Economy

US: Weekly jobless claims fall; seasonal factors revised. The number of Americans filing new claims for unemployment benefits fell last week, indicating a further tightening of labour market conditions heading into the second quarter, which could contribute to keeping inflation elevated. Initial claims for state unemployment benefits dropped 5,000 to a seasonally adjusted 166,000 for the week ended April 2. The government revised claims data from 2017 through 2021, and published new seasonal factors, the model that it uses to strip out seasonal fluctuations from the data. March marked the 11th straight month of job gains in excess of 400,000, which pushed the unemployment rate to a fresh two-year low of 3.6%. The jobless rate is just one tenth of a percentage point above its pre pandemic level. (Reuters)

EU: Producer price inflation continues to accelerate. Eurozone producer price inflation continued to rise in Feb driven by higher energy and intermediate goods prices. Producer price inflation increased to 31.4% in Feb from 30.6% in Jan. Among components of PPI, energy prices climbed 87.2% and intermediate goods prices gained 20.8%. Durable and non-durable consumer goods prices grew 7.2% and 6.8%, respectively. Prices of capital goods were up 5.9%. Excluding energy, producer price inflation rose to 12.2% from 11.8% in the previous month. Eurozone producer price inflation continued to rise in Feb driven by higher energy and intermediate goods prices. Producer price inflation increased to 31.4% in Feb from 30.6% in Jan. (RTT)

EU: Germany industrial production rises unexpectedly in Feb. Germany industrial production grew unexpectedly in Feb. Industrial output grew 0.2% MoM in Feb, confounding expectations for a fall of 0.2%. This was slower than the revised 1.4% increase posted in January. Excluding energy and construction, production grew only 0.1% in Feb. On a yearly basis, overall industrial output gained 3.2%, faster than the 1.1% rise in the previous month. Within industry, the production of consumer goods was up 4.4% and intermediate goods by 0.5 %. Meanwhile, capital goods output decreased 2.0%. Outside of industry, energy production gained 4.9%, while production in construction fell 0.7%. (RTT)

Japan: Leading index lowest in 5 Months. Japan's leading index declined to the lowest level in five months in Feb. The leading index, which measures the future economic activity, fell to 100.9 in Feb from 102.5 in Jan. This was the lowest reading seen since Sep last year, when it was 100.0. The coincident index that measures the current economic situation, decreased marginally to 95.5 in Feb from 95.6 in the previous month. This was the lowest since Oct. The lagging index rose to 96.5 in Feb from 94.3 a month ago. This was the highest since April 2020. (RTT)

India: Service sector growth remains strong in March. India's service sector growth expanded at the strongest rate since Dec last year. The services Purchasing Managers' Index rose to 53.6 in March from 51.8 in Feb. Any score above 50.0 indicates expansion in the sector. In the fourth quarter, the reading was at its lowest average of 52.3 since the beginning of this fiscal year versus 57.4 in the third quarter. New work intakes increased further in March, while new business from abroad continued to decline. New export orders contracted at the fastest pace since Sep last year. The overall rate of cost inflation was the strongest since March 2011 and the overall rate of charge inflation remained high, but moderated. (RTT)

Australia: Trade surplus declines in February. Australia's trade surplus declined in Feb on higher imports. The trade surplus fell to AUD7.46bn in Feb from AUD11.79bn in Jan. The expected level was AUD12.0 bn. Exports of goods and services remained almost unchanged in Feb, while imports advanced 12% driven by the increase in imports of processed industrial supplies and fuels and lubricants. Another report from the statistical office showed that the dwelling approvals surged 43.5% in Feb, reversing a 27.1% fall in Jan. This was in line with the preliminary estimate published on March 31. Private sector house approvals climbed 16.5%, following a 16.3% decline in Jan. Excluding houses, private sector dwellings jumped 78.3%. (RTT)

Singapore: Unemployment rates back to pre-pandemic levels as they continue to fall. Unemployment rates continued to fall in Feb, with the overall rate at 2.1%, down from 2.3% in Jan. The resident unemployment rate fell to 3 % from the 3.1 % in Jan, while the citizen unemployment rate dipped to 3.2 % from 3.3 % previously. The unemployment rates are now back to around pre Covid-19 levels. A total of 71,700 residents, of whom 65,000 are citizens, were unemployed in Feb. Ministry for Manpower expects the unemployment rates to fluctuate around this level depending on the prevailing economic situation going forward. The high number of vacancies could bring rates down further, but at the same time, the downside risks in the global economy have increased - protracted supply chain disruptions and higher energy prices could affect business sentiments and profitability. (The Straits Times)

Markets

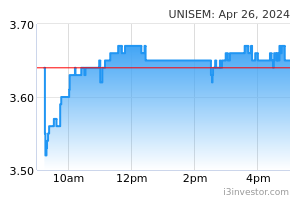

Unisem: To sell land in Batam for RM143m. Unisem (M) has proposed the disposal of its land and building in Batam city in Indonesia’s Riau province for USD34m (RM143.31m). The group is selling the assets to PT Infineon Technologies Batam, with the proceeds to be used to fund Unisem’s operations in the form of working capital and capital expenditure. (The Edge)

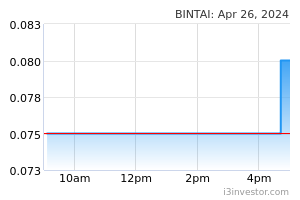

Bintai Kinden: KLCC Urusharta awards Petronas Twin Towers contract to Bintai Kinden. KLCC Urusharta has awarded a RM2.62m contract to Bintai Kinden Corp to undertake mechanical and electrical (M&E) work involving the replacement of the existing transformer at Tower 2 of the Petronas Twin Towers here with a new one. (The Edge)

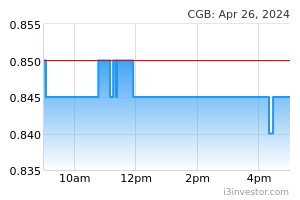

Central Global: Clinches RM26m contract for construction of quarters in Labuan. Industrial tape and label stock maker Central Global has secured a RM26.03m contract to supply labour, materials, machinery, tools and equipment for a project involving the construction of quarters for students and staff for Institut Latihan Perindustrian (ILP) in Labuan, Sabah. (The Edge)

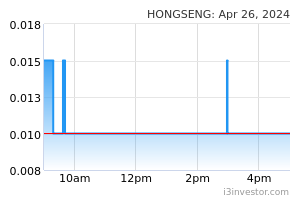

Hong Seng: Teams up with molecular diagnostics provider to supply healthcare products. Hong Seng Consolidated has entered into a collaboration agreement with a molecular diagnostics provider for the provisioning of healthcare products and services. Hong Seng is teaming up with Mediven Innovation Ventures to expand their respective coverage in the healthcare sector by leveraging on each other’s strengths, skills, expertise, network and capabilities. (The Edge)

Gagasan Nadi: Aims to deliver over 10,000 affordable houses. Gagasan Nadi Cergas plans to deliver more than 10,000 affordable houses over the next five years to meet resilient demand in Malaysia. This should begin with the launch of 2,800 units in the FY22. Gagasan Nadi unveiled its 1,260-unit Rumah Idaman in Bukit Jelutong, Shah Alam, with a total gross development value (GDV) of RM304m. (BTimes)

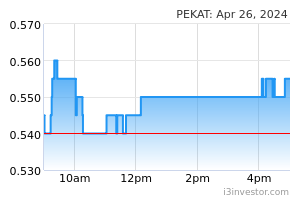

Pekat: Wins RM38.3m solar farm contract from Sun Estates. Pekat Group has secured a contract from Sun Estates to develop a large-scale solar (LSS) photovoltaic (PV) farm worth RM38.3m. The solar PV and earthing and lightning protection specialist had accepted the letter of award from Sun Estates for its appointment as the turnkey engineering, procurement, construction and commissioning (EPCC) contractor for the project. (BTimes)

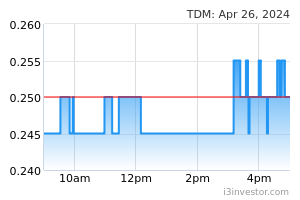

TDM: Inks HoA for specialist hospital in Kota Bharu. TDM has entered into a heads of agreement with Mutiara Premier (MPSB) to build and lease a specialist hospital building in Kota Bharu, Kelantan. Under the proposed project, MPSB will construct a specialist hospital building which is able to accommodate 94 beds of single rooms with a minimum of 300 parking bays for Phase 1 of the proposed project. (StarBiz)

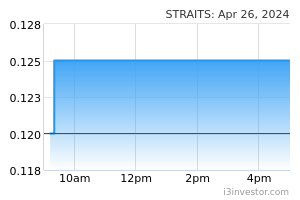

Straits Energy: Proposes share consolidation. Straits Energy Resources has proposed to consolidate every two existing shares held into one consolidated share. The issued share capital of the group was RM138.84m comprising 882.18m shares as at March 25. (StarBiz)

Market Update

The FBM KLCI might open with a positive bias today as US stocks steadied on Thursday, stanching the large losses incurred the previous day after the release of minutes from the Federal Reserve’s March meeting that detailed officials’ willingness to tighten policy aggressively to combat inflation. Wall Street’s benchmark S&P 500 stock index ended Thursday up 0.4%, having closed the previous session 1% lower. The tech-heavy Nasdaq Composite, which fell 2.2% on Wednesday, rose 0.1%. Europe’s regional Stoxx 600 share index fell 0.2% after ending Wednesday 1.5% lower, on concerns that the European Central Bank would follow the Fed’s rapid monetary policy tightening. Also rattling markets were fears that sanctions against Russia could stoke higher consumer prices. Germany’s Dax slipped 0.5% while London’s FTSE 100 also lost 0.5%. The Fed minutes detailed plans to shrink its $9tn balance sheet, part of an effort to fight inflation. The minutes also showed that “many” policymakers viewed one or more half-point increases as appropriate if inflation remained elevated, after the Fed had raised its benchmark interest rate by 0.25 percentage points last month.

Back home, Bursa Malaysia’s benchmark index ended slightly lower after trading in a range-bound mode as selling interspersed with buying of selected heavyweights, mainly plantation, banking and oil and gas stocks. At 5pm on Thursday, the benchmark FBM KLCI was 3.93 points, or 0.24%, lower at 1,600.79, compared with Wednesday's close at 1,604.72. In the region, Hong Kong’s Hang Seng share index fell 1.2% and Japan’s Nikkei lost 1.6%, mirroring declines on Wall Street in the previous session

Source: PublicInvest Research - 8 Apr 2022