Prelude to more profit taking

Market Review

Malaysia:. The FBM KLCI (-0.04%) edged marginally lower after erasing all its intraday gains, dragged by selected banking heavyweights. The lower liners ended mixed, but the broader market closed mostly positive, led by the healthcare sector (+1.8%) on bargain hunting activities.

Global markets:. Wall Street retreated as the Dow (-0.5%) fell after the US Federal Reserve remains committed in raising rates to bring inflation under control, with the future pace of rate hikes will be largely data driven. The European stock markets also turned lower, but the Asia stock markets ended mostly upbeat.

The Day Ahead

The FBM KLCI saw a mild setback despite a bullish momentum across the regional markets; KLCI’s earlier gains faded in the afternoon session. In view of the softer Wall Street performance, sentiment on the local bourse may turn cautious as attention shifted back to the US Fed’s interest rate policy following the release of the Fed’s July meeting minutes. Nevertheless, investors may look out on the upcoming earnings season, stocks with solid earnings growth under this environment will be on the focus. Commodities wise, the crude oil rose above USD93, while the CPO continued to hover above RM4,100.

Sector focus:. The technology sector may see a pullback as Nasdaq led the sentiment lower on Wall Street. Healthcare sector, could be a low base buying opportunity given the climactic volume may have achieved and could be a pivot point on the glove stocks. Meanwhile, sectors such as transportation & logistics, consumer and REIT are likely to remain bullish.

FBMKLCI Technical Outlook

The FBM KLCI ended with an inverted hammer candle, but still remained above its daily EMA120 mark. Technical indicators turned positive as the MACD Histogram moved above zero, while the RSI is still hovering above 50. Resistance will be envisaged at 1,530-1,560, while the key 1,480-1,500 will act as the supports

Company Brief

Kuala Lumpur Kepong Bhd's (KLK) 3QFY22 net profit tumbled 28.8% YoY to RM558.2m, due to the absence of a disposal gain from an associate that was recorded in the previous corresponding quarter. Revenue for the quarter, however, rose 34.6% YoY to RM6.96bn. (The Star)

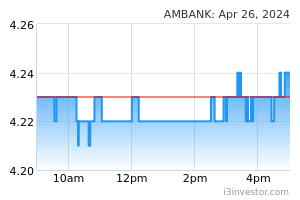

AMMB Holdings Bhd's (AmBank Group) 1QFY23 net profit improved 8.4% YoY to RM419.2m, on the back of lower impairment charges at RM63.9m as compared to RM203.2m in the previous corresponding quarter. Revenue for the quarter, however, declined 6.2% YoY to RM1.16bn. (The Star)

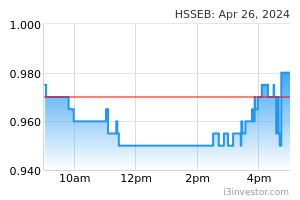

HSS Engineers Bhd’s (HEB) 2QFY22 net profit surged 147.9% YoY to RM3.9m, on favourable project mix from project management consultancy (PMC) works for Phase 1 of Pan Borneo Highway Sabah project. Revenue for the quarter, however, fell 2.9% YoY to RM37.9m. (The Star)

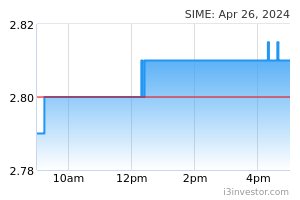

Sime Darby Bhd's 4QFY22 net profit rose 31.8% YoY to RM278.0m, on the back of improved contribution from its industrial division. Revenue for the quarter, however, slipped 4.0% YoY to RM10.85bn. A second interim dividend of 7.5 sen per share, payable on 30th September 2022 was declared. (The Edge)

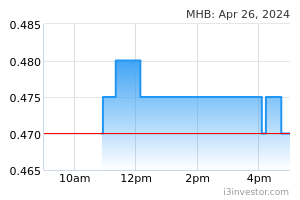

Malaysia Marine and Heavy Engineering Holdings Bhd’s (MHB) 2QFY22 net profit stood at RM22.0m vs. a net loss of RM34.4m recorded in the previous corresponding quarter, due to the absence of cost provision associated with the Covid-19 pandemic, coupled with the recovery of dry-docking activities at its yard, thanks to the reopening of Malaysia's international borders. Revenue for the quarter grew 32.5% YoY to RM400.6m. (The Edge)

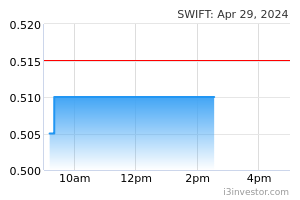

Swift Haulage Bhd's 2QFY22 net profit rose 13.7% YoY to RM13.2m, driven by the easing of Covid-19 restrictions and recovery of business activities. Revenue for the quarter gained 11.0% YoY to RM160.1m. An interim dividend of 1.0 sen per share, payable on 21st October 2022 was declared. (The Edge)

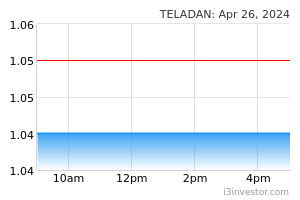

Teladan Setia Group Bhd's 2QFY22 net profit jumped 85.9% YoY to RM14.2m, mainly due to better sales from Taman Desa Bertam Phases 2, 3A and 3B as well as Bali Residences. Revenue for the quarter rose 86.6% YoY to RM75.6m. An interim dividend of 0.6 sen per share, payable on 19th September 2022 was declared. (The Edge)

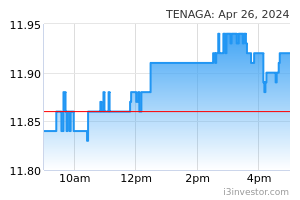

Tenaga Nasional Bhd (TNB) will invest around RM20.00bn per year over the next 28 years as capital expenditure for initiatives to fast-track TNB's Energy Transition Plan aimed at reducing its emissions intensity to net zero by 2050. (The Edge)

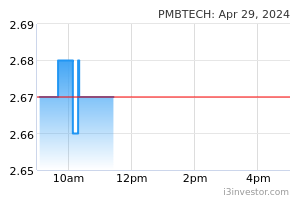

PMB Technology Bhd's subsidiary PMB Land (Sg Besi) Sdn Bhd has proposed to sell land in Kuala Lumpur for RM37.0m and use the proceeds to repay a loan and for working capital. The disposal of the freehold land, measuring 6,658 sqm, is part of the company's plans to streamline its operations by focusing on its core business of aluminium smelting. (The Edge)

Malaysia Pacific Corp Bhd (MPCorp) whose shares will be suspended from trading effective from 19th August 2022 has bagged 2 subcontracts worth RM44.9m from Windsor Aims Machinery Sdn Bhd. It has inked a memorandum of understanding with Windsor Aims to negotiate for a joint collaboration agreement or any other agreements for the implementation of its proposed regularisation plan. (The Edge)

Source: Mplus Research - 18 Aug 2022