Recovery tone setting up

Market Review

Malaysia:. The FBM KLCI (+0.2%) extended its lead, boosted by gains in more than half of the key index components yesterday. The lower liners ended mixed, while the broader market closed mostly upbeat, with the exception of energy (-0.4%) and plantation (-0.1%) sectors as commodity prices continues to retreat.

Global markets:. Wall Street advanced as the Dow (+0.6%) edged higher after a volatile spell as markets brushed off the US Federal Reserve Chairman Jerome Powell comments over their hawkish stance on interest rate directions. Both the European and Asia stock markets closed mostly upbeat.

The Day Ahead

The FBM KLCI closed on a positive note, tracking the performance on Wall Street. We believe the key index should find firmer footing moving forward following an extension of rebound on Wall Street as softening crude oil price could ease the inflationary concerns on the global front. Nevertheless, the mounting economic risk in China may pose some threat to the global markets. Meanwhile, the Brent crude oil price saw mild increase but remained below USD90 per barrel mark, while the crude palm oil price trended lower, hovering below RM3,600.

Sector focus:. We believe the energy and plantation sectors should remain under pressure over the near term, while investors are likely to turn their focus on the consumer and banking sectors. Meanwhile, the technology stocks may gain traction given the positive performance of Nasdaq overnight.

FBMKLCI Technical Outlook

The FBM KLCI extended its gains and closed above its daily EMA9 level. Technical indicators remained mixed as the MACD Histogram extended a negative bar, while the RSI hovered above 50. Resistance is located at 1,510-1,530, while the support is pegged along 1,465-1,485.

Company Brief

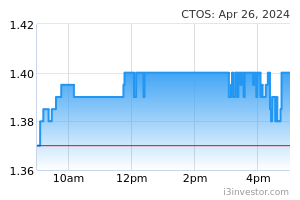

CTOS Digital Bhd has proposed to acquire 80,000 and 1.6m shares in RAM Holdings Bhd from Deutsche Bank (M) Bhd and Dragonline Solutions Sdn Bhd for RM2.28 m and RM44.6m, respectively. The proposed acquisitions, representing 0.8% and 15.7% of the total paid-up share capital in RAM respectively. The acquisition of the stakes in RAM will allow CTOS to achieve a majority shareholding (55.6%) in RAM. (The Star)

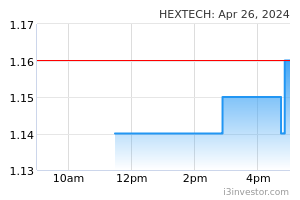

Hextar Technologies Solutions Bhd’s wholly-owned subsidiary, Malsuria (M) Sdn Bhd has obtained a moneylender license issued under the Moneylenders Act 1951 and the Moneylenders (Control and Licensing) Regulations 2003 from the Housing and Local Government Ministry on 5th September 2022. The license is valid for two years and is renewable upon the renewal application with the ministry. (The Star)

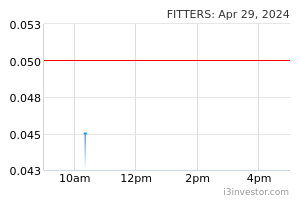

Fitters Diversified Bhd has proposed to dispose of 19.0-ha agriculture land in Rawang for RM36.0m. Fitters said its indirect wholly-owned subsidiary, Rasa Anggun Development Sdn Bhd had entered into a sale and purchase agreement with Aikbee Development (Kepong) Sdn Bhd for the proposed disposal. The proposed disposal that is expected to be completed by 4Q22, is expected to result in a gain of approximately RM3.3m. (The Star)

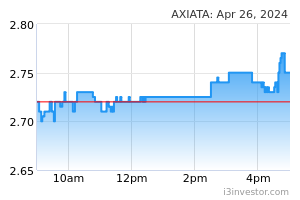

Axiata Group Bhd’s wireless tower business edotco Group Sdn Bhd is considering a share sale that could raise as much as USD600.0m (RM2.70bn) as it seeks to turbocharge its growth. Existing shareholders including Axiata could also tag along and sell down their stakes in the privately held tower unit, which could boost the total transaction size to as much as USD1.00bn. (The Edge)

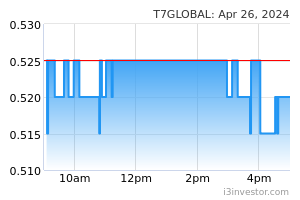

T7 Global Bhd expects its Bayan Mobile Offshore Production Unit to increase its annual revenue by 50.0%. The Bayan Mopu, which is in the final stages of construction, is T7 Global's second Mopu project. Once Bayan Mopu is installed and the first gas comes out, it will be leased to Petronas Carigali Sdn Bhd for the Bayan Gas Redevelopment Project Phase 2 in Sarawak for 10 years until 2032. (The Edge)

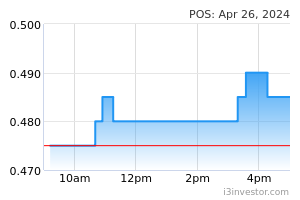

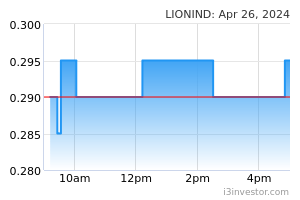

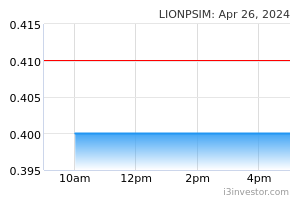

Deloitte PLT has voluntarily resigned as the external auditor, after more than 25 years, for Lion Industries Corp Bhd and Lion Posim Bhd after the two companies received written notices on the matter from Deloitte on 8th September 2022. (The Edge)

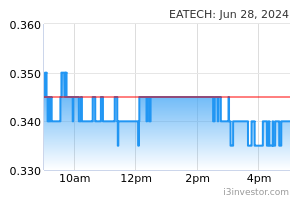

EA Technique (M) Bhd is acquiring a new tugboat for US$3.8m (RM16.7m) in cash to undertake activities associated with marine terminal operations. EA Technique is expected to incur logistic costs of RM430,000 for the vessel to be delivered to Malaysia, with the exercise expected to be completed by 4Q22, which it plans to fund through the proposed disposal of three vessels for an aggregate sum of at least US$13.5m (RM60.1m). (The Edge)

Pos Malaysia Bhd has issued the country’s first non-fungible token (NFT) stamps, making it the second postal service provider in Southeast Asia to do so after Thailand. (The Edge)

Source: Mplus Research - 9 Sept 2022