Dampened by external headwinds

Market Review

Malaysia:. The FBM KLCI (-0.7%) retreated with more than two-thirds of the key index components ended in red, taking cue from the weakness on Wall Street. The lower liners also closed lower, while the construction (+0.9%) and transportation & logistics (+0.5%) sectors outperformed the negative sectorial peers.

Global markets:. Wall Street remained downbeat as the Dow (-0.3%) erased all its intraday gains after the US Federal Reserve minutes meeting signalled that interest rate hikes may extend amid the on-going concern over inflationary pressure. Both the European and Asia stockmarkets ended mostly in red.

The Day Ahead

The FBM KLCI retreated from a rebound-attempt yesterday, taking cue from the bearish regional markets following the negative performance on Wall Street. As broad-based selldown persisted on Wall Street, investors may remain cautious while eyeing the inflation data for more clues on the interest rate directions going forward. On the local front, all eyes shall be on the re-tabling of Budget 2023 tomorrow as well as Malaysia’s inflation rate. Commodities wise, the Brent crude oil price staged a pullback towards USD80 following a substantial rise earlier after data showing crude inventory build, while the CPO price hovered above RM4,200.

Sector focus:. While the regional markets may remain negative, investors may look out for trading opportunities in renewable energy, EV, and construction sectors prior to the re-tabling of Budget 2023. Meanwhile, the plantation sector should gain momentum given the solid CPO price.

FBMKLCI Technical Outlook

The FBM KLCI has fallen deeper into the negative territory throughout the session. Technical indicators remained negative as the MACD Histogram is forming a rounding top formation, while the RSI hovered below 50. The key index is moving towards its support at 1,450-1,460, while resistance is pegged along 1,500-1,510.

Company Brief

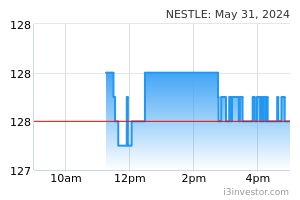

Nestle (M) Bhd’s wholly-owned subsidiary Nestle Products Sdn Bhd has proposed to acquire Wyeth Nutrition (M) Sdn Bhd (Wyeth Malaysia) for RM165.0m. Nestle entered into a conditional share purchase agreement with Wyeth (Hong Kong) Holding Company Limited (Wyeth HK) for the proposed acquisition of 2.0m ordinary shares in Wyeth Malaysia. (The Star)

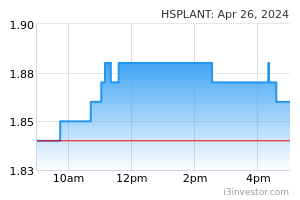

Hap Seng Plantations Holdings Bhd’s 4QFY22 net profit sank 80.0% YoY to RM18.9m, due to higher production costs which were adversely affected by higher fertiliser and diesel costs, and an increase in the minimum wage. Revenue for the quarter fell 26.3% YoY to RM143.6m. (The Star)

(FY2021: 17 sen per share). (The Edge)

Kuala Lumpur Kepong Bhd’s (KLK) 1QFY23 net profit net profit fell 26.1% YoY to RM443.0m as palm oil prices have eased considerably from the historically high levels seen recently. Revenue for the quarter declined 1.5% YoY to RM6.70bn. (The Star)

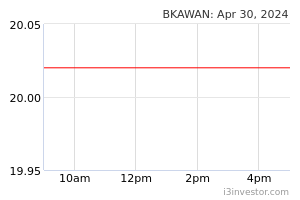

Batu Kawan Bhd’s 1QFY23 net profit declined 28.9% YoY to RM235.3m, dragged down by lower crude palm oil and palm kernel selling prices and impairment losses. It also attributed the lower earnings to a net loss of RM70.1m from fair value changes on outstanding derivative contracts. Revenue in the quarter slipped 1.6% YoY to RM6.99bn. (The Edge)

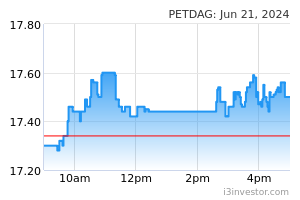

Petronas Dagangan Bhd’s (PetDag) 4QFY22 net profit grew 5.3% YoY to RM144.5m, with all business segments reporting higher earnings on increased demand. Revenue for the quarter rose 33.6% YoY to RM9.50bn. A total dividend of 40.0 sen per share, consisting of a special dividend of 14.0 sen per share and an interim dividend of 26.0 sen per share, payable on 23rd March 2023 was declared. (The Edge)

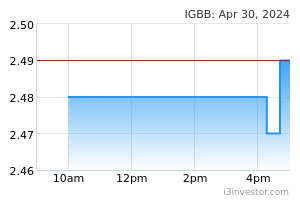

IGB Bhd’s 4QFY22 net profit sank 92.0% YoY to RM18.8m, due to the absence of the RM193.4 m one-off gain from the disposal of a joint venture company in 2021. Revenue for the quarter, however, grew 27.6% YoY to RM383.2m. (The Star)

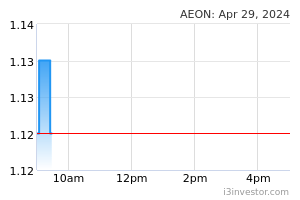

AEON Co (M) Bhd’s 4QFY22 net profit plummeted 64.9% YoY to RM24.9m, mainly due to an increase in promotional activities, maintenance costs and lower reversal of impairment of receivables. Revenue for the quarter, however, rose 7.0% YoY to RM1.06bn. A final dividend of 4.0 sen per share was announced. (The Edge)

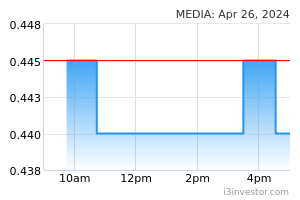

Media Prima Bhd's 2QFY23 net profit fell 21.0% YoY to RM22.9m, as revenue from advertising and home-shopping businesses declined. Revenue for the quarter decreased 20.0% YoY to RM252.7m. (The Edge)

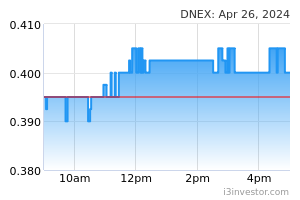

A lawsuit against 2 subsidiaries of Dagang NeXchange Bhd (DNeX) in relation to a shareholders agreement signed in July 2021 was struck out on 22nd February 2023 after the parties reached an out-of-court settlement. The High Court also struck out an application for injunction against DNeX Semiconductor Sdn Bhd (DSSB) and SilTerra Malaysia Sdn Bhd. (The Edge)

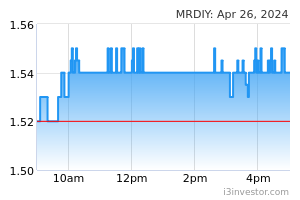

MR DIY Group (M) Bhd has reported that Creador has ceased to be a substantial shareholder in the home improvement retailer after it offloaded another 65.0m shares on 22nd February 2023. Creador's deemed interest in MR DIY fell to 4.9% or 464.6m shares. (The Edge)

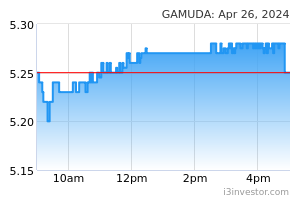

Gamuda Bhd has executed an asset sale agreement to acquire the Australian transport projects business at an enterprise value of AUSD212.0m (RM636.0m). Its Australian unit DT Infrastructure Pty Ltd inked the agreement on 22nd February 2023 to take over Downer’s Australian transport projects business which provides civil construction services in delivering transport projects, with specialist rail capability from Downer EDI Works Pty Ltd and VEC Civil Engineering Pty Ltd. The cash deal, which is expected to be completed by June 2023, will be financed by internally-generated funds as well as borrowings. (The Edge)

Source: Mplus Research - 23 Feb 2023