Small steps of rebound

Market Review

Malaysia:. The FBM KLCI (+0.3%) inched higher after trading in a lacklustre manner as gains were largely boosted by selected banking heavyweights yesterday. The lower liners, however, ended mixed, while the transportation & logistics sector (+1.7%) outperformed the mostly positive sectorial peers.

Global markets:. US stockmarkets retreated as the Dow (-2.0%) snapped a 3-day winning streak ahead of the release of monthly inflation data, while the mid-term election results will be monitored closely. The European stockmarkets closed mostly lower, while Asia stock markets ended mixed.

The Day Ahead

The FBM KLCI rose marginally as the market appeared to be on a bargain-hunting mode amid persistent inflows of foreign funds. However, we believe the downside risk could return with the selling pressure on Wall Street as the US mid-term election results are uncertain and the US CPI print may stay elevated and contribute to a selling tone in the near term. Commodities wise, the crude oil price declined further towards USD92-93 per barrel mark as the rising US crude stockpiles coupled with ongoing Covid-19 curbs in China dampened the price. Meanwhile, the CPO price trended lower, trading just below RM4,250.

Sector focus:. With the ongoing uncertainties in place, the investors may look out for more defensive sectors such as telecommunications, REIT and utilities. Meanwhile, construction and building material stocks may be put on their radar with ahead of the GE15.

FBMKLCI Technical Outlook

The FBM KLCI drifted sideways and hovering around the EMA60 level. Technical indicators, however, remained mixed as the MACD Histogram extended a negative bar, while the RSI hovered above 50. The resistance is set along 1,465-1,480, while support is located at 1,410-1,420.

Company Brief

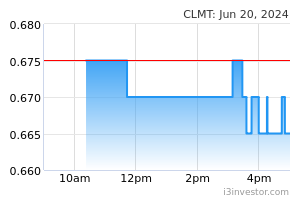

MTrustee Bhd, the trustee of Capitaland Malaysia Trust (CLMT) has entered into agreements to acquire 91.8% of the total strata floor area of retail parcels in Queensbay Mall in Penang for RM990.5m. The purchases from parties related to CapitaLand Investment Ltd (CLI) represent a discount of about 1.0% to the independent valuation of RM1.00bn. It said the manager has proposed to undertake a private placement with an issuance of new CLMT units to raise gross proceeds of up to 50.0% of the total purchase consideration, while the remainder will be funded by bank borrowings. The acquisition, which is conditional upon the approval of CLMT's non-interested unitholders at an extraordinary general meeting, is expected to be completed by 1Q23. (The Star)

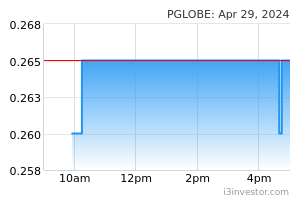

Paragon Globe Bhd's wholly-owned subsidiary Paragon Business Hub Sdn Bhd has proposed to acquire a tract of freehold land in Plentong, Johor Bahru, measuring about 42.3-ha for RM71.5m. The group expects to fund the purchase consideration via a cominbation of internally generated funds, bank borrowings and equity fundraising. Following the completion of the acquisition, Paragon Global intends to develop the land into an industrial area with 171 units of industrial properties. The project with an estimated gross development value ranges from RM544.0m to RM626.0m, while its gross development cost is expected to be about RM473.0m is expected to commence in 2024, and is projected to take 8-10 years to complete. (The Star)

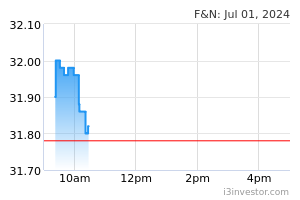

Fraser & Neave Holdings Bhd aims to raise up to RM800.0m in capital expenditure (capex) for FY23, with most of the funds earmarked for its dairy farm business. With the the completed acquisition of agricultural land in Gemas, Negeri Sembilan for RM215.6m, the group is on track to resume its plans for the upstream fresh milk business for downstream production and distribution of fresh milk. (The Edge)

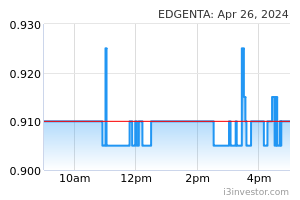

UEM Edgenta Bhd is selling its 51.0% stake in Faber Sindoori Management Services Pte Ltd for 700.0m rupees (RM40.0m) to Apollo Sindoori Hotels Ltd (ASHL). The group wholly-owned subsidiary Edgenta Facilities Sdn Bhd has entered into a share purchase agreement with ASHL, which holds the remaining 49.0% in Faber Sindoori, which is mainly involved in the provision of integrated facilities management services in India. The proceeds from the sale will be used for potential investments, including capital expenditure for growth opportunities. (The Edge)

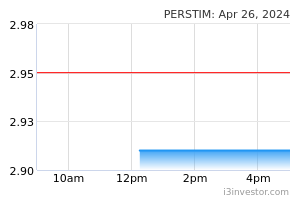

Perusahaan Sadur Timah Malaysia Bhd’s (Perstima) 2QFY23 net loss stood at RM1.0m vs. a net profit of RM10.9m recorded in the previous corresponding quarter, due to unrealised exchange loss of RM26.9m Revenue for the quarter, however, climbed 62.6% YoY to RM465.2m. (The Edge)

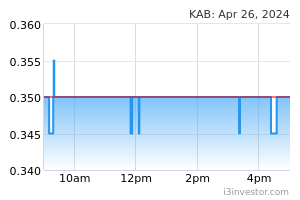

Kejuruteraan Asastera Bhd (KAB) is expanding its sustainable energy solutions (SES) segment through the proposed acquisition of the entire equity of Future Biomass Gasification Sdn Bhd (FBG) for RM15.0m. FBG, a wholly-owned subsidiary of Future NRG Sdn Bhd, owns a biogas power plant in Kedah with an installed capacity of 2.4-MW has a renewable energy power purchase agreement with Tenaga Nasional Bhd for 16 years until March 2034. (The Edge)

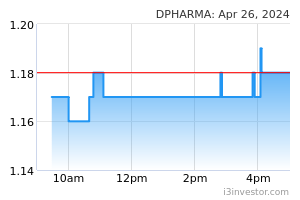

Duopharma Biotech Bhd's 3QFY22 net profit slipped 3.6% YoY to RM16.4m, pressured by higher finance and operating costs. Revenue for the quarter increased 3.1% YoY to RM177.1m. (The Edge)

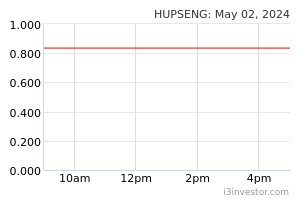

Hup Seng Industries Bhd’s 3QFY22 net profit dropped 6.1% YoY to RM3.8m, dragged down by higher raw material costs. Revenue for the quarter, however, climbed 8.4% YoY to RM70.2m. (The Edge)

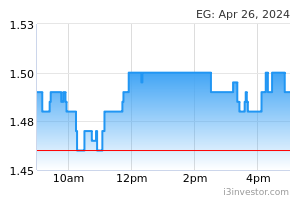

EG Industries Bhd expects its RM180.0m Smart Factory 4.0 in Batu Kawan, Penang, to potentially create more than 1,000 high-value jobs for the local community upon its commencement in 2024. EG Industries first fully automated Lights-Out Smart Factory 4.0 will be situated on a 6.0-ac piece of industrial land under its unit SMT Technologies Sdn Bhd. (The Edge)

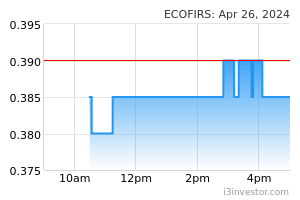

Signature International Bhd’s co-founder Datuk Michael Chooi Yoey Sun has ceased to be a substantial shareholder of EcoFirst Consolidated Bhd. Chooi, who emerged as the property developer’s substantial shareholder in January 2022, disposed of 10.0m shares on the open market on 7th November 2022. This trimmed his stake in EcoFirst to 4.8%, from 5.7%. (The Edge)

Stella Holdings Bhd has announced the resignation of its group chief executive officer Ng Jun Lip, and the appointment of major shareholder Datuk Lau Beng Sin as the new managing director. Ng resigned to pursue his other personal interest and Lau's appointment as managing director took effect immediately. (The Edge)

Source: Mplus Research - 10 Nov 2022