Market Review

Malaysia: The FBM KLCI (-0.1%) edged marginally lower, dragged by the absence of fresh leads; the key index fell -0.2% WoW. The lower liners, however, closed higher, while the energy sector (+1.6%) extended its lead for the third straight session.

Global markets: Wall Street marched higher as Dow (+1.2%) rose after the ISM Services PMI rose to 55.1 in February; implying that the world’s largest economy can withstand the previous aggressive rate hikes. The European stockmarkets also extended their gains, while Asia stockmarkets finished mostly upbeat.

The Day Ahead

The FBM KLCI settled lower on Friday as profit-taking activities re-surfaced, bucking the positive performances across regional markets. Global risk appetite improved, but still awaiting comments from the US Fed officials which will provide clues for the future rate hike directions during congressional testimony. Nevertheless, the market has priced in the solid ISM manufacturing data, which should contribute to at least a positive short term trading environment. Meanwhile, investors may keep an eye on Bank Negara Malaysia’s interest rate decision this week. Commodities wise, the Brent oil climbed above USD85 per barrel mark, while the CPO price surged above RM4,350.

Sector focus: The technology sector may be lifted by Wall Street’s movements, while the energy and plantation sectors could be in focus amid rising crude oil and CPO prices. Also, we expect the potential upliftment of the price capping mechanism may bode well for poultry stocks.

FBMKLCI Technical Outlook

The FBM KLCI reversed gains from the previous session but remained well supported above the 1,450 level. Technical indicators, however, remained negative as the MACD Histogram extended a negative bar, while the RSI is hovering below 50. Support is set along 1,430-1,440, while the resistance is at 1,470-1,480.

Company Brief

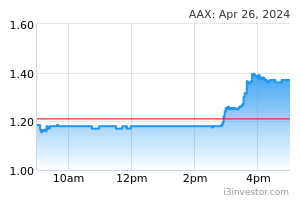

AirAsia X Bhd (AAX) has resumed its flight services to Shanghai, China with four weekly flights from Kuala Lumpur starting 2nd March 2023. The carrier plans to ramp up capacity and increase the frequency of services to Shanghai with 11 weekly flights by 2Q23, akin to its pre-pandemic frequency. (The Star)

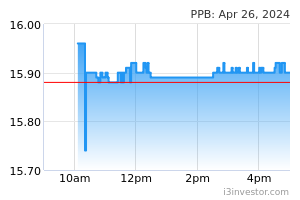

PPB Group Bhd sees an increase of between 30-38% in its utility cost, after the government removed electricity subsidies and raised the power tariff for mediumand high-voltage users to a surcharge of 20.0sen/kWh from 1st January 2023. Looking at their utilisation, the impact could be between RM20-25m increase in cost across the group. (The Edge)

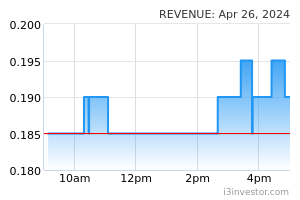

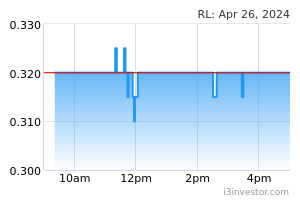

Two executive directors of Revenue Group Bhd, namely Ooi Guan Hoe and Lai Wei Keat, as well as independent and non-executive director Loo Jo Anne, have resigned from the board on 3rd March 2023. The e-payment solutions provider cited health reasons for Ooi's resignation, while Lai and Loo stepped down due to personal reasons. The group is currently in a dispute with its co-founders Brian Ng Shih Chiow and Dino Ng Shih Fang, who were suspended in January 2023 after several complaints were lodged against them. (The Edge)

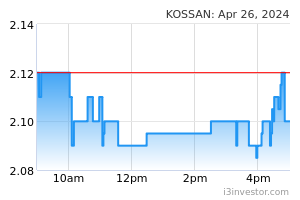

Abrdn PLC (formerly known as Aberdeen Asset Management PLC) has emerged as a substantial shareholder of Kossan Rubber Industries Bhd, after acquiring a 5.1% stake in the glove maker. Abrdn bought the stake, comprising 129.5m shares, on 1st March 2023. (The Edge)

Reservoir Link Energy Bhd plans to diversify its business to include the provision of wastewater treatment services as well as the engineering, procurement, construction, and commissioning (EPCC) of wastewater treatment plants. In tandem with the new business ventures, it also revealed plans to raise RM27.8m via a private placement. (The Edge)

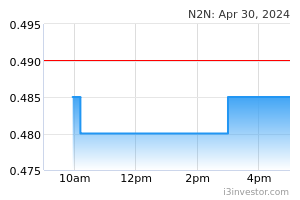

N2N Connect Bhd has called off its plan to transfer its listing from the ACE Market to the Main Market. The group, which had made the proposal in June 2020 has decided to withdraw the application after taking into consideration the continuing market volatility amid the expectation of softening in global growth. (The Edge)

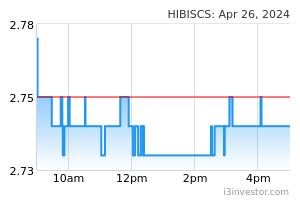

Hibiscus Petroleum Bhd has reported that a Sarawak-based oil and gas services provider has initiated arbitration proceedings against its indirect wholly owned subsidiary Hibiscus Oil & Gas Malaysia Ltd over a RM36.6m claim. Oceancare Corporation Sdn Bhd (OCSB), formerly known as Repsol Oil & Gas Malaysia Ltd is alleging, among other things, variation to the original scope of work, which Hibiscus Oil & Gas denies. (The Edge)

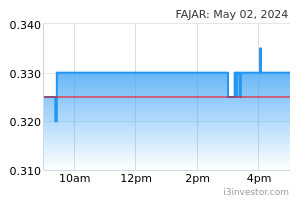

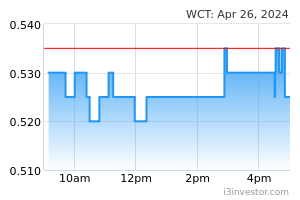

Fajarbaru Builder Group Bhd has won a RM310.5m contract from WCT Holdings Bhd to undertake the main building works for the residential condominium towers located in Mont Kiara, Kuala Lumpur. The main building works consist of three blocks of residential condominium towers comprising 341 units, together with four levels of basement car park and three levels of podium facilities. The tenure for the contract is 35 months, commencing from 15th March 2023. (The Edge)

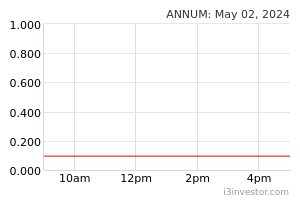

Annum Bhd has called off a collaboration agreement in relation to a RM62.3m subcontract for the Sarawak Water Supply Grid Programme. Annum indirect wholly-owned subsidiary Annum EPCC Sdn Bhd was awarded the subcontract by the main contractor Saratech Sdn Bhd in August 2019. (The Edge)

Source: Mplus Research - 6 Mar 2023