Volatility may persist

Market Review

Malaysia:. The FBM KLCI (+0.7%) rebounded to claw its way back above 1,400 on bargain hunting activities with two-thirds of the key index components closed in green. The lower liners also rebounded, while all the 13 major sectors marched higher with the healthcare sector (+1.7%) taking the lead.

Global markets:. Wall Street retreated as the Dow (-0.9%) erased most of its previous session gains after being spooked by the financial liquidity turmoil impeaching Credit Suisse AG. The European stock markets tumbled with the banking sector taking the worst hit, but Asia stock markets ended mostly higher.

The Day Ahead

The FBM KLCI bounced higher to close above the key 1,400 level as investors picked up beaten-down stocks on the broader market. However, global uncertainties may not abate with the Wall Street turning mixed once again on the back of revived fears of a banking crisis; Credit Suisse is making the headlines after Saudi National Bank mentioned it will not provide further financial help for the bank. Thus, the local bourse may trade in consolidation mode prior to the US interest rate decision next week. Commodities wise, the Brent crude oil fell steeply below the USD75 zone, while the CPO price declined below the RM3,900 level.

Sector focus:. The energy and plantation sectors may stage a pullback in view of the slipping crude oil and CPO prices. Meanwhile, we expect overall sentiment on the banking sector may turn negative. Nevertheless, we favour the defensive sectors such as telco, consumer, healthcare and REIT amid the heightened volatility in the market.

FBMKLCI Technical Outlook

The FBM KLCI rebounded, snapping its five-session losing streak as the key index closed above the key 1,400 level. Technical indicators, however remained negative as the MACD Histogram extended a negative bar, while the RSI is in the oversold zone. Resistance is set along 1,420-1,440, while the support is at 1,380-1,400.

Company Brief

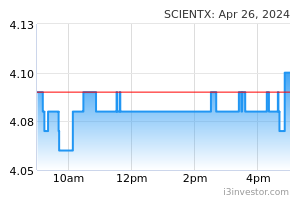

Scientex Bhd’s 2QFY23 net profit grew 13.4% YoY to RM106.3m, on the back of improving property sales and healthy construction progress, as well as positive demand for new affordable home launches in Sungai Petani, Kedah. Revenue for the quarter gained 2.8% YoY to RM978.4m. (The Star)

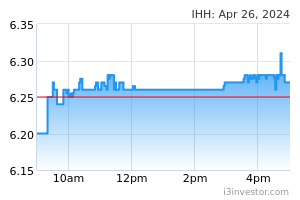

IHH Healthcare Bhd has made a strategic investment in Singapore's digital mental health company Intellect at an undisclosed price, aiming to further expand the hospital operator’s offerings to its customers. IHH will co-develop and customise digital mental health programmes with Intellect for its patients, corporate clients, and staff. In a pilot initiative, Intellect’s offerings will be made available first to maternity patients at Gleneagles Hospital in Singapore. (The Edge)

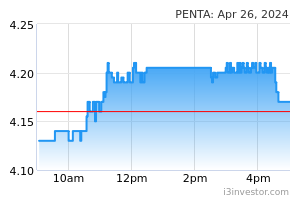

Pentamaster Corp Bhd has withdrawn its subscription of a 29.9% stake in the enlarged capital of Taiwan-based Everready Precision Industrial Corp (Epic) for USD6.8m (RM29.9m). The group did not provide a reason for the withdrawal, but would pursue the return of the investment sum from Epic. (The Edge)

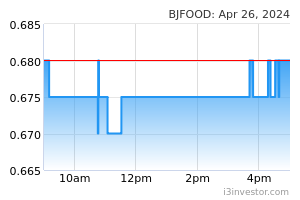

Berjaya Food Bhd (BFood) through its wholly owned subsidiary Berjaya Food (International) Sdn Bhd (BFI) had on 15th March 2023 acquired a total of 11.9m ordinary shares representing 1.1% equity interest in SEM. The shares were acquired from True Ascend Sdn Bhd via a direct business transaction for a total cash consideration of about RM22.0m or at RM1.85 per SEM share. (The Edge)

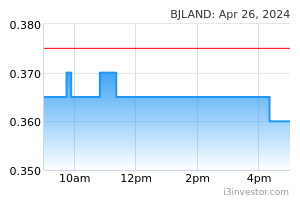

Meanwhile, Berjaya Land Bhd (BLand) announced that BLand and its wholly owned subsidiary Berjaya Vacation Club Bhd had on 27th July 2022 and 15th March 2023 acquired in aggregate of 6.7m ordinary shares representing about 0.6% equity interest in SEM. The shares were acquired from a non-related party and True Ascend via a direct business transaction for a total cash consideration of about RM12.1m or at an average purchase price of about RM1.80 per SEM share. (The Edge)

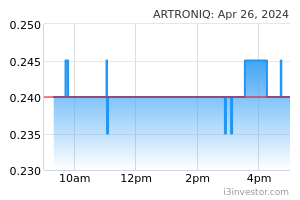

Artroniq Bhd has accepted a letter of award from Cambodian-based Panda Commercial Bank PLC for a research and development blockchain based financial services contract valued at USD10.0m (RM44.8m). The contract is for a period of 2 years, starting from 15th March 2023 to 31st March 2025. The award pertains to the development of basic blockchains, functional API, web and mobile related solutions applicable for Panda Bank. (The Edge)

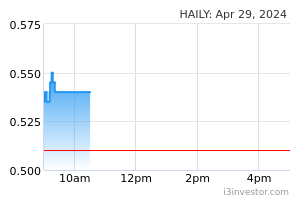

Haily Group Bhd has secured a RM32.7m contract to build 186 units of singlestorey terrace houses in Bandar Putra Kulai, Johor. The contract was awarded to its wholly owned subsidiary Haily Construction Sdn Bhd by JYP Architects Sdn Bhd on behalf of Nice Frontier Sdn Bhd, a member of the IOI Properties Group Bhd. The construction is expected to be completed in 15 months or by 26th June 2024. (The Edge)

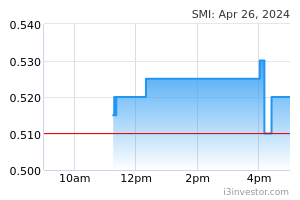

South Malaysia Industries Bhd (SMI) has gone to court for a declaration that the extraordinary general meeting (EGM) scheduled for 24th March 2023 proposed by 2 of its shareholders is unlawful and unconstitutional. The EGM, requested by Honsin Apparel Sdn Bhd and HIQ Media (M) Sdn Bhd, was meant to remove the current 5-member board of directors in SMI, replacing them with 2 persons, namely Lee Boon Siong and Tan Eik Huang. Honsin Apparel and HIQ Media, both subsidiaries of Prolexus Bhd, collectively own a 10.0% stake in SMI. (The Edge)

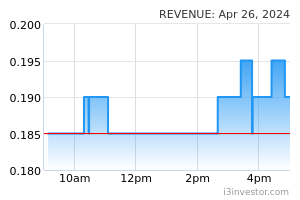

Revenue Group Bhd’s managing director cum alternate chairman Datuk Eddie Ng Chee Siong has resigned after he had disposed of 25.3m of his shares in the company off market. Eddie’s resignation was due to personal matters, which came after he had sold his shares in Revenue Group on 14th March 2023, representing 5.3% of the total issued share capital, thus he ceases to be a substantial shareholder of the group. (The Edge)

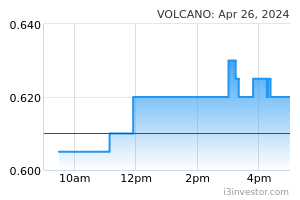

Volcano Bhd has proposed to raise up to RM42.8m via a private placement, mainly to fund its expansion plan. Up to 49.5m new shares, representing 30.0% of Volcano’s current share base of 165.0m shares, will be issued to independent third-party investors to be identified later. The placement shares will be priced at not more than a 10.0% discount to Volcano shares’ 5-day volume weighted average market price. (The Edge)

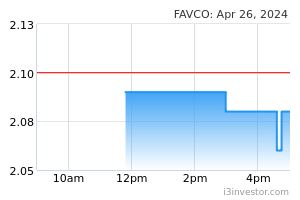

Favelle Favco Bhd (FFB) has secured 2 contracts with a combined value of about RM95.0m. One of them is a contract for the supply of a tower crane, awarded to FFB's subsidiary Kroll Cranes A/S by Samsung Heavy Industries Co Ltd. The crane is expected to be delivered by 2Q24. (The Edge)

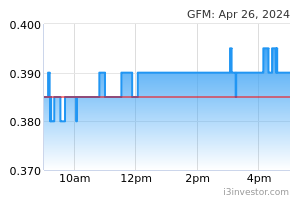

GFM Services Bhd is spending RM9.0m to take over a company that has been awarded the rights to develop a Rest and Service Area along the Kuala LumpurKarak Expressway. The development rights were awarded on 27th May 2022 by the Malaysian Highway Authority. GFM, using internally generated funds, will be buying 100.0% interest in Atmajaya Arvino Sdn Bhd from Ahmad Nasri Abdul Gani. (The Edge)

Source: Mplus Research - 16 Mar 2023