Silver lining ahead

Market Review

Malaysia:. The FBM KLCI (-0.2%) trended lower after erasing all its intraday gains with more than two-thirds of the key index components closed in red. The lower liners also stayed downbeat, while the energy sector (-1.2%) underperformed the mixed sectorial peers.

Global markets:. Wall Street remained upbeat as banking shares rallied after First Citizens BancShares agreed to buy SVB Financial Group’s Silicon Bank, while the US authorities considered expanding emergency lending facilities to First Republic Bank. The European stockmarkets rebounded, but Asia stockmarkets ended mixed.

The Day Ahead

The FBM KLCI drifted lower amid renewed worries on the banking crisis in the US and Europe. However, given that the rally on Dow Jones overnight, contributed by the First Citizens Bancshares-SVB acquisition deal, which has lifted the sentiment on the banking stocks, the Asian stock markets and the local bourse are likely to move higher for the session. Commodities wise, the Brent crude oil price surged above USD78 per barrel mark, while the CPO price hovered above RM3,600. Gold price saw a mild pullback but stayed above USD1,950.

Sector focus:. Investors may pile into the beaten-down energy stocks amid firmer crude oil prices. The plantation stocks may gain momentum along with the stabilised CPO price along RM3,600. Besides, we think investors may favour REIT, consumer stapled, and utilities stocks for its defensive characteristic under this volatile environment.

FBMKLCI Technical Outlook

The FBM KLCI declined for the third consecutive session as the key index struggled to stay above 1,400. Technical indicators remained mixed as the MACD Histogram extended a positive bar, while the RSI hovered below 50. Support is located at 1,370-1,380 and resistance is pegged around 1,420-1,440.

Company Brief

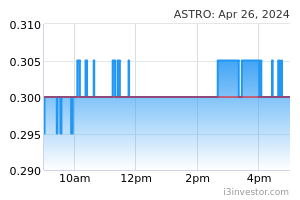

Astro Malaysia Holdings Bhd’s 4QFY23 net profit slipped 56.7% YoY to RM54.8m, as the legal entity recognised a non-cash impairment in respect of its historical cost of investments in subsidiaries. Revenue for the quarter fell 3.8% YoY to RM990.7m. (The Star)

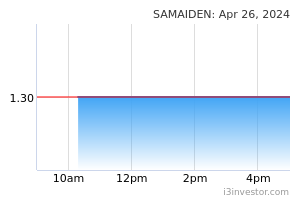

Samaiden Group Bhd has secured approval from Bursa Malaysia for the transfer of its stock's listing from the ACE Market to the Main Market of Bursa Malaysia. The transfer of listing will take effect 2 market days upon the announcement to Bursa Securities on the transfer date to be announced later. (The Star)

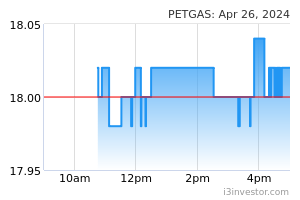

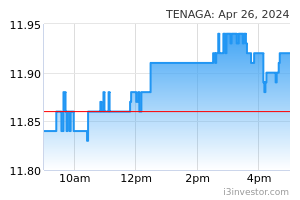

Petronas Gas Bhd independent non-executive director Datuk Abdul Razak Abdul Majid has resigned from the board effective 27th March 2023. He joined the group in September 2018. His resignation as due to his appointment as the chairman of Tenaga Nasional Bhd (TNB) for a 2-year term took effect yesterday. (The Edge)

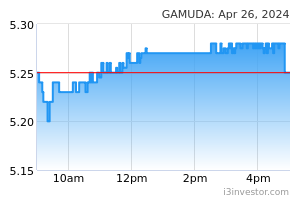

Gamuda Bhd, together with its partner Castleforge Partners Ltd; a UK-based real estate private equity investor has bought the eight-storey commercial building Winchester House London for £257.0m (RM1.39bn). Post acquisition, plans to refurbish and upgrade the property into a best-in-class, top-rated environmentally sustainable office space. (The Edge)

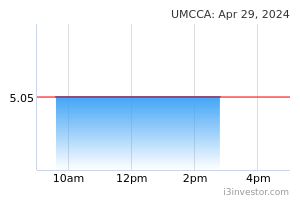

United Malacca Bhd’s 3QFY23 net profit dropped 58.0% YoY to RM12.7m, on lower average crude palm oil (CPO) and palm kernel (PK) prices, as well as higher investment loss. Revenue for the quarter, however, climbed 9.4% YoY to RM161.6m. (The Edge)

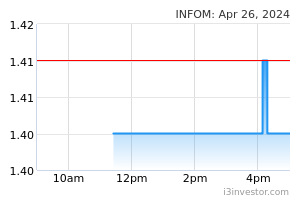

Infomina Bhd has secured a contract worth USD5.4m (RM23.9m) from the Philippine National Bank (PNB) for the provision of technology application and infrastructure operations, maintenance and support services to PNB. The contract is over a period of 3 years from 1st March 2023 to 28th February 2026. (The Edge)

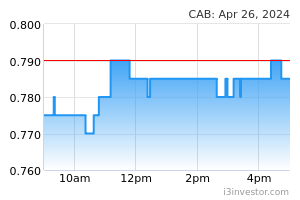

CAB Cakaran Corp Bhd is planning a bonus issue of up to 234.0m free warrants on the basis of 1 warrant for every 3 shares held. The exercise price of the warrants has been fixed at 63 sen apiece. (The Edge)

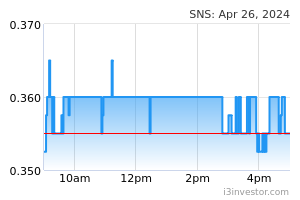

SNS Network Technology Bhd’s 4QFY23 net profit stood at RM16.8m on top of a revenue of RM509.9m. A second interim dividend of 0.25 sen per share, payable on 26th May 2023 was declared. (The Edge)

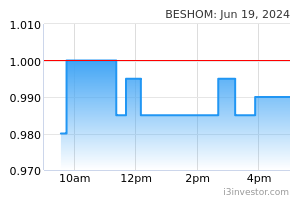

Beshom Holdings Bhd’s 3QFY23 net profit fell 66.3% YoY to RM2.6m, due to lower revenue contributions from its multi-level marketing (MLM) division. Revenue for the quarter decreased 27.8% YoY to RM42.9m. (The Edge)

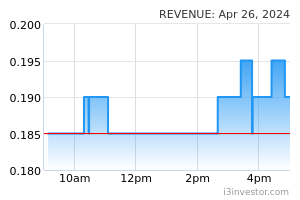

Revenue Group Bhd’s former executive director and co-founder Dino Ng Shih Fang has ceased to be a substantial shareholder of the group, after offloading 54.0m shares or a 11.2% stake. Following the disposal, Dino is left with 15.3m shares or a 3.2% stake in the e-payment solutions provider. (The Edge)

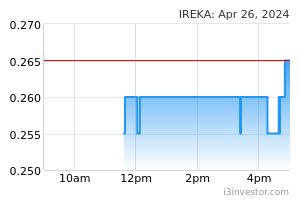

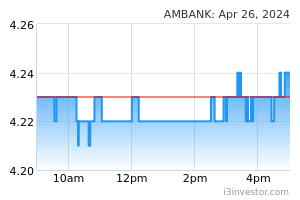

Ireka Corp Bhd was served with a writ on 24th March 2023 from AmBank (M) Bhd, claiming RM4.2m from the group. The sum included a claim on overdraft facilities amounting to RM3.1m and a claim on revolving credit amounting to RM1.1m. Both claims do not include any interest charges to be calculated until full settlement. (The Edge)

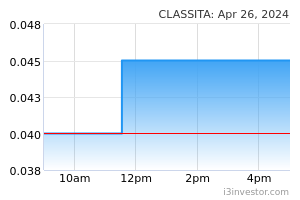

Shareholders of Classita Holdings Bhd have approved the company’s proposed rights issue comprising the issuance of up to 965.4m shares and 579.2m detachable free warrants in the company. The resolution was passed at its extraordinary general meeting (EGM) yesterday, which went through amid a failed attempt by 5 shareholders to block the meeting through a court order last week. (The Edge)

Source: Mplus Research - 28 Mar 2023