Continued foreign buying may lift market

Market Review

Malaysia:. Despite the negative regional markets movements which took cue from Wall Street, the FBM KLCI (+0.4%) pared earlier losses and extended daily gains Meanwhile, the lower liners edged lower, while the healthcare sector (+2.6%) outperformed the broader market as follow-through buying interest emerged.

Global markets:. The US stockmarkets bounced higher on Friday as investors anticipate the rate hikes could take a breather moving forward after November inflation data showed signs of moderation in prices. The European and Asia stockmarkets ended mixed.

The Day Ahead

The FBM KLCI extended gains on Friday amid improving sentiment, with foreign funds extending its buying activities (5-day net foreign buying stood at RM51.2m). Also, the improvement on Wall Street overnight may spill over to the local front, but upside might be capped amid worries over the impact of fresh Covid-19 outbreaks in China. Commodities wise, the Brent crude oil price surged above USD83 per barrel mark, fuelled by tight US supplies, while the CPO price hovered above RM3,800. We believe the crude oil price could remain positive above the support of USD80 over the near term given the production cut from OPEC+ and Russia.

Sector focus:. Trading interest in oil & gas sector could stay positive over near term amid the surge in the crude oil price. Meanwhile, the healthcare sector may continue to gain traction amid rising Covid-19 cases in China. Besides, we expect short term positive mood on the technology sector with the rebound in Nasdaq.

FBMKLCI Technical Outlook

The FBM KLCI climbed higher from the 1,460 support and closed above its daily EMA9 level. Technical indicators, however, were mixed as the MACD Histogram extended a negative bar, while the RSI is hovering above 50. The resistance is pegged along 1,500-1,510, while the support is set at 1,450-1,460.

Company Brief

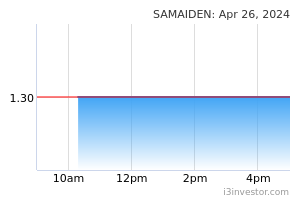

Samaiden Group Bhd’s wholly-owned subsidiary, Samaiden Capital Management Sdn Bhd’s first solar investment project at Sunway Nexis has commenced operation on Friday. Samaiden Capital Management Sdn Bhd will operate and maintain the system, which has a capacity of 531 kilowatt-peak (kWp) for a duration of 20 years. The group expects the generation of 12.5 million kilowatt hour (kWh) over the 20-year period to reduce approximately 8,400 tonnes of carbon emissions. (The Star)

Comintel Corp Bhd’s wholly-owned subsidiary Total Package Work Sdn Bhd has secured a contract worth RM227.6m from Mightyprop Sdn Bhd for a proposed development on Plot 9, Phase 3 in Damansara Perdana, Sungai Buloh, Selangor. It involves the construction of a 48-storey apartment block with 671 units of serviced apartments. The contract, commencing on 30th January 2023, should be completed within 32 months and is expected to provide an additional income stream for the group over the next three financial years. (The Star)

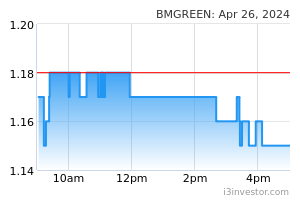

Boilermech Holdings Bhd (Boilermech) has entered into a share acquisition agreement with Leong Jit Min, the main executive director of TERA VA Sdn Bhd (TERA), for the acquisition of 245,000 shares, or 35.0% stake in TERA for RM8.2m cash. TERA is principally in the business of installation of solar green power energy products and electrical machinery products. The acquisition is part of Boilermech’s growth strategy in developing sustainable environmental solutions. It is also in line with the group’s effort in streamlining its shareholding structure in TERA. (The Star)

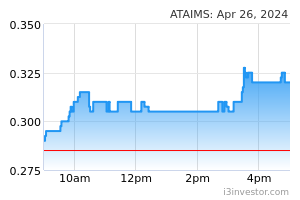

ATA IMS Bhd’s units, JABCO Filter System Sdn Bhd and Winsheng Plastic Industry Sdn Bhd (WSP), received the notices of termination dated 12th December 2022 and 22nd December 2022 from Dyson Manufacturing and Dyson Operations. The effective date of the terminations shall be 31st March 2023, or such later termination date as may be agreed by the parties in writing. The financial impact is material in all aspects arising from the termination of the contracts. (The Star)

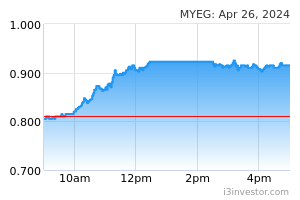

My EG Services Bhd plans to distribute its entire 25.8% equity interest in Agmo Holdings Bhd by way of dividend-in-specie to its shareholders. The stake, comprising 84.0m shares, will be distributed in two tranches based on an entitlement date that is yet to be fixed. The first tranche, involving 69.7m shares, will be distributed once the voluntary moratorium on the sale, transfer or assignment of the shares — which MyEG undertook prior to Agmo's listing, in compliance with listing requirements — is uplifted on 17th February 2023. The remaining 14.2m Agmo shares will be distributed once their moratorium ends on 17th August 2023. The first tranche will be distributed on the basis of 0.0093 Agmo share for every one MyEG share held, while the second tranche will be distributed on the basis of 0.0019 Agmo share for every one MyEG share held. (The Edge)

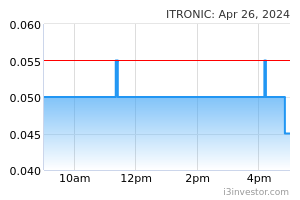

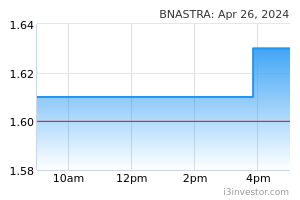

Industronics Bhd via a consortium has been shortlisted for the Kedah Aerotropolis development project worth €3.3 bn or RM15.48 bn. The consortium comprises Industronics, Hong Kong-based stockbroking firm Bluemount Financial Group Ltd and China-based sovereign wealth fund China Investment Corp (CIC). CIC has also agreed to support the expansion plans of Industronics' credit leasing arm, TTE Electronics Sdn Bhd, by investing in its microfinance business. (The Edge)

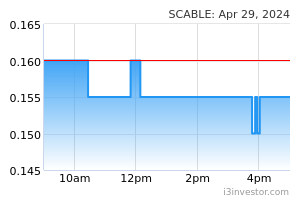

Sarawak Cable Bhd has appointed Baker Tilly Monteiro Heng PLT (Baker Tilly Malaysia) as its auditor until the conclusion of its next annual general meeting. Baker Tilly Malaysia replaces Ernst & Young PLT (EY), which retired at the conclusion of Sarawak Cable's 24th AGM on Thursday (22nd December 2022). (The Edge)

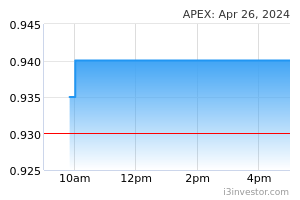

Datuk Choong Chee Meng, who controls ACE Group — formerly the second largest shareholder of Apex Equity Holdings Bhd — has resigned as Apex Equity's group managing director. His resignation follows the disposal of ACE Group's stake in Apex Equity earlier this month, shortly after the Securities Commission Malaysia went to court to prevent the group from taking control of Apex Equity. (The Edge)

Source: Mplus Research - 27 Dec 2022