Slight pullback in FBM KLCI

Market Review

Malaysia: The FBM KLCI (-0.1%) resumed trading on a lacklustre manner as the key index failed to sustain its position above 1,500. The lower liners, however, marched higher, while the energy sector (+2.9%) rallied to close at the highest level since May 2021 on the brighter outlook on crude oil demand.

Global markets: The US stockmarkets closed mixed as the Dow ended relatively flat, while the S&P 500 recovered most of its intraday losses to close 0.02% lower on mixed corporate earnings released from AT&T and Boeing. The European stockmarkets also retreated, but the Asia stockmarkets ended mostly higher.

The Day Ahead

The FBM KLCI failed to build onto the positive momentum from the pre-CNY moves as the key index lost ground on quick profit taking activities. Still, we are banking on the recovery theme from China which will boost the FBM KLCI above the 1,500 level, while the lower liners may continue to capitalise on the improved trading environment and enjoy further rotational play. Globally, the focus will shift to the preliminary reading of the US 4Q22 GDP data tonight. Commodities wise, the Brent crude oil edged slightly higher to stay above USD86/bbl, but the CPO price slipped below RM3,800/MT on further profit taking activities.

Sector focus: The energy sector is expected to stay focus by the firm oil prices amid China’s recovery, while focusing on the OPEC meeting on 1st February 2023. The record high automotive total industry volume registered in 2022 may lift the automotive-related stocks. On the flipside, the financial services sector may undergo a consolidation following the pause of OPR hike by Bank Negara.

FBMKLCI Technical Outlook

The FBM KLCI took a step back, retreating marginally below 1,500. Technical indicators remained positive as the MACD Histogram marched higher, while the RSI remains above 50. Should 1,500 be re-tested again, the next resistances are envisaged around 1,525-1,540, supports are located at 1,450-1,460.

Company Brief

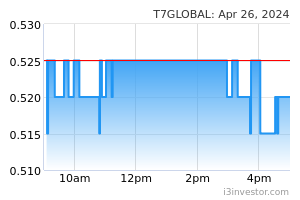

T7 Global Bhd has secured 2 contracts worth a combined value of about RM100.0m under its energy division for recruitment and manpower services and offshore construction services. The first award was from the PTTEP Group of Companies for the provision of headhunting and recruitment services. The second award was from Hibiscus Oil & Gas Malaysia Ltd for the provision of facilities decommissioning services for South Angsi Alpha. (The Star)

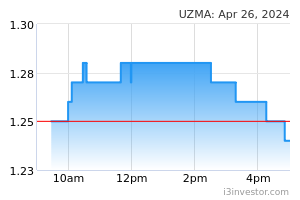

Uzma Bhd's 70.0%-owned subsidiary Malaysian Energy Chemical & Services Sdn Bhd has accepted a contract from Sarawak Shell Bhd for the provision of a kinetic hydrate inhibitor, corrosion inhibitor and associated services for the Shell Timi field. The contract is valued at RM40.0m over 5-year duration from 20th January 2023 to 19th January 2028. (The Star)

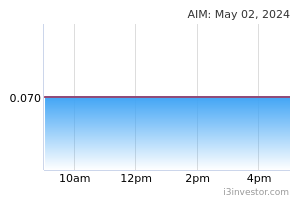

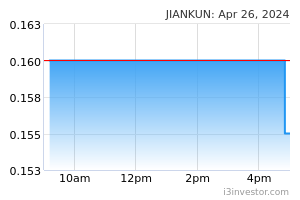

Jiankun International Bhd’s single largest shareholder Advance Information Marketing Bhd (AIM) has ceased to be its substantial shareholder due to the dilution of shareholding arising from Jiankun’s private placement exercise. Advance Information, which held 7.7%, representing 16.4m shares as at 22nd April 2022, has had its shareholding diluted to 4.8%. (The Edge)

PLS Plantations Bhd has proposed a placement of up to 56.2m new shares at 95.0 sen per share to meet its public shareholding spread, and to part-fund its future plantation business expansion in Pahang. Based on the minimum scenario of its placement (40.0m shares representing 10.0% of its existing share base), its public shareholding spread will rise to 20.2%, from 12.3% as at end-2022. (The Edge)

Duopharma Biotech Bhd has received another contract extension to 30th June 2023 for the supply of pharmaceutical and non-pharmaceutical products to hospitals and clinics from Pharmaniaga Logistics Sdn Bhd (PLSB), a unit of Pharmaniaga Bhd extending the contract term. (The Edge)

Yinson Holdings Bhd’s contract for the operation of a floating, production and storage and offloading asset for the Agogo Integrated West Hub development project in Angola has been extended up to 20th February 2023. The initial 60-day agreement, with an aggregate value of USD218.0m (RM956.0m), was signed on 2nd December 2022, to commence preliminary works. Save for the extension of the tenure, the terms under the extension and the value of the contract remain unchanged. (The Edge)

Atlan Holdings Bhd’s 75.5%-owned subsidiary listed on the Singapore Exchange, Duty Free International Ltd (DFIL), has lodged a police report after discovering that an organisation or individuals based in Ghana are passing off as DFIL and running a scam. The scam promotes the transfer of funds to the organisation or persons, and to an investment scheme on a Binance platform. (The Edge)

Source: Mplus Research - 26 Jan 2023