Sapped by quick profit taking

Market Review

Malaysia:. The FBM KLCI (-0.1%) edged lower after reversing all its intraday gains on quick profit taking activities ahead of the extended weekend break. Both the lower liners and the broader market ended mixed with the plantation sector (-1.3%) underperformed after CPO prices turned downbeat.

Global markets:. Wall Street fell as the Dow (-0.5%) extended its decline with markets staying risk off mode with investors pricing in another 75-basis point of rate hike from the US Federal Reserve this week. The European stock markets closed in red, while Asia stock markets ended mostly negative.

The Day Ahead

The FBM KLCI slipped into the negative territory at the closing bell on Friday as sentiment remained fragile prior to the Malaysia Day holiday weekend. All eyes should be on the US Fed’s September meeting and Malaysia’s inflation rate this week. Hence, the local bourse may continue to see sideways trading tone along with the regional peers as investors preparing for further interest rate hikes by the US Fed. Commodities wise, the crude oil price was above USD91 per barrel mark, while the CPO is hovering below RM3,900.

Sector focus:. The technology sector should remain under pressure overall in line with the sentiment on Wall Street. Meanwhile, investors may look out for stocks in the banking, telco, consumer sectors, as well as building material to prepare for October’s Budget tabling. Other sectors that we like include export-oriented and energy.

FBMKLCI Technical Outlook

The FBM KLCI declined for the third straight session as the key index. Technical indicators remained negative as the MACD Histogram extended a negative bar, while the RSI hovered below the 50 level. Next support is set at 1,465, followed by 1,430, while the resistance is pegged along 1,500-1,530.

Company Brief

Malaysian telecoms firm Axiata Group Bhd’s subsidiary Celcom Axiata Bhd and Norway's Telenor ASA’s unit DiGi.Com Bhd have been given clearance from the Securities Commission Malaysia for the proposed merger of their local units. The Malaysian Communications and Multimedia Commission has reported in June it had no objections to the plans. The completion of the proposed transaction will now be subject to approval of Bursa Malaysia and Axiata and Digi shareholders. The two parent companies plan to own 33.1% each. (The Star)

Genting Malaysia Bhd’s indirect subsidiary, GMM S.A. (GMM) has submitted a bid to the Macau SAR Government on 14th September 2022 for the award of a new 10- year gaming concession for the operation of casino games of fortune in Macau SAR. Genting Malaysia said it would make appropriate announcements once there is more clarity on the company’s position in relation to its bid. (The Star)

Jiankun International Bhd’s wholly-owned subsidiary, JKI Construction Sdn Bhd (JKIC) has secured a construction contract worth RM90.6m from Menarez Development Sdn Bhd. The contract for a period of 45 months was for the design and build contract for the development of one block of residential apartment and shop units comprising of residential units inclusive of ‘rumah mampu milik Wilayah Persekutuan’ (RUMAWIP), common facilities and shop units at Setapak. (The Star)

Siab Holdings Bhd has proposed to acquire a 1.6-ac leasehold vacant industrial land in Dengkil, Selangor for RM4.3mil cash. The purpose for the acquisition of the property is for the construction of storage facility on the property to store construction materials as well as construction machinery and equipment that are not in use in the construction. (The Star)

Sime Darby Bhd has reported that there is no final decision yet on whether the group will revive plans to list its healthcare unit on the Bursa Main Market. The diversified group will continue to explore all options, including an IPO for its 50.0%- owned subsidiary Ramsay Sime Darby Health Care Sdn Bhd (RSDH), after talks with IHH Healthcare Bhd to buy 100.0% of RSDH from its owners were terminated. (The Edge)

Malaysia Airports Holdings Bhd (MAHB) total passenger movements jumped 129.8% YoY to 8.0m in August 2022. MAHB's network of airports recorded a surge in international passenger movements that was partly driven by the summer holiday period and visa relaxation in Saudi Arabia from 30th July 2022, while domestic passenger movements also improved. (The Edge)

Perdana Petroleum Bhd has secured 2 work order awards worth RM11.6m from Petronas Carigali Sdn Bhd that involve the provision of anchor handling tug and supply vessels with crew and equipment to perform 24-hour services for assisting and servicing drilling rigs, offshore installation, derrick barges, towing and anchor jobs. (The Edge)

Capital A Bhd’s unit, AirAsia plans to enlarge its Indonesian and Philippine operations beyond their pre-pandemic levels by the 1Q23, riding on better tourism and connectivity prospects. (The Edge)

Petronas Gas Bhd (PetGas) has reported that the group has not issued any proposal or tender for an alleged 700km pipe replacement project from Johor's Segamat district to Terengganu's Kertih town. (The Edge)

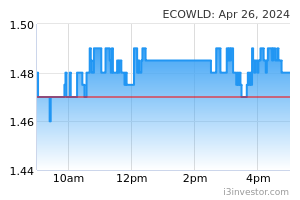

Eco World Development Group Bhd’s (EcoWorld) 3QFY22 net profit grew 32.0% YoY to RM46.4m, thanks to lower finance costs, coupled with cost savings on selling and administrative expenses. Revenue for the quarter fell 1.1% YoY to RM444.0m. An interim dividend of 1.0 sen per share, payable on 20th October 2022 was declared. (The Edge)

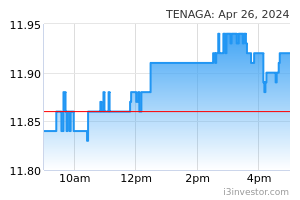

Tenaga Nasional Bhd (TNB) has received a sum of RM1.90bn from the Federal government for the imbalance cost pass-through (ICPT) mechanism. The amount comprised the latest tranche of RM1.60bn, adding on to another RM300.0m received previously. (The Edge)

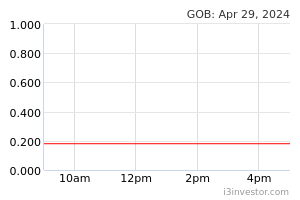

Global Oriental Bhd is acquiring 3 shop units in Pavilion Bukit Ceylon, Kuala Lumpur for RM30.0m, as part of its development of a 39-storey premium service residence project. The shops units, priced at RM12.5m, RM11.4m and RM6.1m respectively, are being purchased from Jelita Orientasi Sdn Bhd. (The Edge)

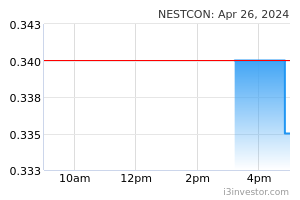

The agreement between Nestcon Bhd and Singapore Exchange-listed Hatten Land Ltd to form a joint venture to supply, construct and manage solar photovoltaic (PV) plants and facilities in Malaysia has been terminated. The termination is due to internal change in Hatten Land's unit Hatten Renewable Energy Sdn Bhd’s business strategy and growth goals in its energy division. (The Edge)

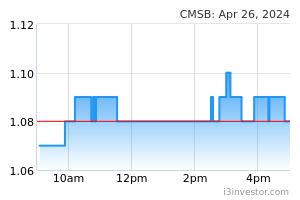

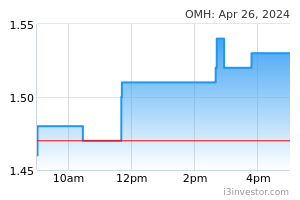

OM Holdings Ltd (OMH), via its subsidiary OM Materials (S) Pte Ltd (OMS), has fulfilled conditions to acquire the remaining 25.0% interest in its key Malaysian operating subsidiaries OM Materials (Sarawak) Sdn Bhd and OM Materials (Samalaju) Sdn Bhd from Cahya Mata Sarawak Bhd for a total cash consideration of US$120.0m (RM526.6m). (The Edge)

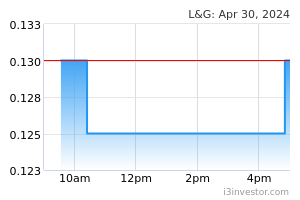

Land & General Bhd expects demand for the property sector to remain stable, despite challenges such as the anticipation of rising interest rates as well as increasing cost of materials and labour. The current overnight policy rate of 2.5% is still below the threshold of 3.0% recorded during pre-Covid-19 period. (The Edge)

Source: Mplus Research - 19 Sept 2022