Ending lower ahead of mid-week break

Market Review

Malaysia:. The FBM KLCI (-0.9%) turned lower, dragged by month-end portfolio rebalancing activities by institutional players as the key index fell 0.7% MoM. The lower liners also retreated, while all 13 major sectors on the broader market closed in red with the healthcare sector (-1.5%) taking the biggest blow.

Global markets:. The US stockmarkets advanced as the Dow (+0.02%) rose after the US Federal Reserve downshifted to a 0.25% rate hike after acknowledging that the inflation has started to ease. The European stockmarkets closed mixed, but Asia stockmarkets finished mostly higher.

The Day Ahead

The FBM KLCI took a breather before heading into the Federal Territory Day holiday as investors stayed cautious prior to the US Fed’s FOMC meeting. Meanwhile, the quarter-point rate hike from the Fed is within the market’s expectation and it has reversed the negative mood on Wall Street to close in the positive zone; this might be suggesting that the market has priced in the interest rate impact and acknowledging that the inflationary pressure has been easing. Hence, we believe the positive sentiment on both Wall Street and the regional markets will spill over to the local bourse. Commodities wise, the Brent crude oil traded around USD82, while the CPO price fell near the RM3,800/MT level.

Sector focus:. The technology sector may gain momentum after a strong surge on Wall Street. Meanwhile, investors may take a breather on energy stocks given the pullback in Brent oil price and remain focused on sectors such as travel related, transportation, and consumer.

FBMKLCI Technical Outlook

The FBM KLCI retreated, closing below its daily EMA20 and just above the SMA200 level. Technical indicators remained mixed as the MACD Histogram extended a negative bar, while the RSI is hovering above 50. Support is located at 1,450-1,460, while the resistance is set around 1,525-1,540.

Company Brief

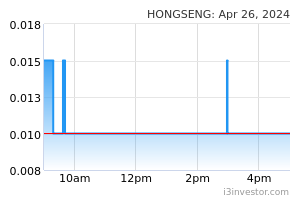

Hong Seng Consolidated Bhd has entered into a share sale agreement with Innov8tif Consortium Sdn Bhd to acquire 717,570 shares or 51.0% stake in Innov8tif Holdings Sdn Bhd for RM30.6m. The acquisition would pave the way for the company to venture into the digital industry. (The Star)

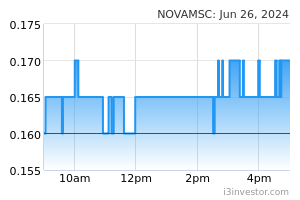

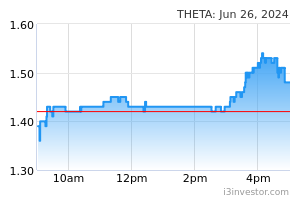

NOVA MSC Bhd has entered into a memorandum of understanding (MoU) with Theta Edge Bhd on the joint marketing and promotion of healthcare, public sector and applied artificial intelligence (AI) solutions and products in Malaysia and other Asean countries. The MoU will remain in force for 12 months and both parties have agreed to enter into commercial discussion at a later stage to determine the sharing of revenue derived from the collaboration. (The Star)

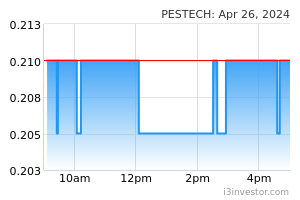

Pestech International Bhd has confirmed that 2 of its top executives have been charged for allegedly abetting the misappropriation of RM10.6m related to its wholly-owned subsidiary, PESTECH Technology Sdn Bhd. Both executive chairman Lim Ah Hock and managing director-cum-group chief executive officer Lim Pay Chuan were charged at Shah Alam Sessions Court on 27th January 2023. (The Edge)

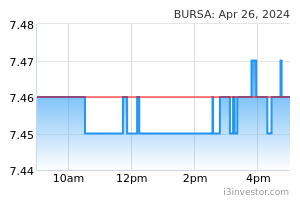

Bursa Malaysia Bhd’s 4QFY22 net profit declined 24.6% YoY to RM49.0m, due to lower trading revenue in the securities market. Revenue for the quarter fell 11.8% YoY to RM145.7m. A final dividend of 11.5 sen per share, payable on 1st March 2023 was declared. (The Edge)

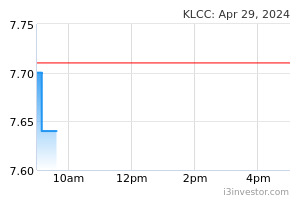

KLCCP Stapled Group Bhd’s 4QFY22 net profit surged 297.4% YoY to RM279.5m, boosted by strong recovery in the retail and hotel segments. Revenue for the quarter increased 18.7% YoY to RM413.3m. A dividend of 14.0 sen per stapled security, payable on 28th February 2023 was declared. (The Edge)

Pavilion Real Estate Investment Trust’s (Pavilion REIT) 4QFY22 net property income (NPI) rose 17.2% YoY to RM96.9m, on higher rental income that covered that higher utilities and maintenance costs. Revenue for the quarter added 17.3% YoY to RM145.8m. A distributable income of 2.21 sen per unit, payable on 28th February 2023 was declared. (The Edge)

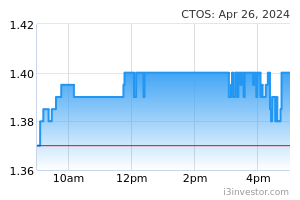

CTOS Digital Bhd’s 4QFY22 net profit rose 13.1% YoY to RM13.7m, driven by stronger demand for its products and services. Revenue for the quarter expanded 36.0% YoY to RM52.7m. (The Edge)

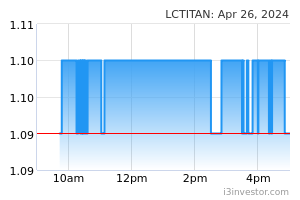

Lotte Chemical Titan Holding Bhd’s 4QFY22 net loss stood at RM317.2m vs. a net profit of RM168.9m recorded in the previous corresponding quarter, due to a decline in margin spread amid weakened market demand resulting from a volatile external environment, higher foreign exchange losses of RM32.7m and its share of loss from Lotte Chemical USA Corporation (LC USA) of RM6.4m. Revenue for the quarter declined 23.0% YoY to RM2.07bn. (The Edge)

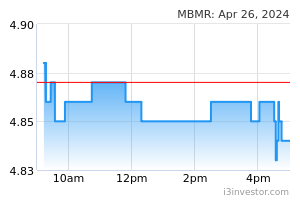

MBM Resources Bhd has appointed Aqil Ahmad Azizuddin as its new chairman with immediate effect, succeeding Datuk Dr Aminar Rashid Salleh. Aqil, 64, is no stranger to the group, as he had previously sat on the board from 2001 till 2017, and is currently chairman of Med-Bumikar MARA Sdn Bhd and Daihatsu (Malaysia) Sdn Bhd. Aqil is also a board member in Perusahaan Otomobil Kedua Sdn Bhd and Perodua Sales Sdn Bhd. (The Edge)

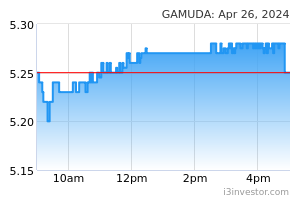

Gamuda Bhd has redesignated former Auditor General Tan Sri Ambrin Buang as the group’s new chairman, succeeding Datuk Mohammed Che Hussein, who retired in December 2022. Ambrin, 74, joined Gamuda’s board in September 2018 as the construction giant’s independent non-executive director. (The Edge)

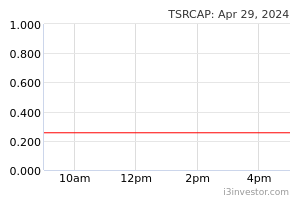

TSR Capital Bhd's independent, non-executive chairman Tan Sri Mohamad Noor Abdul Rahim has resigned due to personal reasons. He had been chairman of the construction group since October 2015. The group's senior independent nonexecutive director Tan En Chong, 73, has also resigned due to personal reasons. The group appointed Lee Siew Chen, who has several years of experience in taxation, as its new independent non-executive director. (The Edge)

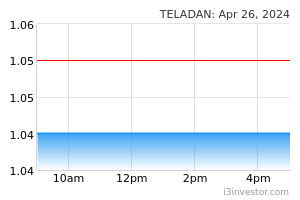

Teladan Setia Group Bhd through its wholly-owned subsidiary Asal Harta Sdn Bhd has entered into a sales and purchase agreement with Megan Mastika Sdn Bhd to purchase a piece of vacant commercial land in Melaka Tengah for RM48.5m. The land, which measures approximately 7.5-ac, will be developed into a health and wellness centre as well as serviced apartments. (The Edge)

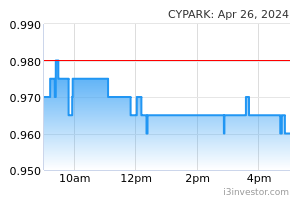

Cypark Resources Bhd is not aware of any explanation for the unusual trading volume of its shares recently, except for the completion of its private placement and the emergence of Jakel Group’s investment arm as its new substantial shareholder, which may have boosted investor confidence. (The Edge)

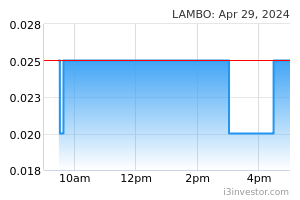

Lambo Group Bhd’s external auditor has expressed a disclaimer of opinion in the group’s financial statement due to lack of audit evidence on financials relating to its subsidiary Fujian Accsoft Technology Development Co Ltd. CAS Malaysia PLT expressed the disclaimer of opinion in Lambo’s financial statement for the 16- month period ended 30th September 2022. (The Edge)

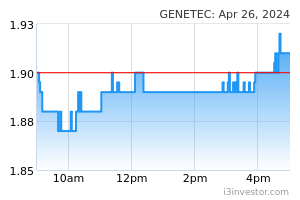

Genetec Technology Bhd has fixed the issue price of its private placement exercise at RM2.61 per share to raise RM178.0m. The issue price represents a discount of 2.7% to the volume weighted-average of the shares for the 5 market days up to and including 30th January 2023 of RM2.6821 per share. The funds will be mainly used for its business expansion, particularly to improve and upgrade its manufacturing facilities for automated industrial systems and equipment, and the provision of value-added services for customers in the electric vehicle and energy storage industries as well as working capital requirements. (The Edge)

Source: Mplus Research - 2 Feb 2023