Gains kept in check

Market Review

Malaysia:. The FBM KLCI (+0.2%) extended its gains, mainly driven by the less hawkish remarks from the US Federal Reserve overnight. The lower liners also remained upbeat, while the technology sector (+6.5%) roared to close at its highest level in more than 3 months.

Global markets:. The US stockmarkets retreated as the Dow (-0.6%) fell after the ISM manufacturing PMI declined to 49.0 in November 2022; the first contraction since May 2020, whilst investors wait for the release of unemployment data tonight. Both the European and Asia stockmarkets closed mostly upbeat.

The Day Ahead

The FBM KLCI added another day of gains following the shift of tone from the Fed, turning less hawkish on its interest rate direction going forward. However, Wall Street has pulled back mildly yesterday, ahead of the jobs data that is widely watched by traders and may give a hint to the next course of action by the Fed. As the market has turned cautious in the US stock markets, we expect Bursa exchange to reciprocate and trading momentum may decline throughout the session. Nevertheless, we opine that the downside risk could be limited with the uplifting of Covid-19 restrictions in selected region in China. Commodities wise, the Brent oil price traded above USD87, while the CPO price hovered around RM4,100.

Sector focus:. Given the pullback in momentum on Wall Street, we expect the technology sector to take a mild breather. Still, we like the O&G segment for its decent earnings growth observed during the recent reporting season. Besides, we like the tourism and consumer sectors due to the ease of restrictions in China.

FBMKLCI Technical Outlook

The FBM KLCI rebounded and could have formed a flag pattern breakout yesterday. Technical indicators are suggesting that the positive momentum is intact, with the MACD Histogram added another positive bar, while the RSI is above 50. Resistance is at 1,500-1,510, while the support is pegged along 1,450-1,460.

Company Brief

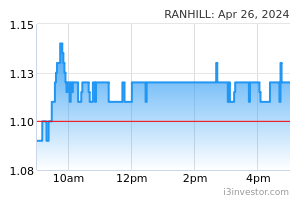

Ranhill Utilities Bhd has announced that 51.0% owned subsidiary Ranhill Worley Sdn Bhd, through its 49.0% owned associate Perunding Ranhill Worley Sdn Bhd, has bagged a RM50.0m contract from Malaysia Marine and Heavy Engineering Sdn Bhd. The contract, to be completed by 4Q23, involves performing detailed engineering design for the Kasawari Carbon Capture & Storage (CCS) project. (The Star)

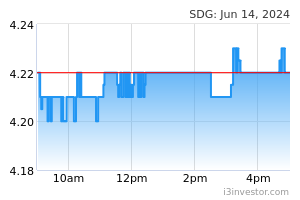

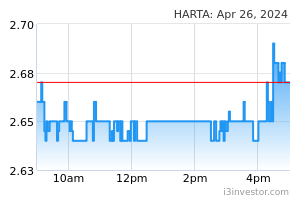

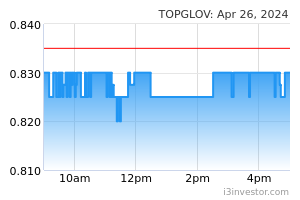

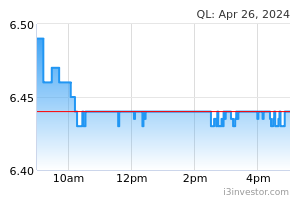

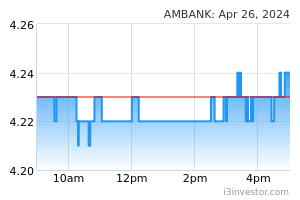

AMMB Holdings Bhd and QL Resources Bhd will be included in the FBM KLCI 30- stock benchmark index come 19th December 2022, replacing Top Glove Corp Bhd and Hartalega Holdings Bhd, whose shares have been under selling pressure in most of 2021 and this year. (The Edge)

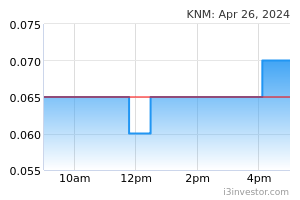

KNM Group Bhd’s proposed EUR220.8m (RM1.03bn) sale of its key subsidiary Borsig GmbH has fallen through, after KNM decided not to extend the deal’s long stop date from the latest 30th November 2022 deadline. This raises the question on how the company will meet its debt obligations. (The Edge)

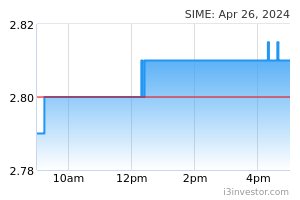

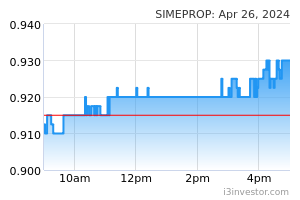

Sime Darby Plantation Bhd is disposing of 949-ac of freehold land in Kapar, Klang to Sime Darby Property Bhd for RM618.0m. The deal is in pursuant to one of the nine call option agreements entered into between both companies in 2017, when Sime Darby Bhd embarked on a pure play exercise, which involved the creation of stand-alone listed entities in plantation, property, trading and logistics sectors. (The Edge)

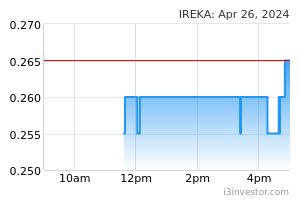

Ireka Corp Bhd has been slapped with a RM97.91 m suit from a joint venture (JV) partner linked to obligations of a JV agreement for a development project. The dispute is related to a JV agreement dated Dec 31, 2009, entered between the company, ASPL M9 Ltd and Urban DNA Sdn Bhd (UDNA), with the primary objective of overseeing the development of the RuMa project. UDNA was to be the developer of the project, with a 70:30 shareholding split between ASPL M9 and Ireka. (The Edge)

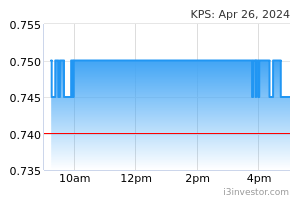

Kumpulan Perangsang Selangor Bhd (KPS) via its wholly-owned unit Perangsang Dinamik Sdn Bhd (PDSB) is acquiring the entire stake in computer numerical control machining company MDS Advance Sdn Bhd for RM85.0m. The purchase consideration values MDS Advance within the industry benchmark in terms of enterprise value to earnings before interest, tax, depreciation and amortisation (EV/EBITDA) ratio of 7.9x, which will be fully satisfied by internally-generated funds. (The Edge)

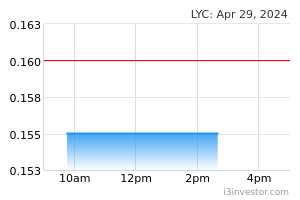

LYC Healthcare Bhd’s unit LYC Nutrihealth Sdn Bhd has inked an exclusive distribution agreement with CuraLife Spain SLU to distribute a diabetic supplement product known as Curalin in Malaysia and Singapore. The supplement reduces the craving for sugars and other carbohydrates and promotes healthy weight loss. Curalin has more than 100,000 active daily consumers and is available in 20 countries. (The Edge)

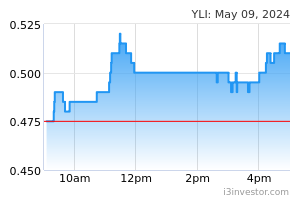

YLI Holdings Bhd is disposing of 2 parcels of freehold land in Penang to ZW Packaging Sdn Bhd for RM17.3m in cash. The 2 pieces of land have a combined size of 4.7-ac, both located in Seberang Perai Tengah. Proceeds from the disposal will be used to upgrade machinery, and to fund the working capital requirement, as well as repayment of bank borrowings. (The Edge)

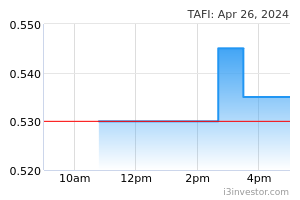

TAFI Industries Bhd has bagged a RM23.6m contract to construct the Ministry of Health’s staff quarters in Labuan. The 1-year contract was awarded to its wholly owned subsidiary, TA Furniture & Projects Sdn Bhd, by Lambaian Delta Sdn Bhd. (The Edge)

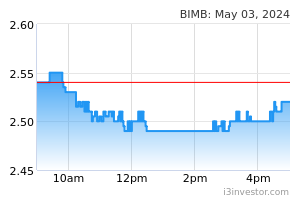

After 12 years of service on the board of Bank Islam Malaysia Bhd, non independent and non-executive director Mohamed Ridza Mohamed Abdulla has stepped down from the post. In tandem with his exit from Bank Islam’s board, Mohamed Ridza, 53, is also leaving behind his post as chairman of the Islamic bank’s investment arm, BIMB Investment Sdn Bhd. (The Edge)

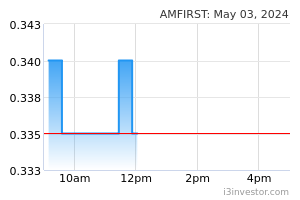

AmFIRST Real Estate Investment Trust (AmFIRST REIT) chief executive officer Raja Nazirin Shah Raja Mohamad has stepped down from his post. Nazirin, 59, has resigned as CEO and director of the REIT to pursue other opportunities. (The Edge)

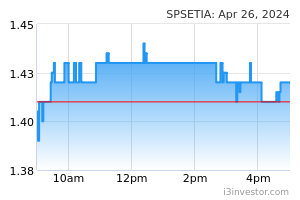

S P Setia Bhd announced the appointment of Annuar Marzuki Abdul Aziz as its new chief financial officer (CFO) effective 1st December 2022. He replaced Datuk Yuslina Mohd Yunus, 55, who had held the post as acting CFO since 9th May 2022. Prior to holding the CFO position at S P Setia, Annuar Marzuki, 52, was CFO and chief investment officer of KLCC Property Holdings Bhd. (The Edge)

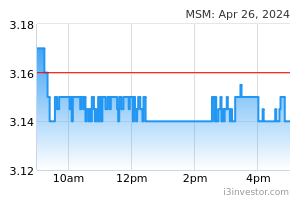

MSM Malaysia Holdings Bhd has appointed Dr Mazatul ‘Aini Shahar Abdul Malek Shahar as the company’s new CFO, replacing Ab Aziz Ismail. Ab Aziz, 55, has held the CFO position since June 2019, after he served as deputy CFO for a month from April 2019. (The Edge)

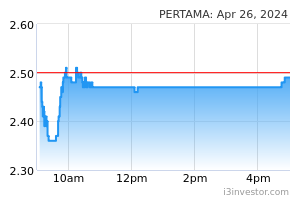

Pertama Digital Bhd has appointed Saify Akhtar as its new chief executive officer and Sivabalan Poobalasingam (Balan) as its chief financial officer. Saify will be responsible for spearheading and driving the company forward, with bold and innovative business plans, to ensure a sustainable and profitable future. Meanwhile, Balan will be tasked with structuring and focusing on improving Pertama Digital’s financial health through prudent financial management, as required of any public-listed company. (The Edge)

Top Builders Capital Bhd, whose shares have been suspended since 8th November 2022 for the pending submission of its 2022 annual report, has also failed to submit its quarterly financial report for the period ended 30th September 2022. Trading suspension of Top Builders will continue until further notice. In a separate announcement, Top Builders reported that the delay in the release of its 2022 annual report was because the auditors require more time to finalise the identification of assets. (The Edge)

Source: Mplus Research - 2 Dec 2022