debt position with a gearing of 0.1x (currently net cash). Our earnings forecasts remain unchanged, as we are not expecting any material earnings contribution from this acquisition in the near-term. We maintain our Outperform call on Kawan.

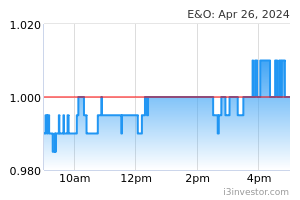

E&O (Neutral, TP: RM0.60): Tanjung Pinang Development's special resolution rejected by Islamic bondholders under RM1.5bn scheme . Holders of tranche one of Eastern & Oriental Bhd's (E&O) subsidiary Tanjung Pinang Development SB's RM1.5bn Islamic bonds or sukuk have rejected a special resolution proposed by Tanjung Pinang Development in Dec 2021, according to the bond's facilitating agent RHB Investment Bank on April 21, 2022. (The Edge)

MAHB: Sees 52% growth in international traffic at its airports . Malaysia Airports Holdings's (MAHB) network of airports nationwide posted a 52% increase in international traffic in March compared to Feb. The airport operator said this was driven by the implementation of various Vaccinated Travel Lane (VTL) programmes. "The increase recorded by the 420,000 international passenger movements was due to the implementation of various VTL programmes between Kuala Lumpur and Singapore, Bangkok, Phuket and Phnom Penh as well as between Penang and Singapore," MAHB said. (Business Times)

Taliworks: Completes acquisition of four solar projects. Taliworks Corp has completed the acquisition of the majority economic interest in four solar projects from TerraForm Global Operating LP (TerraForm Global) and several of its subsidiaries. The infrastructure company said the solar projects, located within the vicinity of the Kuala Lumpur International Airport, have an aggregate capacity of 19-megawatt peak. (StarBiz)

Boustead: Boustead Naval Shipyard given extension of restraining order until June 2 . Boustead Holdings controlled by the Lembaga Tabung Angkatan Tentera, succeeded in getting the High Court to extend the restraining order until June 2, pursuant to a scheme of arrangement and leave to hold the court-convened meeting up to June 2. Judicial Commissioner Liza Chan Sow Keng granted the extension, after the court took into account the Cabinet's position to continue with the littoral combat ship project. (The Edge)

Market Update

US markets reversed earlier gains and fell sharply overnight as rising bond yields weighed on sentiment and negated optimism from a solid set of corporate earnings. Concerns are mounting that the Federal Reserve’s aggressive fight against inflation will hurt economic growth. The Dow Jones Industrial Average and S&P 500 slumped 1.1% and 1.5% while the Nasdaq Composite was 2.1% lower. European markets were mostly higher as investors here reacted positively to earnings reports while keeping a wary eye on developments in Ukraine. On the latter, Russia has set a new ultimatum for surrender in the city of Mariupol. Separately, the US has authorised a further USD1.3bn in security and direct economic assistance to Ukraine. France’s CAC 40 and Germany’s DAX rose 1.4% and 1.1%. UK’s FTSE 100 ended largely unchanged. Asian markets were mixed, though Chinese markets led the losers in the region with a 2.3% drop. The Hang Seng Index fell 1.3%. Investors are watching out for policy support from the government as the country continues to grapple with a severe COVID-19 outbreak. Japan’s Nikkei 225 gained 1.2% on the day.

Source: PublicInvest Research - 22 Apr 2022