Window dressing may lift stock markets

Market Review

Malaysia:. The FBM KLCI (-0.1%) witnessed a mild decline amid bearish sentiment observed across the regional markets following the extended selldown on Wall Street. The plantation sector (-2.4%) underperformed the broader market while the transportation & logistics sector (+1.3%) gained momentum.

Global markets:. The US stockmarkets continues with the risk-off sentiment amid ongoing worries over an interest rate hike-induced recession. Also, the ongoing rise in treasury yield weighed on the technology sector. The European stockmarkets ended mostly positive, while bearish sentiment prevailed in Asia stockmarkets.

The Day Ahead

The FBM KLCI closed lower in tandem with the regional bourses as lingering recession fears continued to weigh on sentiment due to the rising interest rates environment throughout the globe. While bearish sentiment persisted on the global front, we believe the passing of the motion of confidence for the 10th Prime Minister will strengthen the confidence of investors on the local bourse moving forward. Commodities wise, the Brent crude oil price hovered around USD80, while the CPO price rose above RM3,950.

Sector focus:. Investors may favour the construction and building material sectors ahead of the re-tabling of Budget 2023. Besides, we expect some policies to be crafted on the RE segment, hence solar or EV related stocks may gain traction. Meanwhile, we expect the medical sector to observe decent earnings momentum at least for the next few quarters and should translate to higher stock price.

FBMKLCI Technical Outlook

The FBM KLCI booked marginal losses but managed to hold above its daily EMA9 level. Technical indicators are mixed as the MACD Histogram extended a negative bar slightly below zero, while the RSI is hovering above 50. Support is envisaged along 1,450-1,460, while the resistance is monitored at 1,500-1,510.

Company Brief

Samaiden Group Bhd’s unit Samaiden Sdn Bhd has signed a partnership agreement with Management Venture Asia (Cambodia) Ltd (MVA) to explore clean energy-related business opportunities in Cambodia. the collaboration and expansion in Southeast Asia is in line with its five-year plan given its growing population and geographical advantages. (The Star)

Trading in the securities of Serba Dinamik Holdings Bhd will be suspended from 23rd December 2022, if the company fails to issue its FY22 annual report on 22nd December 2022. (The Star)

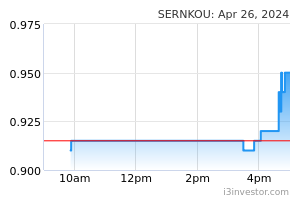

Sern Kou Resources Bhd has reported a fire incident at one of its manufacturing plants in Muar, Johor. The incident which occurred on 16th December 2022 did not result in any fatalities, and none of the workers there were injured. (The Edge)

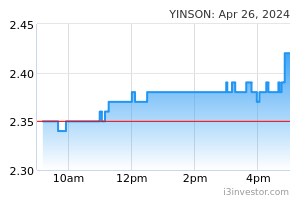

Yinson Holdings Bhd (Yinson) has secured a contract extension worth RM15.0m for the charter of its Adoon floating production storage and offloading, stationed at the Antan field off Nigeria. Yinson through its indirect unit, Adoon Pte Ltd and Addax Petroleum Development (Nigeria) Ltd, entered into an agreement on 16th December 2022 to extend the contract until 16th January 2023. (The Edge)

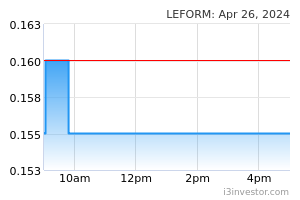

Leform Bhd, through its 60%-owned subsidiary LF Engineering Sdn Bhd, has received a letter of acceptance from Ganda Imbuhan Sdn Bhd as a subcontractor for the supply and installation of guard rails for a portion of the West Coast Expressway. The subcontract is valued at RM10.1m and is expected to be completed on 30th June 2023. (The Edge)

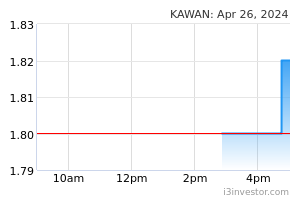

Kawan Food Bhd has cancelled its plan to buy five parcels of land measuring 7.08 acres in Shah Alam, for RM50.5m from RGP Warehouse Solutions Sdn Bhd, who had failed to get PKNS’ agreement to sell the plots. RGP managed to get the stateauthority consent to transfer its lots to Kawan Food Manufacturing Sdn Bhd, Kawan Food’s wholly-owned subsidiary, but failed to have PNKS sign the sale and purchase agreement to complete the purchasing process. Both parties agreed to terminate the agreement on 16th December 2022. (The Edge)

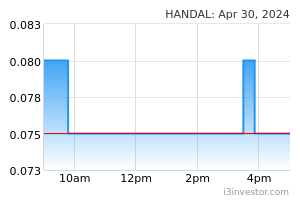

Handal Energy Bhd’s 49%-owned associate company Handal Borneo Resources Sdn Bhd has entered into an agreement with Tanjung Aru Eco Development Sdn Bhd (TAED), a unit of Chief Minister of Sabah Inc, for the operation, management, extraction and sale of marine sea sand for a 15-year period in three concession areas. The concession areas are the Sunken Barrier Shoal, Hayter Shoal and Bunbury Shoal, all of which are about 55km offshore from Kota Kinabalu, Sabah but the company did not state the value of the concession. The concession is expected to contribute positively to the group’s earnings for the FY23 onwards, until it expires. (The Edge)

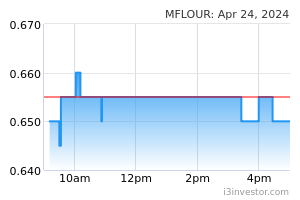

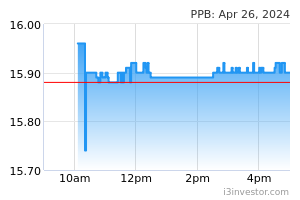

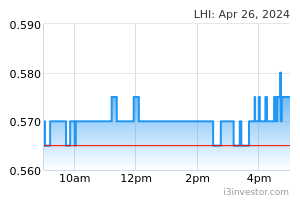

The Malaysia Competition Commission (MyCC) has granted the units of Leong Hup International Bhd, PPB Group Bhd and Malayan Flour Mills Bhd (MFM) the final extension to submit their representation in response to the alleged price-fixing of poultry feed cases. Each unit was given the fourth and last extension until 12.00 noon on 31st January 2023. This includes Leong Hup’s wholly-owned subsidiary Leong Hup Feedmill Malaysia Sdn Bhd (LFM), MFM’s partially-owned Dindings Poultry Development Centre Sdn Bhd (DPDC), and PPB’s 80%-owned FFM Bhd. (The Edge)

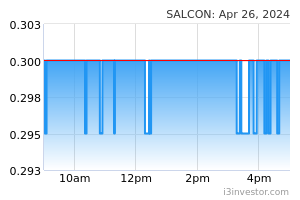

Salcon Bhd’s 51%-owned subsidiary, JR Engineering and Medical Technologies (M) Sdn Bhd (JREMT), has filed a counterclaim against Aspen Glove Sdn Bhd, demanding the payment of RM22.4m, being unutilised funds under a contract between the two parties which involves JREMT’s purchase of gloves by Aspen in 2021. The counterclaim is in response to a lawsuit filed by Aspen against JREMT, which it viewed as “non-meritorious”. Aspen filed the suit after JREMT served a letter of demand on the glove firm to demand the RM22.4m. (The Edge)

Source: Mplus Research - 20 Dec 2022