Economy

US: Inflation quickens to 8.5%, ratcheting up pressure on Fed . US consumer prices rose in March by the most since late 1981, evidence of a painfully high cost of living and reinforcing pressure on the Federal Reserve to raise interest rates even more aggressively. The consumer price index increased 8.5% from a year earlier following a 7.9% annual gain in Feb, Labor Department data showed. The widely followed inflation gauge rose 1.2% from a month earlier, the biggest gain since 2005. (Bloomberg)

US: March budget deficit falls sharply as revenues surge, COVID outlays drop . The US government posted a USD193bn budget deficit in March, less than a third of the USD660bn gap a year earlier, the Treasury Department said, as COVID-19 relief outlays fell sharply and tax receipts surged to record levels. The Treasury said March outlays were USD508bn, down 45% from March 2021, while receipts jumped 18% to USD315bn, a new March record, reflecting a strong US economic recovery. (Reuters)

EU: German investor morale dips in April, inflation expectations ease . German investor sentiment fell by less than expected in April, a survey showed, as a decline in inflation expectations gave some cause for hope about the outlook for Europe’s largest economy. The ZEW economic research institute said its economic sentiment index fell to -41.0 points from -39.3 in March. A Reuters poll had pointed to a reading of -48.0 for April. “The ZEW Indicator of Economic Sentiment remains at a low level. The experts are pessimistic about the current economic situation and assume that it will continue to deteriorate,” ZEW President Achim Wambach said in a statement. “The decline in inflation expectations, which cuts the previous month’s considerable increase by about half, gives some cause for hope. However, the prospect of stagflation over the next six months remains,” he added. (Reuters)

EU: German economic institutes slash 2022 GDP forecast – sources . Germany’s leading economic institutes are slashing their 2022 growth forecast for Europe’s biggest economy to 2.7% from 4.8% due to the impact of the war in Ukraine, two people familiar with the matter told Reuters. The five institutes - the RWI in Essen, the DIW in Berlin, the Ifo in Munich, the IfW in Kiel and Halle’s IWH - are due to release their joint forecast on Wednesday, amid spiking inflation and expectations for a dip in growth. The institutes now see consumer prices jumping by more than 6% this year, compared with a previous forecast for 2.5%, issued in Oct 2021. (Reuters)

UK: Labor market tightens further . The UK labor market tightened further as unemployment declined in three months to Feb, average pay increased and job vacancies rose to a record high, official data revealed. The jobless rate fell 0.2 percentage points from the previous quarter to 3.8% in three months to Feb, the Office for National Statistics said. The rate came in line with expectations. Moreover, the unemployment rate was 0.1 percentage points below pre-coronavirus pandemic levels. At the same time, the employment rate was largely unchanged at 75.5%, but remained below the pre pandemic level. (RTT)

UK: Retail sales fall in March: BRC . UK retail sales declined slightly in March as consumer confidence continued to weaken, the British Retail Consortium said. The like-for-like sales dropped 0.4% in March from the previous year. Meanwhile, total sales grew 3.1%, underpinned by non-food sales. Food sales were down 6.1%, due to the timing of Easter in 2021 and compounded by the impact of the lockdown in March last year. The rising cost-of-living and the ongoing war in Ukraine dampened consumer confidence, (RTT)

Australia: NAB business conditions, confidence improve in March . Australia business conditions and confidence improved in March, survey results from NAB showed. The business conditions index doubled to 18 in March from 9 in the previous month. This was the largest one-month jump since June 2020. The business confidence index climbed three points to 16 in March, continuing the steady growth seen since Dec. Trading conditions and profitability strengthened sharply in March. Employment also improved. Alan Oster, NAB Group chief economist, said businesses reported very strong trading conditions and a sharp rise in profitability, which indicates demand is continuing to hold up as the economy rebounds from Omicron and growth gathers momentum. (RTT)

Markets

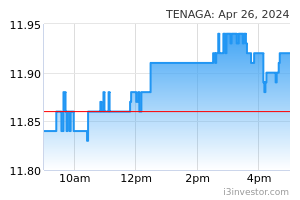

TNB (Outperform, TP: RM12.42): To provide RE solutions for S P Setia's new projects. Tenaga Nasional (TNB) will provide smart energy and renewable energy (RE) solutions as the main source of electricity in SP Setia’s new residential and commercial development projects. The premises will be designed to support EV (electric vehicle) charger installation when the owner intends to install it later. (The Edge)

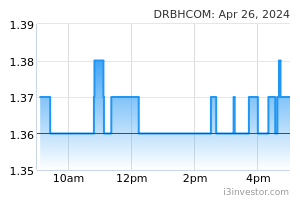

DRB-HICOM (Outperform, TP: RM1.95): Signs MoU with Perak govt to identify additional land for AHTV project. DRB HICOM has signed a memorandum of understanding (MoU) with the Perak state government for the newly launched Automotive Hi-Tech Valley (AHTV) project, to jointly identify suitable additional land in the area to be earmarked for AHTV. (The Edge)

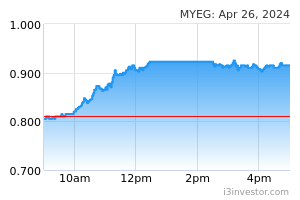

MYEG: Zetrix blockchain to launch mainnet on April 15. MY EG Services (MYEG)’s Zetrix blockchain has completed the foundational development for its Layer-1 blockchain functionalities and will launch its mainnet on April 15. The Layer- 1 infrastructure will host applications, protocols and networks to be deployed on top of its proprietary smart contracts and proof of-stake (PoS) consensus mechanisms across a network of validator nodes. (The Edge)

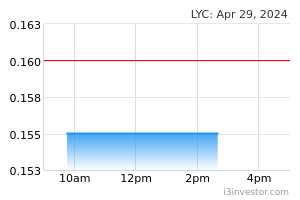

LYC Healthcare: To raise up to RM10.3m via private placement for business expansion. LYC Healthcare has proposed a private placement of up to 10% of its issued shares to raise as much as RM10.3m to finance its business expansion and working capital. Up to 46.45m placement shares will be issued to third party investors to be identified later at a price to be determined later. (The Edge)

CHS Alliance: Unit appointed as BYD Malaysia’s commercial van distributor. CHS Alliance, through its wholly-owned subsidiary Alliance EV SB was appointed by BYD Malaysia SB as the distributor of its commercial electric van. The appointment by BYD was in pursuant to the previous MOU entered between both the companies in March 2022 to jointly work together in the distribution of the commercial electric van, BYD T3 model. (SunBiz)

KAB: Inks power purchase agreement with Mydin for solar PV system in Kelantan. Kejuruteraan Asastera (KAB) has inked a power purchase agreement (PPA) with Mydin Mohamed Holdings for a solar photovoltaic (PV) system on the latter’s Mydin Tunjong Hypermarket in Kelantan. KAB said the PPA was signed between its wholly-owned subsidiary KAB Gree Solar SB and Mydin for the former’s unit to design, construct, install, own, operate and maintain a grid-connected solar PV energy system on the roof of the latter’s open car park of Mydin Tunjong Hypermarket. (The Edge)

Artroniq: To acquire remaining 49% stake in AISB. Artroniq (previously known as Plastrade Technology) has proposed to acquire the remaining 49% stake in Artroniq Innovation SB (AISB) for RM14.7m. The power cable and ICT products distributor said the acquisition will be satisfied via the issuance of 26.07m shares at 56 sen a piece. (The Edge)

Market Update

The FBM KLCI might open flat today as Wall Street stocks gave up earlier gains after a sharp rise in oil prices helped reignite inflation concerns, even after a crucial element of US inflation data came out lower than expected. The S&P 500 ended the day 0.3% lower, having moved as much as 1.3% higher earlier on Tuesday. The tech-heavy Nasdaq Composite also dipped 0.3%. Oil prices surged by more than 6%, undermining an initially positive reaction to fresh US inflation data released Tuesday morning. Stripping out price gains for volatile items such as food and energy left the “core” US consumer price index up 0.3% month on month, lower than the 0.5% forecast from economists polled by Reuters. Elsewhere in equity markets, the European Stoxx 600 index declined 0.4%, Germany’s Dax fell 0.5% and France’s Cac 40 slipped 0.3%. London’s FTSE 100 fell 0.5%. European bank stocks were among the worst performers, with shares in German lenders Deutsche Bank and Commerzbank down more than 9% and 8% respectively.

Back home, Bursa Malaysia closed lower on Tuesday on profit taking across the board, amid a mixed performance in regional peers as investors await the release of US inflation data later on Tuesday. At 5pm, the benchmark FBM KLCI was 7.48 points or 0.47% easier at 1,597.13, its intraday low, compared with Monday’s close of 1,604.61. In the region, Hong Kong’s Hang Seng index closed up 0.5% and China’s CSI 300 added 1.9%. Japan’s Topix shed 1.4% and South Korea’s Kospi fell 1%.

Source: PublicInvest Research - 13 Apr 2022