Poised for a rebound

Market Review

Malaysia:. There was no reprieve for the FBM KLCI (-0.6%) and it marked its sixth straight session of losses after more than half of the key index components faltered. The lower liners were also downbeat with all the 13 major sectors painted in red with the energy sector (-2.5%) underperformed.

Global markets:. Wall Street staged a strong rebound overnight as the Dow (+1.9%) rallied, following a surprise intervention from the Bank of England in the bond market as the US treasury yields retreated from a 12-year high. The European stock markets also rebounded, but Asia stock markets finished mostly in red.

The Day Ahead

The FBM KLCI slid alongside with the regional peers as persistent negative sentiment prevailed and pulled the key index below the 1-year low. However, we believe the local bourse should see decent buying interest after a sharp rally on Wall Street overnight as the surprise policy pivot by the Bank of England should lift the regional sentiment. Commodities wise, the crude oil above USD89 per barrel, rebounding from its recent downtrend move as the market anticipated a rebound in consumer demand following a mild pullback in the USD. Meanwhile, the CPO price trended lower to hover along RM3,200.

Sector focus:. We believe the market should see recovery today and the technology stocks may be the leader for the session. Meanwhile, the rebound in crude oil price may boost the energy sector higher. Also, we expect traders to focus on the upcoming Budget 2023, positioning in the market ahead of the event; we like the healthcare, automation, automotive, telco and solar industries.

FBMKLCI Technical Outlook

The FBM KLCI crossed below its 52-week low at 1,410 after a 5-day losing streak. Technical indicators remained negative as the MACD Histogram extended a negative bar, while the RSI is oversold. We believe it could be due for a technical rebound, next resistance is at 1,450-1,460, while the support is at 1,380-1,400.

Company Brief

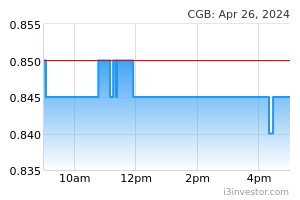

Central Global Bhd’s (CGB) 70.0%-owned subsidiary, RYRT International Sdn Bhd, has secured a sub-contract works from a third-party main contractor, Pembinaan Urusmesra Sdn Bhd, worth RM183.3m. The contract also included the supply of plant, machinery, labour and materials required for the construction and completion of a project known as Projek Jalan Semawang Ke Tanjung Kuala Gum Gum, Sandakan, Sabah. The project shall commence on 14th October 2022 and is estimated to be completed by 13th October 2025. (The Star)

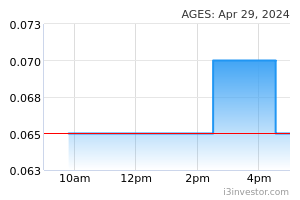

Ageson Bhd's 99.0%-owned subsidiary Solidvest Properties Sdn Bhd has entered into a memorandum of understanding with Koperasi Belia Nasional Bhd (Kobena) to sell a 9.3-ac tract of land in Gombak, Selangor, for a consideration of RM35.0m cash. The estimated gross development value of the project is RM85.2m while the estimated gross development cost is RM41.2m, which will be jointly financed by Solidvest's collaboration partner, ShuangLing Holdings Ltd. The proposed project is expected to commence with 3 months from the date of approval to be obtained by Solidvest and will take about 2 years for completion. (The Star)

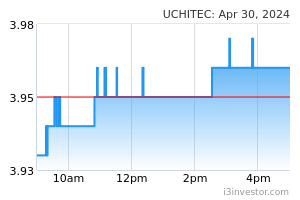

Uchi Technologies Bhd's wholly owned subsidiary Uchi Optoelectronic (M) Sdn Bhd has entered into an agreement with XFS Sdn Bhd to dispose of a tract of leasehold land measuring about 12,999.5-sqm, including a factory building and structure in Seberang Perai Tengah on Penang Island for RM19.0m. The disposal is expected to result in an estimated gain of RM9.6m. (The Star)

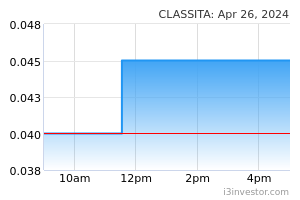

Caely Holdings Bhd’s new board of directors has officially apologised for the group’s “false announcements” made in June 2922 about the board appointment and withdrawal of Datuk Jovian Mandagie and Sandraruben Neelamagham. Caely confirmed there were no relevant appointment or withdrawal documents signed by the duo in regard to their purported appointments, following the outcome of recent internal inspection of the group’s documentation. (The Edge)

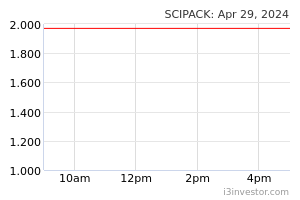

Scientex Packaging (Ayer Keroh) Bhd’s 4QFY22 net profit rose 27.8% YoY to RM11.4m, helped by higher domestic sales. Revenue for the quarter grew 43.5% YoY to RM191.8m. (The Edge)

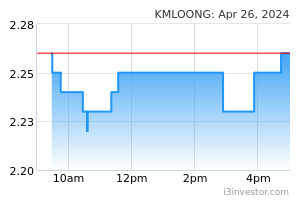

Kim Loong Resources Bhd’s 2QFY23 net profit grew 37.4% YoY to RM49.7m, on the back of higher palm oil prices. Revenue for the quarter rose 40.8% YoY to RM564.4m. (The Edge)

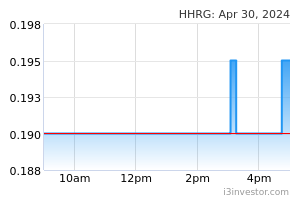

Trading in the shares and warrants of Heng Huat Resources Group Bhd will be halted on 29th September 2022, pending the release of a material announcement. (The Edge)

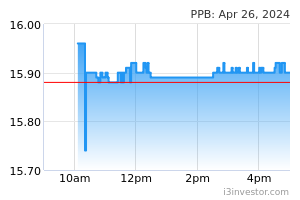

PPB Group Bhd’s property division unveiled the Megah Rise Mall, a new community-centric neighbourhood mall in Petaling Jaya. Megah Rise at Taman Megah comprise four-level retail space will have about 100 outlets, totalling 142,000 sqf of net lettable area, and is slated to open to the public in December 2022. (The Edge)

K-One Technology Bhd has secured approval from the Health Ministry’s Medical Device Authority (MDA) to market silicone adhesive tapes primarily used for wound care dressing. The K-One group will sell the silicone adhesive tapes in Malaysia as an authorised representative of Wuhan Huawei Technology Co Ltd, which is the manufacturer based in China. (The Edge)

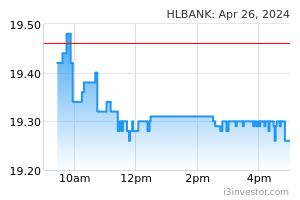

Hong Leong Bank Bhd chairman Tan Sri Quek Leng Chan has announced that Malaysia remains susceptible to global developments and external shocks as inflation and higher interest rates are expected to dominate the global and domestic landscapes. Central banks around the world are expected to normalise and tighten monetary policy to tamp down inflation amid high energy and food prices. (The Edge)

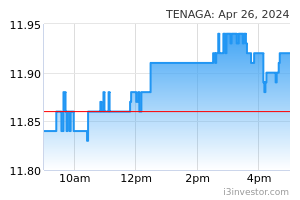

Tenaga Nasional Bhd (TNB) expects the green electricity tariff (GET) quota to increase and be awarded on a yearly basis in 2023. This is due to the high demand in 2022 as all quotas generated through hydro and large scale solar programmes have been taken up in just a few months. (The Edge)

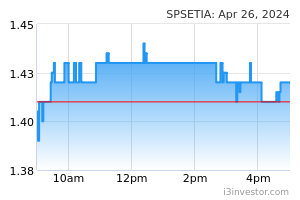

S P Setia Bhd and Tenaga Nasional Bhd (TNB) have kick-started their green initiative partnership with the installation of solar panels at S P Setia's corporate headquarters in Setia Alam, Shah Alam, at a commencement signing ceremony on Wednesday. This is the first phase of S P Setia's green initiative in partnership with TNB. (The Edge)

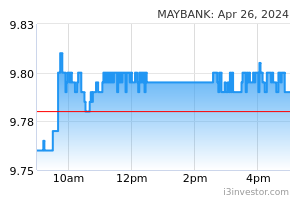

Malayan Banking Bhd (Maybank) will fully migrate to a more secure authentication method via Secure2u by June 2023, from SMS one-time password (OTP), to heighten online banking security. This is in line with Bank Negara Malaysia’s steer for banks to migrate from SMS OTP to more secure authentication for online banking transactions.

Meanwhile, Maybank’s indirect 68.3%-owned subsidiary Etiqa Life and General Assurance Philippines Inc (Etiqa Philippines) will form an insurance distribution partnership with the Philippine Bank of Communications (PBCOM) under an exclusive partnership that will allow PBCOM to distribute Etiqa’s life and non-life insurance products to PBCOM clients. (The Edge)

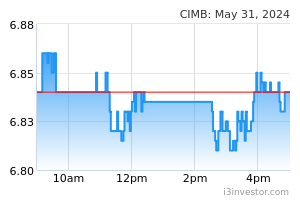

CIMB Group Holdings Bhd has established baseline “Scope 3” financed emissions in its Malaysia and Indonesia businesses as part of its environmental transition plans, enabling it to achieve its net zero overall greenhouse gas emissions target by 2050. (The Edge)

Betamek Bhd, which is slated to be listed on Bursa Malaysia’s ACE Market on 26th October 2022, aims to raise RM33.8m from its initial public offering exercise. Under the listing exercise, Betamek is issuing 67.5m new shares, representing 15.0% of the enlarged share capital at an issue price of 50 sen per share. (The Edge)

Source: Mplus Research - 29 Sept 2022