Firming up

Market Review

Malaysia:. The FBM KLCI (+0.3%) edged higher, mainly driven by gains in telco heavyweights yesterday. The lower liners, however, ended mixed, while the property (+1.4%) sector anchored the mostly positive sectorial peers after closing at its highest level in more than 1 month.

Global markets:. US stockmarkets extended their lead as the Dow (+1.3%) advanced after investors shook off the concern over the hawkish remarks from the US Federal Reserve and focus on the US midterm elections. Both the European and Asia stock markets ended mostly on an upbeat note.

The Day Ahead

The FBM KLCI ended a choppy session higher, mainly buoyed by the telecommunication heavyweights as foreign funds returned for the second consecutive day. While the local bourse may cheer on hopes over China’s reopening, investors may remain cautiously optimistic as the US inflation data which will due later this week may indicate a prolonged interest rate upcycle environment, adding more risk to the shaky stock market. Commodities wise, the crude oil price held above USD97 per barrel mark, while the CPO traded above RM4,400.

Sector focus:. As the polling day for GE15 is getting closer, the election-theme sectors may set to take the centre stage over the near term. Meanwhile, investors may favour stocks with positive outlook prior to the earnings season such as consumer and O&G stocks. The energy and plantation sectors could remain its uptrend move on the back of firmer commodity prices.

FBMKLCI Technical Outlook

The FBM KLCI wrapped up a volatile session in the green as the key index climbed above its daily EMA9 level. Technical indicators were mixed as the MACD Histogram is negative, while the RSI hovered above the 50 level. The resistance is 1,465-1,480, while support is envisaged at 1,410-1,420.

Company Brief

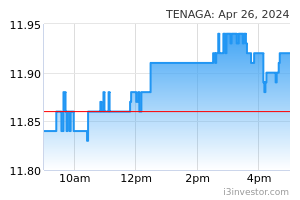

Tenaga Nasional Bhd is exploring selling a minority stake in a planned renewable energy unit to help fund its expansion into the sector. Tenaga’s renewable energy growth strategy involves establishing a pure-play entity. It is still at an early stage of developing its capital strategy. (The Star)

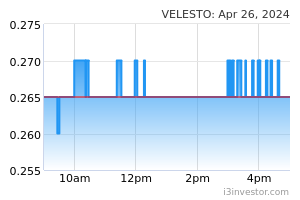

Velesto Energy Bhd’s wholly owned unit Velesto Drilling Sdn Bhd, has bagged a USD135.0m contract from Hess Exploration And Production Malaysia B.V. It said the contract was for the provision of integrated rig, drilling and completion (I-RDC) services for Hess’ 2022 to 2024 North Malay Basin full field development campaign. Velesto would assign its jack-up rig NAGA 5 for the contract. (The Star)

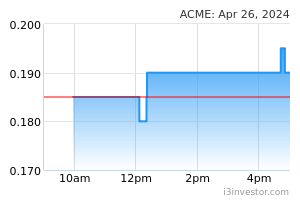

ACME Holdings Bhd's wholly-owned subsidiary, Ayana Bayu Sdn Bhd (ABSB), and Koperasi Kampung Melayu Balik Pulau Bhd (KKMBPB) will be jointly developing 7 pieces of land in Penang into a multi-phased integrated developments with an estimated gross development value (GDV) of RM1.40bn. The total acreage for all 7 land plots is approximately 72.2-ha. Both parties have agreed that the JV development of the said land is on sharing basis of 17.0% of the GDV to the KKMBPB and 83.0% to ABSB. (The Star)

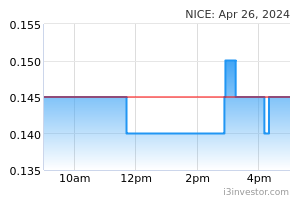

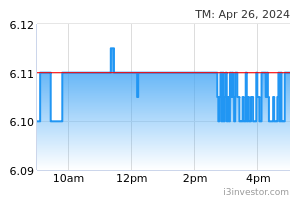

The Association of Accredited Advertising Agents Malaysia (4As) has taken Telekom Malaysia Bhd (TM) to task for charging panel agencies with high non refundable document fees as a tender requirement. The association claimed that TM has imposed a non-refundable tender document fee of up to RM5,000 and a refundable tender deposit of up to RM20,000 per tender as part of its tender requirement. (The Edge)

Boustead Plantations Bhd has announced the resignation of its chief executive officer (CEO) Zainal Abidin Shariff effective 8th November 2022. Zainal Abidin, 53, is exiting the position that he assumed in July 2021 to pursue other interests. (The Edge)

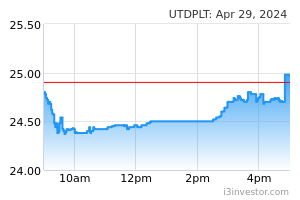

United Plantations Bhd's 3QFY22 net profit rose 27.6% YoY to RM196.7m, thanks to elevated crude palm oil and palm kernel prices. Revenue for the quarter climbed 23.6% YoY to RM649.6m. An interim dividend of 40.0 sen per share, payable on 5th December 2022 was declared. (The Edge)

Datasonic Group Bhd has clinched a contract worth RM140.0m to supply foreign worker cards (i-Kads) to the Immigration Department. The group wholly owned subsidiary, Datasonic Technologies Sdn Bhd received the Letter of Award from the Ministry of Home Affairs to supply the i-Kads from 1st November 2022 to 31st October 2025. (The Edge)

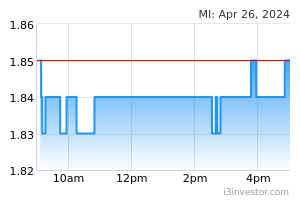

MI Technovation Bhd’s 3QFY22 net profit climbed 6.9% YoY to RM20.3m, buoyed by favourable foreign exchange (forex) gains. Revenue for the quarter, however, fell 21.3% YoY to RM89.7m. (The Edge)

Niche Capital Emas Holdings Bhd has proposed a private placement to raise up to RM37.7m to fund its mining business and working capital. The exercise will see the issuance of 369.2m shares at an indicative issue price of 10.2 sen per share. Proceeds will be utilise to acquire interests in minerals and mining assets and to develop and construct beneficiation facilities for new mineralisation identified, as well as for exploration activities in order to identify new gold mineralisation in the Sokor north area in Kelantan. (The Edge)

Source: Mplus Research - 8 Nov 2022