Breaking below 1,400

Market Review

Malaysia:. The FBM KLCI (-0.3%) reversed all its intraday gains and extended its losing streak as sentiment turned sour in the second half of the trading session yesterday. The lower liners also stayed downbeat, while the utilities sector (-0.8%) underperformed its sectorial peers.

Global markets:. Wall Street was grappled with volatility as the Dow (-1.5%) sank after the strong personal consumption and weekly jobless claims data reinforced the US Federal Reserve aggressive stance on future rate hikes. The European stock markets also turned downbeat, but Asia stock markets ended mixed.

The Day Ahead

The FBM KLCI declined below the key 1,400 level as increasing concerns over global recession permeated the local bourse. As Wall Street wiped out its gains from the previous session, we reckon that the local sentiment may remain fragile as investors will adopt a wait-and-see approach amid the rising macroeconomic pressure. Nevertheless, we expect mild buying support on index heavyweights for 3Q window dressing activities and the key index may be supported above 1,400. Commodities wise, crude oil is traded around the USD88 per barrel mark as market anticipated an output cut by OPEC+, while the CPO hovered above RM3,300.

Sector focus:. We expect heavyweights to trade mildly higher for the session on the back of 3Q window dressing activities. Meanwhile, investors may favour the energy sector as crude oil price remains firm around USD88. Besides, sectors such as solar, healthcare, and telecommunication may be in focus ahead of Budget 2023.

FBMKLCI Technical Outlook

The FBM KLCI fell below the 1,400 psychological level, logging its seventh straight daily decline. Technical indicators remained negative as the MACD Histogram extended a negative bar, while the RSI continues to stay oversold. Next support is located at 1,360-1,375, while the resistance is pegged along 1,430-1,450.

Company Brief

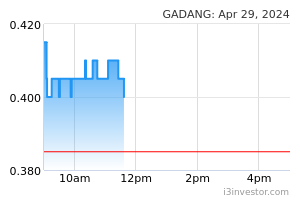

Gadang Holdings Bhd’s wholly-owned unit Gadang Engineering (M) Sdn Bhd has secured a contract from the Public Works Department worth RM188.8m. The contract is for a project known as Institut Perubatan Forensik Negara (IPFN), Hospital Kuala Lumpur shall commence upon site possession on 12th December 2022 and shall be completed on 6th October 2026. (The Star)

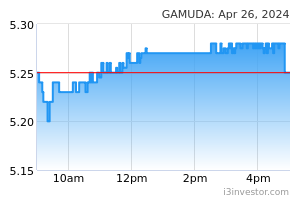

Gamuda Bhd’s 4QFY22 net profit increased 19.9% YoY to RM255.2m, on the back of improved earnings in the construction and property divisions. Revenue for the quarter leapt 123.7% YoY to RM1.87bn. (The Edge)

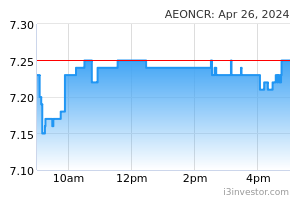

AEON Credit Service (M) Bhd's 2QFY23 net profit improved marginally by 1.6% YoY to RM75.7m, as stronger revenue was largely offset by higher impairment losses on financing receivables of RM150.0m. Revenue for the quarter grew 6.6% YoY to RM399.2m. (The Edge)

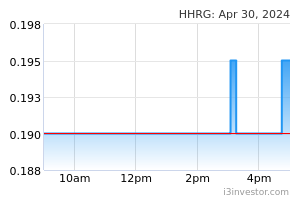

Heng Huat Resources Bhd received a notice of mandatory takeover offer at 37.7 sen per share and 29.7 sen per warrant from two substantial shareholders — its managing director Datuk H'ng Choon Seng and Goh Boon Leong. Their shares plus those held by parties acting in concert, are all housed under GH Consortium Sdn Bhd, which currently controls a 48.1% stake, or 359.3m shares. (The Edge)

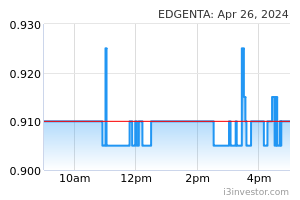

UEM Edgenta Bhd is investing RM13.5m for a 60.0% equity interest in a facilities management services business in Riyadh, Saudi Arabia. The group wholly owned unit, Edgenta Arabia Ltd, is buying the stake in MEEM for Facilities Management Company (MEEM) from Mohammed Ibrahim Al-Subeaei and His Sons Investment Company (MASIC). MASIC will continue to own the remaining 40% stake in MEEM. (The Edge)

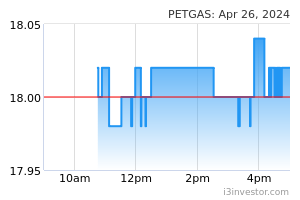

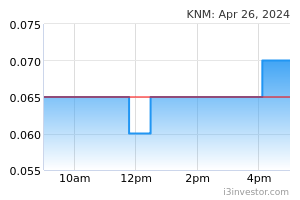

KNM Group Bhd has bagged an engineering, procurement, construction and commissioning contract worth RM25.7m from Petronas Gas Bhd (PetGas). The job involves packed bed modification for special scheme inspection at PetGas' Santong gas processing plant in Dungun, Terengganu for 2 years. (The Edge)

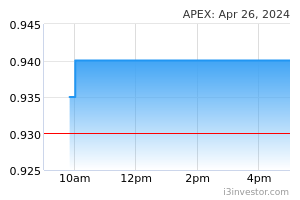

Apex Equity Holdings Bhd shareholders have rejected the proposal of a general mandate for issuance and allotment of new shares during the group’s extraordinary general meeting (EGM) on 29th September 2022. Shareholders also blocked the resolution for payment of directors’ fees to non-executive directors who were appointed after the group’s annual general meeting in June 2022 and a proposed alteration of the company’s existing memorandum and articles of association. (The Edge)

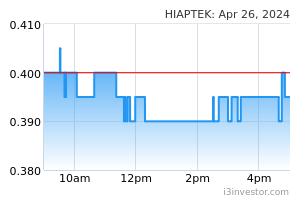

Hiap Teck Venture Bhd’s 4QFY22 net profit dropped 59.5% YoY to RM24.5m, amid lower profit margins for its downstream operating subsidiaries as a result of the higher cost of goods sold and the write-down of inventories to net realisable value. Revenue for the quarter, however, jumped 134.5% YoY to RM386.5m A first and final dividend of 1.0 sen per share was proposed. (The Edge)

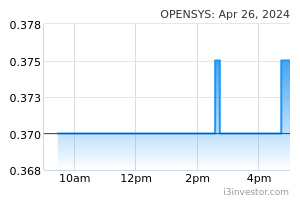

OpenSys (M) Bhd obtained its shareholders' approval to transfer the group's listing from the ACE Market to the Main Market of Bursa Malaysia Securities at an extraordinary general meeting on 29th September 2022. This exercise will enhance the group's reputation and increase its recognition and acceptance among investors. (The Edge)

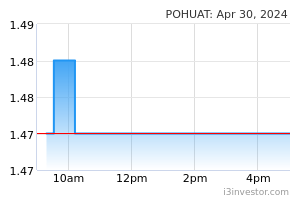

Poh Huat Resources Holdings Bhd’s 3QFY22 net profit rose 64.2% YoY to RM22.0m, boosted by strong turnover growth in its domestic operations. Revenue for the quarter climbed 9.2% YoY to RM166.5m. A second interim dividend of 2.0 sen per share, payable on 28th October 2022 was declared. (The Edge)

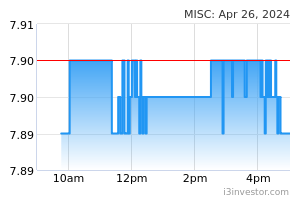

MISC Bhd’s wholly owned Singapore-based maritime transport operator, AET has signed a Memorandum of Understanding with Thailand's national energy company PTT for the construction of 2 Aframax oil tankers that will be powered by green ammonia. AET will select a suitable shipyard and the 2 tankers are to be delivered to PTT for long-term charters in 4Q25 and 4Q26 respectively. (The Edge)

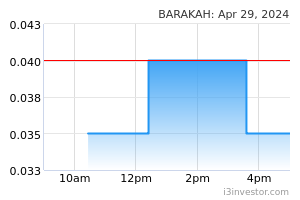

Barakah Offshore Petroleum Bhd and its subsidiary have withdrawn their appeal against the High Court decision dismissing their RM1.02bn claim against Petronas Nasional Bhd (Petronas). (The Edge)

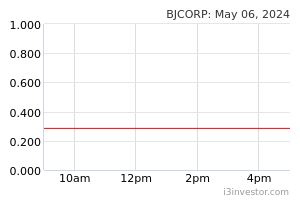

Chailease Berjaya Credit Sdn Bhd (CBC), a joint venture between Taiwan-based Chailease Holding Co Ltd and Berjaya Corp Bhd, is planning a RM1.00bn bond sale as it expands its financing operations for new motorcycles. (The Edge)

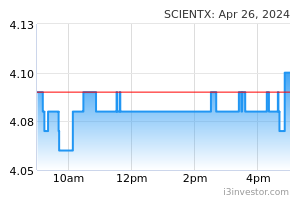

Scientex Bhd's 4QFY22 net profit slipped 12.4% YoY to RM125.0m, hit by higher tax and interest expenses amid margin compression in its property segment. Revenue for the quarter, however, rose 14.5% YoY to RM1.11bn. A final dividend of 5.0 sen per share, payable on 9th January 2023 was declared. (The Edge)

Source: Mplus Research - 30 Sept 2022