Negative bias tone persisted

Market Review

Malaysia:. The FBM KLCI (-0.5%) trended lower for the 4th straight session, dragged by losses in more than two-thirds of the key index components yesterday. The lower liners remained downbeat, while the healthcare sector (+1.0%) outperformed the mostly negative sectorial peers.

Global markets:. Wall Street edged lower after erasing all their intraday gains as the Dow (-0.1%) fell ahead of the release of monthly inflation data that may generate more clues over the future interest rate hike direction. The European stock markets also fell, while Asia stock markets closed mixed.

The Day Ahead

The FBM KLCI remained lacklustre as the key index marked its fourth-session decline while the investors were looking around for fresh catalyst. As the final-hour selldown on Wall Street implied persisted concerns over the monthly US CPI data, we believe the global market may remain volatile in the near term. Meanwhile, on the local front, we believe traders are shifting their stance from growth to value stocks and we may expect some rebound in undervalued stocks with solid fundamentals. Commodities wise, the crude oil price staged a pullback to trade above USD92, while the CPO price hovered above RM3,700.

Sector focus:. We believe investors may continue to avoid technology counters ahead of the US CPI data. Meanwhile, buying interest may build up in solid consumer staples stocks such as the F&B counters. Besides, political related stocks may gain traction ahead of the GE15.

FBMKLCI Technical Outlook

The FBM KLCI swung lower from the key 1,400 level and the key index hovered below its daily EMA9 level. Technical indicators showed signs of oversold as the MACD Histogram extended a positive bar, while the RSI continued holding below 30. Support is pegged along 1,355-1,365, while the resistance is set at 1,400-1,430.

Company Brief

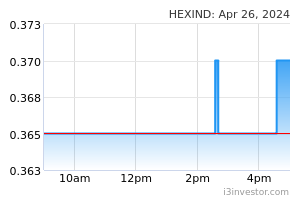

Hextar Industries Bhd (HIB) has obtained its shareholders’ approval to acquire the entire equity interest in Hextar Fertilizers Limited (HFL) from Hextar Holdings Sdn Bhd (HHSB) for RM480.0m. In view that HHSB’s shareholdings in HIB will increase from 45.7% to 77.3% pursuant to the issuance of the consideration shares for the acquisition, HHSB is required to extend a mandatory general offer to acquire the remaining HIB Shares not already owned by HHSB. (The Star)

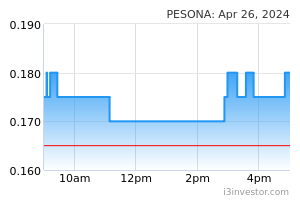

Pesona Metro Holdings Bhd has received a letter of award (LOA) for a contract to execute and complete the main building works of Lakefront Residence in Cyberjaya worth RM154.7m. Its wholly-owned subsidiary, Pesona Metro Sdn Bhd, has accepted the LOA from Ong&Ong 360 Consultancy Sdn Bhd on 12th October 2022. The project is for a duration of 24 months commencing from 25th October 2022. Lakefront Residence is developed by Lakefront Residence Sdn Bhd, a wholly-owned subsidiary of MCT Bhd. (The Star)

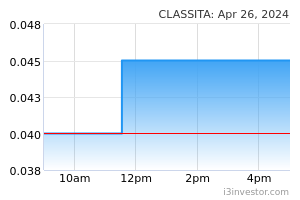

Caely Holdings Bhd founder and former non-executive director Datin Fong Nyok Yoon has withdrawn her suit against the company and 6 former directors without liberty to file afresh and at no cost. No reasons were given for the withdrawal from Fong. (The Edge)

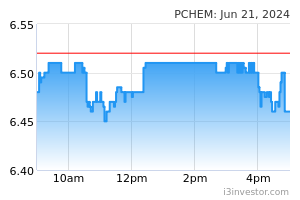

Petronas Chemicals Group Bhd has completed its acquisition of Perstorp Holding AB for RM7.31bn on 11th October 2022. Petronas Chemicals in May 2022 signed a securities purchase agreement with Financière Forêt S.à.r.l, a company under PAI Partners, a European private equity firm, to acquire the entire equity interest in Perstorp, a sustainability-driven global specialty chemicals company based in Sweden. (The Edge)

Malaysia Digital Economy Corporation’s (MDEC) former chief executive officer Datuk Yasmin Mahmood has joined the board of UMW Holdings Bhd. She has been appointed as an independent and non-executive director of the automotive group with effect from 12th October 2022. (The Edge)

Datasonic Group Bhd has appointed 2 new directors to its board. The independent and non-executive directors are Tan Sri Borhan Dolah, who currently serves as chairman of the Malaysian Anti-Corruption Commissions Consultation and Corruption Prevention Panel, and Aurelius Technologies Bhd’s independent non executive chairperson Datin Normaliza Kairon. (The Edge)

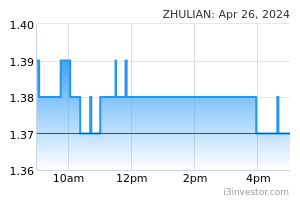

Zhulian Corp Bhd’s 3QFY22 net profit fell 20.1% YoY to RM7.7m, on lower revenue amid weak consumer sentiment, coupled with the impact of the Covid-19 pandemic and rising inflation. Revenue for the quarter declined 10.1% YoY to RM33.0m. A 3.0 sen dividend per share, payable on 7th December 2022 was declared. (The Edge)

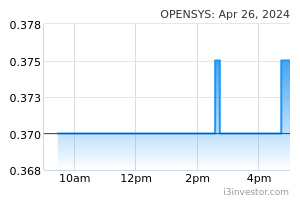

OpenSys (M) Bhd is banking on a rebound in its cash recycle machine (CRM) business segment to drive earnings growth. The group claims a lion’s share of over 80% of Malaysia’s CRM market. (The Edge)

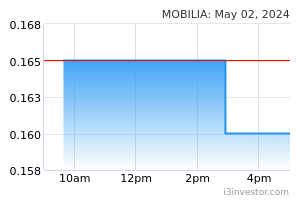

Mobilia Holdings Bhd has secured approval from the Securities Commission Malaysia (SC) for the transfer of its listing to the Main Market of Bursa Malaysia. The home furniture maker was listed on the ACE Market on 23rd February 2021. (The Edge)

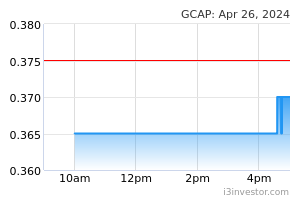

G Capital Bhd has been appointed as a non-revenue water (NRW) specialist for a project in Kota Samarahan, Sarawak. G Capital’s 51.0%-owned subsidiary G Capital Water Solutions Sdn Bhd had received a letter of award from main contractor Exxor Technologies Sdn Bhd on 12th October 2022, appointing the unit as an NRW specialist for a 70km leak detection and pipe inspection for the Sarawak Rural Water Supply Department. (The Edge)

Source: Mplus Research - 13 Oct 2022