Recouping weekly losses

Market Review

Malaysia: The FBM KLCI (+1.5%) rebounded alongside with the regional markets, taking cue from the calmer market conditions on Wall Street overnight. The lower liners also advanced, while all 13 major sectors marched higher with the construction sector (+3.0%) taking the lead.

Global markets: Wall Street remained volatile as the Dow (-1.2%) sank on lingering concerns over the banking turmoil in the US and the Credit Suisse crisis. The European stockmarkets also turned lower with investors digesting the 50 basis points hike by the European Central Bank, but Asia stockmarkets closed upbeat.

The Day Ahead

The FBM KLCI bounced higher along with the regional markets amid a relief rally in view of a rescue plan for the US banking sector. Although the volatility may persist on the local bourse following Wall Street’s retreat amid lingering concern over the US banking turmoil and Credit Suisse crises, we expect the market to stay calmer as UBS announced to take over Credit Suisse just this morning. Meanwhile, traders will monitor on the US Federal Reserve interest rate decision this week. Commodities wise, the Brent crude oil is still hovering above USD72 per barrel, while the CPO price is trading below RM4,000. Gold prices surged, trading just below USD1,990 as investors rush for safe haven asset.

Sector focus: The gold related counters may gain momentum as turmoil in US banking sector has brought interest in gold, spurring the commodities prices. Besides, other defensive sectors such as telecommunications, consumer staples, and health care sectors may shine amidst fragile sentiment in the market.

FBMKLCI Technical Outlook

The FBM KLCI staged a strong rebound to close above the key 1,400 level. Technical indicators however, turned slightly positive as the MACD Histogram is forming a rounding bottom, while the RSI has crossed above 30. Next resistance is located around 1,420-1,440, while the support is envisaged along 1,390-1,400.

Company Brief

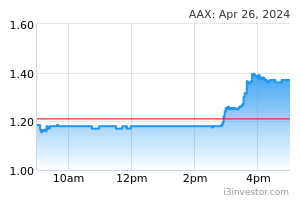

AirAsia X Bhd (AAX), which was issued an unusual market activity (UMA) query by Bursa Malaysia earlier, is unaware of any reason for the recent sharp rise in its share price and volume. Except for its proposed regularisation plan to holistically restructure its business and financial condition, it is not aware of any other corporate development, rumour or report which may account for the UMA. (The Star)

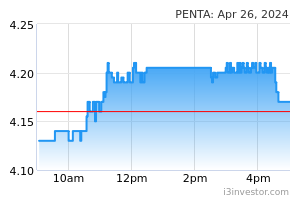

Pentamaster Corp Bhd is withdrawing from subscribing for a 29.9% stake in the enlarged capital of Taiwan-based Everready Precision Industrial Corp (Epic) for USD6.8m (RM29.9m) because approval from Taiwanese authorities will not come soon. The proposed subscription is currently classified under other receivables and the withdrawal from the proposed subscription will be subject to an impairment assessment (if any). (The Edge)

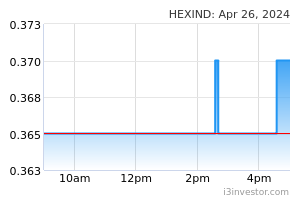

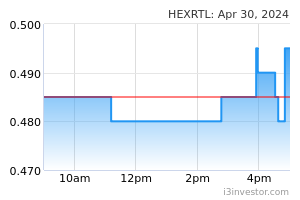

Hextar Industries Bhd (HIB) has commenced the winding up of its wholly owned subsidiary Hextar Fertilizers Ltd (HFL), to streamline its organisation for greater efficiency. HFL is an investment holding company which holds 100.0% equity interest in Hextar Fertilizers Group Sdn Bhd (HFGSB), which in turn holds 100% equity interest in Hextar Fert Sdn Bhd (HFTSB), Hextar Solutions Sdn Bhd (HSOSB) and PK Fertilizers Sdn Bhd (PKF). All shares held by HFL in HFGSB shall be distributed to HIB, and HFGSB shall be the wholly owned subsidiary of HIB. HFTSB, HSOSB and PKF will then be the indirect wholly owned subsidiaries of HIB. (The Edge)

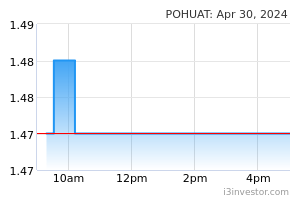

Poh Huat Resources Holdings Bhd’s 1QFY23 net profit dropped 55.5% YoY to RM6.8m, amid weaker consumer spending power and business confidence in North America. Revenue for the quarter declined 34.7% YoY to RM119.5m. (The Edge)

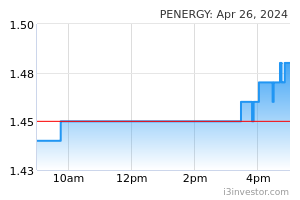

Petra Energy Bhd announced that its subsidiary Petra Resources Sdn Bhd has received 2 contracts for the provision of accommodation workboats from Petronas Carigali Sdn Bhd (PCSB). The contracts are for its accommodation workboats Petra Orbit and Petra Galaxy. The value of the contracts is based on work orders issued by PCSB throughout the contract duration of up to 255 days from the commencement date effective 17th February 2023, with an option to extend up to 60 days. (The Edge)

Classic Scenic Bhd has shelved its 1-for-1 bonus issue plan, and instead proposed to undertake a new bonus issuance on the basis of 1 bonus share for every 2 Classic Scenic shares held to comply with Bursa Malaysia’s listing rules. It did not submit the application for its one-for-one bonus issue plan as the company would not be in compliance with the Main Market Listing Requirements (MMLR), following the recent decline in its share price. (The Edge)

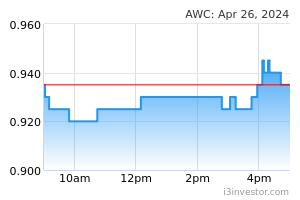

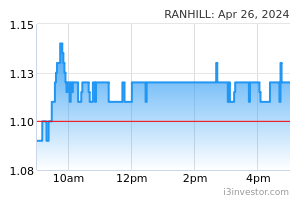

AWC Bhd has entered into a memorandum of understanding (MOU) with Ranhill Utilities Bhd in exploring opportunities and strategic collaborations to expand into the water business in Indonesia. The duration of the MOU is for 12 months from the date of signature unless terminated by both parties. (The Edge)

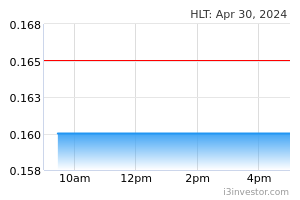

HLT Global Bhd is proposing a capital reduction exercise as a set-off against its nearly RM100.0m of accumulated losses as at end-FY22. The proposed capital reduction entails the cancellation of RM120.0m from its share capital, which stood at RM208.3m comprising 775.4m shares as at 7th March 2023. (The Edge)

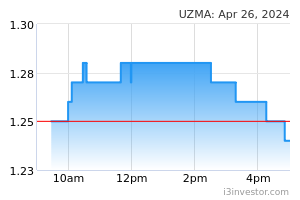

Uzma Bhd is proposing a private placement of up to 10.0% of its share capital to raise an estimated RM21.8m to partially fund the group’s development of a 50.0- MW Large Scale Solar 4 project in Sungai Petani, Kedah. The placement will involve the issuance of up to 35.2m shares in Uzma to external parties at a discount of not more than 10.0% of the group's 5-day volume weighted average market price immediately before the price-fixing date. (The Edge)

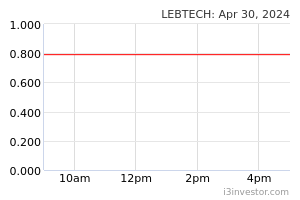

Lebtech Bhd has secured a RM29.5m construction contract for a project in Section U13, Shah Alam, Selangor. The group’s wholly owned subsidiary Lebtech Construction Sdn Bhd received the 20-month contract from Brighton Land Sdn Bhd on 14th March 2023. (The Edge)

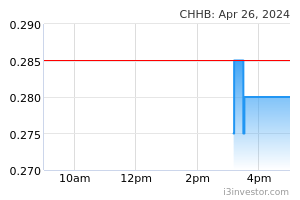

Country Heights Holdings Bhd’s unit Country Heights Sea Resort Sdn Bhd (CHSR), has failed to complete the acquisition of a 10-storey office tower, The Heritage Tower @ Mines Wellness City, for RM44.1m after its unit failed to pay outstanding balance of RM39.7m (90.0% of the purchase consideration on time). The group’s unit Country Heights Sea Resort Sdn Bhd (CHSR) was unable to proceed with the completion of the acquisition after it failed to pay the outstanding balance of RM39.7m. Country Heights and CHSR are exploring all available legal options in response to the situation. (The Edge)

ManagePay Systems Bhd is developing an online financing platform QuicKredit which is the Shariah-compliant platform that enables investors to buy and trade gold with credit. Buyers can buy gold by acquiring purchasing financing from QuicKredit with interest based on Tawarruq financing. Users may also choose to receive their gold physically, store it in a secured vault or pawn their purchased gold for a fee and repurchase it later in the form of Ar Rahnu practice. The platform is expected to be launched in 3Q23, subject to regulatory approvals. (The Edge)

Sentoria Group Bhd through its wholly owned subsidiary Sentoria Borneo Land Sdn Bhd has entered into a sales agreement with Pembinaan Dinasti Tias Sdn Bhd to dispose of several plots of land in Bandar Semariang, Kuching. The disposal will realise proceeds of RM8.2m, which will be utilised to repay bank borrowings and expected to generate an estimated net gain of RM600,000. The repayment is also expected to result in interest savings of approximately RM390,000 per annum and lower gearing from 2.8x as at 31st March 2022 to 2.7x after the disposal. (The Edge)

Perak Corp Bhd has reported that one of its creditors has applied for a court order to set aside the group and its subsidiary’s court-sanctioned scheme of arrangement (SOA). The suit is filed by Mohamed Shafeii Abdul Gaffoor, a scheme creditor representing less than 0.02% of the total sum owing under the SOA. During proceedings in the Ipoh Magistrate's Court, which ruled in September 2022, were elements of crime detected in the diversified group's restructuring exercise. Mohamed Shafeii is seeking the court’s leave to object to and set aside the SOA, saying it is no longer valid, and wants the court to appoint a receiver and manager to manage the company in a more equitable manner. (The Edge)

Source: Mplus Research - 20 Mar 2023