Solidifying above SMA200

Market Review

Malaysia:. The FBM KLCI (+0.4%) registered its fourth winning session, driven by the eleventh-hour buying support in Petronas-related and telco heavyweights yesterday. The lower liners also extended their gains, while the telco & media (+1.1%) sector outperformed the mostly positive sectorial peers.

Global markets:. The US stockmarkets closed higher as the Dow (+0.1%) was buoyed by the strong retail sales data that expanded 6.4% YoY in January 2023. The European stockmarkets also closed upbeat, but Asia stockmarkets ended mostly negative.

The Day Ahead

The FBM KLCI outperformed the regional markets on the back of final-hour bargain hunting activities as well as the inflow from foreign investors. While Wall Street notched higher overnight, we believe the global sentiment could remain shaky in view of the strong retail data, which might indicate potential interest rate hikes by the US Fed going forward. However, closer to home, investors might be relatively positive prior to the earnings season and the re-tabling of Budget 2023. Commodities wise, the Brent oil price stayed above USD85, while the CPO price hovered above RM3,900.

Sector focus:. The technology sector may be in focus as the Nasdaq crossed above the key 12,000 level overnight. Besides, the banking, telecommunications, REIT, and selected consumer stocks might be under the limelight amidst persisted buying from foreign funds.

FBMKLCI Technical Outlook

The FBM KLCI registered its fourth straight session of gains. Technical indicators however were mixed as the MACD Histogram extended a negative bar, while the RSI is hovering above 50. Resistance is monitored at 1,525-1,540, while support is pegged along 1,450-1,460.

Company Brief

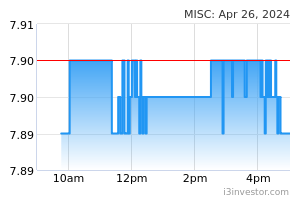

MISC Bhd’s 4QFY22 net profit climbed 39.7% YoY to RM645.0m, on the back of improved contribution from various segments. Revenue for the quarter improved 35.3% YoY to RM4.17bn. An interim dividend of 12.0 sen per share, payable on 15th March 2023 was declared. (The Star)

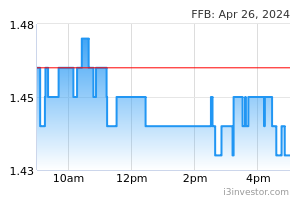

Farm Fresh Bhd has proposed to take up a 65.0% stake in ice cream chain The Inside Scoop Sdn Bhd (TISSB) for RM83.9m. The dairy producer will first acquire a 53.0% stake from the chain's existing shareholders for RM68.4m. Of this purchase price, RM48.4 m will be paid in cash, while the remaining RM20 m will be satisfied via the issuance of new shares in Farm Fresh. Subsequently, Farm Fresh will acquire 12.0% of the enlarged issued TISSB shares for RM15.5m. (The Edge)

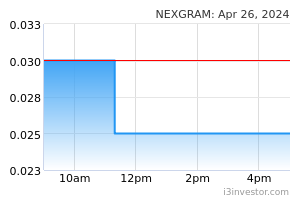

Nexgram Holdings Bhd has terminated a deal with Melaka Corporation (MCorp) pertaining to the acquisition of a 10.0-ha. piece of land in the state for RM61.5m. This was because the pair were unable to fulfil certain conditions required under the agreement after numerous extensions of time. (The Edge)

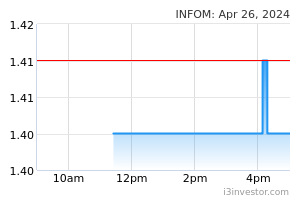

Infomina Bhd's unit, PT Infomina Solution Indonesia has secured a maintenance and support contract worth USD3.3m (RM14.5m) from PT Bank Maybank Indonesia TBK, boosting its ambitions of expanding into the country. The duration of the contract is 5 years till 29th November 2027. (The Edge)

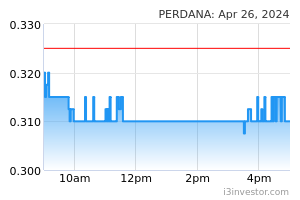

Perdana Petroleum Bhd’s 4QFY22 net profit stood at RM20.5m vs. a net loss of RM264.8m recorded in the previous corresponding quarter, mainly due to a reversal of impairment loss on property, plant and equipment of RM11.4m, lower depreciation charges of RM17.2m and a higher utilisation rate. Revenue for the quarter rose 25.8% YoY to RM55.2m. (The Edge)

Hume Cement Industries Bhd’s 2QFY23 net profit declined 41.0% YoY to RM4.5m, dragged down by higher input costs from coal and electricity that offset the revision in cement’s retail selling price and higher sales volume. Revenue for the quarter, however, rose 32.0% YoY to RM255.3m. (The Edge)

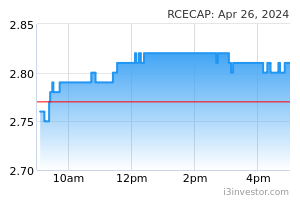

RCE Capital Bhd’s 3QFY23 net profit rose marginally by 1.4% YoY to RM35.2m, mainly driven by an ongoing sales campaign and higher early settlement income arising from increased refinancing activities by customers. Revenue for the quarter climbed 6.1% YoY to RM81.6m. (The Edge)

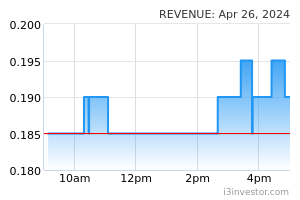

Two extraordinary general meetings (EGMs) of Revenue Group Bhd fixed for 17th February 2023 pertaining to the removal of directors, will not be held pending further direction from the High Court. The court had on 13th February 2023 granted an ad interim order to restrain the e-payment solution provider from proceeding with either of the EGMs, pending the determination of an interim injunction application filed by its co-founders Brian Ng Shih Chiow and Dino Ng Shih Fang. (The Edge)

Source: Mplus Research - 16 Feb 2023