Solidifying above 1,400

Market Review

Malaysia:. The FBM KLCI (+1.1%) extended its lead, taking cue from the gains on Wall Street overnight, underpinned by gains in plantation, banking and oil & gas heavyweights. The lower liners, however, ended mixed while the financial services sector (+1.8%) anchored the winners list amongst the sectorial peers.

Global markets:. The US stock markets took a pause as the Dow (+0.3%) retreated after the US treasury yield crept back to multi-year highs and re-surfacing concern over the hawkish Federal Reserve stance on interest rate direction. The European stock markets also edged lower, while Asia stock markets ended mixed.

The Day Ahead

Banking-led rallies kept the FBM KLCI above the key 1,400 level after the greater than-expected special dividend by AFFIN. However, we opine that the rebound may remain fragile as investors may weigh potential global recession concerns over the recent reporting season on Wall Street as the spike in UK inflation spooked the markets. Nevertheless, traders may look at companies with strong balance sheet to invest in the long run. Commodities wise, the crude oil price hovered above the USD90 per barrel mark, while the CPO price surged above RM4,150 on worries over impact of tropical storms on palm oil production in East Malaysia and Kalimantan.

Sector focus:. The healthcare stocks may extend mild gains given their attractive valuation, but risk of being excluded from the FBM KLCI in the upcoming review might capped the upside reward. Meanwhile, investors may favour the plantation stocks as worries over supply disruption may push the CPO price higher.

FBMKLCI Technical Outlook

The FBM KLCI extended gains and surpassed its daily EMA20 level. Technical indicators are turning more positive as the MACD Histogram climbed above zero, while the RSI moved towards 50. Resistance is pegged along 1,420-1,430, while the support is set at 1,370-1,400.

Company Brief

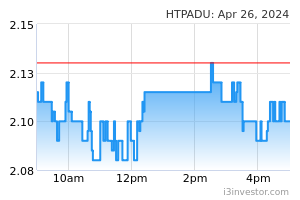

Heitech Padu Bhd has received a 4 months contract extension worth RM13.2m for the upkeep of the Road Transport Department’s (JPJ) mainframe systems. The contract extension is from 1st October 2022 to 31st January 2023. (The Star)

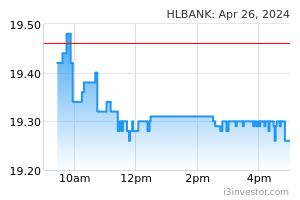

Permodalan Nasional Bhd (PNB) plans to vote against Hong Leong Bank Bhd’s proposal to issue shares, citing insufficient disclosure on the matter as the reason. PNB, however, plans to vote in favour of the remaining eight proposals at the bank’s annual general meeting scheduled for 27th October 2022. PNB and related entities — Amanah Saham Bumiputera, Amanah Saham Bumiputera 2 and Amanah Saham Malaysia — collectively owned a 2.3% stake in the bank as at 30th August 2022. (The Edge)

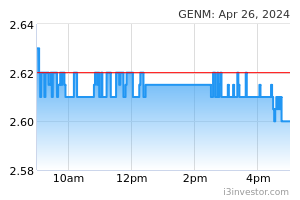

The Macau Special Administrative Region have unconditionally accepted Genting Malaysia Bhd’s indirect subsidiary GMM SA’s bid for the award of a new 10-year gaming concession involving casino operations. Genting Malaysia had initially on 15th September 2022 announced GMM’s bid for the 10-year gaming concession in Macau, to expand its business in the leisure and hospitality sector, diversify its geographical footprint, and participate in the recovery prospects of the Macau gaming segment. (The Edge)

Caely Holdings Bhd has filed a suit against its founder and former executive director Datin Fong Nyok Yoon, her husband and former managing director Datuk Chuah Chin Lai, and 10 of its ex-directors over the alleged misappropriation of RM30.6m of its unit’s funds. (The Edge)

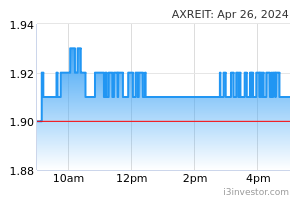

Axis Real Estate Investment Trust’s (Axis REIT) 3QFY22 net property income for climbed 12.5% YoY to RM61.5m, on the back of rental income from newly-acquired properties. Revenue for the quarter grew 16.4% YoY to RM71.7m. A third interim income distribution of 2.45 sen per unit, payable on 30th November 2022 was declared. (The Edge)

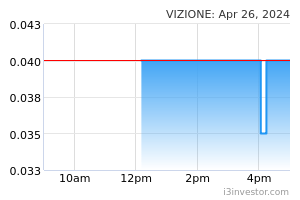

Vizione Holdings Bhd’s 3QFY22 net loss widened to RM7.9m, from a net loss of RM5.2m recorded in the previous corresponding quarter, impacted by high building material costs and labour shortages. Revenue for the quarter, however, rose 29.1% YoY to RM49.9m. (The Edge)

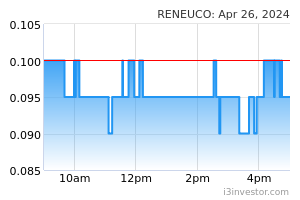

Reneuco Bhd, through its subsidiary Reneuco RE Sdn Bhd, has entered into a conditional share sale agreement with OHP Ventures Sdn Bhd to acquire Adat Sanjung Sdn Bhd (ASSB) for RM90.0m in a cash-plus-shares deal. ASSB, through its wholly-owned unit Pristine Falcon Sdn Bhd, controls a 70.0% stake in a special purpose vehicle established to undertake the development of hydropower plants in Sabah. (The Edge)

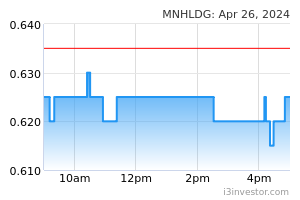

MN Holdings Bhd has clinched a substation engineering contract worth RM22.5m in Nusajaya Technology Park, Johor. The wholly-owned unit MN Power Transmission Sdn Bhd was awarded the contract by GDS IDC Services (M) Sdn Bhd, to design and install 2 interim consumer landing stations for GDS’ data centre. (The Edge)

Source: Mplus Research - 20 Oct 2022