Economy

Global: G20 must push relief to avoid debt crises — experts, campaigners . Wealthy nations must improve their floundering flagship debt relief initiative or face a spate of debt crises in the developing world, experts and campaigners say as finance chiefs of G20 major economies prepare for meetings later this week. As the pandemic battered global economies, the Group of 20 leading economies launched measures, including a temporary debt service suspension for poor countries to provide breathing room, as well as the Common Framework - a debt restructuring scheme for long term relief. (Reuters)

US: Weekly jobless claims unexpectedly rebound after three straight drops. After reporting three straight weekly decreases in first-time claims for US unemployment benefits, the Labor Department released a report showing initial jobless claims unexpectedly increased in the week ended Feb 12th. The report showed initial jobless claims rose to 248,000, an increase of 23,000 from the previous week's revised level of 225,000. The rebound surprised economists, who had expected jobless claims to edge down to 219,000 from the 223,000 originally reported for the previous week. (RTT)

US: Housing starts pull sharply, but building permits unexpectedly rise . The Commerce Department released a report showing new residential construction in the US pulled back sharply in the month of Jan. The report said housing starts tumbled by 4.1% to an annual rate of 1.638m in Jan after inching up by 0.3% to a revised rate of 1.708 million in Dec. Economists had expected housing starts to edge down by 0.1% to a rate of 1.700m from the 1.702m originally reported for the previous month. The much bigger than expected decrease came after housing starts reached their highest annual rate since last March in Dec. (RTT)

Japan: Core machine orders rise 3.6% in Dec . The value of core machine orders in Japan was up a seasonally adjusted 3.6% on month in Dec, the Cabinet Office said - coming in at JPY932.4bn. That beat forecasts for a decline of 1.8% following the 3.4% gain in Nov. On a yearly basis, core machine orders climbed 5.1% - again topping expectations for an increase of 0.6% after spiking 11.6% in the previous month. For the 4Q of 2021, core machine orders were up 6.5% on quarter and 6.4% on year at JPY2,703.5bn. For the 1Q of 2022, core machine orders are seen lower by 1.1% on quarter and higher by 8.6% on year. (RTT)

Australian: Unemployment holds at 13-year low as Omicron hits hours . Australia's unemployment rate held at a 13-year low in Jan as a surge in coronavirus cases took more of a toll on hours worked than on jobs, and hiring still rising moderately in the month. Figures from the Australian Bureau of Statistics showed employment rose 12,900 in Jan, pipping forecasts of a flat outcome and following two months of exceptional gains. The unemployment rate stayed at 4.2%, matching the lowest reading since 2008 when it bottomed out at 4.0%. The impact of the Omicron wave was felt most in hours worked which slid 8.8% as employees stayed home sick or were forced to isolate. (Reuters)

Philippines: Central bank keeps rate steady, sees risks to growth outlook . The Philippine central bank left key interest rates unchanged for a 10th consecutive policy meeting, reaffirming continued support for the domestic economy's recovery as it expects inflation to remain manageable. The Bangko Sentral ng Pilipinas (BSP) kept the rate on the overnight reverse repurchase facility at a record 2.0%, as expected by all 21 economists in a Reuters poll. (Reuters)

Singapore: GDP climbs 6.1% on year in 4Q . Singapore's GDP expanded by an annualized 6.1% on year in the 4Q of 2021, the Ministry of Trade and Industry said - slowing from 7.5% in the three months prior. On a seasonally adjusted quarterly basis, GDP was up 2.3% - accelerating from 1.5% in the previous quarter. For all of 2021, GDP grew 7.6% after contracting 4.1% in 2020. For 2022, the MTI is maintaining a growth forecast of between 3.0 and 5.0%. (RTT)

Markets

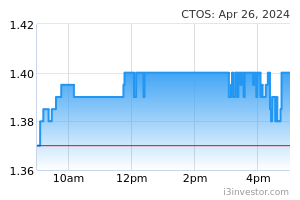

CTOS: To raise RM270m via private placement of new shares. CTOS Digital plans to raise RM270m via a private placement of up to 166.67m new shares at an indicative RM1.62 each to fund proposed acquisitions and investments to further grow its business. The placement shares are intended to be placed out to third party investors and the corporate exercise is expected to be implemented in a single tranche within six months from the date of approval from the bourse regulator for the listing and quotation of the placement shares on the Main Market of Bursa. (The Edge)

Datasonic: Bags RM50m contract to supply raw MyKad. Datasonic Group has bagged a RM50.12m contract to supply the National Registration Department (NRD) with MyKad, MyTentera and MyPOCA raw cards and consumables. The contract awarded by the Home Ministry spans a period of 12 months from Feb 15. Datasonic in May 2016 announced a 3½-year contract worth RM260.4m for the supply of 12m MyKad raw cards and consumables to NRD, from July 1, 2016 to Dec 31, 2019. (The Edge)

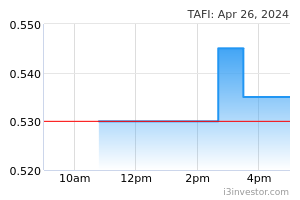

Tafi: In supply pact of fittings, furniture products with OMG. Tafi Industries 's subsidiary T.A. Furniture Industries SB (TAFISB) has signed an agreement with OMG Free Reno SB (OMG) for the supply of fittings and furniture related products. This was to strengthen the partnership between Tafi and OMG's ground breaking subscriber-based renovation platform. OMG's mobile app-based platform brings a synergy of renovation techniques and innovative revolution to the home renovation. (BTimes)

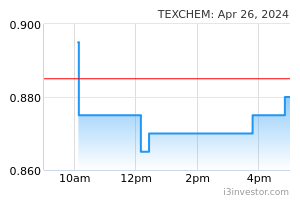

Texchem: Shutters Sushi King operations in Vietnam. Texchem Resources has dissolved its Sushi King operations in Vietnam. Texchem said it does not intend to reactivate its 70.53%-owned subsidiary, Sushi King Co Ltd (SKCL), which operated the Sushi King outlets in Vietnam. SKCL had been operating in a loss position since its incorporation. (The Edge)

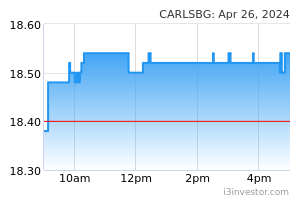

Carlsberg: Allocates largest capex in 30 years to upgrade brewery facilities, sees potential hit from commodity headwinds in 2022. Carlsberg Brewery Malaysia said it has allocated RM110m of its capital expenditure (capex) to upgrade its brewery facilities, which is expected to be completed by the end of this year, according to its managing director Stefano Clini. (The Edge)

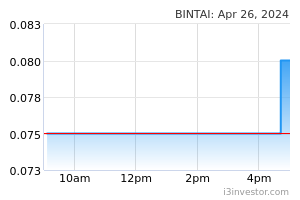

Bintai Kinden, MGRC: Bintai Kinden buys substantial stake in MGRC. Bintai Kinden Corporation has emerged as a substantial shareholder of Malaysian Genomics Resource Centre (MGRC). This follows the acquisition of 6.25m shares by Bintai Kinden unit Bintai Trading SB on Feb 17. MGRC said Bintai Kinden now has an effective 5.03% stake in the genomics and biopharmaceutical company. (BTimes)

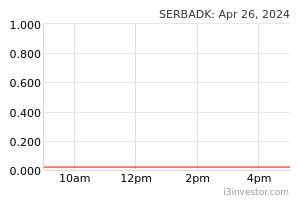

Serba Dinamik: Files notice of appeal to invalidate High Court order to make public announcement on fact-finding update, says source. Serba Dinamik Holdings has filed a notice of appeal at the High Court to invalidate High Court Judicial Commissioner Wan Muhammad Amin Wan Yahya’s order. (The Edge)

Market Update

The FBM KLCI might end the week lower after Wall Street and European stocks sank on Thursday as the US said Russia was on the brink of invading Ukraine within several days. The technology heavy Nasdaq Composite index faced the brunt of the losses, sliding 2.9%, while the blue-chip S&P 500 closed down 2.1%. The market declines this year have wiped more than USD3trn off the value of US stocks, with the S&P 500 down over 8%. Linda Thomas-Greenfield, US ambassador to the UN, said in a tweet that “the evidence on the ground is that Russia is moving towards an imminent invasion”. Speaking at the White House later on Thursday, US President Joe Biden said there was a “very high risk” of a Russian invasion, adding he believed that Moscow was engaged in “a false flag operation to have an excuse to go in”. The selling in the US was broad-based, with 85% of the stocks in the S&P 500 declining. In Europe, the region-wide Stoxx 600 index closed 0.7% lower and London’s FTSE 100 dipped 0.9%. Financial markets have whipsawed over the past week as the developments in Ukraine and threat of tighter monetary policy to tamp down surging inflation have weighed on investors.

Back home, Bursa Malaysia ended marginally higher on Thursday after a roller coaster session during the final hour of trading as plantation heavyweights continued to push the key index, coupled with better regional market performances. At the closing bell, the FBM KLCI gained 1.82 points to 1,605.02 compared with 1,603.2 at Wednesday's close. In the region, Japan’s Topix fell 0.8%. Hong Kong’s Hang Seng trimmed losses from earlier in the day to close 0.3% higher.

Source: PublicInvest Research - 18 Feb 2022