Ending the week on flat note

Market Review

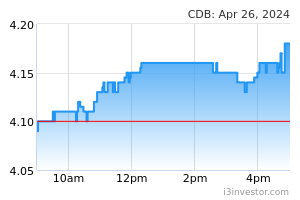

Malaysia:. The FBM KLCI (-0.1%) extended its decline after reversing the intraday gains that was marred by the weakness in selected banking heavyweights. The lower liners, however, extended their winning run, while the energy sector (+1.2%) outperformed the mostly positive sectorial peers on higher crude oil prices.

Global markets:. The US stockmarkets edged slightly higher as the Dow (+0.1%) rose after the consumer sentiment index rose to 64.9 in December 2022; the highest level since April 2022. The European stockmarkets extended their gains, while the Asia stockmarkets ended mostly higher.

The Day Ahead

The FBM KLCI has ended marginally below 1,500 dragged by the weakness on the banking sector as BNM maintained the OPR at 2.75%. However, with the positive sentiment from Wall Street, we believe the buying interest may spillover to the broader market, providing an upside towards the lower liners, especially the technology sector. Global stock markets could see further recovery on the back of decent US GDP data coupled with the recovery theme from China, which may boost the recovery further going forward. Commodities wise, the Brent crude oil is trading along USD86-87 zone, while the CPO price is hovering above RM3,900/MT.

Sector focus:. We believe the O&G sector could trade on a positive note until the upcoming reporting season amid firmer Brent oil price. With the Nasdaq surged near 1% overnight, the technology sector may trade higher for the near term. Malaysia PM Anwar Ibrahim is visiting Singapore today to promote digital economy and green economy, and investors may anticipate discussions on KL-SG HSR.

FBMKLCI Technical Outlook

The FBM KLCI is consolidating sidesways below the 1,500 level. Meanwhile, the MACD Indicator remains positive and the RSI is hovering above 50; suggesting that the FBM KLCI is positive biased tone at this juncture. The resistances are pegged around 1,525-1,540, while the support is located at 1,450-1,460.

Company Brief

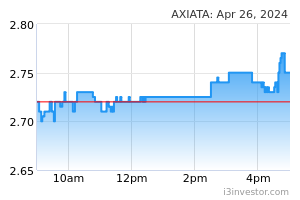

Digi.com Bhd announced a proposal to change its name to CelcomDigi Bhd following its successful merger with Celcom Axiata Bhd. The proposed change of name was in conformance with the company’s obligation under the share purchase agreement dated 21st June 2021 with Axiata Group Bhd in relation to the merger with Celcom Axiata. (The Star)

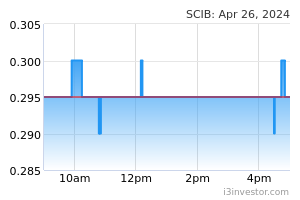

Sarawak Consolidated Industries Bhd (SCIB) has withdrawn from proposed engineering, procurement, construction and commissioning (EPCC) contracts involving a specialist hospital project in Johor Bahru. The group had issued a letter of withdrawal to Kencana Healthcare Sdn Bhd, and it was accepted on 26th January 2023. Kencana would reimburse the commitment fee totalling RM1.7m that it had paid in 2 tranches under a settlement agreement. (The Edge)

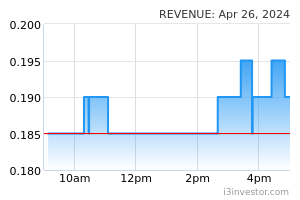

Revenue Group Bhd has confirmed that 2 of its directors; Brian Ng Shih Chiow and his younger brother Dino Ng Shih Fang have been arrested by the Malaysian AntiCorruption Commission (MACC) over an alleged false claim relating to the purchase of thermal printing paper worth more than RM400,000. Its business and operation are not affected by MACC’s arrest of the two directors as they have been suspended from their executive functions earlier. The e-payment solutions provider will hold 2 separate extraordinary general meetings (EGMs) virtually on 17th February 2023. The first EGM at 10.00am will vote on the current board's resolution to remove Brian and Dino as directors of the group. The second EGM at 4.00pm has been requisitioned by Brian in an effort to remove the current board. (The Edge)

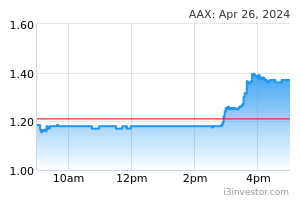

AirAsia X Bhd (AAX) flew 337,638 passengers in 4Q22, surging 324.4% QoQ from 3Q22 period, as travel recovery gained momentum in tandem with the peak travel season. Passenger load factor rose to 79.0%, from 73.0% as it focused on flying the most popular and profitable routes. (The Edge)

Malaysia Airports Holdings Bhd (MAHB) saw monthly passenger movements reaching a record high in December 2022, with 6.8m passengers for its operations in Malaysia. The year-end holiday season contributed to the significant 31.0% MoM increase, and enabled the airport operator to reach 50.0% of 2019 levels for its Malaysian operations. (The Edge)

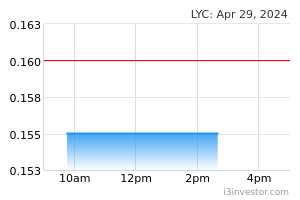

LYC Healthcare Bhd is expecting the listing of its subsidiary, LYC Medicare (Singapore) Pte Ltd (LYCSG), on the Catalist Board of the Singapore Exchange Securities Trading Ltd to be completed by 1H23. The proposed listing would raise gross proceeds of SGD11.2m (RM36.1m) and would accrue entirely to LYCSG. (The Edge)

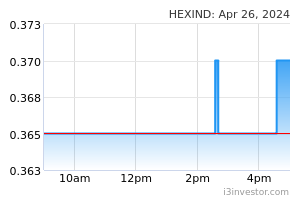

Hextar Industries Bhd’s 5QFY22 net profit grew 29.8% QoQ to RM4.0m, mainly due to better profit margin achieved from the products’ sales mix. Revenue for the quarter, however, decreased 6.9% QoQ to RM57.2m. There is no YoY comparative figures as the group recently changed its financial year end from 31st August to 31st December. (The Edge)

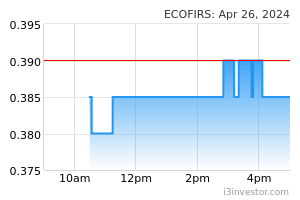

EcoFirst Consolidated Bhd’s 2QFY23 net loss widened to RM4.1m, from a net loss of RM1.9m recorded in the previous corresponding quarter, due to higher finance costs after the end of the moratorium period. Revenue for the quarter, however, rose 38.1% YoY to RM5.1m. (The Edge)

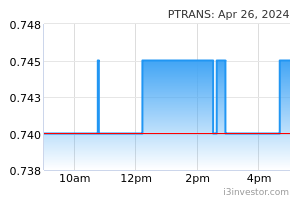

Perak Transit Bhd, which in early December 2022 inked a deal with edotco Malaysia Sdn Bhd's 79.0%-owned On Site Services Sdn Bhd to provide construction and engineering services to On Site Services for the building of telecommunication towers, has now accepted an extended agreement to extend its services to another edotco subsidiary. Perak Transit accepted the extended agreement to provide the same scope of services to Touch Matrix Sdn Bhd via its wholly owned PTrans Resources Sdn Bhd. (The Edge)

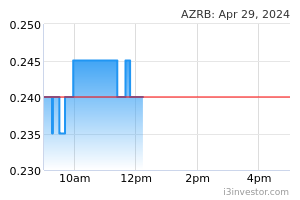

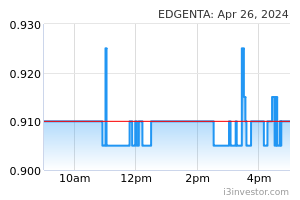

UEM Edgenta Bhd’s unit has withdrawn its winding up petition against Ahmad Zaki Resources Bhd (AZRB)’s wholly owned Ahmad Zaki Sdn Bhd (AZSB) after the pair mutually agreed that AZSB would settle an RM11.1m outstanding sum by way of 11 monthly instalments. The outstanding sum relates to a sub-contract work for the protection and relocation of utilities that Edgenta Propel Bhd (UEM Edgenta’s unit) awarded to AZSB under the Klang Valley Mass Rapid Transit Putrajaya Line (MRT2) project in 2016. (The Edge)

Source: Mplus Research - 30 Jan 2023