Market Review

Malaysia:. The FBM KLCI (-0.5%) extended its decline with more than half of the key index components closed in red, taking cue from the weakness on Wall Street overnight. The lower liners also retreated, while the telco & media (+0.2%) and industrial products & services (+0.03%) sectors outperformed the negative peers.

Global markets:. The US stockmarkets ended mixed as the Dow (+0.4%) advanced, but the S&P 500 (-0.3%) and Nasdaq (-0.6%) were bogged down by comments from US Federal Reserve officials that were backing for larger interest rate hikes. Elsewhere, both the European and Asia stockmarkets closed mostly in red. The Day Ahead The FBM KLCI consolidated further last Friday amidst bearish sentiment across the regional markets. However, we believe bargain hunting activities may emerge on the local bourse after a broad-based selldown ahead of the re-tabling of Budget 2023, but the global sentiment could weighed further by renewed concerns over expectations of larger interest rate hikes going forward. This week, investors may keep an eye on the US FOMC minutes, US GDP growth rate (second estimates), Eurozone’s inflation rate, Malaysia’s inflation rate, as well as the re-tabling of Budget 2023. Commodities wise, the Brent crude oil price hovered above USD83, while the CPO price climbed above RM4,100.

Sector focus:. The plantation sector may gain traction in view of the firmer CPO commodities prices hovering above RM4,100. Besides, construction, building material, and renewable energy sectors may look attractive prior to the re-tabling of Budget 2023 on the upcoming Friday.

FBMKLCI Technical Outlook

The FBM KLCI slid below EMA60, lying just above its daily EMA120 level after hovering in the negative territory for the entire session. Technical indicators turned mixed as the MACD Histogram extended a positive bar and the RSI moved below 50. Resistance is set at 1,525-1,540, while support is pegged along 1,450-1,460.

Company Brief

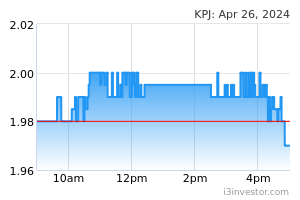

KPJ Healthcare Bhd’s 4QFY22 net profit surged 255.2% YoY to RM72.1m, on increased in patient visits and bed occupancy rate. Revenue for the quarter rose 14.7% YoY to RM780.9m. (The Star)

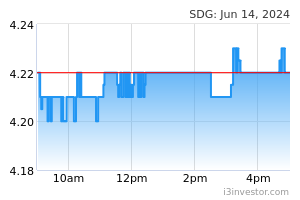

Sime Darby Plantation Bhd’s 4QFY22 net profit rose 20.3% YoY to RM562.0m, driven by lower non-recurring loss and tax charges, which offset the 2.0% and 4.0% drop in FFB production and realised CPO prices respectively. Revenue for the quarter increased YoY 2.2% YoY to RM5.67bn. A final dividend of 6.04 sen per share, payable on 15th May 2023 was declared. (The Edge)

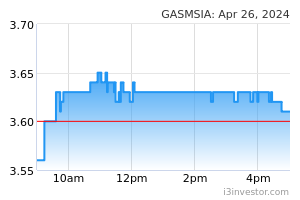

Gas Malaysia Bhd's 4QFY22 net profit rose 37.4% YoY to RM95.2m, on the back of higher gross profit, lower finance cost and higher finance income. Revenue for the quarter added 14.6% YoY to RM2.22bn. A second interim dividend of 8.24 sen per share, payable on 31st March 2023 was declared. (The Edge)

Malaysia Smelting Corp Bhd’s (MSC) 4QFY22 net profit declined 59.6% YoY to RM25.9m, due to lower average tin price that offset the higher sales of refined tin. Revenue for the quarter, however, rose 53.4% YoY to RM391.2m. (The Edge)

Classic Scenic Bhd’s 4QFY22 net profit increased 22.9% YoY to RM4.2m, mainly thanks to the strong USD and lower operating expenses. Revenue for the quarter, however, was marginally lower by 1.0% YoY to RM17.7m. Separately, the group proposed a 1-for-1 bonus issue of up to 361.5m shares and the exercise is expected to be completed in 2Q23. (The Edge)

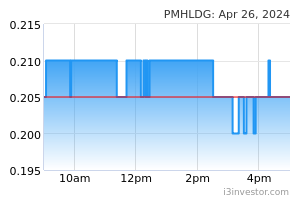

Pan Malaysia Holdings Bhd (PMH) and its 68.3% shareholder Malayan United Industries Bhd (MUI) are fighting back against a new lawsuit alleging that the sale of three firms; PM Securities Sdn Bhd, PCB Asset Management Sdn Bhd and Miranex Sdn Bhd to NewParadigm Capital Ventures Sdn Bhd for RM90.0m cash are in breach of Section 223 of the Companies Act 2016. On 14th February 2023, both PMH and MUI had received an originating summons and notice of application for interim injunction of the sales from Chan Weng Fui, a shareholder of Pan Malaysia Capital Bhd (PMC) with a direct stake of 4.8%. (The Edge)

Tan Sri Zainun Ali has returned to helm Malaysia Airports Holdings Bhd (MAHB) two-and-half years after stepping down as its non-independent non-executive chairman. Zainun, 71, has been appointed to the same position with effect from 17th February 2023. The former Federal Court judge succeeds Datuk Seri Dr Zambry Abdul Kadir, who vacated the chairman’s post after his appointment as the country's foreign affairs minister. (The Edge)

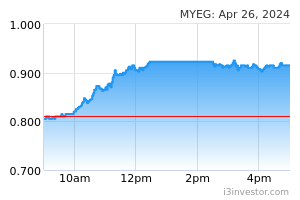

MyEG Services Bhd continued its share buyback spree on 17th February 2023, raising the amount spent by the company to mop up its own shares since 7th February 2023 to RM10.7m. The latest buyback involved 4.0m shares at a price of between 66 sen and 68.5 apiece, for a total sum of RM2.7m. In total, MyEG has bought back 16.0m shares for RM10.7m in the repurchase exercise since 7th February 2023. (The Edge)

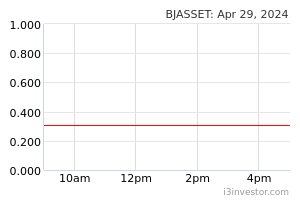

Berjaya Assets Bhd’s (BAssets) 2QFY23 net loss narrowed to RM1.9m, from a net loss of RM2.0m recorded in the previous corresponding quarter, on the back of a higher revenue, which offset by higher finance costs. Revenue for the quarter rose 24.1% YoY to RM58.3m. (The Edge)

Source: Mplus Research - 20 Feb 2023