Economy

US: Treasuries show foreign inflows in Feb for 4th month. Net foreign inflows into Treasuries rose for a fourth straight month in Feb in the amount of USD75.3bn. Of that, private overseas investors bought USD91.9bn in Treasuries and foreign official institutions sold USD16.2bn. Foreigners have bought Treasuries in 10 of the last 12 months, including a record net monthly purchase of USD118bn in March 2021. The overall foreign buying came as US yields rose. (Reuters)

US: Autos rebound fuels manufacturing output gain in March. A sharp rebound in automotive output in March spurred a third straight monthly gain in US factory activity, perhaps signaling the worst of the production woes that have dogged the motor vehicle industry over the last year may have passed. Overall industrial production increased 0.9% last month, keeping pace with Feb upward revised pace. Output jumped 5.5% from a year earlier. Manufacturing, which accounts for 11.9% of the US economy, has benefited from a shift in spending to goods from services during the COVID-19 pandemic. (Reuters)

US: New York manufacturing activity shows substantial rebound in April. After reporting an unexpected contraction in New York manufacturing activity in the previous month, the Federal Reserve Bank of New York released a report on April 15 showing a substantial rebound in activity in the month of April. Its general business conditions index soared to a positive 24.6 in April after tumbling to a negative 11.8 in March. A positive reading indicates an expansion in regional manufacturing activity. The rebound by the headline index came as the new orders spiked to a positive 25.1 in April from a negative 11.2 in March, and the shipments index skyrocketed to a positive 34.5 from a negative 7.4. Meanwhile, the report showed the number of employees index slid to 7.3 in April from 14.5 in March, indicating a slowdown in the pace of job growth. (RTT)

China: Banking sector NPL ratio eased to 1.79% at end-March. China’s banking sector’s non-performing loan (NPL) ratio was at 1.79% at the end of March, down 0.03 percentage points from the start of the year. Outstanding NPLs totaled CNY3.7trn at the end of the first quarter. No comparison figure was given for the end of 2021. Total assets of China’s banking sector rose 8.9% in the first quarter from a year earlier, while total liabilities rose 8.8%. Banks’ lending in the Yangtze River Delta, which covers Jiangsu, Zhejiang, Anhui and Shanghai, had shown little impact so far from an extended COVID-19 lockdown in Shanghai. (Reuters)

China: Cuts reserve requirements for banks as economy slows. China cut the amount of cash that banks must hold as reserves for the first time this year, releasing about CNY530bn in long-term liquidity to cushion a sharp slowdown in economic growth. The People's Bank of China (PBOC) would cut the reserve requirement ratio (RRR) for all banks by 25 basis points (bps), effective from April 25. The latest RRR cut would boost the long term funds for banks, enabling them to step up support for industries and firms affected by Covid-19 outbreaks, and lower costs for banks. It will cut financial institutions' annual funding costs by about CNY6.5bn. (The Star)

Singapore: Economy grows 3.4% in 1Q, slower than previous quarter. Singapore’s economy grew 3.4% YoY in the 1Q 2022. This marked a slower pace than the previous quarter when the economy expanded 6.1%. On a QoQ seasonally adjusted basis, Singapore’s gross domestic product (GDP) grew 0.4% in the first quarter, slower than the 2.3% in the preceding quarter. The advance GDP estimates are computed largely from data gathered in the first two months of the quarter. (CNA)

Markets

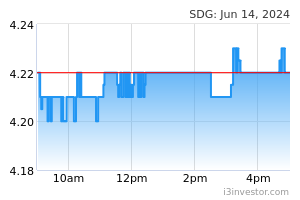

Sime Darby Plantation (Neutral, TP: RM5.09): Ferrero is not a customer, says Sime Darby Plantation . Sime Darby Plantation (SDP) said that Italian confectionery firm Ferrero, which is reportedly planning to stop sourcing palm oil from it, is not its customer and has not been for a while. Neither are General Mills and The Hershey Company, which are also mentioned in the Reuters news report published earlier on Friday, the plantation company said in a statement. (Bernama)

Opcom: Secures RM25m consultancy services project . Opcom Holdings has secured a RM25m consultancy project for the design and consultation of a data centre for the provision and maintenance of point of presence for an optic fibre infrastructure hub near schools, industrial areas, government premises and their nearby community areas in the central and eastern regions. The fibre optic cable manufacturer said its subsidiary, Opcom Vision SB, clinched the job from VC Telecoms SB. (The Edge)

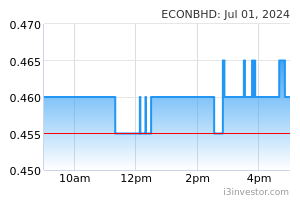

Econpile: Clinches RM23m foundation and basement works job in PJ. Econpile Holdings has received a letter of award (LoA) for a RM23m contract to undertake foundation and basement works for an industrial building in Petaling Jaya, Selangor. The construction engineering company said its wholly owned subsidiary Econpile (M) SB received the LoA from CJ Energy Solutions SB. (The Edge)

Malaysia Pacific Corp: In JV to develop land in Johor . Malaysia Pacific Corp has teamed up with privately held company Chesland SB to jointly develop a 5.7ha piece of land in Johor Bahru. Malaysia Pacific Corp said its indirect wholly owned subsidiary Taman Bandar Baru Masai SB (TBBM) has signed a JV agreement with Chesland to undertake the proposed development. (The Edge)

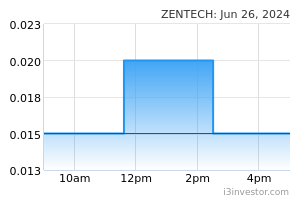

Inix Technologies: NPRA rejects Inix Technologies' application for registration to source Covid-19 vaccine from China. The Ministry of Health's National Pharmaceutical Regulatory Agency (NPRA) has rejected INIX Technologies Holdings's application for registration with the former to source vaccine for Covid-19 from China, dealing a blow to the glove maker's plan to become a vaccine distributor. In a bourse filing, INIX said its application for registration with NPRA to source vaccine for Covid-19 from China has been rejected by the drug control authority. It added that it has no intention to reapply for said application. (The Edge)

Pegasus Heights: Seeks to raise up to RM24m via private placement for working capital . Pegasus Heights plans to raise up to RM23.66m in a private placement of up to 20% of its total issued shares at an issue price to be determined later, for working capital. (The Edge)

HSS Engineers: Bags RM11.29m consultancy services from MRT Corp . HSS Engineers Bhd's unit HSS Integrated SB (HSSI), has clinched a contract from Mass Rapid Transit Corp SB to provide peer review consultancy services. HSS Engineers said the services include tender documentation for the civil main contractor (CMC) and line-wide systems contractor (STC) for the MRT3 circle line project. (Business Times)

Market Update

Most markets were closed for Good Friday holiday while Asian shares fell in muted trading. Shanghai Composite, Nikkei 225 and Straits Times were down 0.45%, 0.29% and 0.19% respectively. After market closed, China’s central bank freed up extra money for lending in its bid to support the slowing economy by cutting the amount of reserves commercial banks are required to hold. The move added about CNY500bn (USD85bn) to the pool for lending. Shutdowns of major cities in China due to Covid-19 outbreaks and the war in Ukraine have been weighing on sentiment. Meanwhile, the head of the International Monetary Fund warned that Russia Ukraine conflict is darkening the outlook for most countries and reaffirmed the danger of high inflation on global economy.

Back home, FBMKLCI lost 0.42% to finish at 1,589.01. Khazanah Nasional has completed a placement of 105m shares representing 1% in CIMB Group at RM5.10 per share, raising a gross proceed of RM535.5m. Italian confectionery giant Ferrero said it will stop sourcing palm oil from Sime Darby Plantation after the US found the Malaysian planter used forced labour. Palm oil is a key ingredient used in Ferrero Rocher chocolates and Nutella spread.

Source: PublicInvest Research - 18 Apr 2022