Ripe for near term bounce

Market Review

Malaysia:. The FBM KLCI (+0.3%) extended its lead, backed by gains in selected banking, telco and gloves heavyweights yesterday. The lower liners, however, ended mixed, while the healthcare sector (+3.4%) outperformed the mostly negative sectorial peers.

Global markets:. The Dow (+1.9%) rebounded strongly driven by better-than-expected corporate earnings from Bank of America and Bank of New York Mellon. The European stock markets advanced after UK announced that almost all planned tax cuts would be scrapped, but Asia stock markets closed mixed.

The Day Ahead

The FBM KLCI is attempting to find stability over the near term, ahead of the official GE15 date being announced. Meanwhile, China unexpectedly delayed the release of 3Q22 GDP that is scheduled today, may imply that the data might not meet market expectations of +3.4% YoY. Back home, we reckon that the rebound on Wall Street may see buying interest spilling over on beaten down or oversold stocks over the near term. Still, the weakening trading liquidity and the persistent selling from foreign funds (net sell RM870.1m month-to-date) will keep bigger strides of gains at bay. Commodities wise, the crude oil price steadied above USD90, while the CPO price has inched above RM3,900.

Sector focus:. The beaten down healthcare sector appears to look attractive and may extend their revival trend, backed by the prospects of improved outlook. The technology sector may stage a rebound to mirror the gains on Nasdaq overnight, while the stability in crude oil prices may lend some support to the energy sector.

FBMKLCI Technical Outlook

The FBM KLCI recovered all its intraday losses to form a hammer candle as the key index threaded below the daily EMA9. Technical indicators stayed negative as the MACD Line is still below Signal Line, while the RSI remained below 50. Resistance is set along 1,400-1,430, while the support is envisaged along 1,355-1,365.

Company Brief

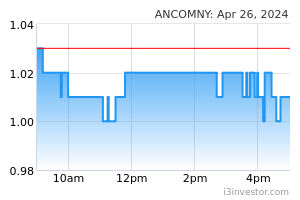

Ancom Nylex Bhd’s 1QFY23 net profit jumped 121.6% YoY to RM20.0m, on the back of increased revenue contribution from almost all business segments. Revenue for the quarter increased 35.9% YoY to RM549.8m. (The Star)

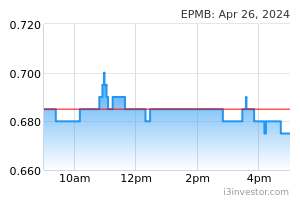

EP Manufacturing Bhd has entered into a memorandum of agreement with California's Saean Group Inc to mass produce 20,000 electric cars a year for the Southeast Asian market. The group is making its debut in the manufacturing of four-wheeled electric vehicles (EV) with the partnership to mutually develop and manufacture electric vehicles (EV) in the A-segment's four-seater, five-door electric car. (The Star)

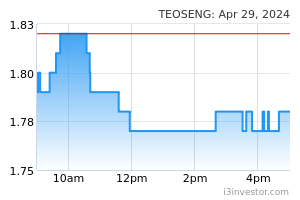

Teo Seng Capital Bhd has announced that Singapore recalled eggs from its chicken layer farm in Malaysia due to the presence of Salmonella enteritidis (SE), which may cause food-borne illness if the food is consumed raw or undercooked. The company will communicate with Malaysia’s Department of Veterinary and Services to investigate and monitor the matter, while maintaining full cooperation to identify the cause and remedial process, before resuming sales of eggs from the farm. The Teo Seng Layer Farm 1 accounted for approximately 3.5% of the company’s total production. (The Edge)

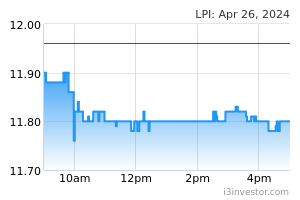

LPI Capital Bhd’s 3QFY22 net profit fell 29.1% YoY to RM74.8m, on lower profit from its general insurance segment. Revenue for the quarter, however, increased marginally by 0.4% YoY to RM429.6m. (The Edge)

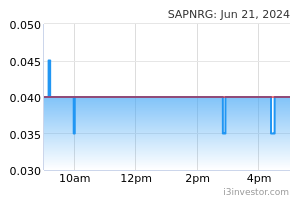

Sapura Energy Bhd’s shareholders greenlighted the proposal on the disposal of three drilling rigs to UK-based NKD Maritime Ltd for US$8.2m (RM35.1m) at the EGM. The group will utilise RM34.8m disposal proceeds for the repayment of bank borrowings, while the remaining RM350,000 will be used for the disposal’s estimated expenses. (The Edge)

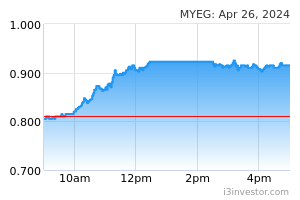

MyEG Services Bhd has made a lodgement with the Securities Commission Malaysia for the establishment of a sukuk wakalah programme of up to RM1.00bn. Proceeds from the issuance of the sukuk wakalah programme will be used for shariah-compliant working capital requirements, capital expenditures, investments and financing of business expansions of the group. (The Edge)

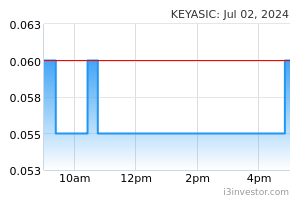

Key Asic Bhd has announced that it has bagged chip design contracts with a cumulative value of over RM28.0m from S Company. Key Asic has secured three system-on-chip design wins, which entail the delivery of wafers and chips in the next 3 years. (The Edge)

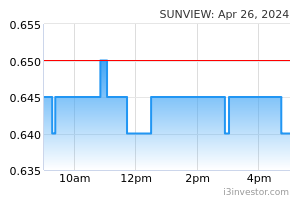

Sunview Group Bhd aims to gradually strengthen its market share to more than 10.0% over the next few years, from 4.0% in 2021. The group has a strong unbilled order book of RM558.3m as at 30th August 2022, to provide earnings visibility until FY24. Additionally, there are still quotas and incentives from the government, such as the net energy metering scheme, as well as the allocation and redistribution of a renewable energy quota of 1,200MW for solar resources. (The Edge)

Source: Mplus Research - 18 Oct 2022