Minor scale back

Market Review

Malaysia:. The FBM KLCI (-0.6%) staged a pullback with more than two-thirds of the key index components closed in red, taking cue from the weakness on Wall Street overnight. The lower liners closed mixed, while the healthcare sector (-1.4%) underperformed after retreating for the third straight session.

Global markets:. Wall Street rebounded as the Dow (+0.6%) rose on expectations that the upcoming release of the US CPI data would be softer and that may potentially soften the US Federal Reserve hawkish stance. The European stockmarkets, however, retreated, while the Asia stockmarkets ended mixed.

The Day Ahead

The FBM KLCI traded lower for the session as investors took profit prior to Jerome Powell’s speech and the US CPI data later this week. While the expectations of a tighter monetary policy may continue to weigh on market, we believe the local bourse could be on track for further recovery as the reopening of China’s border will dominate investors’ sentiment over the near term. Commodities wise, the Brent crude oil price climbed above USD80, driven by the expectation of strong demand growth following the China’s reopening. Meanwhile, the CPO price hovered above RM3,950.

Sector focus:. Investors may favour the technology sector following the advance in Nasdaq overnight. Following a pullback in transportation & logistics stocks yesterday, the sector may stage a rebound, supported by the China’s reopening theme. Besides, the energy sector may gain traction with the crude oil price crossing slightly above the USD80 per barrel mark.

FBMKLCI Technical Outlook

The FBM KLCI digested gains from previous session but remained above its daily EMA9 level. Technical indicators were mixed as the MACD Histogram extended a negative bar, while the RSI is hovering above 50. Resistance is pegged along 1,500- 1,510, while support is located at 1,450-1,460.

Company Brief

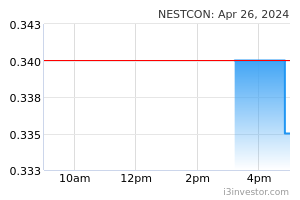

Nestcon Bhd has accepted a letter of award worth RM200.0m from Armada Istimewa Sdn Bhd for the development of a mixed commercial development in Kuala Lumpur. The overall completion for the contract works is within 41 months, including the mobilisation period, all festivals and public holidays and is expected to be completed on or before 16th June 2026. (The Star)

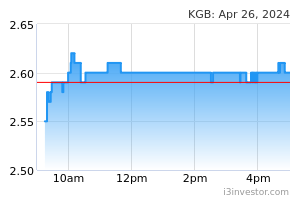

Kelington Group Bhd has won a contract worth RM170.0m to undertake construction works with respect to an integrated chip manufacturing facility at Sama Jaya Free Industrial Zone in Kuching. The said construction work shall commence in January 2023 and is expected to be completed by March 2024. (The Star)

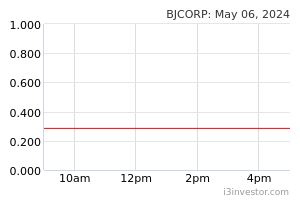

Berjaya Corp Bhd is in the midst of negotiations for the proposed acquisition of a controlling stake in MCIS Insurance Bhd as the group is in talks with South Africabased Sanlam Ltd to purchase the latter’s 51.0% stake in MCIS Life. Koperasi MCIS Bhd holds another 44.4% equity interest in MCIS Life, while the remaining shares are held by individuals. (The Edge)

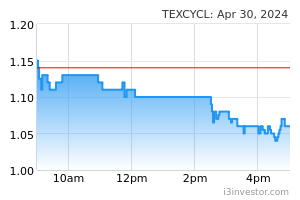

Tex Cycle Technology (M) Bhd has proposed to dispose of 2 detached factories in Puchong for RM19.0m, which is expected to result in a gain on disposal of approximately RM13.7m. Proceeds from the disposal would be used for general working capital requirements in respect of its day-to-day operations to support its existing business operations. (The Edge)

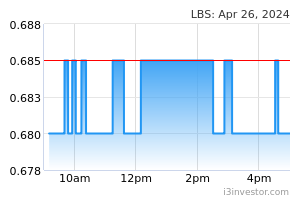

LBS Bina Group Bhd has set a sales target of RM2.00bn for 2023, after it closed off 2022 with RM2.00bn in property sales that surpassed its sales target of RM1.60bn. The group’s plans to launch 12 new projects in 2023 covering the Klang Valley, Johor, Pahang and Perak, with a total gross development value (GDV) of RM2.09 bn and 4,021 cumulative units across all property types. (The Edge)

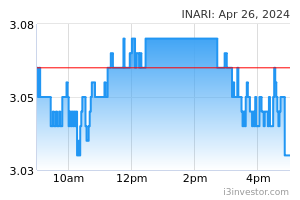

Inari Amertron Bhd, which saw its stock price fall by as much as 25.0 sen or 8.9% to an intraday low of RM2.55 yesterday has reported that it is unlikely to be affected by news that consumer electronics giant Apple Inc might be dropping Broadcom Inc's chip from its devices. Inari’s exposure to Broadcom's business is more on RF chips. In short, Inari should see muted impact, even if Broadcom's WiFi and Bluetooth chips were to be replaced. (The Edge)

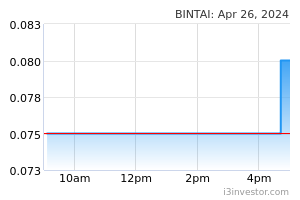

Bintai Kinden Corp Bhd is venturing into digital assets via its unit Bintai Trading Sdn Bhd (BTSB) as part of the group’s treasury management and for the longerterm needs in its business expansion. BTSB has an account with a digital currency exchange licensed by the Securities Commission Malaysia. (The Edge)

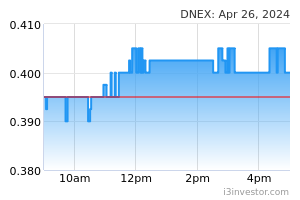

The composition of the board of Dagang Nexchange Bhd’s (DNeX) 60.0%-owned subsidiary SilTerra Malaysia Sdn Bhd’s directors see no changes pending the conclusion of a lawsuit concerning appointments to its board based on a consent order recorded at the High Court mutually agreed upon by SilTerra, DNeX Semiconductor Sdn Bhd as well as Tethystronics Technologies Co Ltd. (The Edge)

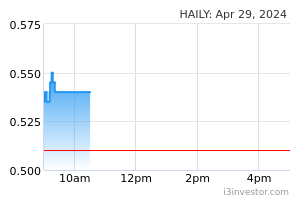

Haily Group Bhd’s wholly-owned unit Haily Construction Sdn Bhd has won a RM37.9m from RDC Arkitek Sdn Bhd contract to construct 77 units of three-storey shop offices at Bandar Jaya Putra in Tebrau district. With this latest job win, Haily’s orderbook comprises 25 ongoing projects with a total contract value of RM631.2m. (The Edge)

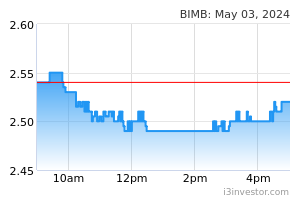

The High Court has allowed the petition made by six financial institutions — Standard Chartered Saadiq Bhd, HSBC Amanah Malaysia Bhd, Ambank Islamic Bhd, MIDF Amanah Investment Bank Bhd, United Overseas Bank (Malaysia) Bhd and Bank Islam Malaysia Bhd to wind up Serba Dinamik Holdings Bhd and its 3 subsidiaries, namely Serba Dinamik International Ltd, Serba Dinamik Sdn Bhd and Serba Dinamik Group Bhd, over debits totalling about RM5.00bn. Serba Dinamik is seeking legal advice to appeal or set aside the winding-up order. (The Edge)

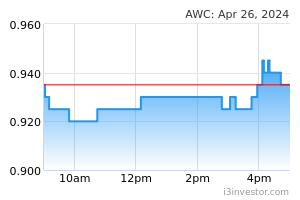

AWC Bhd has inked a Memorandum of Understanding (MOU) with 2 Indonesian firms PT Gema Karya Manunggal and PT Prasarana Danoes Cemerlang to jointly explore opportunities in the oil & gas business, as well as airport and port infrastructure in Malaysia and Indonesia. Other areas to be explored include safety, water treatment, waste treatment, municipal waste treatment and environmental maintenance sectors. (The Edge)

Source: Mplus Research - 11 Jan 2023