Economy

Global: Growth is biggest challenge for emerging economies - World Bank chief economist. Lack of growth is the biggest economic challenge facing developing economies, the World Bank’s chief economist said. Economic growth was essential for poverty reduction, as well as creating government revenues to use for fiscal space, social safety nets and the provision of public goods. (Reuters)

UK: Shoppers, hit by fuel crisis, turn more cautious on spending. British shoppers increased their spending in Sept at the slowest pace since Jan, when the country was stuck in a coronavirus lockdown, as they worried about a shortage of fuel, according to a survey published. The British Retail Consortium said retail spending lost more momentum last month, rising by just 0.6% compared with Sept 2020, much weaker than Aug’s 3.0% increase. (Reuters)

UK: Sunak told scarred UK economy will add to strains on budget. Britain’s economy will retain deep scars long after the pandemic has passed, slowing growth and adding to the strain on the public finances, a major report ahead of the government’s budget concluded. The findings from the Institute for Fiscal Studies illustrate the pressures facing Chancellor of the Exchequer Rishi Sunak, with rising prices and interest rates likely to add GBP15bn (USD20bn) to the Treasury’s debt payments this year and beyond. The projection sketch out the tensions from inflation to increased demands on the public purse that Sunak will have to juggle in his statement on Oct 27. (Bloomberg)

Japan: Japanese Bonds show rare bout of inflation anxiety. A sudden spike in inflation expectations priced into Japanese government bonds shows some investors are changing long-held assumptions about the economy being resistant to any global supply side shocks. Growing concerns about global inflation, fuelled by rising commodity prices and a supply crunch worldwide, have prompted investors to buy Japanese inflation-linked bonds, driving the 10-year breakeven inflation (BEI) rate higher last week. (Reuters)

Japan: Households expect inflation to pick up - BOJ survey. Japanese households' inflation expectations rose in the three months to Sept, a survey showed, suggesting a global rise in raw material costs may be affecting perceptions in a country worried about the risk of deflation. The ratio of Japanese households that expect prices to rise a year from now stood at 68.2% in Sept, up from 66.8% three months ago, a quarterly central bank survey showed. The median projection of inflation a year from now stood at 3.0% in Sept, up from 2.0% in June, the survey showed. (Reuters)

India: Said to mull higher consumption tax and fewer rates. India may look at increasing tax on some goods and services in a step toward moving to a simpler structure with fewer rates, according to people familiar with the matter. A panel on goods and services tax, headed by Finance Minister Nirmala Sitharaman, will likely meet in Dec to consider the overhaul from the current four-rate system, the people said, asking not to be identified as the discussions are private. India currently taxes good and services produced in the country at 5%, 12%, 18% and 28%, with some essentials such as food items attracting the lowest rate and sin and luxury goods ending up with the highest levy. (Bloomberg)

Indonesia: Retail sales fall in Sept. Indonesia retail sales decreased in Sept, results of a survey by Bank Indonesia showed. Retail sales fell 1.1% MoM in Sept, after a 2.1% growth in Aug. The latest growth was mainly due to increasing sales of spare parts and accessories, and food, beverages and tobacco. On a yearly basis, retail sales declined 1.8% in Sept, following a 2.1% fall in the previous month. Retailers expect inflationary pressure increased in the coming three months ending in Feb 2022. (RTT)

Markets

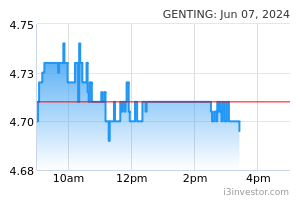

Genting (Outperform, TP: RM5.70): Subsidiary Resorts World Las Vegas to deduct back taxes on employees’ tips. Genting’s 100%-owned subsidiary Resorts World Las Vegas LLC said the latter has taken steps to remedy an inadvertent "system error" that resulted in the under-withholding or deduction of taxes on tips received by some employees and that the amounts that should have been deducted will be withheld over the remaining pay periods in 2021. News websites have published its statement after the company’s internal memorandum on the system issues was posted, hence leading to reporters’ enquiries on the matter. (The Edge)

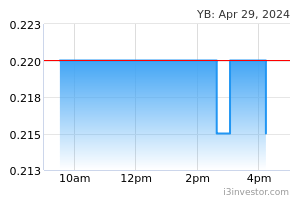

YB Ventures: Plans private placement to raise up to RM146m to fund solar PV system. YB Ventures has proposed a private placement of up to 20% of its issued shares to raise as much as RM145.9m to fund the installation of a rooftop solar photovoltaic (PV) system. The exercise entails the issuance of up to 48.36m shares. The placement shares will be issued at a price of not more than 10% discount to the five-day VWAP of YB Ventures shares immediately preceding the price-fixing date. (The Edge)

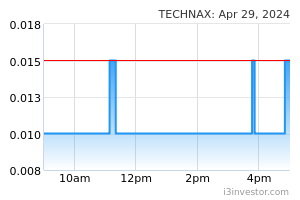

Techna-X: Signs five-year technology partnership agreement with Kenya-based Pesapass Ltd. Techna-X has secured a five year exclusive technology partnership agreement with Pesapass Ltd, a company incorporated in Kenya, to license TISB's revenue management system (RMS) for Kenya Wildlife Service (KWS) and all of its 65 national parks and reserves. The RMS developed for KWS will be known as the Safaripay Platform and will be implemented across all of its managed parks which receive over two million visitors per year. (BTimes)

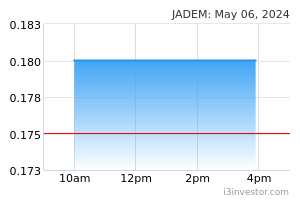

Jade Marvel: Looking to set up frozen seafood processing facility in diversification push. Jade Marvel Group (JMG) has entered into a memorandum of understanding (MoU) with YHL Foods SB for a proposed joint venture to set up an integrated frozen seafood processing facility with cold storage facilities at Bio Desaru in Kota Tinggi, Johor. The MoU represents a planned diversification into the food business for JMG, which is already a diversified company with businesses including construction and property development. (The Edge)

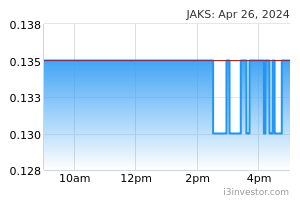

Jaks Resources: Insulated against coal price hike, says CEO. JAKS Resources has assured that the recent fluctuation in coal prices will not impact the profit from its power plant in Vietnam. This was given that the coal prices were passing through to the off-taker Vietnam Electricity, according to Jaks chief executive officer Andy Ang Lam Poah. The coal supplied to JAKS Hai Duong power plant was entirely sourced locally to ensure a stable supply of coal for 25 years. (BTimes)

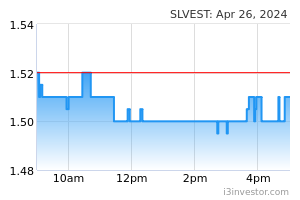

Solarvest: Allocates an initial RM1m fund for its Innovation Lab 202. Solarvest Holdings is allocating an initial RM1m fund for its Solarvest Innovation Lab 2021 (SIL 2021). SIL 2021 is a start up programme to spur innovation and entrepreneurship developments in Malaysia with particular emphasis on renewable energy (RE), green technology and financial technology (fintech). It expects to see the funds growing in the near future as more partners came on board. (BTimes)

Market Update

The FBM KLCI might open with a cautious note today after US stocks fell on Monday on worries about slowing growth and mounting inflation, punctuated by a rally in oil prices. The S&P 500 slid 30.15 points, or 0.7%, to 4361.19. Stocks rose in the morning but later turned lower, with losses accelerating in the last minutes of trading. The Dow Jones Industrial Average declined 250.19, or 0.7%, to 34496.06. The technology-heavy Nasdaq Composite dropped 93.34, or 0.6%, to 14486.20. The price of US crude oil hit a fresh seven-year high on Monday on fears that fuel demand was recovering faster from last year’s economic slowdown than producers could bring supply to the market. West Texas Intermediate, the US crude benchmark, hit a high of more than USD82 a barrel, its highest level since 2014, before pulling back to USD80.46, up 1.4% for the day. Oil prices have climbed more than 16% since the start of September, encouraged by a global economic rebound and a shortage of natural gas that has increased demand for other energy sources. The energy- and mining-heavy FTSE 100 index enjoyed the biggest boost among big markets in Europe, rising 0.7%, while the broader region-wide Stoxx 600 inched up 0.1%.

Back home, surging oil prices, which have lifted energy index by 6.5%, and optimism over domestic economic recovery, saw Bursa Malaysia ending at a one-month high on Monday. The FBM KLCI gained for five days in a row, adding 6.92 points to 1,570.82 at 5pm on Monday, compared with 1,563.9 at Friday’s close. Stocks in the region were mixed. Hong Kong’s Hang Seng climbed about 2%, while Japan’s Nikkei 225 index added 1.6%. In mainland China, the benchmark Shanghai Composite was roughly flat.

Source: PublicInvest Research - 12 Oct 2021