Summary

- ELKDESA 3Q23 core net profit grew 7.5% YoY to RM11.1m, bringing a significant 101.9% YoY jump in 9M23 to RM40.2m. The results came in above expectations, amounting to 84.8% of our previous full year forecast at RM47.4m and 103.1% of consensus forecast at RM39.0m. Key deviations were largely due to a lower-than expected impairment allowance on hire purchase receivables.

- YoY, the bottom line growth was mainly due to a higher contribution from the hire purchase segment, resulted from an increase in hire purchase portfolio which outweighed the increase in impairment allowance. On the other hand, the furniture segment saw lower sales in current quarter. QoQ, core net profit slid 3.4% owing to lower contribution from the hire purchase segment.

- The impairment allowance on hire purchase receivables increased 83.4% YoY to RM3.8m, mainly due to an absence of significant credit recovery in current quarter as compared to the previous corresponding quarter when MCO was uplifted. Hence, credit loss charge increased from 0.4% to 0.7% YoY.

- In line with the ELKDESA’s strategic direction to grow its hire purchase portfolio amidst economic recovery environment, the group increased its hire purchase receivables 19.4% YoY and 7.5% QoQ to RM560.3m. Demand for hire purchase receivables was driven by the growth of online trading platforms for used cars, as well as the introduction of a higher minimum wage rate of RM1,500.

- Liabilities wise, the group’s bank borrowings increased by 51.9% YoY to RM198.6m as a result of higher drawdown of block discounting facilities to support the increased hire purchase receivables. As at 3Q23, the group’s gearing remains at a low level of 0.43 times.

- Moving forward, we believe a continuous expansion in the hire purchase receivables portfolio, coupled with an increase in market share for used car hire purchase financing, will be the key driver for ELKDESA’s performance. However, we do not foresee the reversal trend of impairment allowance on hire purchase receivables in 1H23 to continue.

Valuation & Recommendation

- As the earnings came in above our expectations, we upgrade our earnings forecast by 6.1% to RM50.3m and 12.0% to RM48.5m for FY23f and FY24f respectively. The earnings forecast will take into account a greater hire purchase portfolio amid stronger demand for used-car hire purchase financing, as well as the gradually normalising impairment allowance on hire purchase receivables.

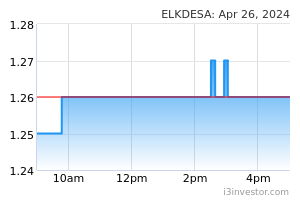

- We maintained our HOLD recommendation on ELKDESA, with a revised target price of RM1.53. The target price is derived by ascribing a P/E of 0.95x to FY24f book value per share of RM1.61. Meanwhile, ELKDESA remained committed to distribute not less than 60.0% of its net profit after tax.

- Downside risks to our recommendation include rising living cost and expiry of loan moratoriums given by banks that may impact borrowers’ disposable incomes and their repayment ability. Besides, any logistics disruption could cause supply chain constraints and delay shipment for the furniture segment.

Source: Mplus Research - 17 Feb 2023