Grappled by renewed volatility

Market Review

Malaysia:. The FBM KLCI (-2.2%) was spooked by the hawkish remarks over the future interest rate direction in Wall Street. The lower liners also sank, while all the 13 major sectors were painted in red with the healthcare sector (-5.7%) taking the worst hit, following the disappointing corporate earnings from KOSSAN.

Global markets:. US stockmarkets extended their decline as the Dow (-0.5%) fell after the unabated hawkish stance of interest rate hikes from the US Fed contributed to the renewed recession concerns. The European stock markets remained downbeat, while the Asia stock markets ended mostly negative.

The Day Ahead

The FBM KLCI plunged after the hawkish remarks from the US Fed; foreign investors turned net seller as outflows from Malaysia accelerated (5-day net foreign selling:. -RM114.5m). We believe the local bourse performance may be impacted by the gloomy sentiment over the near term as investors anticipate further interest rate hikes by the US Fed to tackle inflation, contributing to the recession fears. However, investors may position themselves ahead of the GE15 event and the November reporting season. Commodities wise, the crude oil price hovered slightly below USD95, while the CPO traded above RM4,350.

Sector focus:. The construction and banking sectors may gain momentum ahead of the GE15 following a heavy selldown. Meanwhile, we believe the politically-neutral sectors such as telecommunication and O&G may see some bargain hunting activities. However, the technology stocks may remain in its downtrend move along with the significant selling on Nasdaq.

FBMKLCI Technical Outlook

The FBM KLCI plummeted to close below its immediate support at 1,440 and its daily EMA20 level. Technical indicators, however, remained positive as the MACD Histogram extended a positive bar, while the RSI hovered above 50. Next support is monitored at 1,400, followed by 1,370, while the resistance is set at 1,440-1,460.

Company Brief

Signature International Bhd (SIB) is proposing to acquire Singapore’s Corten Interior Solutions Pte Ltd and Areal Interior Solutions Pte Ltd (Areal) for S$47.8m (RM160.5m). SIB has entered into a conditional share sale agreement (SSA) with Lim Leng Foo to acquire 1.5m ordinary shares or 75.0% equity interest in Corten for S$45.0m (RM151.1m). The company also entered into a SSA with Lim and Chua Wei Ping to acquire 1.0m ordinary shares or 100.0% equity interest in Areal, for S$2.8m (RM9.4m). The acquisitions will be funded via a combination of internally generated funds and bank borrowings and is expected to be completed by the first half of 2023. (The Star)

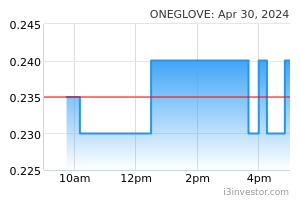

One Glove Group Bhd has proposed to undertake a renounceable rights issue with free detachable warrants to raise up to RM85.2m. The proposed rights issue with warrants entailed an issuance of 284.0m rights shares at the issue price of 30 sen per rights share, on the basis of 1 rights share for every existing One Glove share held, together with 142.0m warrants on the basis of 1 warrant for every 2 rights shares. The company intends to use RM21.2m from the proceeds as working capital, RM16.0m as capital expenditure, and RM47.4m to set off arrangements. (The Star)

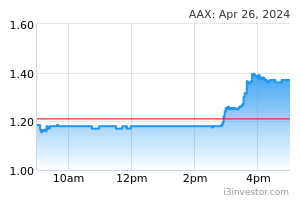

AirAsia X Bhd (AAX) has no immediate plan to find a successor to Tan Sri Tony Fernandes, as the airline's management and board will oversee its operations. The airline group announced that Fernandes is stepping down from his position as the acting group chief executive officer of AAX due to other commitments. (The Edge)

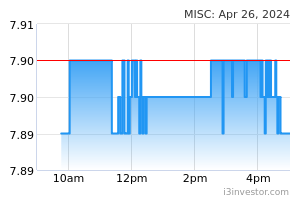

MISC Bhd and its consortium partners have secured long-term shipping charter contracts from Qatar state-owned QatarEnergy which is involved in exploration, production, refining, transport and storage. The consortium with Nippon Yusen Kabushiki Kaisha (NYK), Kawasaki Kisen Kaisha Ltd (K-Line) and China LNG Shipping (Holdings) Ltd (CLNG) had been awarded the time charter parties (TCPs) by QatarEnergy for five 174,000m3 newbuild liquefied natural gas carriers (LNGCs) to be built by Hudong-Zhonghua Shipbuilding (Group) Co Ltd. (The Edge)

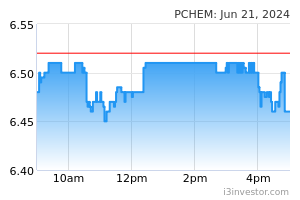

Petronas Chemicals Group Bhd (PetChem) and US-based fertiliser maker Anuvia Plant Nutrients have entered into an agreement, under which PCG will produce and market Anuvia's fertiliser in the Asia-Pacific region. The partnership aims to assist PCG’s venture into the sustainable fertiliser segment, and contribute to the company's overall goal to reach net zero carbon emissions by 2050. (The Edge)

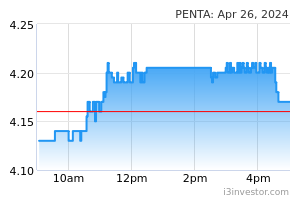

Pentamaster Corp Bhd’s 3QFY22 net profit rose 5.6% YoY to RM20.1m, helped by improved revenue contribution from its automated test equipment and factory automation solutions segments. Revenue for the quarter grew 11.1% YoY to RM155.6m. (The Edge)

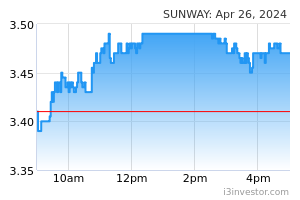

Sunway Bhd's wholly owned indirect subsidiary Sunway South Quay Sdn Bhd (SSQ) has lodged with the Securities Commission Malaysia a sukuk wakalah programme. The perpetual programme that allows sukuk wakalah to be issued from time to time, provided that the aggregate outstanding nominal value of the sukuks does not exceed RM2.00bn at any point in time. (The Edge)

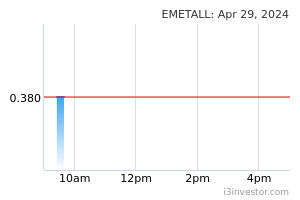

Mitraland Group founder and chief executive officer Chuah Theong Yee has emerged as a new substantial shareholder of Eonmetall Group Bhd. Chuah had on 31st October 2022 acquired 20.2m shares in an off-market transaction, representing a 7.3% stake in the company. (The Edge)

Penang-based businessman Datuk Seri Goh Choon Kim has ceased to be a substantial shareholder of Caely Holdings Bhd, having let go of 54.4m shares on 31st October 2022 via off-market disposal. Prior to the disposal, Goh was the largest shareholder of Caely with a 21.1% stake. Datuk Seri Tee Yam @ Koo Tee Yam is now deemed to be the largest shareholder of Caely with a 19.1% stake. (The Edge)

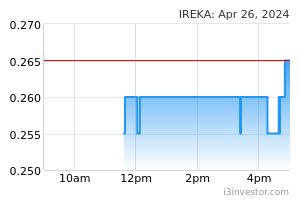

Ireka Corp Bhd will jointly develop houses on a piece of land in Seberang Perai Tengah with Wakaf Pulau Pinang Sdn Bhd (WPPSB), a corporate representative of the Penang State Islamic Religious Council (MAINPP). Ireka wholly-owned subsidiary, Ireka Development Management Sdn Bhd (IDMSB) has accepted a Letter of Award from WPPSB to jointly undertake the development of 131 units of double-storey terrace houses and 16 units of three-storey terrace houses on the 12.5-ac piece of land. (The Edge)

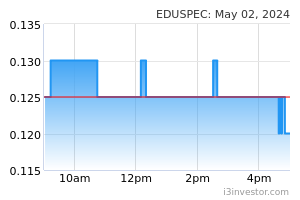

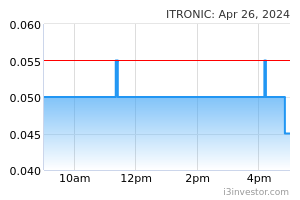

Industronics Bhd has entered into an agreement to acquire a 50.0% stake in 5T3M Sdn Bhd for RM1.0m, as part of its venture into the education industry. The acquisition represents a further extension of the collaboration between Industronics and Eduspec Holdings Bhd following the Memorandum of Agreement signed to set up a special purpose vehicle (SPV) to offer electronic hardware and school equipment to over 10,000 schools in Malaysia. (The Edge)

Source: Mplus Research - 4 Nov 2022